Exploring Shenyu Communication Technology And 2 Other Undiscovered Gems In China

Reviewed by Simply Wall St

In a holiday-shortened week, Chinese stocks experienced a significant surge, driven by optimism surrounding Beijing's comprehensive support measures despite ongoing challenges in manufacturing and real estate sectors. The Shanghai Composite Index and the CSI 300 Index posted impressive gains, reflecting renewed investor confidence amid relaxed homebuying restrictions in major cities. In this dynamic market environment, identifying promising opportunities requires looking beyond immediate headlines to explore companies like Shenyu Communication Technology that may offer unique potential within China's evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shandong Link Science and TechnologyLtd | 2.65% | 15.68% | 10.94% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 4.87% | 9.24% | -21.23% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -10.91% | -28.38% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.00% | 5.87% | -14.07% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 1.38% | 19.38% | ★★★★★★ |

| Aeolus Tyre | 35.66% | -1.22% | 10.27% | ★★★★★☆ |

| Hubei Forbon TechnologyLtd | 22.99% | 15.04% | 2.15% | ★★★★★☆ |

| Changshu Fengfan Power Equipment | 85.99% | 7.52% | 27.60% | ★★★★☆☆ |

| Sichuan Zigong Conveying Machine Group | 30.45% | 15.38% | 3.12% | ★★★★☆☆ |

| Shanghai Feilo AcousticsLtd | 36.01% | -17.85% | 55.43% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shenyu Communication Technology (SZSE:300563)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyu Communication Technology Inc. focuses on the research, development, production, and sale of radio frequency coaxial cables in China with a market capitalization of CN¥8.67 billion.

Operations: Shenyu Communication Technology derives its revenue primarily from the production and sale of coaxial cable products, amounting to CN¥816.30 million.

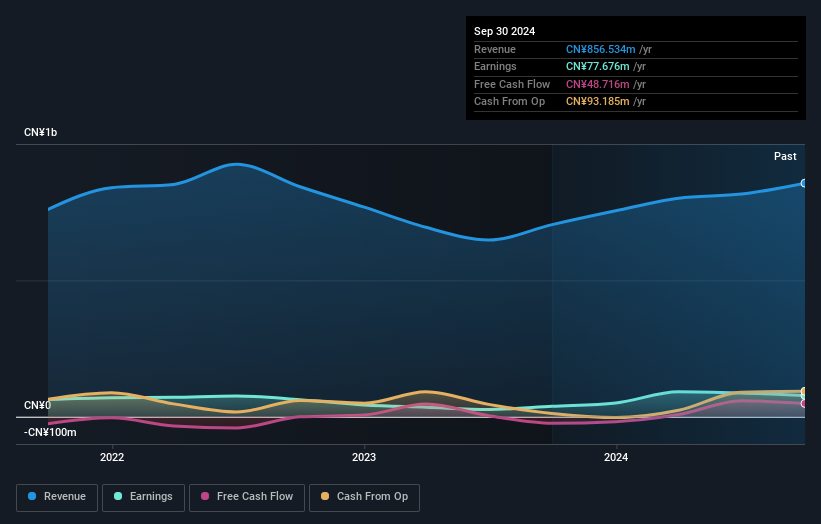

Shenyu Communication Technology, a nimble player in China's tech scene, has shown remarkable earnings growth of 226.8% over the past year, outpacing the broader Communications industry. The company boasts high-quality earnings and operates debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 6%. Recent financials reveal sales of CNY 392.46 million for the first half of 2024, with net income jumping to CNY 57.21 million from CNY 20.79 million last year.

- Click here to discover the nuances of Shenyu Communication Technology with our detailed analytical health report.

Learn about Shenyu Communication Technology's historical performance.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Farben Information Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥13.26 billion.

Operations: The company generates revenue primarily from its technology offerings, with a focus on specific segments that drive its financial performance. Over recent periods, the net profit margin has shown fluctuations, reflecting changes in operational efficiency and cost management strategies.

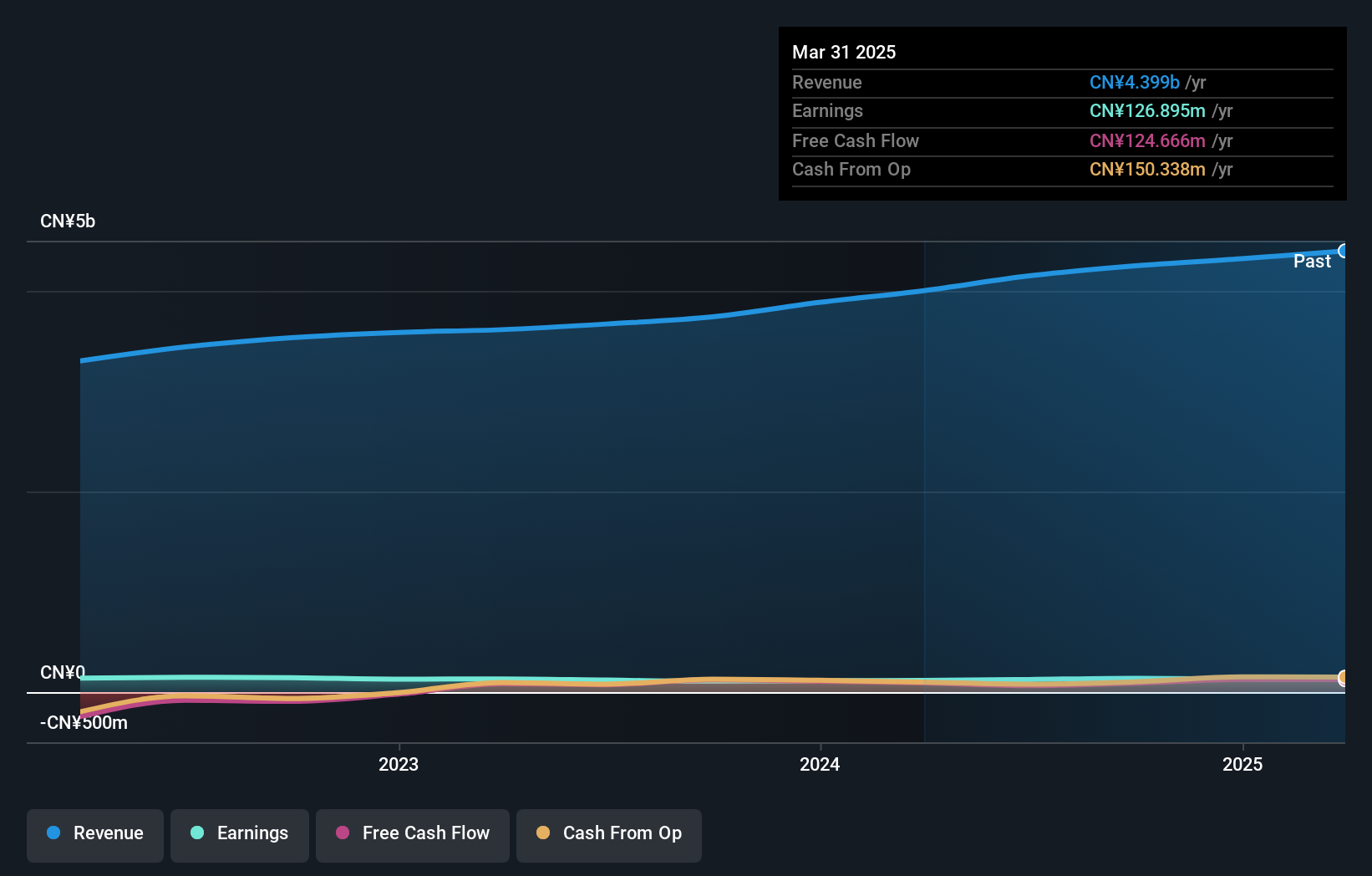

Shenzhen Farben, a promising player in the tech sector, has shown impressive financial resilience. Over the past year, earnings grew by 4.9%, outpacing the IT industry average of -11.5%. The company's debt to equity ratio improved significantly from 12.7% to 6.8% over five years, indicating better financial management. Recently reported half-year sales reached CNY 2.09 billion with net income at CNY 73.96 million, reflecting solid growth despite market volatility concerns and shareholder dilution last year.

Googol Technology (SZSE:301510)

Simply Wall St Value Rating: ★★★★★★

Overview: Googol Technology Co., Ltd. specializes in the research, development, manufacturing, and sale of motion control products both in China and internationally with a market cap of CN¥12.52 billion.

Operations: Googol Technology generates revenue primarily from the sale of motion control products. The company's financial performance is characterized by a focus on its cost structure, impacting its profitability metrics.

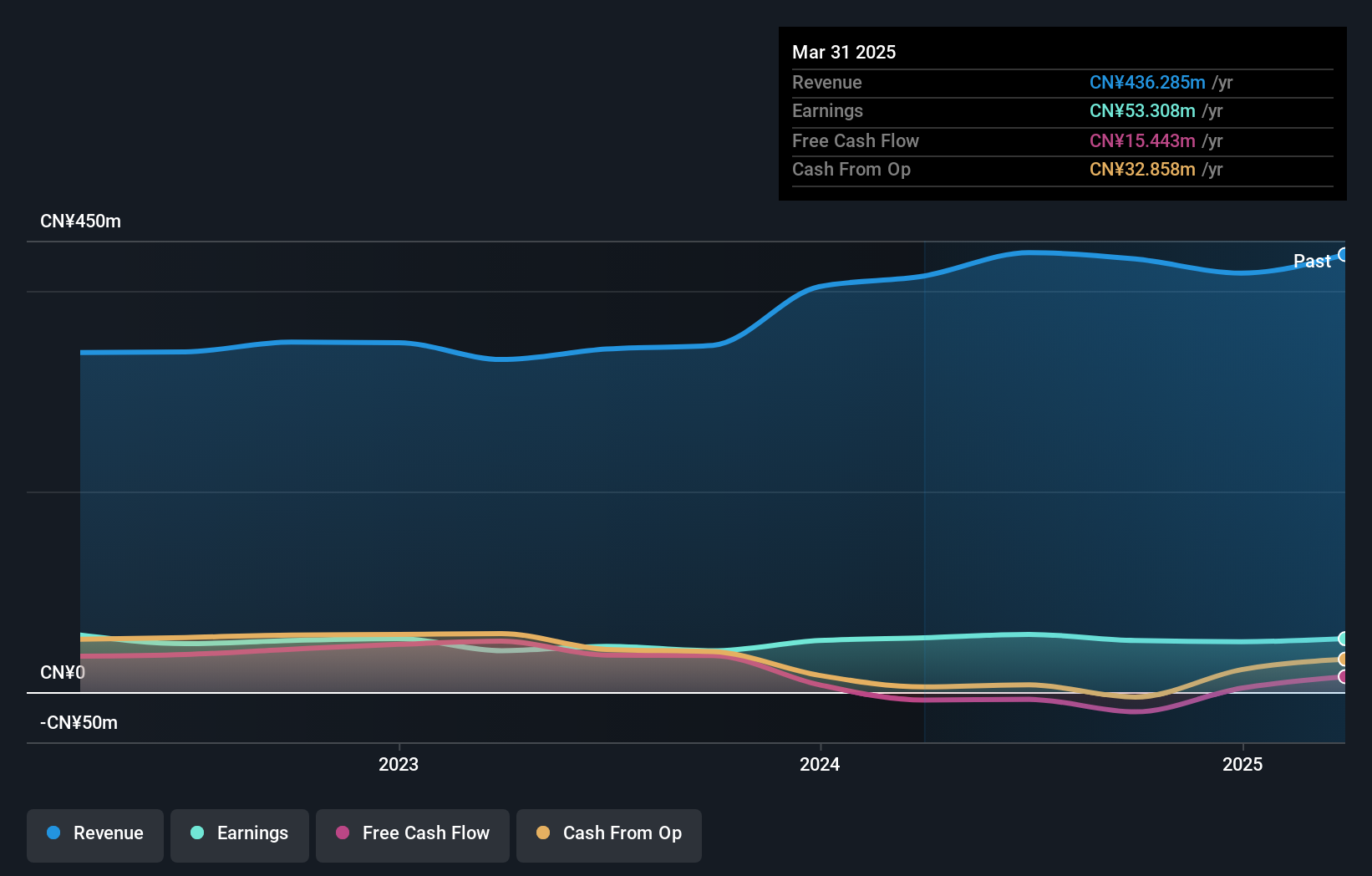

Googol Technology, a nimble player in the tech space, has shown impressive growth with earnings up 26% over the past year, outpacing the industry’s -4.2%. The company reported net income of CN¥26.5M for the half year ending June 2024, an increase from CN¥20.28M previously. Despite some volatility in its share price recently, Googol's debt-to-equity ratio improved significantly from 16% to 0.6% over five years, suggesting solid financial health and potential resilience moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Googol Technology.

Explore historical data to track Googol Technology's performance over time in our Past section.

Next Steps

- Discover the full array of 894 Chinese Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shenzhen Farben Information TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300925

Shenzhen Farben Information TechnologyLtd

Shenzhen Farben Information Technology Co.,Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives