As global markets continue to show resilience, with U.S. indexes approaching record highs and smaller-cap indexes outperforming their larger counterparts, investors are increasingly optimistic about the potential of small-cap stocks. This positive sentiment is further bolstered by strong labor market indicators and a steady economic growth trajectory, creating an opportune environment for discovering lesser-known stocks that may offer unique value propositions. In such a dynamic market landscape, identifying stocks with solid fundamentals and growth potential can be key to enhancing portfolio diversification and capturing emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Zhejiang HangminLtd (SHSE:600987)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Hangmin Co., Ltd, along with its subsidiaries, operates in the textile printing and dyeing industry in China and has a market capitalization of approximately CN¥7.46 billion.

Operations: Zhejiang Hangmin Co., Ltd generates revenue primarily from its textile printing and dyeing operations in China. The company has a market capitalization of approximately CN¥7.46 billion.

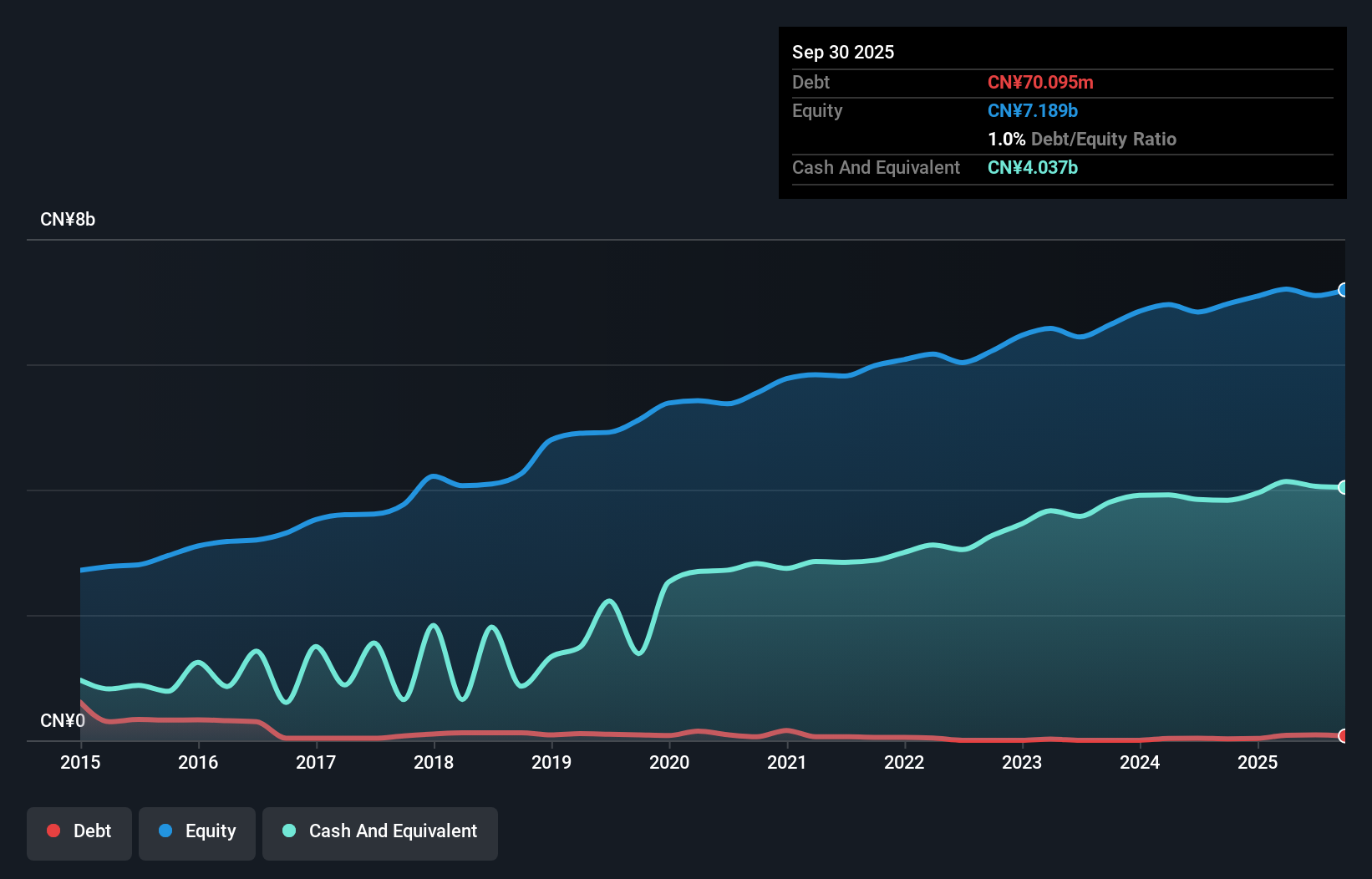

Zhejiang Hangmin, a notable player in the luxury industry, has demonstrated resilience despite a one-off loss of CN¥245.2M impacting its recent financial results. The company reported earnings growth of 6.5% over the past year, outpacing the industry's 3.3%. Trading at 25.6% below estimated fair value suggests potential undervaluation in the market's eyes. Recently, Zhejiang Hangmin completed a share repurchase of over 10 million shares for CN¥74.55M, signaling confidence in its future prospects and aiming to reduce registered capital further enhancing shareholder value through strategic buybacks amidst ongoing profitability and sound debt management with a reduced debt-to-equity ratio from 1.7 to 0.3 over five years.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang HangminLtd.

Understand Zhejiang HangminLtd's track record by examining our Past report.

Shannon Semiconductor TechnologyLtd (SZSE:300475)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shannon Semiconductor Technology Co., Ltd. operates in the semiconductor industry and has a market cap of CN¥13.28 billion.

Operations: Shannon Semiconductor generates revenue primarily from its semiconductor operations, with a market capitalization of CN¥13.28 billion. The company focuses on optimizing costs and achieving profitability through efficient production processes.

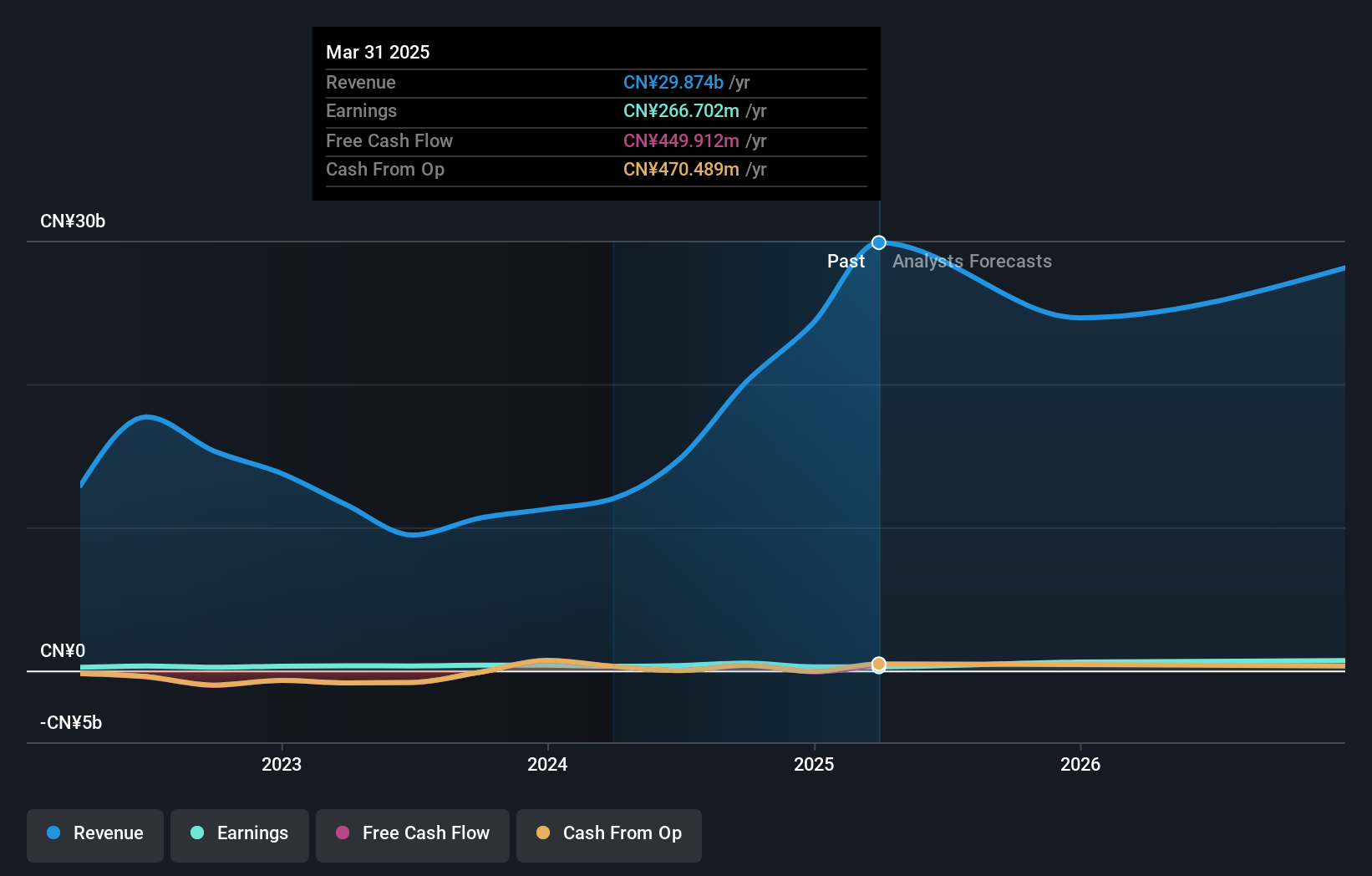

Shannon Semiconductor Technology, a promising player in the semiconductor industry, reported impressive revenue growth for the nine months ending September 2024, reaching CNY 16.51 billion from CNY 7.63 billion last year. Net income rose to CNY 364.31 million from CNY 216.78 million previously, and earnings per share improved to CNY 0.8 from CNY 0.48. Despite a volatile share price recently, the company is trading at nearly 80% below estimated fair value and shows strong financial health with a satisfactory net debt to equity ratio of 39.8%. With robust earnings growth of nearly 40% over the past year and well-covered interest payments by EBIT (4.4x), Shannon seems poised for continued success in its sector.

Googol Technology (SZSE:301510)

Simply Wall St Value Rating: ★★★★★☆

Overview: Googol Technology Co., Ltd. focuses on the research, development, manufacturing, and sale of motion control products both in China and internationally, with a market cap of CN¥10.60 billion.

Operations: Googol Technology generates revenue primarily from its Industrial Automatic Control System Equipment Manufacturing segment, which reported CN¥421.52 million. The company's market cap stands at CN¥10.60 billion.

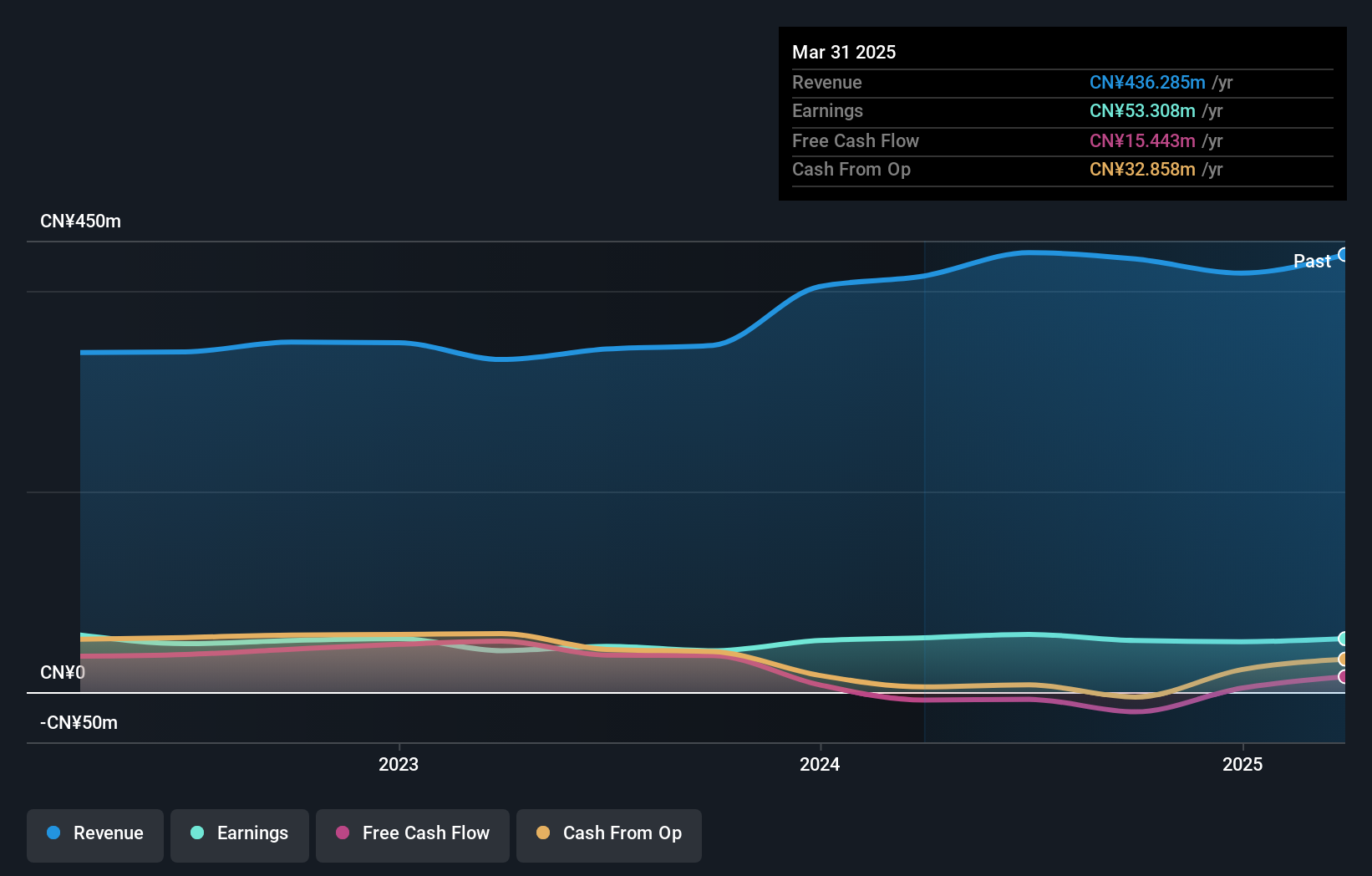

Googol Technology, a lesser-known player in the tech space, has shown notable earnings growth of 24.8% over the past year, outpacing its industry peers. Despite this positive momentum, its share price has been highly volatile recently. The company reported sales of CN¥295.6 million for the first nine months of 2024, up from CN¥267.95 million last year, with net income slightly rising to CN¥29.22 million from CN¥29.16 million previously. However, basic earnings per share dipped to CN¥0.0731 from CN¥0.08 a year ago due to large one-off gains impacting financial results significantly in previous periods.

Seize The Opportunity

- Delve into our full catalog of 4615 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300475

Shannon Semiconductor TechnologyLtd

Shannon Semiconductor Technology Co.,Ltd.

Proven track record with adequate balance sheet.