As we enter January 2025, global markets have shown mixed signals, with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains followed by declines in a holiday-shortened week. In this environment of fluctuating economic indicators and market sentiment, identifying high growth tech stocks requires careful consideration of their potential to innovate and adapt amidst changing conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Shanghai Fengyuzhu Culture Technology (SHSE:603466)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Fengyuzhu Culture Technology Co., Ltd. operates in the digital experience sector and has a market capitalization of CN¥5.41 billion.

Operations: Fengyuzhu Culture Technology generates revenue primarily from its digital experience segment, amounting to CN¥1.47 billion. The company's market capitalization stands at CN¥5.41 billion, reflecting its position within the industry.

Shanghai Fengyuzhu Culture Technology, grappling with a challenging phase, reported a significant revenue drop to CNY 958.32 million from CNY 1.84 billion year-over-year and swung to a net loss of CNY 117.12 million from a prior net income of CNY 208.92 million. Despite these setbacks, the company is poised for recovery with projected earnings growth at an impressive rate of 98% annually over the next three years, surpassing typical market expectations. This potential turnaround is supported by robust R&D investments aimed at innovating within the tech-driven cultural experiences sector, which could redefine its market standing and fuel future growth trajectories in an industry where technological advancement is key.

Piesat Information Technology (SHSE:688066)

Simply Wall St Growth Rating: ★★★★★☆

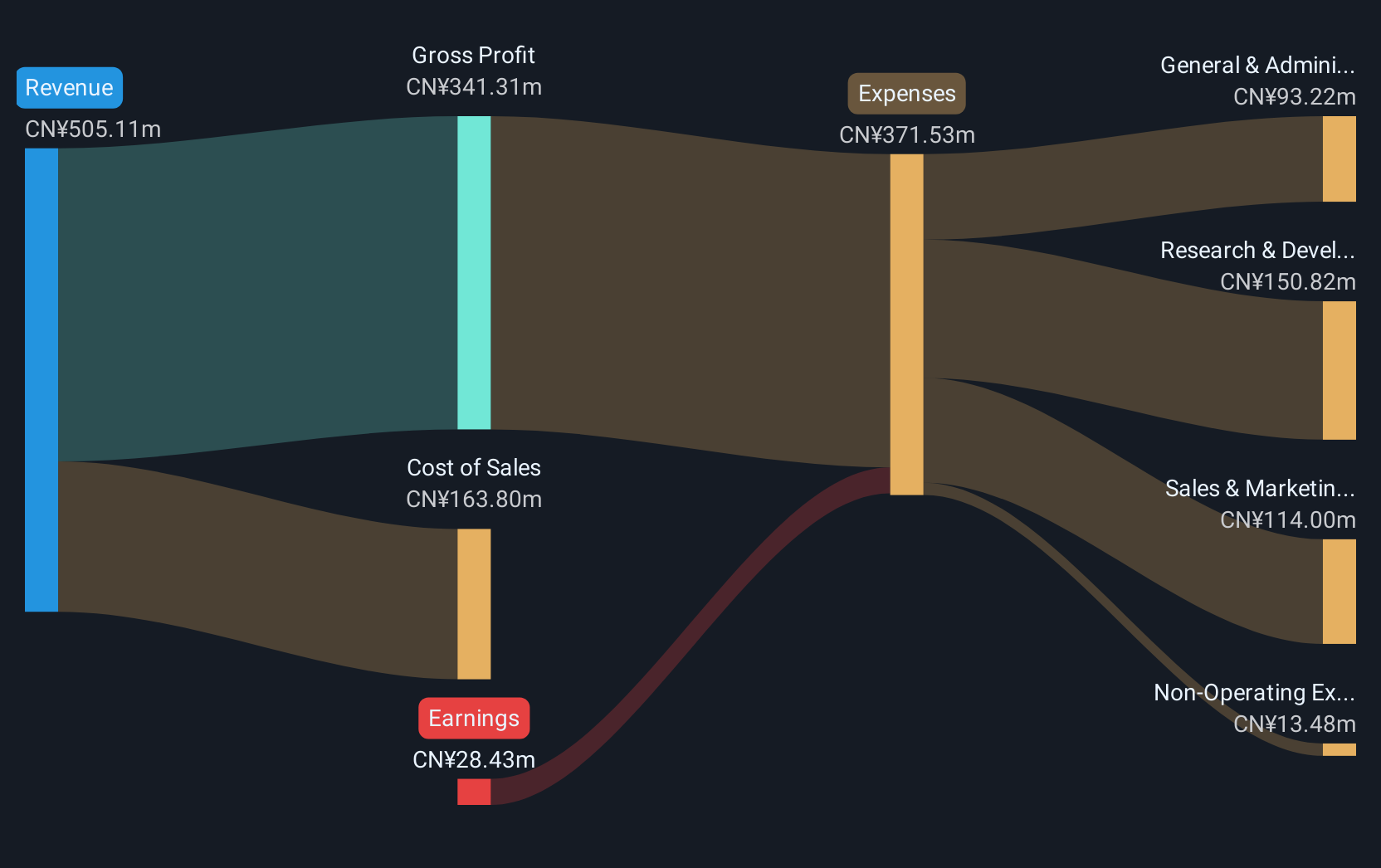

Overview: Piesat Information Technology Co., Ltd. specializes in providing satellite internet services within China and has a market capitalization of CN¥5.22 billion.

Operations: The company generates revenue primarily from its satellite application segment, amounting to CN¥1.58 billion.

Piesat Information Technology, amid a challenging financial landscape with a net loss of CNY 221.8 million from CNY 40.5 million year-over-year, continues to invest in innovation as evidenced by its robust R&D spending. Despite the downturn in revenue to CNY 1,344.88 million from CNY 1,586.47 million, the firm is poised for recovery with an anticipated earnings growth of 104.4% annually over the next three years—a rate significantly above typical market expectations (25%). These projections are supported by recent strategic shareholder meetings aimed at steering future operations towards profitability and growth in an increasingly competitive tech sector.

Beijing Infosec TechnologiesLtd (SHSE:688201)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Infosec Technologies Co., Ltd. specializes in developing and providing application security products in China, with a market cap of CN¥2.69 billion.

Operations: Beijing Infosec Technologies Co., Ltd. focuses on delivering application security solutions within China. The company's revenue streams are primarily derived from its suite of security products, catering to various sectors requiring robust cybersecurity measures.

Beijing Infosec TechnologiesLtd, despite a challenging period with net losses increasing to CNY 49.03 million from CNY 12.25 million year-over-year, showcases potential for significant turnaround. The company's commitment to innovation is evident in its R&D spending, aligned with its revenue growth forecast at 19.5% annually—outpacing the CN market average of 13.6%. Additionally, earnings are expected to surge by an impressive 124.62% annually over the next three years, signaling robust future prospects in a competitive tech landscape. Recent strategic moves include a special shareholders meeting aimed at refining operational strategies to enhance profitability and market position. This proactive approach could steer Beijing Infosec towards becoming a notable contender in the tech sector, leveraging its ongoing investments in research and development to potentially outperform market expectations and achieve profitability.

Taking Advantage

- Click here to access our complete index of 1263 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688066

Piesat Information Technology

Provides satellite internet services in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion