- China

- /

- Electronic Equipment and Components

- /

- SZSE:301413

Discovering Asia's Undiscovered Gems This August 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of evolving trade dynamics and rate cut speculations, Asian markets are capturing attention with their own unique set of opportunities. In this environment, small-cap stocks in Asia present intriguing possibilities for investors seeking growth potential amid broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Allmed Medical ProductsLtd | 20.96% | -1.35% | -31.57% | ★★★★★★ |

| Anji Foodstuff | NA | 9.26% | -13.65% | ★★★★★★ |

| Ningbo Kangqiang Electronics | 43.88% | 2.48% | -7.32% | ★★★★★★ |

| Shenzhen Keanda Electronic Technology | 3.18% | -5.89% | -13.61% | ★★★★★☆ |

| CTCI Advanced Systems | 33.93% | 20.38% | 21.25% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.69% | 8.02% | 10.61% | ★★★★★☆ |

| Jinlihua Electric | 48.71% | 7.36% | 31.30% | ★★★★★☆ |

| Huasi Holding | 16.28% | 5.13% | 20.61% | ★★★★★☆ |

| Hui Lyu Ecological Technology GroupsLtd | 43.35% | -5.67% | -12.37% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Ningbo Henghe Precision IndustryLtd (SZSE:300539)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ningbo Henghe Precision Industry Co., Ltd. operates in the precision manufacturing sector with a market capitalization of CN¥7.01 billion.

Operations: Henghe Precision generates its revenue primarily from the precision manufacturing sector. The company has a market capitalization of CN¥7.01 billion.

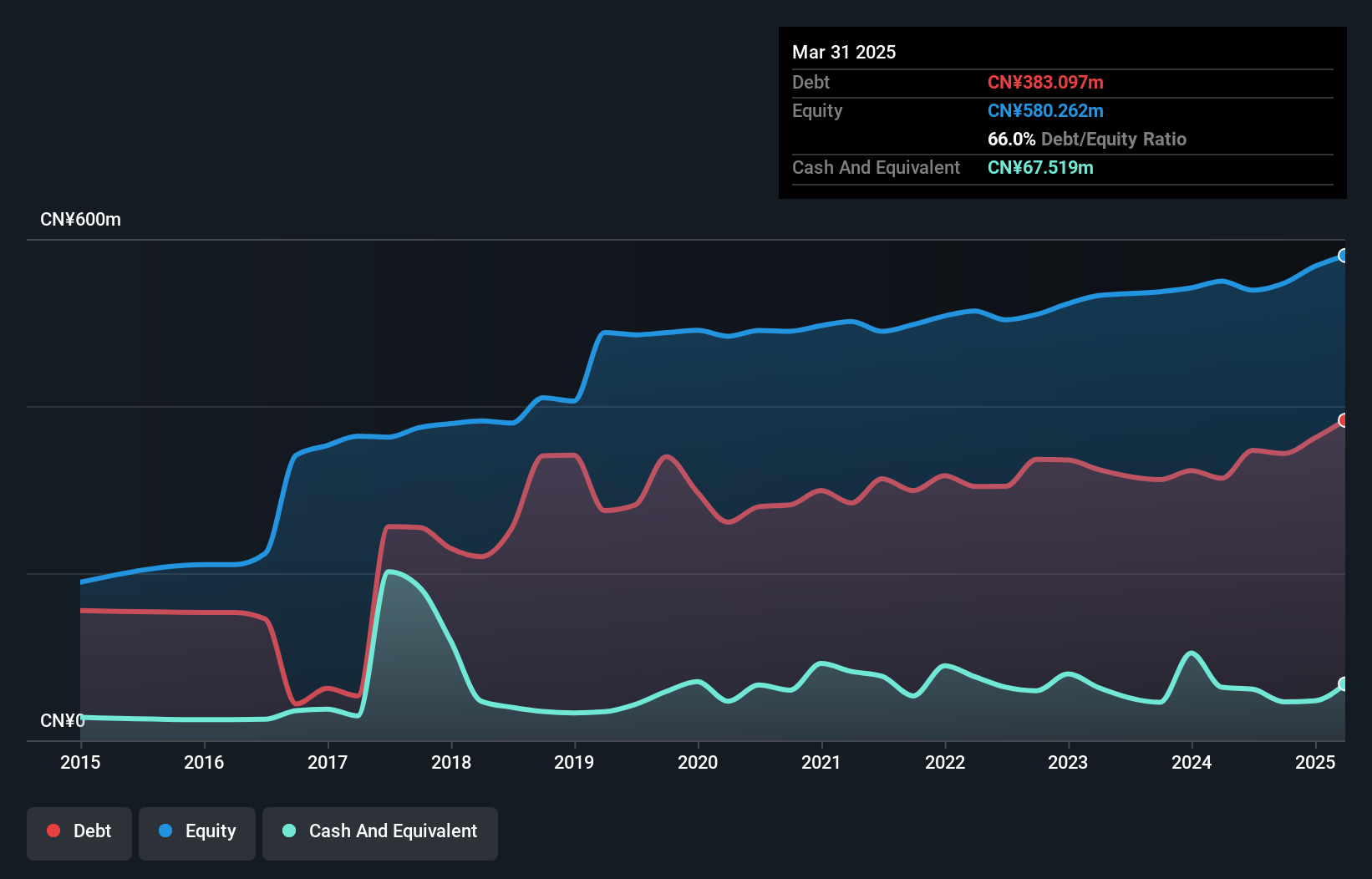

Ningbo Henghe Precision Industry, a small player in the market, showcases impressive earnings growth of 25% over the past year, outpacing the Chemicals industry's modest 0.4%. Despite having high-quality earnings and EBIT covering interest payments by 4.3 times, its net debt to equity ratio stands at a concerning 66%, up from 54% five years ago. The company recently raised CNY 588 million through private placements at CNY 12.98 per share to bolster its financial position amidst volatile share prices. While free cash flow remains negative, profitability ensures that cash runway isn't an immediate worry.

Hunan Jiudian Pharmaceutical (SZSE:300705)

Simply Wall St Value Rating: ★★★★★★

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥9.94 billion.

Operations: Jiudian Pharmaceutical generates revenue primarily from its medicine manufacturing segment, which amounts to CN¥3.04 billion. The company's financial performance is characterized by a gross profit margin that reflects its cost efficiency and pricing strategy within the pharmaceutical industry.

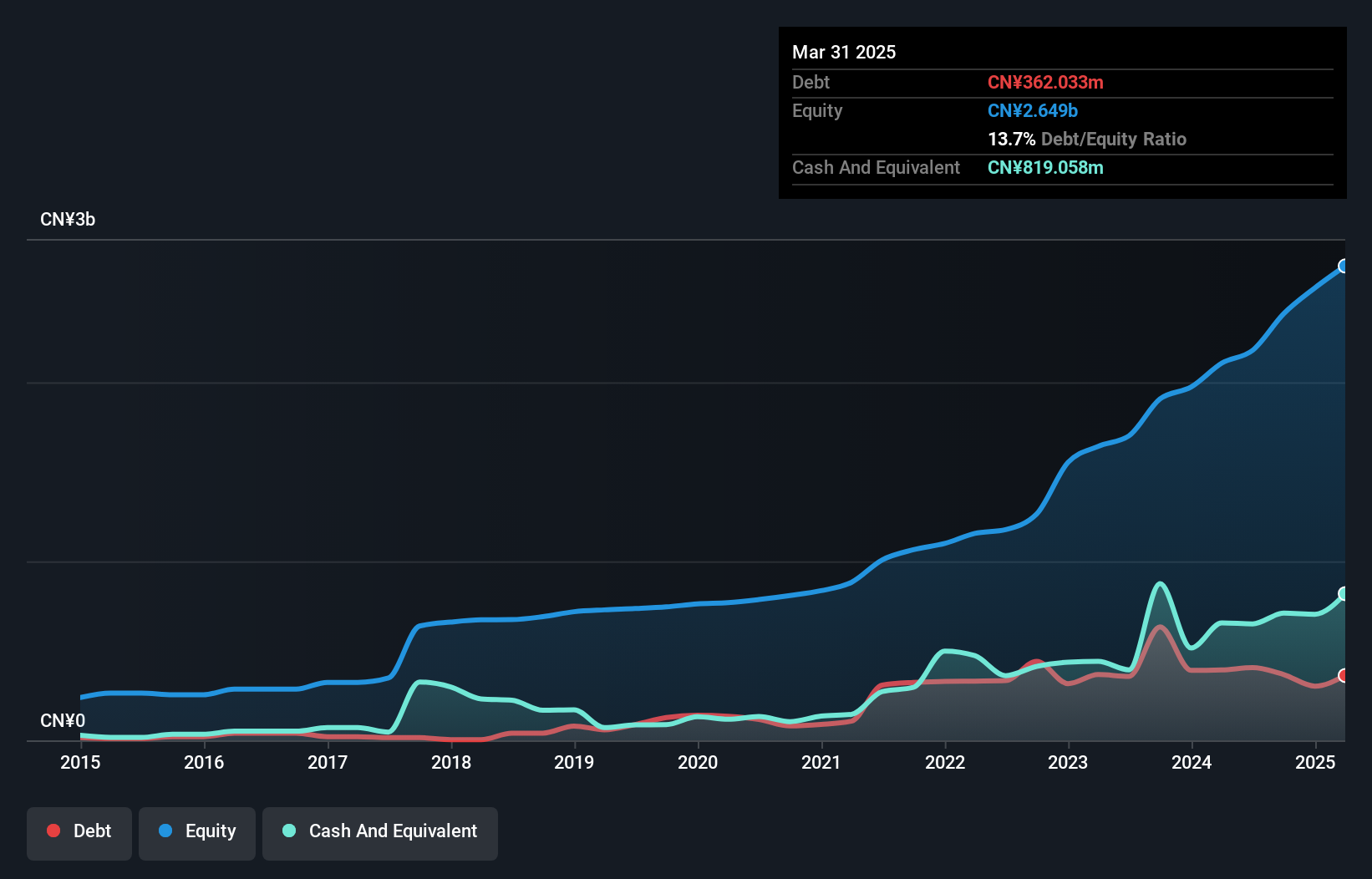

Hunan Jiudian Pharmaceutical, a small yet promising player in the pharmaceutical industry, has demonstrated robust financial health with its interest payments well covered by EBIT at 58.7 times. The company has effectively reduced its debt to equity ratio from 17.4% to 13.7% over five years and boasts high-quality earnings, indicating solid management practices. Its recent buyback of nearly 5.88 million shares for CNY 94.99 million reflects confidence in future prospects and shareholder value enhancement strategies. Trading at a price-to-earnings ratio of 19x, it offers good relative value compared to the broader CN market's average of 45x.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of sensors in China with a market capitalization of CN¥11.08 billion.

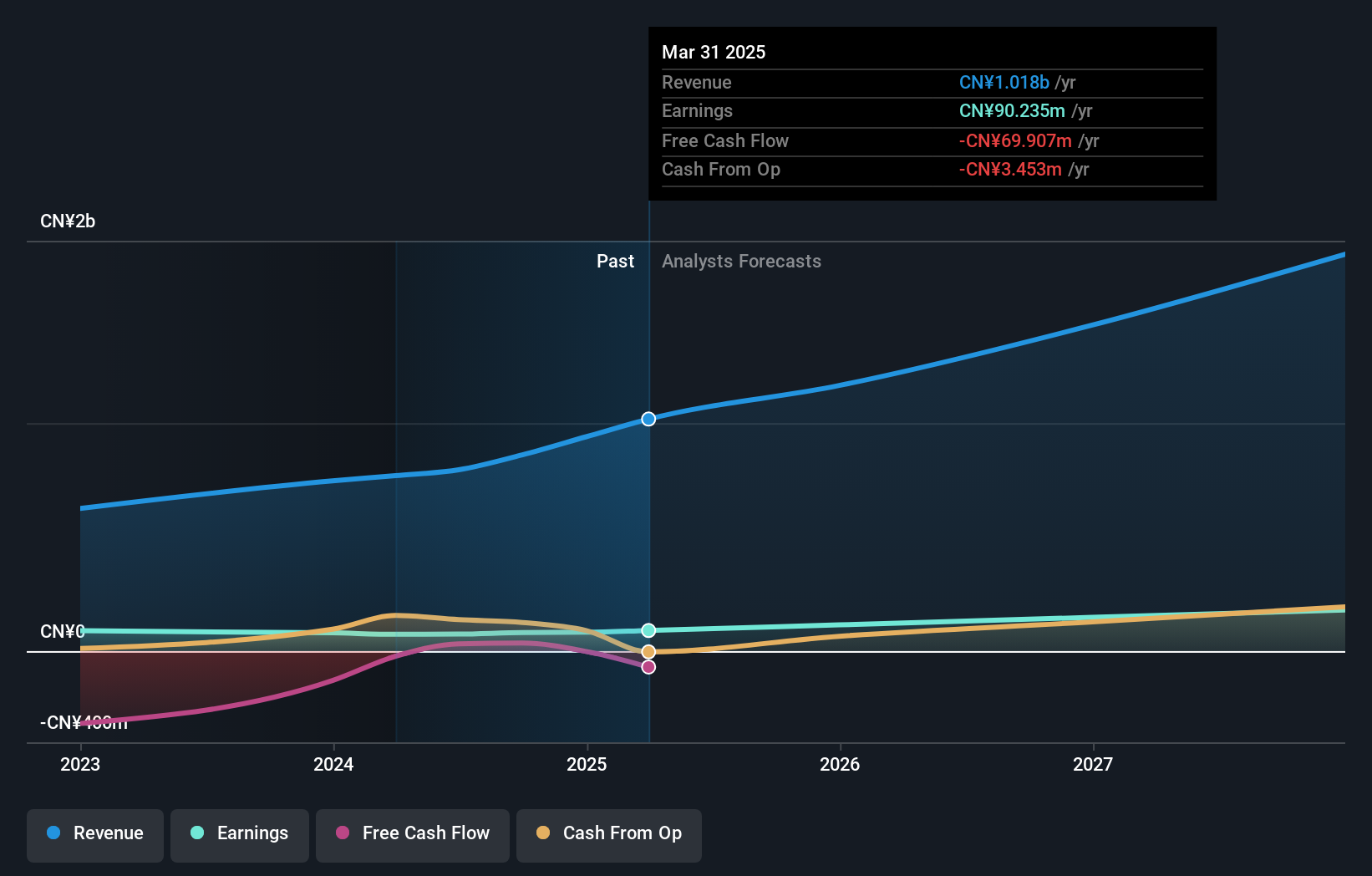

Operations: Ampron Technology generates revenue primarily from its Electronic Components & Parts segment, amounting to CN¥1.02 billion.

Ampron Technology, a dynamic player in the electronics sector, has shown impressive earnings growth of 22.8% over the past year, outpacing the industry average of 3%. Despite a rise in its debt to equity ratio from 9.4% to 37.5% over five years, its net debt to equity ratio remains satisfactory at 19.6%, indicating prudent financial management. Interest payments are comfortably covered by EBIT with an 11.3x coverage, reflecting robust operational efficiency. However, recent share price volatility suggests market uncertainty; yet forecasts indicate potential annual earnings growth of 24.5%, hinting at promising future prospects for investors seeking value in emerging markets.

Taking Advantage

- Click here to access our complete index of 2412 Asian Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301413

Shenzhen Ampron Technology

Engages in the research and development, manufacture, sale, and service of sensors in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives