- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

High Growth Tech Stocks To Watch In August 2025

Reviewed by Simply Wall St

As global markets navigate the implications of potential rate cuts hinted at by Fed Chair Jerome Powell, investor sentiment is buoyed, with small-cap indices like the S&P Mid-Cap 400 and Russell 2000 showing strong returns despite concerns in tech-heavy sectors. In this environment, identifying high growth tech stocks involves assessing their resilience to economic shifts and their ability to innovate amid fluctuating infrastructure spending and evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Fositek | 33.77% | 43.92% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.30% | 59.70% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 33.65% | 39.46% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★☆☆

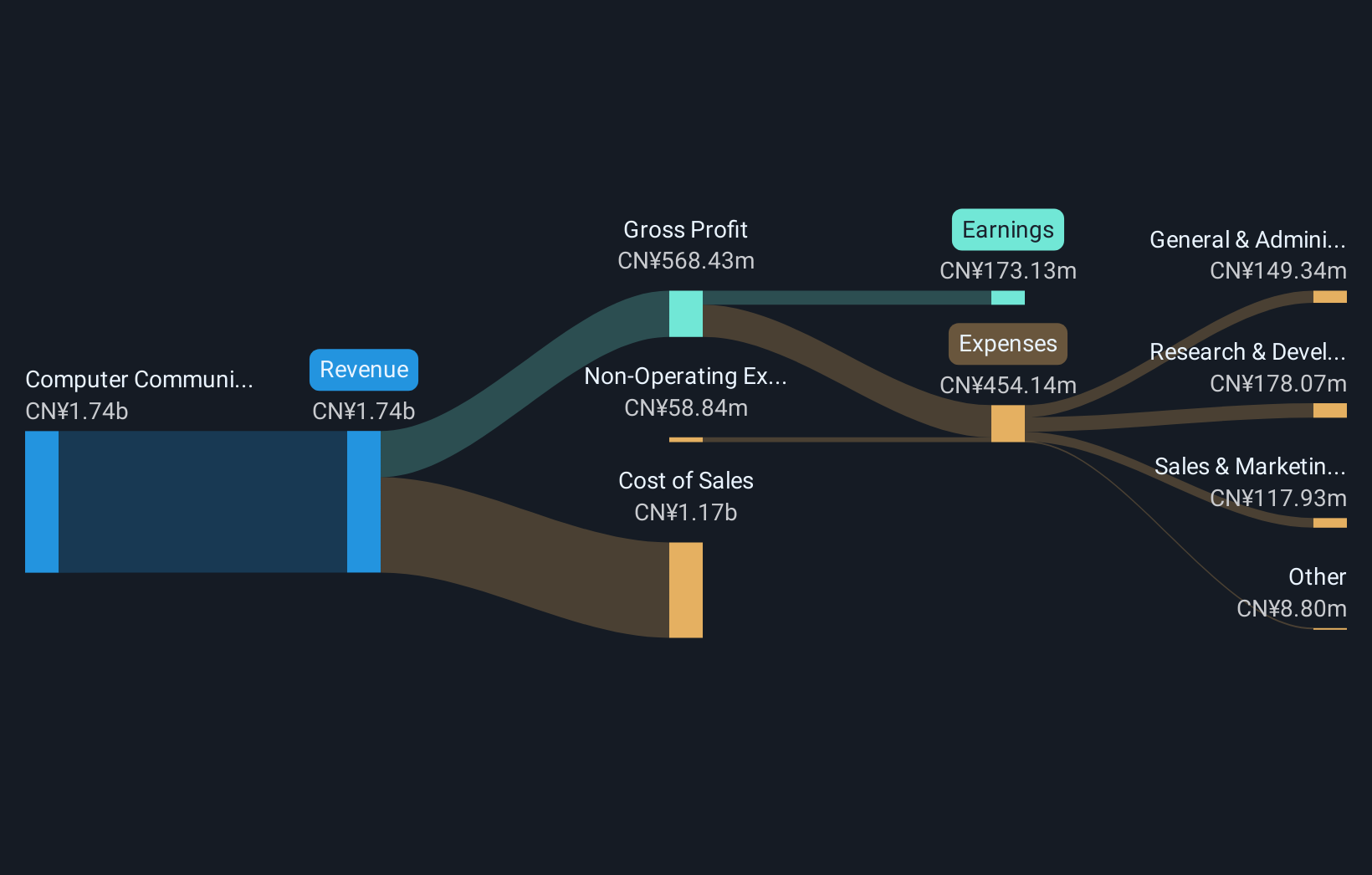

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices with a market capitalization of CN¥12.87 billion.

Operations: JPT Opto-Electronics generates revenue primarily from its Computer Communications and Other Electronic Equipment segment, which accounts for CN¥1.54 billion. The company is involved in the production and sale of laser and optical devices.

Shenzhen JPT Opto-Electronics, a player in the electronic industry, has demonstrated robust growth metrics that outpace market averages. With an annualized revenue increase of 18.4%, it surpasses China's average of 13.4%. This is complemented by a remarkable earnings growth rate of 29.39% per year, which not only exceeds the industry's modest 3.5% but also forecasts a significant uptick over the next three years. The company's focus on innovation is evident from its R&D expenditure trends, ensuring it stays ahead in technology advancements and market competition. Recent events like their extraordinary shareholders meeting and upcoming earnings report suggest active management and potential strategic shifts that could influence future performance. Their consistent financial growth paired with strategic corporate activities positions them well within the high-growth tech sector despite market volatility and competitive pressures.

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. operates in the packaging and containers industry with a market cap of CN¥14.22 billion.

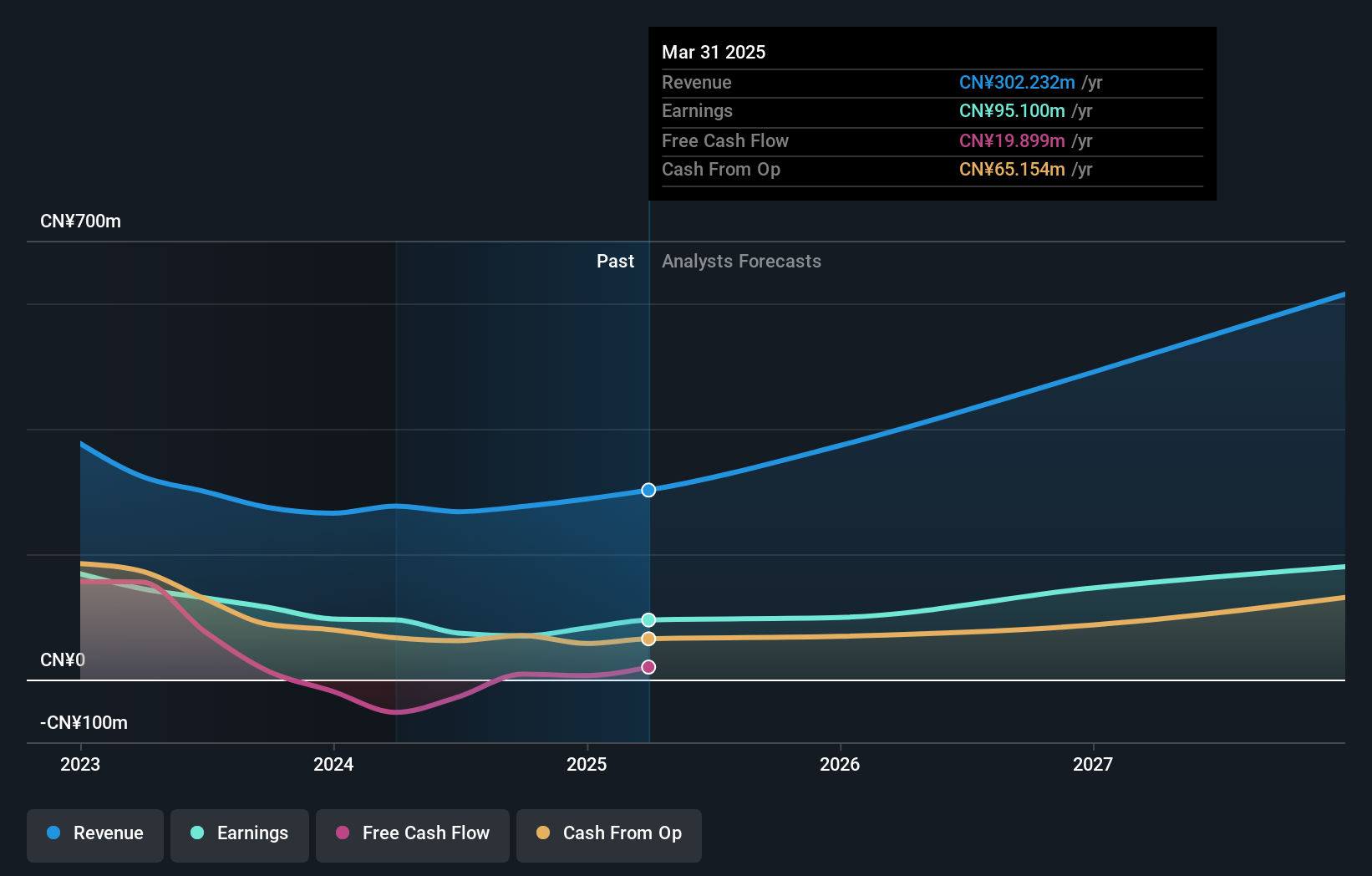

Operations: The company generates revenue primarily from its packaging and containers segment, amounting to CN¥302.23 million.

Long Young Electronic (Kunshan) has been navigating a dynamic market landscape, evidenced by its strategic moves and robust growth metrics. The company's revenue is expected to grow at an impressive rate of 25.7% annually, outpacing the broader Chinese market average of 13.4%. This growth is mirrored in its earnings projections, with an anticipated increase of 25.4% per year, suggesting a strong upward trajectory compared to the industry standard. A recent extraordinary shareholders meeting highlighted considerations for major asset restructuring and acquisitions that could further influence Long Young's market position and operational scale. Despite some volatility in its share price over the past three months, these strategic initiatives coupled with significant R&D investments underscore Long Young's commitment to maintaining technological leadership and enhancing shareholder value in the high-tech sector.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★★

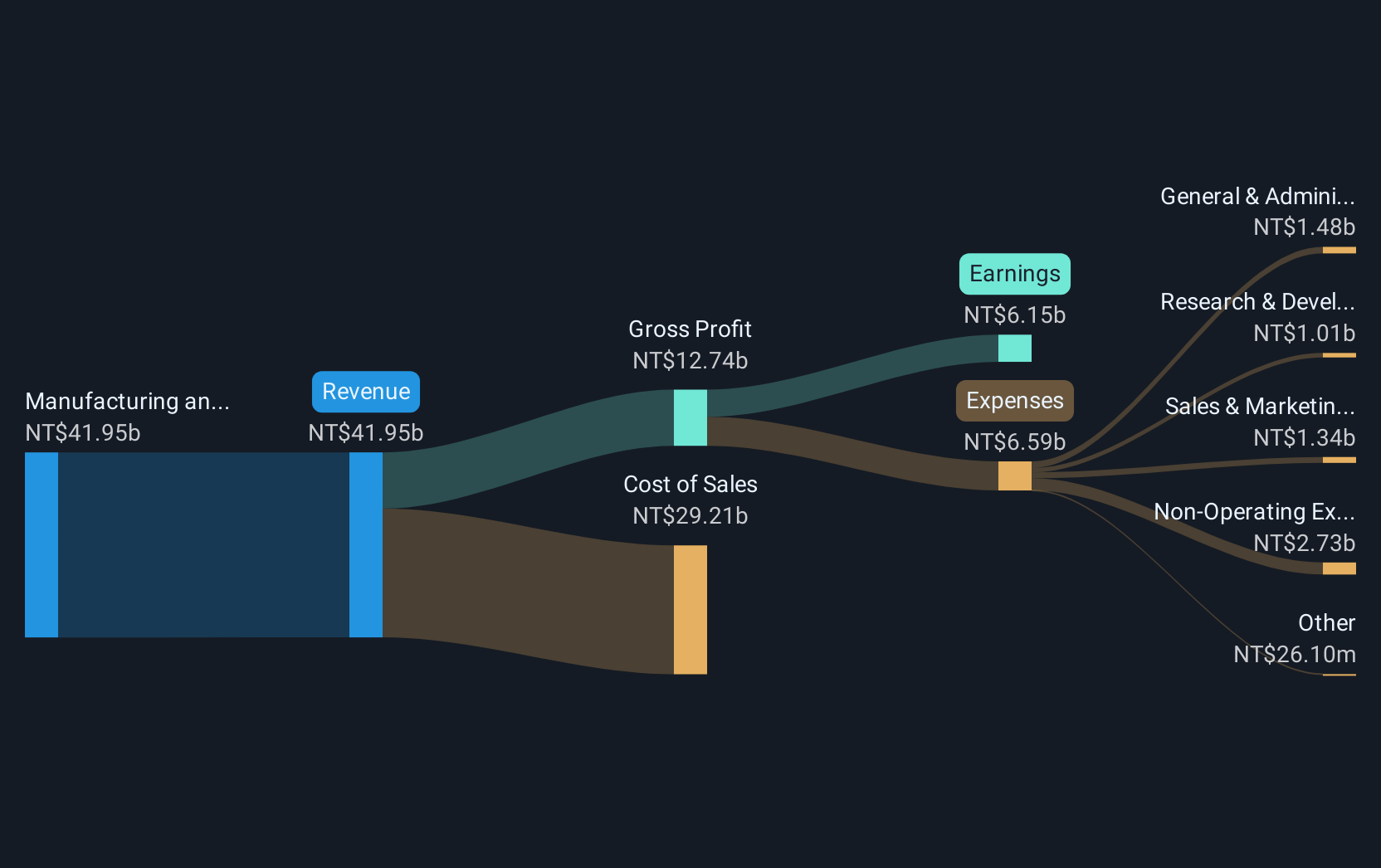

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that specializes in the design, manufacturing, processing, and distribution of printed circuit boards with a market capitalization of NT$222.90 billion.

Operations: Specializing in printed circuit boards, Gold Circuit Electronics Ltd.'s revenue from manufacturing and sales is NT$46.23 billion.

Gold Circuit Electronics has demonstrated robust growth, with recent financials showing a revenue increase to TWD 25.92 billion, up from TWD 18.64 billion year-over-year, and net income rising to TWD 3.45 billion from TWD 2.74 billion in the same period. This performance is underscored by a significant R&D focus, where expenses are strategically aligned with emerging tech trends, ensuring the company stays at the forefront of innovation within the electronics sector. Additionally, amendments to its Articles of Incorporation signify strategic shifts possibly aimed at enhancing operational agility and market responsiveness. These moves could well position Gold Circuit Electronics for sustained growth amidst evolving industry dynamics.

- Navigate through the intricacies of Gold Circuit Electronics with our comprehensive health report here.

Gain insights into Gold Circuit Electronics' past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 234 more companies for you to explore.Click here to unveil our expertly curated list of 237 Global High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026