As we enter January 2025, global markets are experiencing mixed performances, with U.S. stocks closing out a strong year despite recent slumps and economic indicators like the Chicago PMI showing signs of contraction. In this environment, investors may look to high-growth tech stocks that demonstrate resilience and adaptability amid shifting market dynamics and economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Vista Group International (NZSE:VGL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market capitalization of NZ$748.68 million.

Operations: Vista Group International Limited generates revenue primarily through its software and data analytics solutions tailored for the film industry. The company focuses on providing innovative tools that enhance operational efficiency and decision-making for cinema exhibitors and distributors worldwide.

Vista Group International, amidst a dynamic corporate governance landscape marked by recent withdrawal of contentious shareholder resolutions, is navigating through an intriguing phase. The company's revenue growth projection stands at 12.9% annually, outpacing the New Zealand market's average of 4.4%, highlighting its robust position in the tech sector despite not currently being profitable. Furthermore, anticipated earnings growth at a striking rate of 47.8% per annum underscores potential for substantial financial improvement over the next three years. This forecast aligns with Vista’s strategic focus on innovation and market expansion which could significantly shape its industry standing moving forward.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bromake New Material Co., Ltd. specializes in the research, development, production, and sale of consumer electronics protective and functional products with a market capitalization of CN¥3.99 billion.

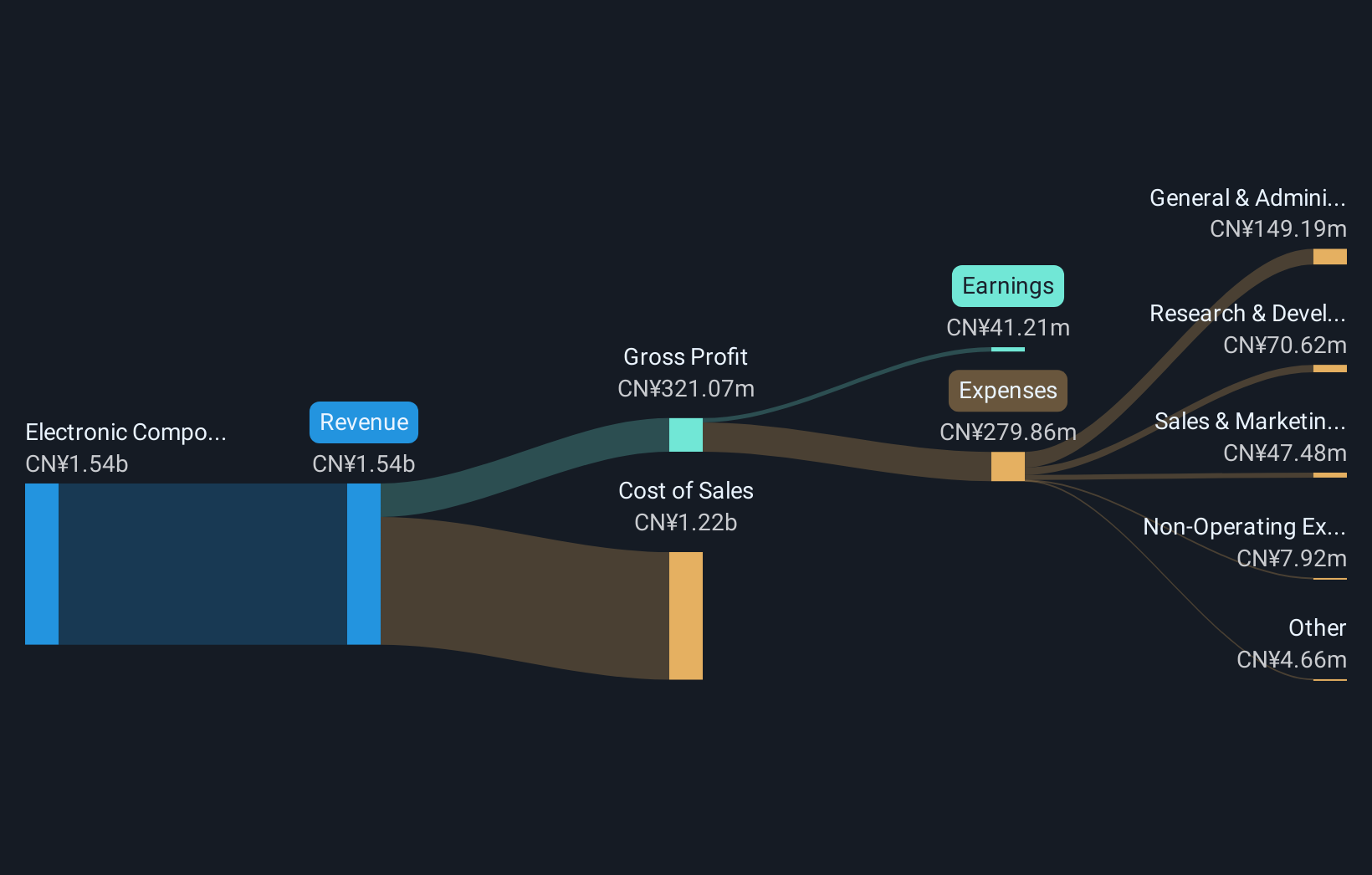

Operations: Bromake focuses on the consumer electronics sector, generating revenue primarily from electronic components and parts, totaling CN¥1.14 billion. The company operates within a specialized niche, emphasizing protective and functional products for electronics.

Shenzhen Bromake New Material Co., Ltd. is navigating a challenging landscape with significant fluctuations in its financial performance. Despite a robust annual revenue growth of 33.4%, the company's net profit margin has contracted to 3% from last year's 11.6%. This downturn is partly due to a substantial one-off loss of CN¥5.2M, which skews the earnings figures for the period ending September 30, 2024. However, looking ahead, earnings are expected to surge by approximately 84% annually, signaling potential recovery and growth driven by strategic initiatives and market adaptations.

PSI Software (XTRA:PSAN)

Simply Wall St Growth Rating: ★★★★★☆

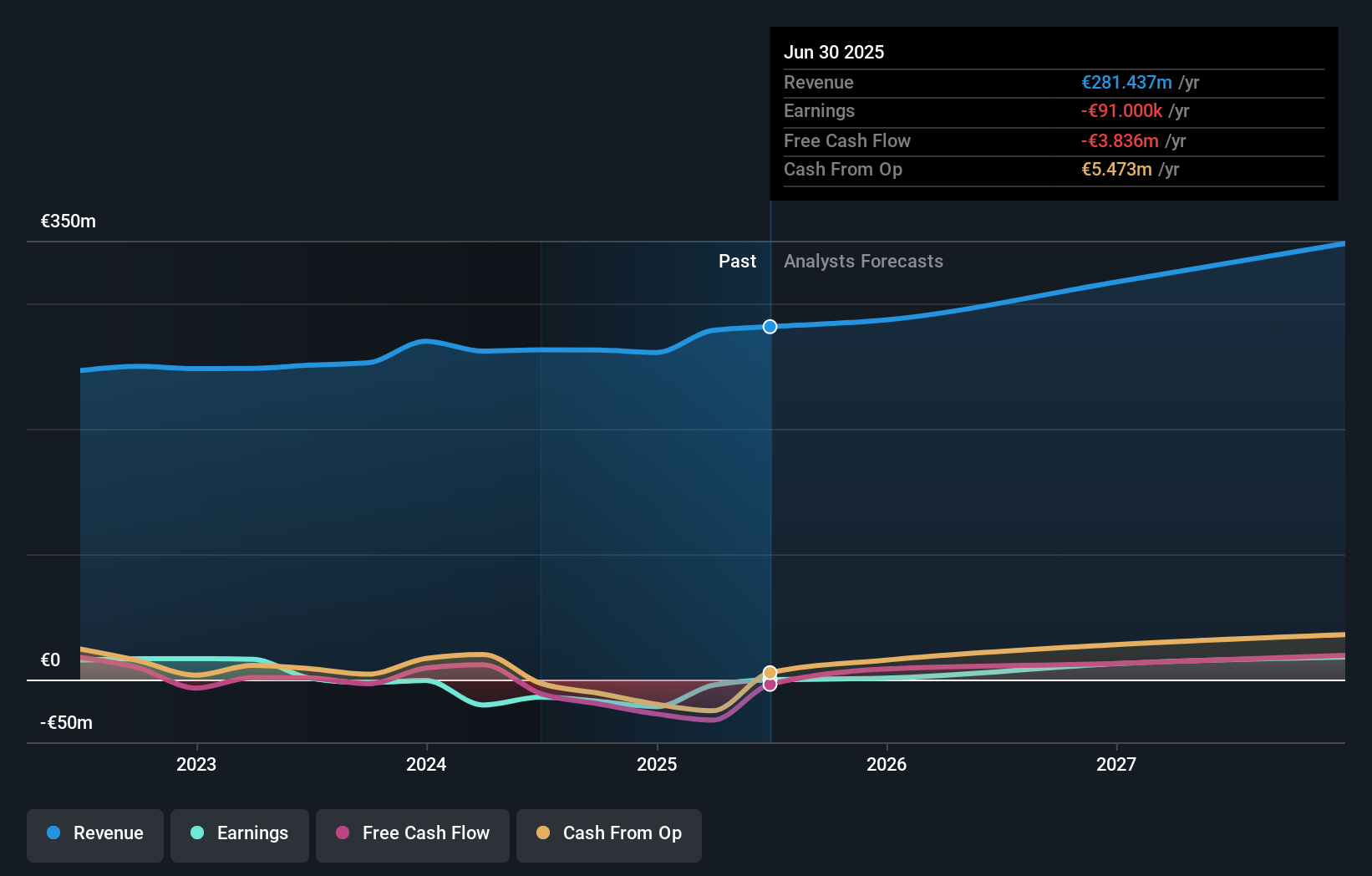

Overview: PSI Software SE specializes in developing and integrating software solutions to optimize energy and material flows for utilities and industries globally, with a market cap of €331.44 million.

Operations: With revenue primarily derived from Energy Management (€132.55 million) and Production Management (€134.45 million), PSI Software SE focuses on optimizing energy and material flows for utilities and industries worldwide.

PSI Software is navigating a transformative phase with its PSI Reloaded program, aiming to streamline operations and enhance efficiency across its segments. This strategic shift is evident in the recent merger into the Grid & Energy Management unit, which consolidates various energy-related services. Despite a challenging financial period with a reported net loss of EUR 24.14 million for the nine months ending September 2024, PSI's forward-looking initiatives such as developing new control systems for energy management signal robust potential for innovation and market adaptation. The company's focus on integrating advanced technologies in sector coupling and energy transition reflects an adaptive strategy aimed at future profitability and growth within the tech landscape.

- Unlock comprehensive insights into our analysis of PSI Software stock in this health report.

Explore historical data to track PSI Software's performance over time in our Past section.

Summing It All Up

- Dive into all 1258 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PSAN

PSI Software

Develops and integrates software solutions and products for optimizing the flow of energy and materials for utilities and industry worldwide.

High growth potential and good value.