Does Heidelberger Druckmaschinen (ETR:HDD) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Heidelberger Druckmaschinen Aktiengesellschaft (ETR:HDD) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Heidelberger Druckmaschinen

What Is Heidelberger Druckmaschinen's Debt?

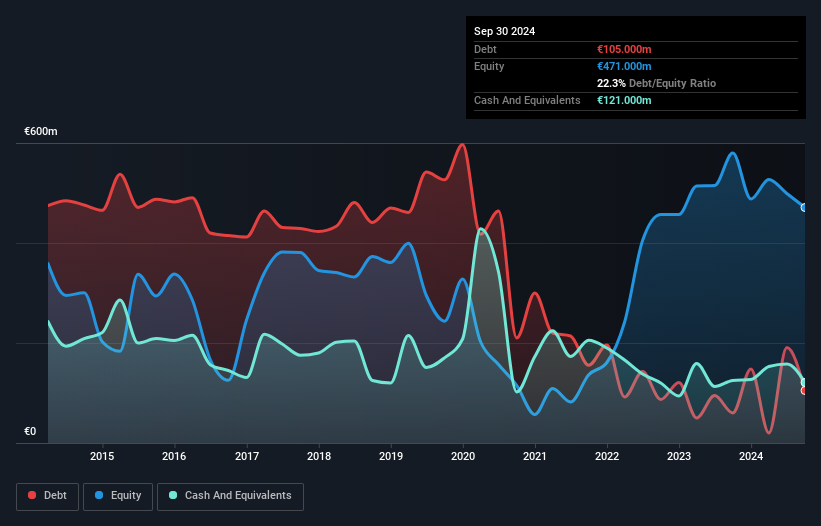

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Heidelberger Druckmaschinen had €105.0m of debt, an increase on €60.0m, over one year. However, its balance sheet shows it holds €121.0m in cash, so it actually has €16.0m net cash.

A Look At Heidelberger Druckmaschinen's Liabilities

Zooming in on the latest balance sheet data, we can see that Heidelberger Druckmaschinen had liabilities of €799.0m due within 12 months and liabilities of €912.0m due beyond that. On the other hand, it had cash of €121.0m and €307.0m worth of receivables due within a year. So its liabilities total €1.28b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €308.6m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Heidelberger Druckmaschinen would likely require a major re-capitalisation if it had to pay its creditors today. Given that Heidelberger Druckmaschinen has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Heidelberger Druckmaschinen's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Heidelberger Druckmaschinen made a loss at the EBIT level, and saw its revenue drop to €2.2b, which is a fall of 8.6%. That's not what we would hope to see.

So How Risky Is Heidelberger Druckmaschinen?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Heidelberger Druckmaschinen lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of €50m and booked a €29m accounting loss. With only €16.0m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. For riskier companies like Heidelberger Druckmaschinen I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberger Druckmaschinen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HDD

Heidelberger Druckmaschinen

Manufactures, sells, and deals in printing presses and other print media industry products in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives