- China

- /

- Electronic Equipment and Components

- /

- SZSE:301379

Does Techshine ElectronicsLtd (SZSE:301379) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Techshine ElectronicsLtd (SZSE:301379). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Techshine ElectronicsLtd

How Fast Is Techshine ElectronicsLtd Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. Techshine ElectronicsLtd boosted its trailing twelve month EPS from CN¥0.80 to CN¥0.88, in the last year. This amounts to a 10% gain; a figure that shareholders will be pleased to see.

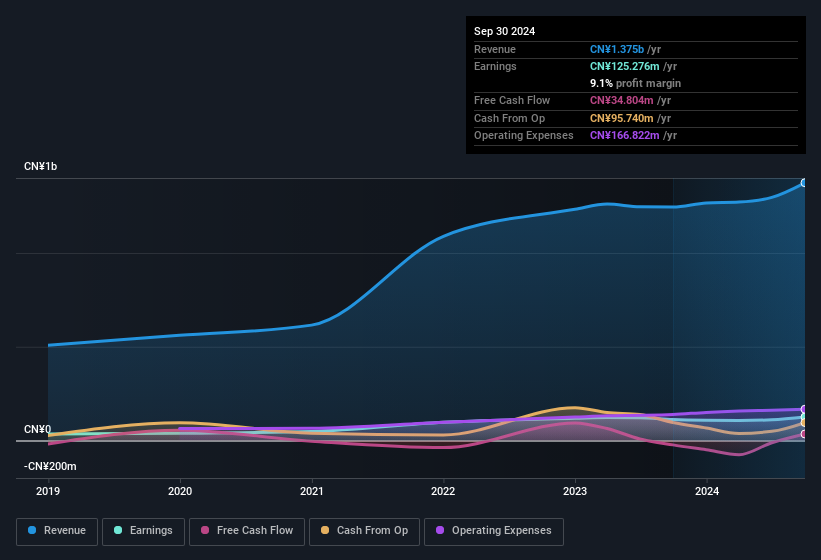

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Techshine ElectronicsLtd achieved similar EBIT margins to last year, revenue grew by a solid 10% to CN¥1.4b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Techshine ElectronicsLtd's balance sheet strength, before getting too excited.

Are Techshine ElectronicsLtd Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Techshine ElectronicsLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 43% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. And their holding is extremely valuable at the current share price, totalling CN¥1.5b. That level of investment from insiders is nothing to sneeze at.

Is Techshine ElectronicsLtd Worth Keeping An Eye On?

One important encouraging feature of Techshine ElectronicsLtd is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. You still need to take note of risks, for example - Techshine ElectronicsLtd has 2 warning signs we think you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Techshine ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301379

Techshine ElectronicsLtd

Engages in the research and development, design, production, and sale of LCD displays, LCM monochrome modules, TFT color screen and complex modules, and TP touch panels in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion