- China

- /

- Electronic Equipment and Components

- /

- SZSE:301339

Neusoft And 2 Promising High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties, the Asian tech sector remains a focal point for investors, with enthusiasm particularly strong in areas like artificial intelligence despite broader economic slowdowns. In this dynamic environment, identifying high-growth stocks involves assessing companies that demonstrate resilience and innovation potential amidst shifting market conditions and evolving consumer demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Neusoft (SHSE:600718)

Simply Wall St Growth Rating: ★★★★☆☆

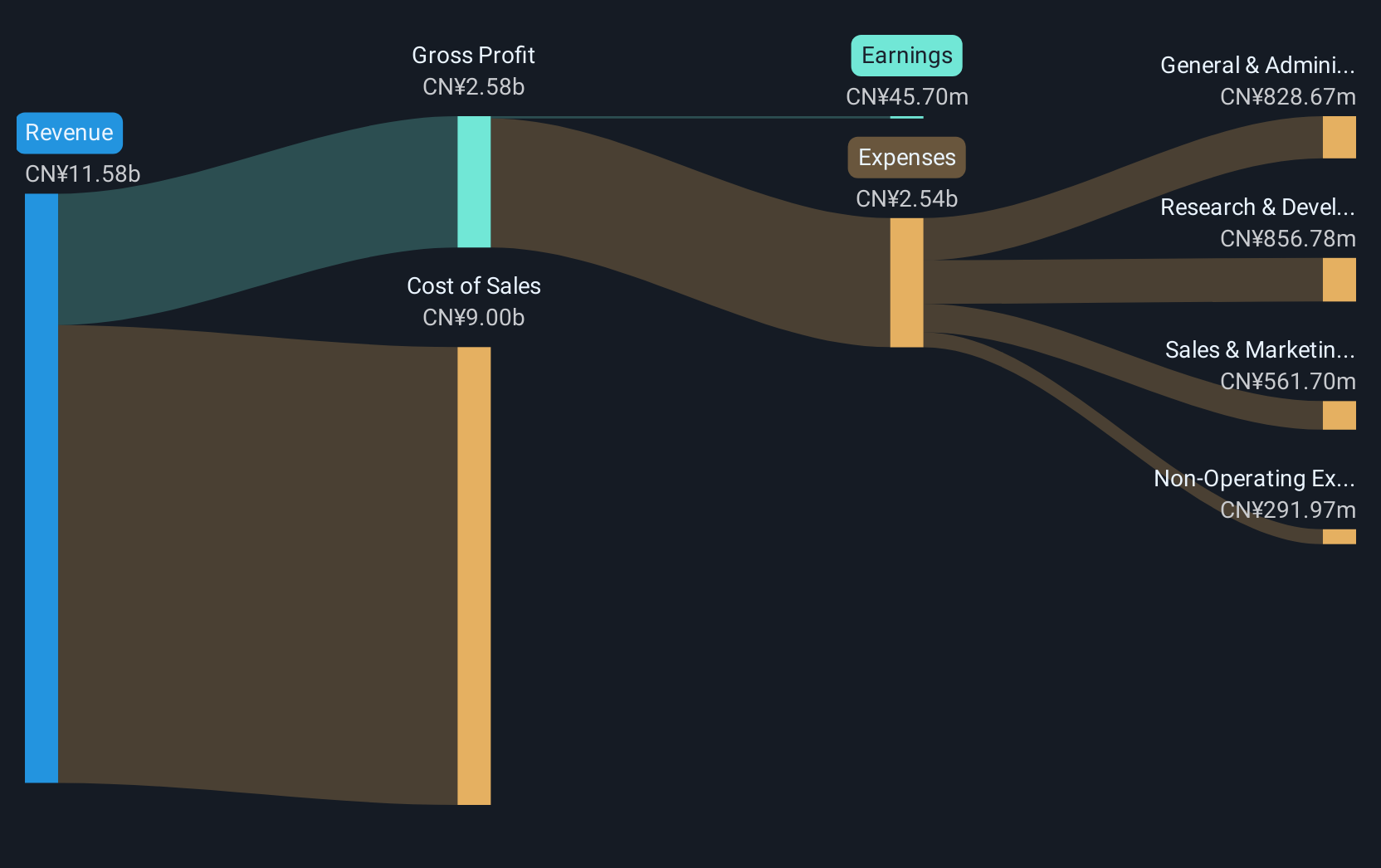

Overview: Neusoft Corporation provides software and information technology solutions and services globally, with a market cap of CN¥11.73 billion.

Operations: Neusoft focuses on delivering a range of software and IT solutions worldwide. The company operates across various revenue segments, contributing to its market cap of CN¥11.73 billion.

Neusoft's strategic alliance with MapmyIndia, as announced on December 4, 2025, underscores its commitment to enhancing intelligent mobility solutions in Southeast Asia and India—regions poised for significant automotive growth. This partnership leverages Neusoft's global navigation ecosystem expertise to address local challenges such as navigation accuracy and integration in complex traffic environments. Despite a challenging financial performance with net income dropping to CNY 51.08 million from CNY 152.36 million year-over-year by Q3 2025, the company is navigating its future with innovative collaborations aimed at improving market adaptability and user experience in emerging markets. These efforts are part of why Neusoft's revenue growth (19.5% annually) outpaces the Chinese market average (14.6%), signaling robust potential amidst operational headwinds.

- Unlock comprehensive insights into our analysis of Neusoft stock in this health report.

Understand Neusoft's track record by examining our Past report.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥8.13 billion.

Operations: Tongxingbao focuses on providing smart transportation platform solutions in China, primarily through its software and information technology segment, which generated CN¥973.70 million in revenue.

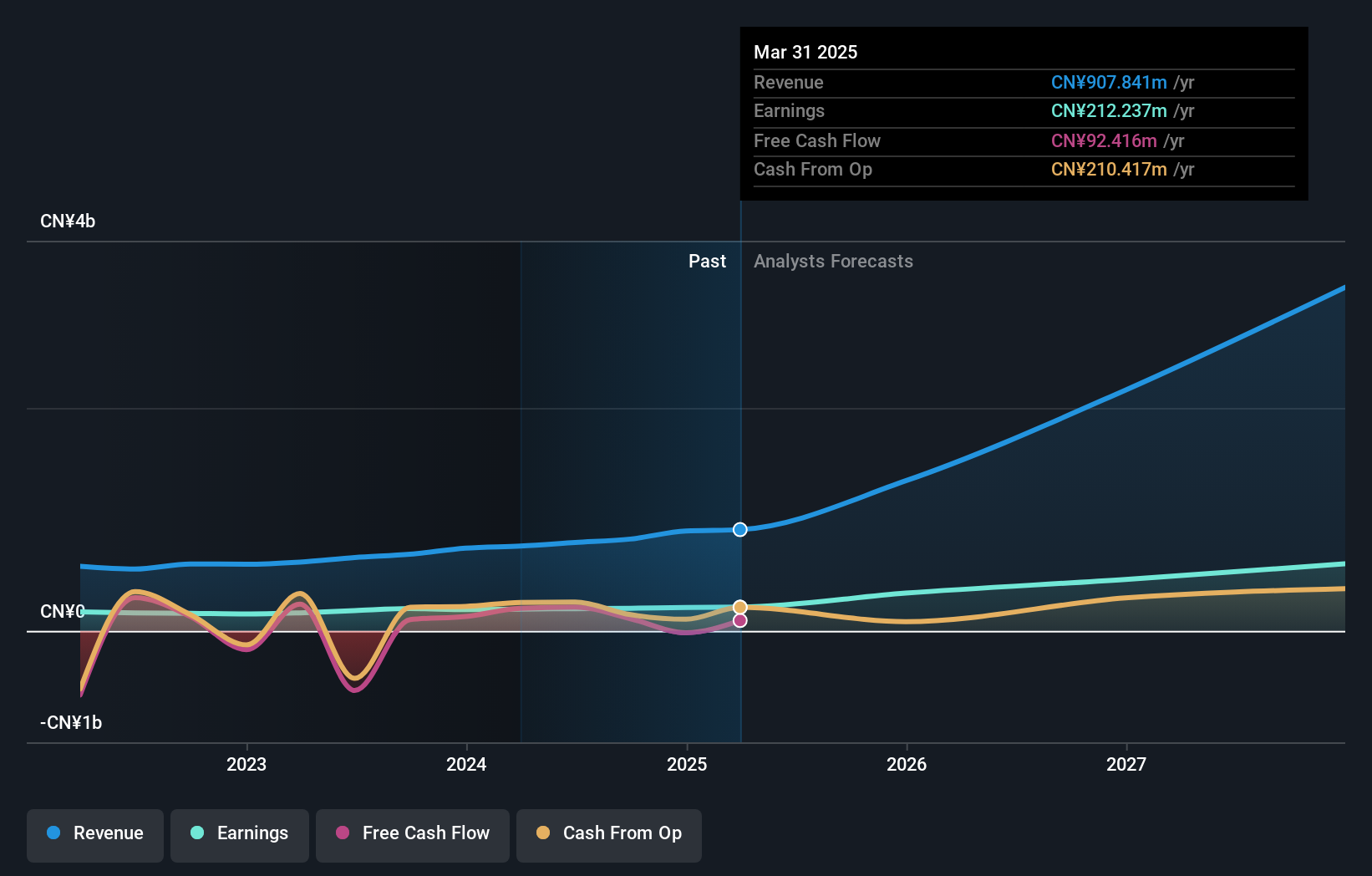

Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. has demonstrated a robust financial trajectory, with revenue climbing to CNY 611.96 million, up from CNY 533.77 million the previous year, marking a notable increase in their market presence in the intelligent transportation sector. This growth is complemented by a stable net income of CNY 168.11 million and consistent dividend distributions, reflecting confidence in their financial health and commitment to shareholder returns. The company's strategic focus on R&D has cultivated innovations that drive these financial outcomes, ensuring it remains at the forefront of technological advancements within Asia's high-growth tech landscape.

Oracle Corporation Japan (TSE:4716)

Simply Wall St Growth Rating: ★★★★☆☆

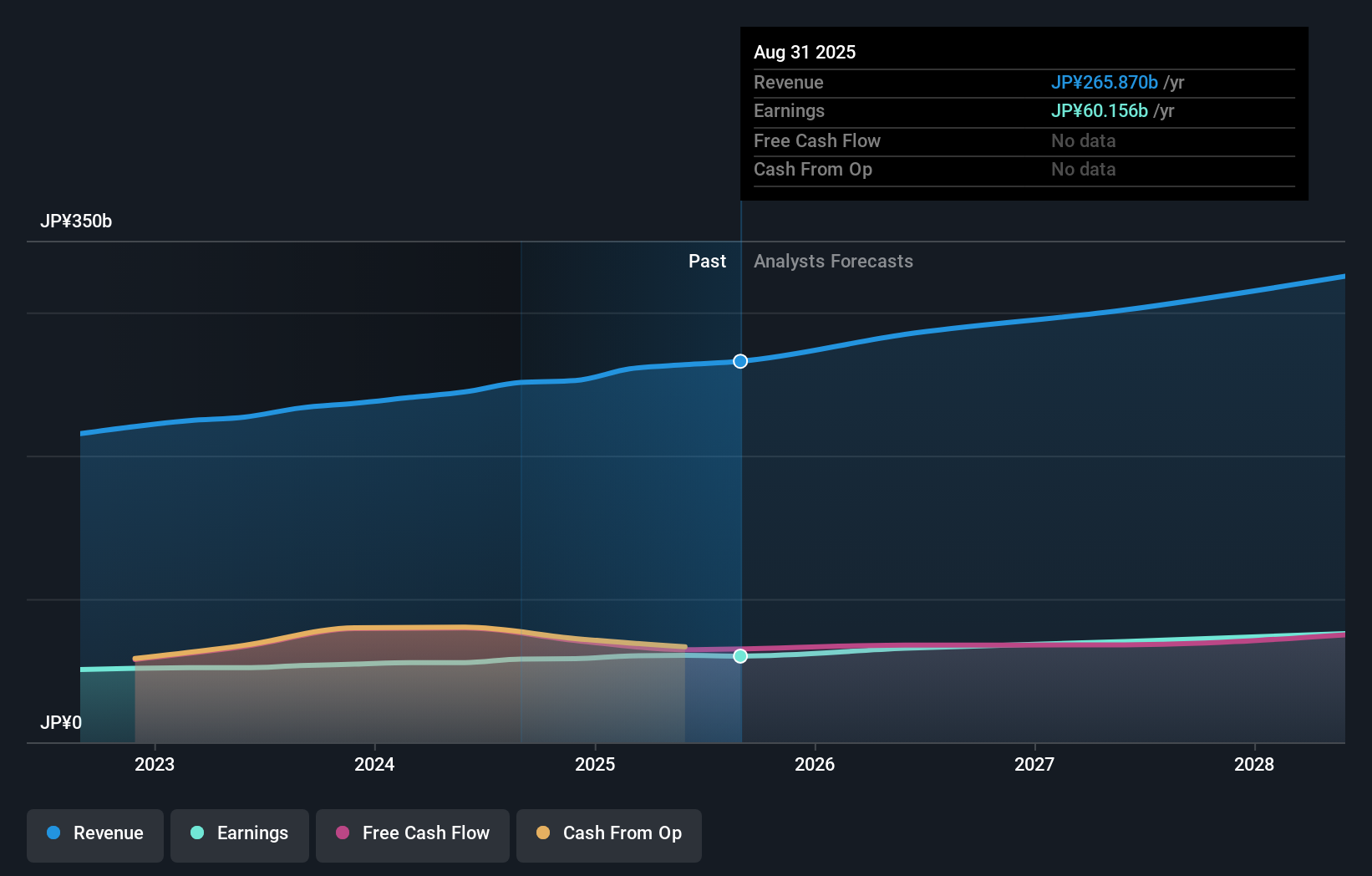

Overview: Oracle Corporation Japan offers software, hardware, and cloud products and solutions in Japan with a market cap of ¥1.72 trillion.

Operations: The company generates revenue through the sale of software, hardware, and cloud solutions in Japan. Its market cap is approximately ¥1.72 trillion.

Oracle Corporation Japan, despite a modest earnings growth of 3.5% last year, continues to make strategic strides in the tech industry. At the recent Rakuten Technology Conference, the company underscored its commitment to expanding its cloud business, a move that aligns with current industry shifts towards robust digital infrastructure. With an annual revenue growth forecast at 8.4%, surpassing Japan's market average of 4.6%, and an expected return on equity of 28.9% in three years, Oracle Japan's focus on high-quality earnings and positive free cash flow positions it well for sustainable growth within Asia’s competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Oracle Corporation Japan's health report.

Assess Oracle Corporation Japan's past performance with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 188 Asian High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301339

Jiangsu Tongxingbao Intelligent Transportation Technology

Provides smart transportation platform solutions for highways, trunk roads, and urban transportation in China.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026