As global markets continue to react to potential interest rate cuts and the surge in artificial intelligence, Asian tech stocks have caught the attention of investors seeking high growth opportunities. In this environment, identifying promising tech stocks involves considering factors such as innovation, market positioning, and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.62% | 43.81% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Zhongji Innolight | 28.38% | 30.29% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.00% | 27.48% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Beetech Inc. specializes in the production and sale of smart sensors and optoelectronic instrument products, with a market capitalization of CN¥3.19 billion.

Operations: The company focuses on smart sensors and optoelectronic instruments, generating revenue primarily from these product lines. Its market capitalization stands at CN¥3.19 billion, indicating its scale in the industry.

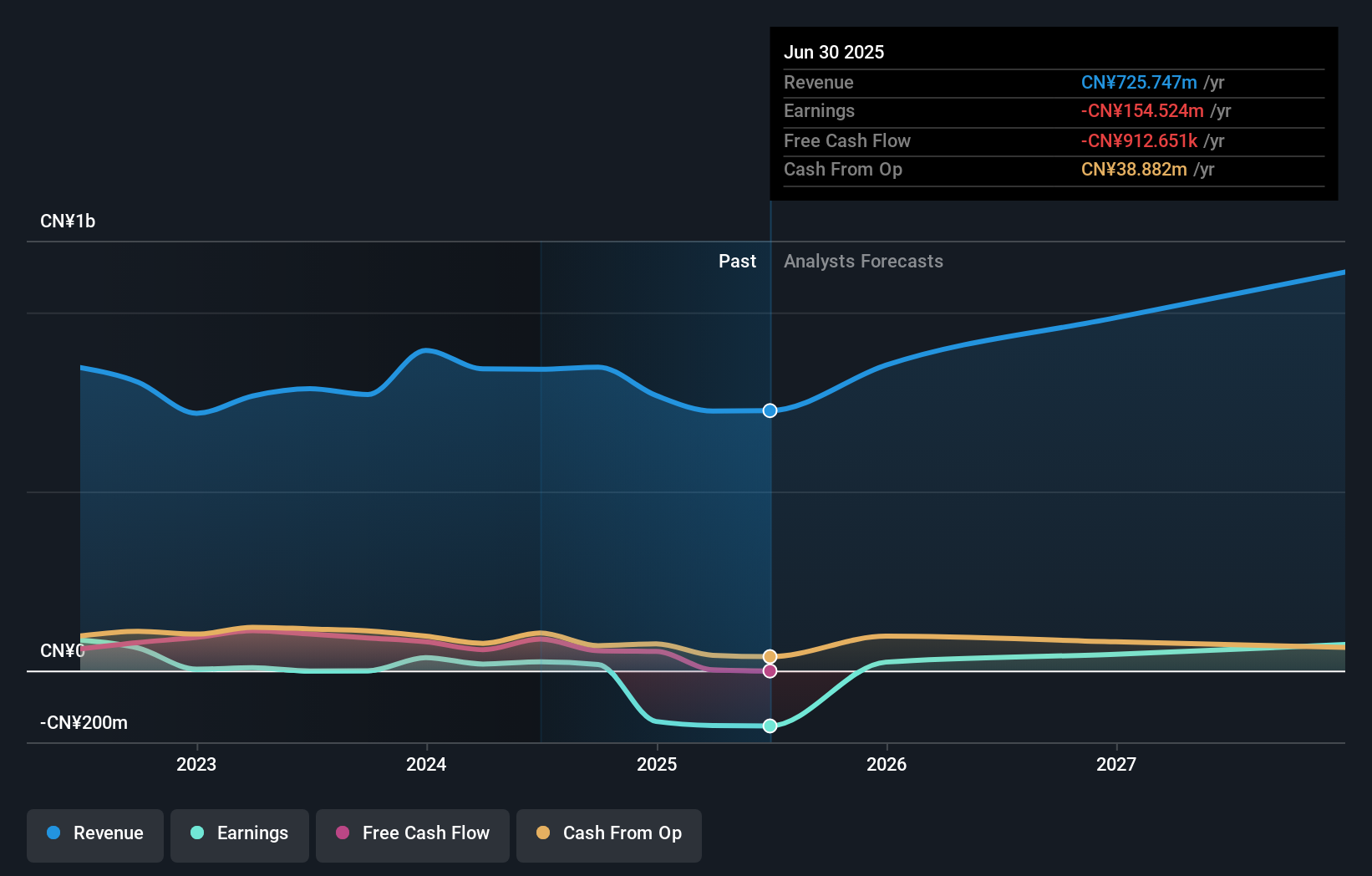

Beijing Beetech, navigating through a challenging phase with its recent announcement of a net loss of CNY 10.01 million for the first half of 2025, contrasts starkly against last year's profit. Despite this setback, the company is poised for recovery with expected earnings growth at an impressive rate of 101% annually. This optimism is bolstered by strategic amendments aimed at broadening its business scope, set to be discussed in an upcoming extraordinary general meeting. These changes could potentially revitalize Beijing Beetech's operational dynamics and align them with evolving market demands, ensuring its relevance and competitiveness in the fast-paced tech sector in Asia.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban areas in China with a market cap of CN¥9.37 billion.

Operations: The company, along with its subsidiaries, specializes in providing smart transportation platform solutions across various infrastructure types in China. Its primary revenue stream comes from the Software and Information Technology segment, generating CN¥956.61 million.

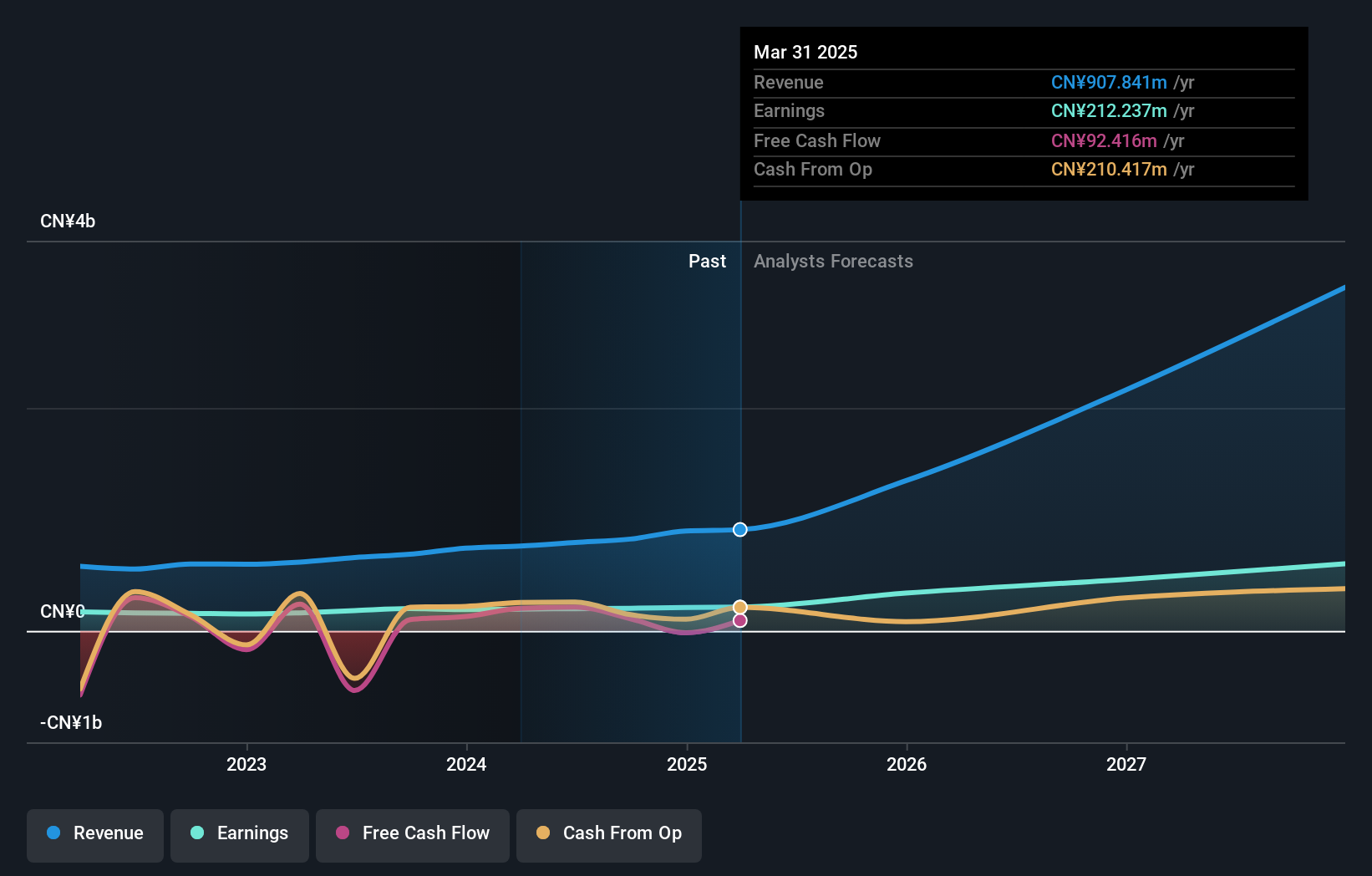

Jiangsu Tongxingbao Intelligent Transportation Technology has demonstrated robust financial health, with a notable revenue increase to CNY 389.39 million in the first half of 2025, up from CNY 328.29 million the previous year. This growth is complemented by a slight uptick in net income to CNY 106.97 million. The company's commitment to innovation and strategic adjustments are evident from recent shareholder meetings discussing significant corporate governance enhancements and profit distribution plans. These initiatives are pivotal as they align with broader industry trends towards enhancing operational efficiencies and capital management, positioning Jiangsu Tongxingbao favorably within Asia's competitive tech landscape.

CELSYS (TSE:3663)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CELSYS, Inc. operates in Japan providing content creation solutions and has a market capitalization of approximately ¥56.65 billion.

Operations: CELSYS, Inc. focuses on content creation solutions in Japan.

CELYS has demonstrated a strong trajectory in the tech sector, with its revenue expected to climb by 10.3% annually, outpacing the Japanese market's growth of 4.4%. This performance is bolstered by an impressive projected annual earnings increase of 24.2%, reflecting robust operational efficiency and market demand for its offerings like CLIP STUDIO PAINT. The company's strategic focus on innovation is underscored by recent expansions, including the establishment of CELSYS UK Ltd., aimed at enhancing global payment solutions and thereby boosting corporate value in the long term. Additionally, a recent share repurchase program highlights CELSYS's commitment to capital efficiency amidst these expansive strategies.

- Click here to discover the nuances of CELSYS with our detailed analytical health report.

Assess CELSYS' past performance with our detailed historical performance reports.

Make It Happen

- Get an in-depth perspective on all 188 Asian High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3663

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives