As global markets react to the Trump administration's emerging policies, U.S. stocks are approaching record highs, buoyed by optimism over potential trade agreements and enthusiasm for artificial intelligence investments. In this environment, investors are particularly attentive to high-growth tech stocks that demonstrate strong innovation and adaptability in an evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Louis Hachette Group (ENXTPA:ALHG)

Simply Wall St Growth Rating: ★★★★☆☆

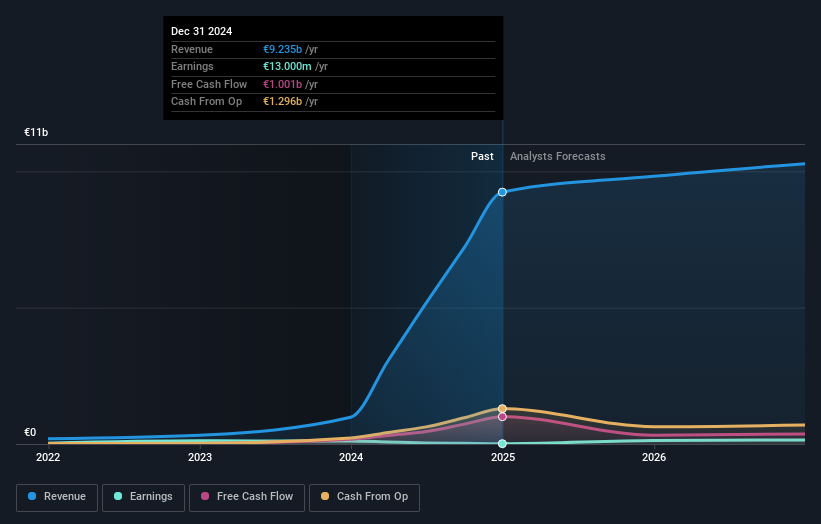

Overview: Louis Hachette Group S.A. operates in the publishing, press, and media sectors with a market capitalization of €1.33 billion.

Operations: The company generates revenue primarily from its publishing and press operations, with a focus on various media channels. It operates within the media industry, leveraging its diverse portfolio to engage audiences across different platforms.

Despite a challenging environment, Louis Hachette Group has demonstrated robust financial agility, with revenue surging by 698.7% over the past year and earnings projected to grow significantly at 45% annually. This growth outpaces the broader French market's expectations, where average earnings are set to rise by only 12% per year. The company's recent inclusion in the FTSE All-World Index underscores its expanding influence and recognition in the global market. However, it faces hurdles with a low return on equity forecast at 6.7% and profit margins that have narrowed to just 0.8%, reflecting some operational challenges ahead.

- Click here and access our complete health analysis report to understand the dynamics of Louis Hachette Group.

Gain insights into Louis Hachette Group's past trends and performance with our Past report.

Shenzhen Sunnypol OptoelectronicsLtd (SZSE:002876)

Simply Wall St Growth Rating: ★★★★★☆

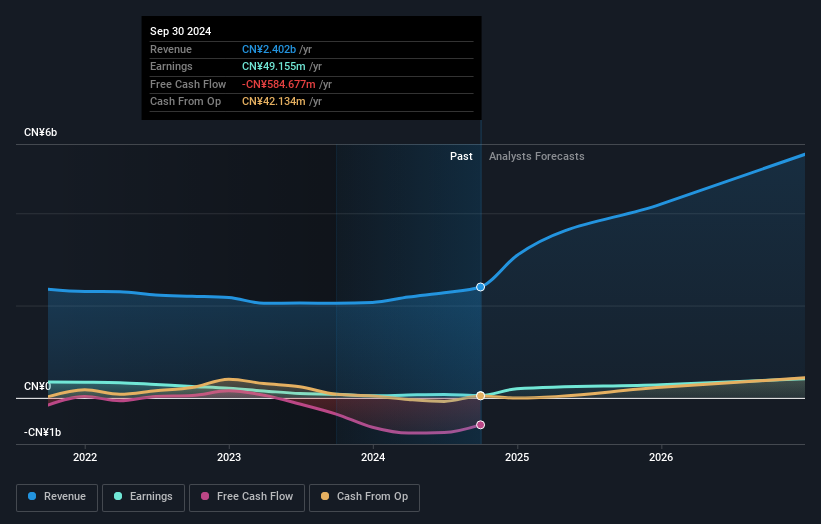

Overview: Shenzhen Sunnypol Optoelectronics Co., Ltd. specializes in the production of optical and electronic components, with a market capitalization of CN¥4.62 billion.

Operations: Sunnypol Optoelectronics generates revenue primarily from its polarizer segment, contributing CN¥2.39 billion. The company's financials indicate a notable focus on this core product line within the optical and electronic components industry.

Shenzhen Sunnypol Optoelectronics Ltd. is navigating a dynamic tech landscape with its substantial investment in innovation, evidenced by R&D expenses which have notably increased to CN¥120 million this past year. This focus on development aligns with its impressive revenue growth of 32.6% annually and an even more striking earnings surge at 60% per year, outpacing the broader Chinese market's averages of 13.3% and 25%, respectively. Despite challenges such as a significant one-off loss of CN¥6.6 million affecting financial results, the company's strategic emphasis on high-tech solutions positions it well for sustained industry relevance and potential market share expansion.

Runa Smart Equipment (SZSE:301129)

Simply Wall St Growth Rating: ★★★★★☆

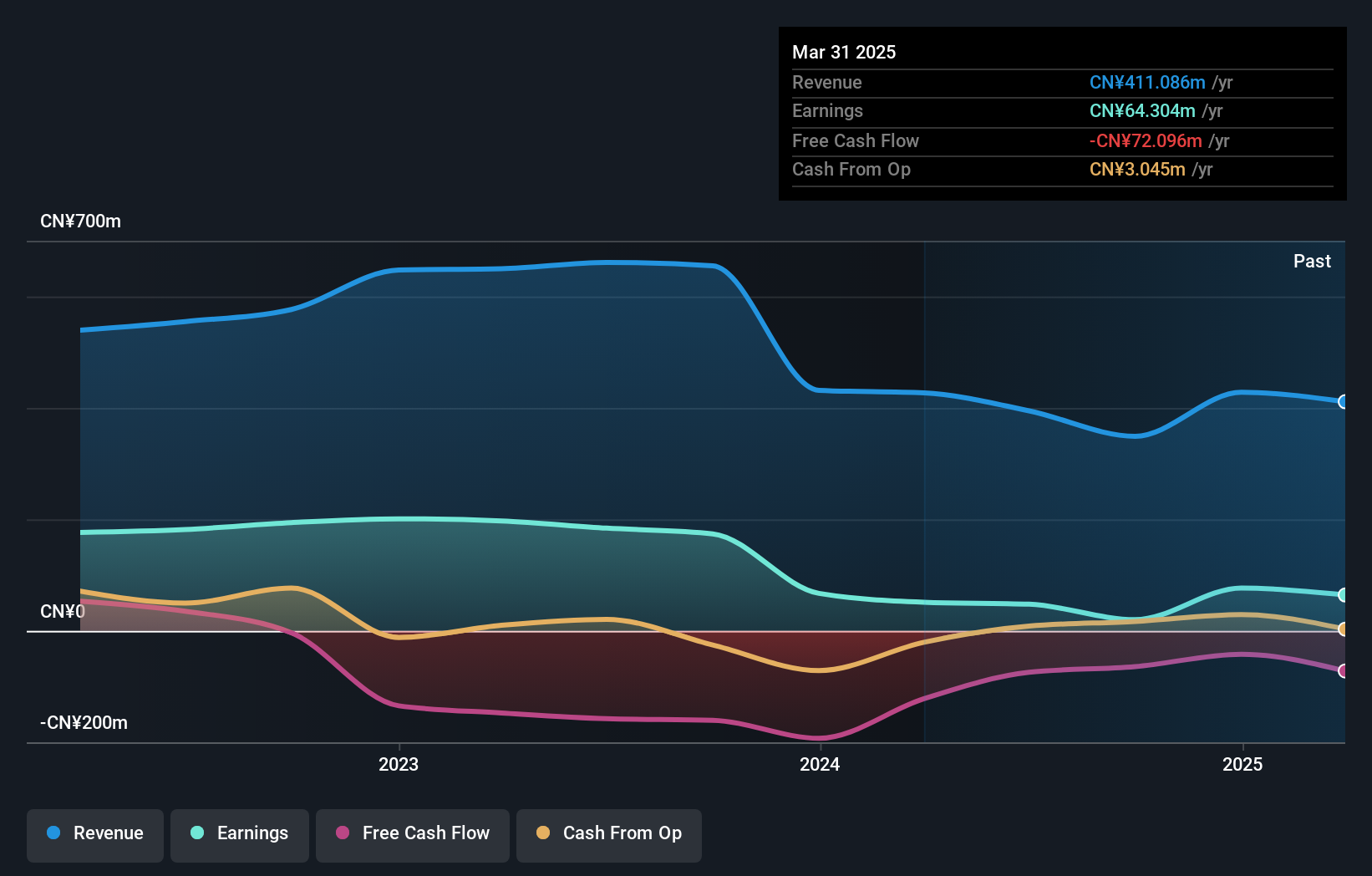

Overview: Runa Smart Equipment Co., Ltd. specializes in providing urban smart heating solutions in China, with a market capitalization of CN¥3.04 billion.

Operations: Runa Smart Equipment focuses on urban smart heating solutions in China. The company operates with a market capitalization of CN¥3.04 billion, offering advanced heating technologies and systems tailored for urban environments.

Runa Smart Equipment is making notable strides in the high-tech sector, with a forecasted annual revenue growth of 80% and earnings growth of 105.2%, significantly outpacing the broader Chinese market benchmarks of 13.3% and 25%, respectively. Despite a highly volatile share price and recent profit margins dipping to 5.7% from last year's 26.6%, due to large one-off gains impacting financials, the company's aggressive R&D spending positions it for potential leadership in innovation-driven markets. A recent shareholders meeting focused on cash management strategies indicates proactive financial oversight, crucial for sustaining its rapid growth trajectory amidst such volatility.

- Get an in-depth perspective on Runa Smart Equipment's performance by reading our health report here.

Make It Happen

- Get an in-depth perspective on all 1231 High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALHG

Louis Hachette Group

Engages in the publishing and travel retail and media businesses.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives