- China

- /

- Electronic Equipment and Components

- /

- SZSE:300951

Investors Don't See Light At End Of Shenzhen Bsc Technology Co.,Ltd.'s (SZSE:300951) Tunnel And Push Stock Down 26%

Shenzhen Bsc Technology Co.,Ltd. (SZSE:300951) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

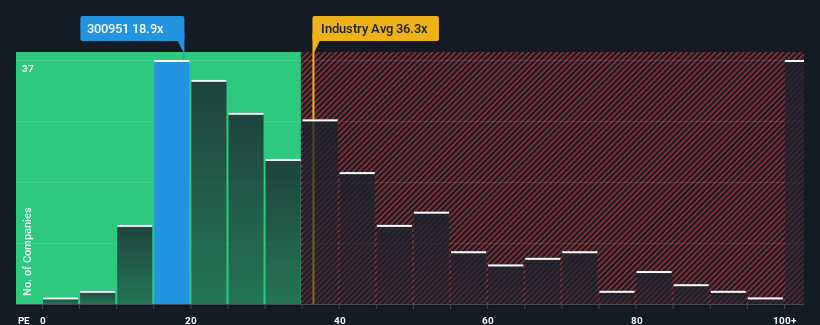

Even after such a large drop in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 28x, you may still consider Shenzhen Bsc TechnologyLtd as an attractive investment with its 18.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Shenzhen Bsc TechnologyLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Shenzhen Bsc TechnologyLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shenzhen Bsc TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 5.5% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Shenzhen Bsc TechnologyLtd is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Shenzhen Bsc TechnologyLtd's P/E

The softening of Shenzhen Bsc TechnologyLtd's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shenzhen Bsc TechnologyLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Shenzhen Bsc TechnologyLtd (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on Shenzhen Bsc TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300951

Shenzhen Bsc TechnologyLtd

Engages in the design, development, production and sales of precision functional parts and intelligent automation equipment products.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.