- China

- /

- Electronic Equipment and Components

- /

- SZSE:300906

There's Reason For Concern Over Jiangxi Everbright Measurement And Control Technology Co.,Ltd.'s (SZSE:300906) Massive 39% Price Jump

Jiangxi Everbright Measurement And Control Technology Co.,Ltd. (SZSE:300906) shareholders have had their patience rewarded with a 39% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

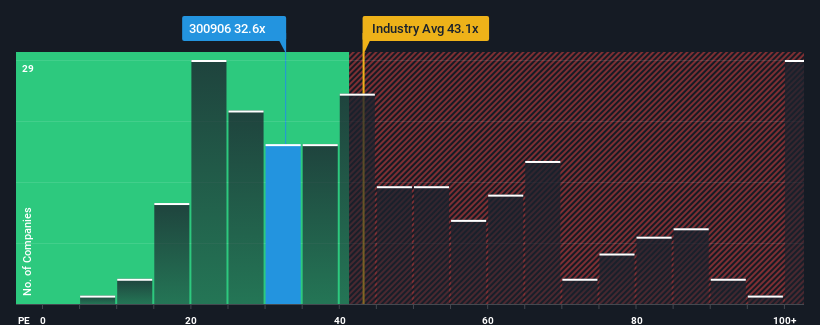

Although its price has surged higher, there still wouldn't be many who think Jiangxi Everbright Measurement And Control TechnologyLtd's price-to-earnings (or "P/E") ratio of 32.6x is worth a mention when the median P/E in China is similar at about 34x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Jiangxi Everbright Measurement And Control TechnologyLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Jiangxi Everbright Measurement And Control TechnologyLtd

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Jiangxi Everbright Measurement And Control TechnologyLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 90% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 3.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Jiangxi Everbright Measurement And Control TechnologyLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Jiangxi Everbright Measurement And Control TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Jiangxi Everbright Measurement And Control TechnologyLtd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Jiangxi Everbright Measurement And Control TechnologyLtd is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300906

Jiangxi Everbright Measurement And Control TechnologyLtd

Jiangxi Everbright Measurement And Control Technology Co.,Ltd.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026