- China

- /

- Tech Hardware

- /

- SZSE:300866

High Growth Tech Stocks to Watch in April 2025

Reviewed by Simply Wall St

In the midst of a mixed global market landscape, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown resilience, outperforming their larger counterparts during a holiday-shortened week marked by trade uncertainties and economic caution. As the information technology sector faces headwinds from new export restrictions and broader geopolitical tensions, identifying high-growth tech stocks that can navigate these challenges becomes crucial for investors looking to capitalize on innovation-driven opportunities within this dynamic environment.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.47% | 23.71% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company with operations in China and internationally, and it has a market cap of CN¥15.50 billion.

Operations: Leyard Optoelectronic focuses on the audio-visual technology sector, serving both domestic and international markets. The company generates revenue primarily through its innovative display solutions and related services.

Leyard Optoelectronic demonstrates a dynamic growth trajectory with its annualized revenue and earnings growth reported at 17.2% and 71.0% respectively, outpacing the broader Chinese market averages of 12.6% and 23.6%. This robust performance is underscored by substantial R&D investments, reflecting the company's commitment to innovation despite recent challenges indicated by a temporary dip in net profit margins to 0.09%. Additionally, Leyard has actively engaged in share repurchases, buying back shares worth CNY 30.02 million over the past year, signaling confidence in its future prospects amidst market volatility and competitive pressures within the tech sector.

- Get an in-depth perspective on Leyard Optoelectronic's performance by reading our health report here.

Gain insights into Leyard Optoelectronic's past trends and performance with our Past report.

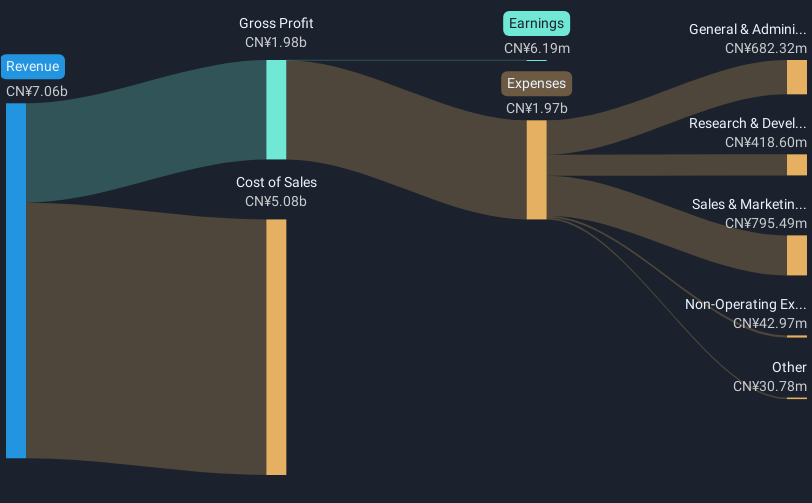

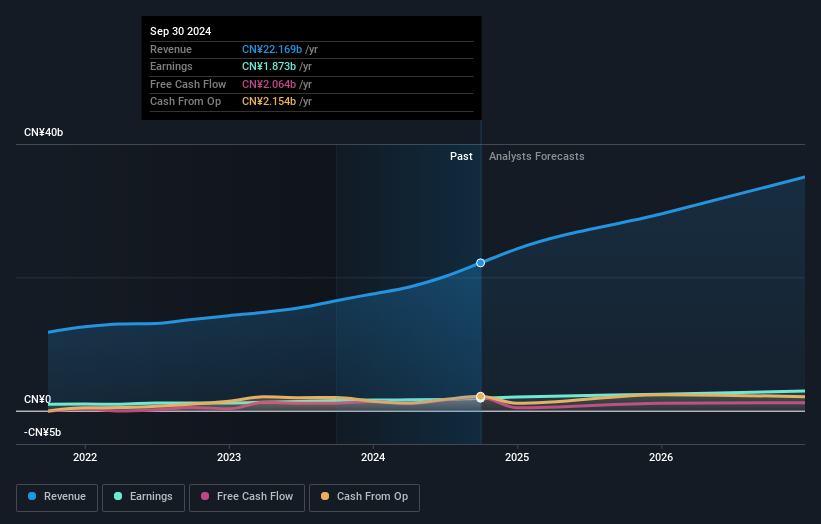

Anker Innovations (SZSE:300866)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anker Innovations Limited specializes in the development and sale of mobile charging products, with a market capitalization of CN¥42.26 billion.

Operations: The company focuses on creating and marketing mobile charging solutions. It operates with a market capitalization of CN¥42.26 billion, emphasizing its significant presence in the tech accessory industry.

Anker Innovations is carving a niche in the high-growth tech sector, particularly with its Anker SOLIX brand, which has been spotlighted for its role in powering Electrify Expo's sustainable energy needs. This partnership, now in its third year, underscores Anker's commitment to innovation and sustainability—key drivers of its 20.7% annual revenue growth. The company's focus on R&D has led to significant advancements like the SOLIX F3800 power station, which meets diverse energy demands with a scalable battery system and dual voltage capabilities. These developments not only enhance Anker’s product offerings but also position it strategically within the renewable energy space, reflecting a robust blend of technological prowess and market responsiveness.

- Click to explore a detailed breakdown of our findings in Anker Innovations' health report.

Evaluate Anker Innovations' historical performance by accessing our past performance report.

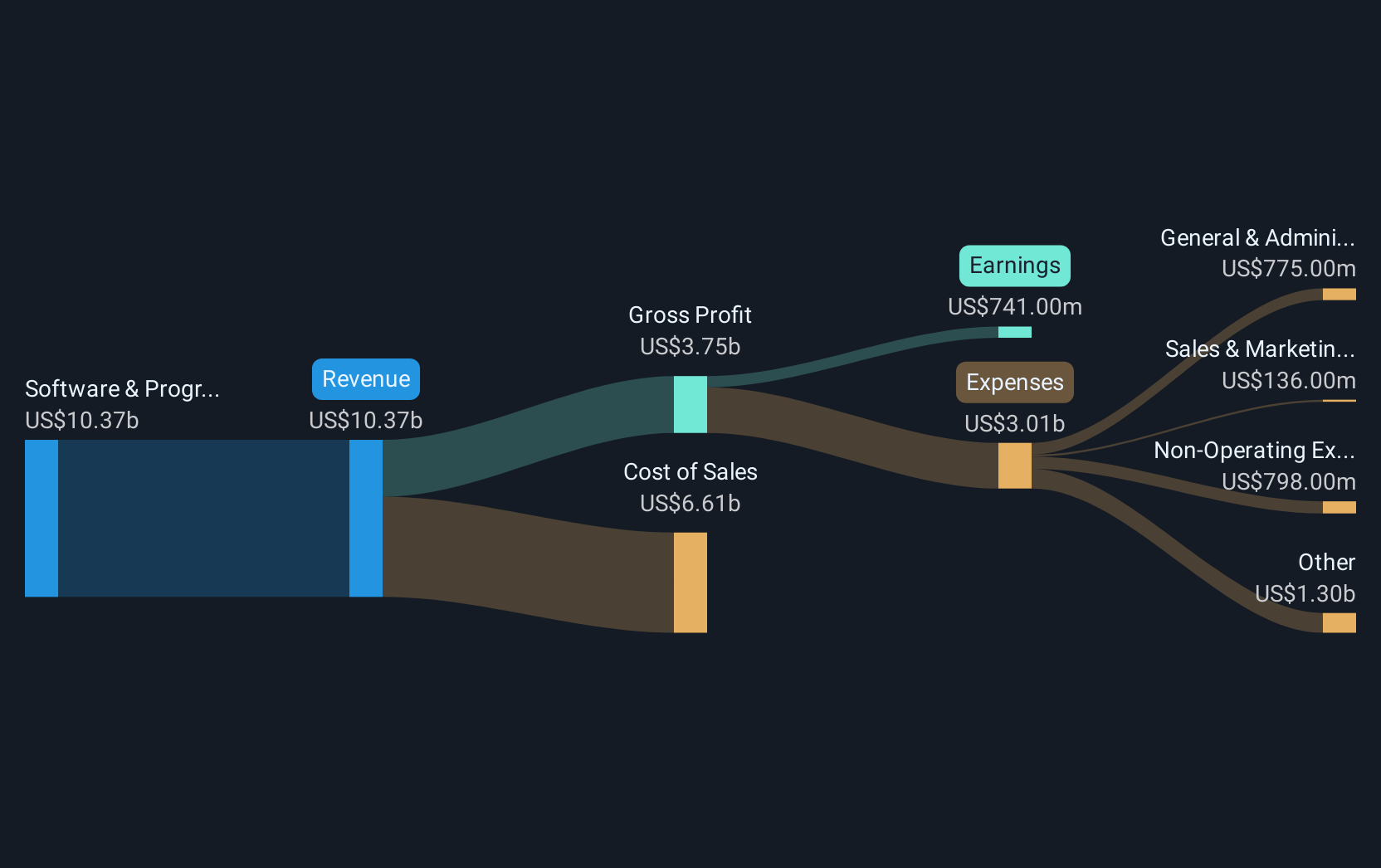

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. is a company that acquires, builds, and manages vertical market software businesses to provide mission-critical software solutions across public and private sectors, with a market cap of CA$99.23 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $10.07 billion. It focuses on developing mission-critical software solutions for diverse public and private sector markets.

Constellation Software demonstrates robust growth dynamics, with a notable 14.3% annual revenue increase and an even more impressive 20.9% surge in earnings per year, outpacing the Canadian market's averages of 4.7% and 16.4%, respectively. This financial vigor is complemented by a significant commitment to innovation, as evidenced by R&D expenses that catalyze leading-edge software solutions, ensuring its competitive edge in the tech landscape. Recent financial disclosures for 2024 reveal revenues soaring to $10.06 billion from $8.41 billion the previous year, alongside net income rising to $731 million from $565 million, underscoring effective operational execution and market adaptation.

Summing It All Up

- Discover the full array of 757 Global High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300866

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives