- China

- /

- Tech Hardware

- /

- SZSE:002180

High Growth Tech Stocks in Asia to Watch August 2025

Reviewed by Simply Wall St

As global markets experience fluctuations, with the tech-heavy Nasdaq Composite recently finishing lower amid concerns about infrastructure spending on artificial intelligence, Asian markets have shown resilience, particularly in China where the CSI 300 Index reached a decade high. In this dynamic environment, high-growth tech stocks in Asia are drawing attention for their potential to capitalize on innovation and regional economic trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Fositek | 33.66% | 43.80% | ★★★★★★ |

| Foxconn Industrial Internet | 27.61% | 27.23% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Eoptolink Technology | 33.64% | 33.77% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 24.93% | 24.09% | ★★★★★★ |

| ALTEOGEN | 55.95% | 71.63% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Ninestar (SZSE:002180)

Simply Wall St Growth Rating: ★★★★☆☆

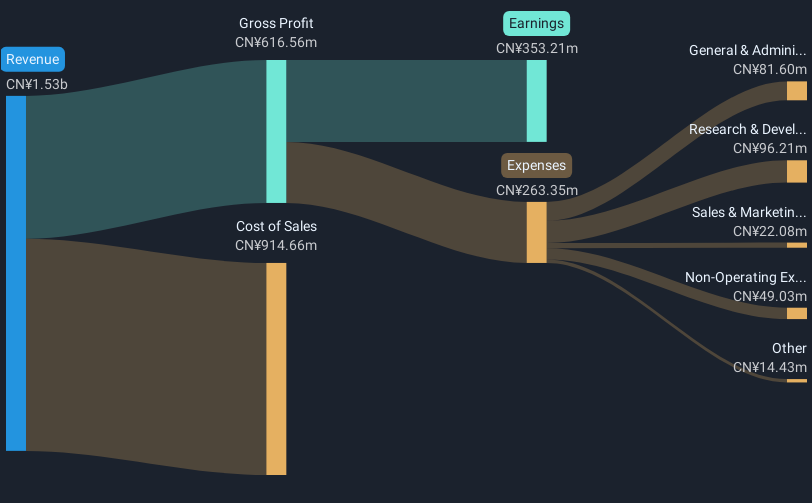

Overview: Ninestar Corporation focuses on the research, development, production, processing, and sales of printers and printer consumables and accessories with a market capitalization of CN¥37.60 billion.

Operations: Ninestar Corporation specializes in producing and selling printers and related consumables, leveraging its expertise in research and development to drive its business model.

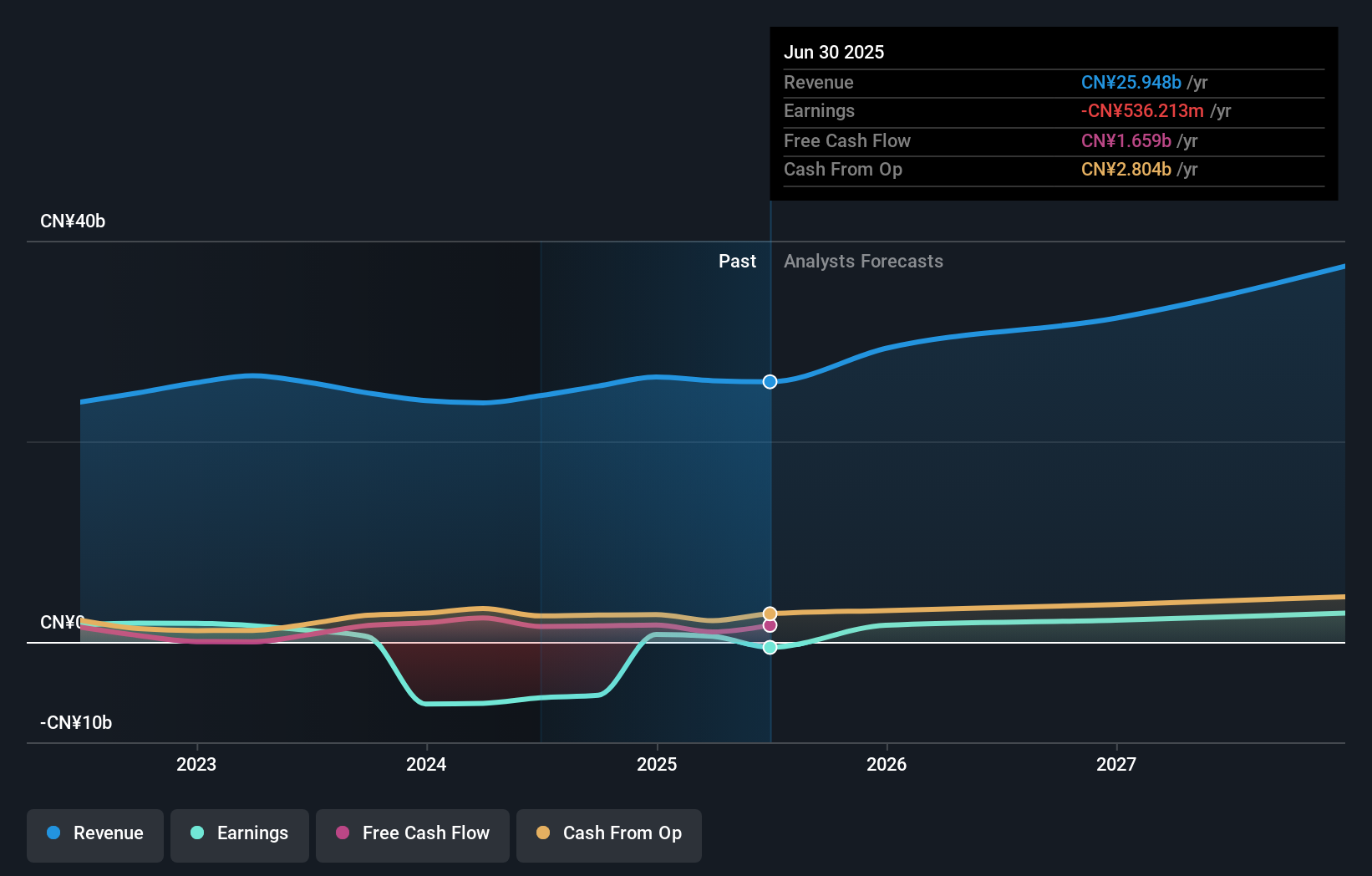

Despite recent financial setbacks, Ninestar shows potential in the high-growth tech sector in Asia. With an expected annual revenue growth of 14%, slightly outpacing the Chinese market average of 13.2%, and a forecast to transition from unprofitability to a robust earnings growth of 69.3% annually, Ninestar is strategically positioning itself for future profitability. The company's commitment to innovation is evident from its significant R&D investments, aligning with industry trends towards advanced technology solutions. Moreover, recent share buybacks totaling CNY 200.84 million underscore management's confidence in the company’s direction and value proposition, despite current challenges reflected in a half-year net loss of CNY 311.77 million and ongoing restructuring efforts aimed at optimizing operations and asset management.

- Get an in-depth perspective on Ninestar's performance by reading our health report here.

Explore historical data to track Ninestar's performance over time in our Past section.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: POCO Holding Co., Ltd. engages in the development, production, and sale of alloy soft magnetic powder and related components for electronic equipment, with a market capitalization of CN¥19.82 billion.

Operations: The company generates revenue primarily from its electronic components segment, which accounts for CN¥1.71 billion. The business focuses on producing alloy soft magnetic powder and cores for electricity electronic equipment.

POCO Holding, demonstrating robust growth in a competitive sector, reported a significant increase in half-year sales to CNY 858.55 million from CNY 794.72 million the previous year, with net income also rising to CNY 191.3 million. This performance is underscored by an annual revenue growth rate of 20.6%, outstripping the broader Chinese market's average of 13.2%. The company's commitment to innovation and market expansion is reflected in its R&D investments and earnings growth forecast at an impressive rate of 23% annually, suggesting strong future prospects despite a volatile share price over the past three months.

- Click here to discover the nuances of POCO Holding with our detailed analytical health report.

Gain insights into POCO Holding's historical performance by reviewing our past performance report.

Co-Tech Development (TPEX:8358)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Co-Tech Development Corporation, along with its subsidiaries, specializes in producing and selling copper foil for the printed circuit board industry in Taiwan and China, with a market cap of NT$45.56 billion.

Operations: The company generates revenue primarily from the sale of copper foil, amounting to NT$7.23 billion. Operating within the printed circuit board industry, it serves markets in Taiwan and China.

Co-Tech Development has demonstrated a notable trajectory in the tech sector, with recent reports showing a revenue increase to TWD 2 billion from TWD 1.82 billion year-on-year for Q2, although net income dipped to TWD 167.01 million from TWD 291.5 million in the same period. The company's aggressive R&D spending aligns with its strategic focus on innovation, crucial for maintaining competitive advantage in Asia’s fast-evolving tech landscape. With earnings expected to surge by an impressive 64% annually over the next three years and revenue growth forecasted at 16.3% per annum, Co-Tech is positioning itself as a formidable player amidst robust market dynamics despite recent volatility in its share price and executive reshuffles aiming to bolster governance and strategic direction.

Where To Now?

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 177 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ninestar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002180

Ninestar

Engages in the research and development, production, processing, and sales of self-produced printers, and printer consumables and accessories.

Excellent balance sheet and fair value.

Market Insights

Community Narratives