- China

- /

- Electronic Equipment and Components

- /

- SHSE:603583

Exploring Three High Growth Tech Stocks in the Global Market

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by a decline in U.S. consumer confidence and a mixed performance across major indices, with growth stocks underperforming amid regulatory uncertainties and concerns about the sustainability of tech-driven rallies. As investors navigate these challenging conditions, identifying high-growth tech stocks that can withstand market volatility involves looking for companies with robust innovation pipelines, strong financial health, and the ability to adapt to shifting economic landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. specializes in the production and development of linear motion systems, with a market cap of CN¥15.99 billion.

Operations: Jiecang Linear Motion Technology generates revenue primarily from the linear drive industry, amounting to CN¥3.50 billion.

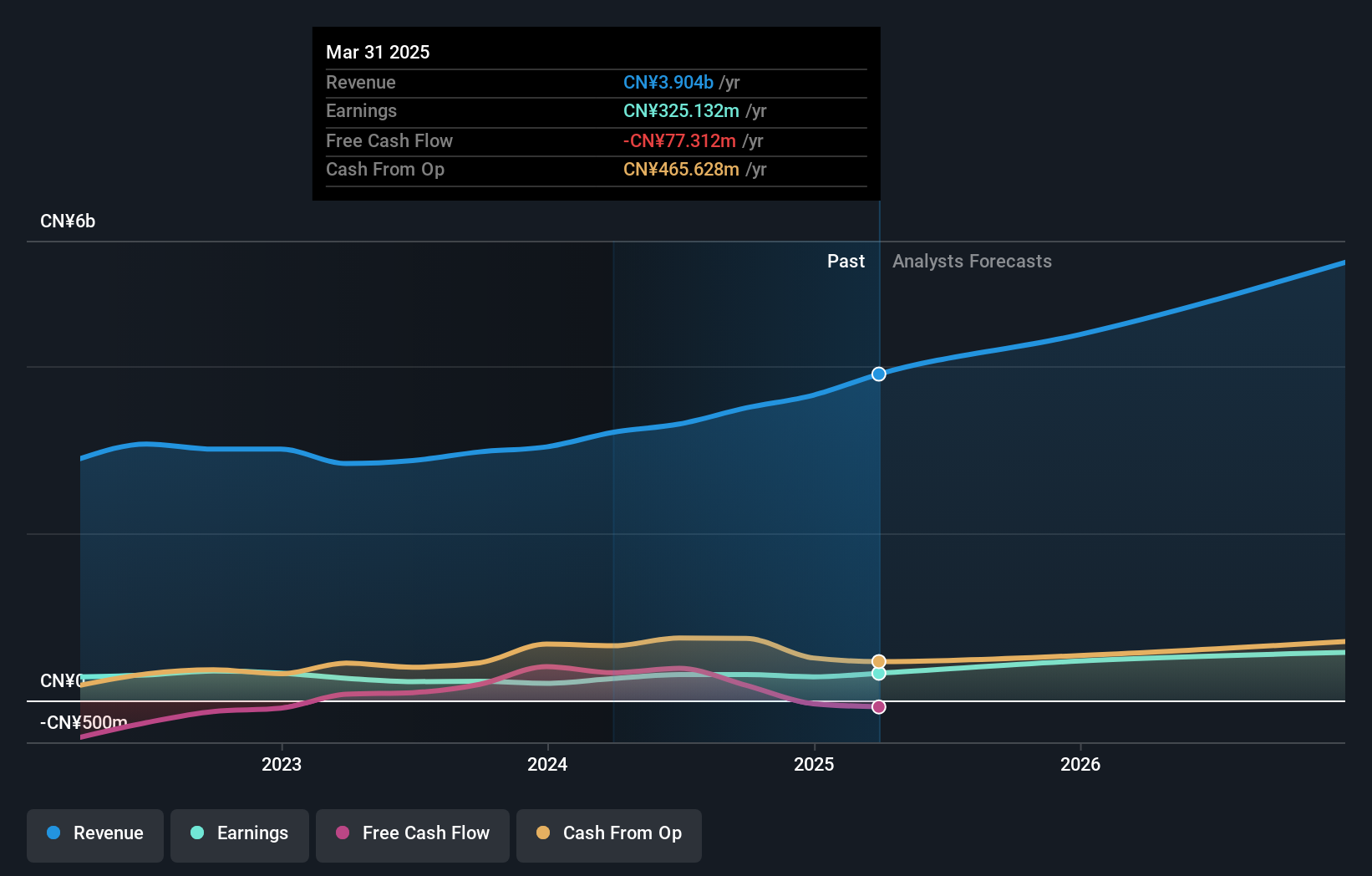

Zhejiang Jiecang Linear Motion Technology Ltd. stands out in the electronic sector with a robust earnings growth of 35.3% last year, surpassing the industry average of 2.6%. This performance is underpinned by significant investment in R&D, crucial for maintaining its competitive edge and fostering innovation. With an expected annual revenue increase of 18.4%, faster than China's market growth rate of 13.3%, the company is positioned well within its sector. Moreover, its strategic focus on high-quality earnings and positive free cash flow highlights operational efficiency and financial health, essential for sustained growth in this fast-evolving industry landscape.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. offers digital health services to medical and health institutions across China, with a market cap of CN¥26.73 billion.

Operations: Winning Health Technology Group Co., Ltd. specializes in providing digital health solutions to medical and health institutions throughout China. The company focuses on leveraging technology to enhance healthcare services, contributing significantly to its market presence with a market cap of CN¥26.73 billion.

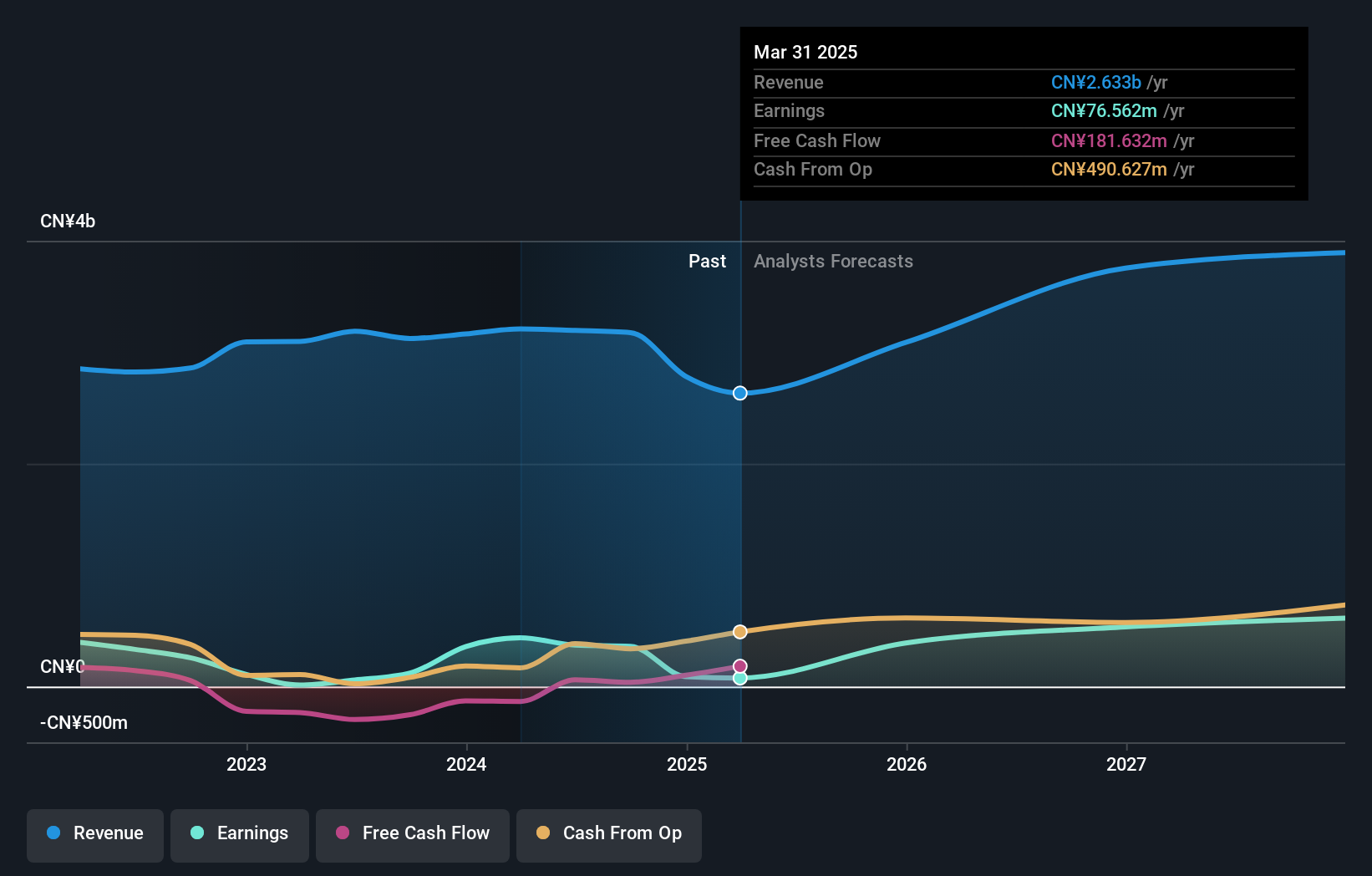

Winning Health Technology Group is capturing attention with its robust annual earnings growth at 34.9%, significantly outpacing the broader CN market's 25.5%. This surge is supported by a strong revenue uptick of 18.9% annually, exceeding the market average of 13.3%. Notably, the company's commitment to innovation is evident from its R&D investments, crucial for maintaining relevance in the competitive tech landscape. Despite a highly volatile share price recently, these financial metrics suggest a dynamic approach to growth and adaptation in the healthcare technology sector.

Jushri Technologies (SZSE:300762)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jushri Technologies, INC. specializes in the development, production, and after-sales service of communication equipment with a market capitalization of CN¥13.71 billion.

Operations: Jushri Technologies focuses on the development, production, and after-sales service of communication equipment.

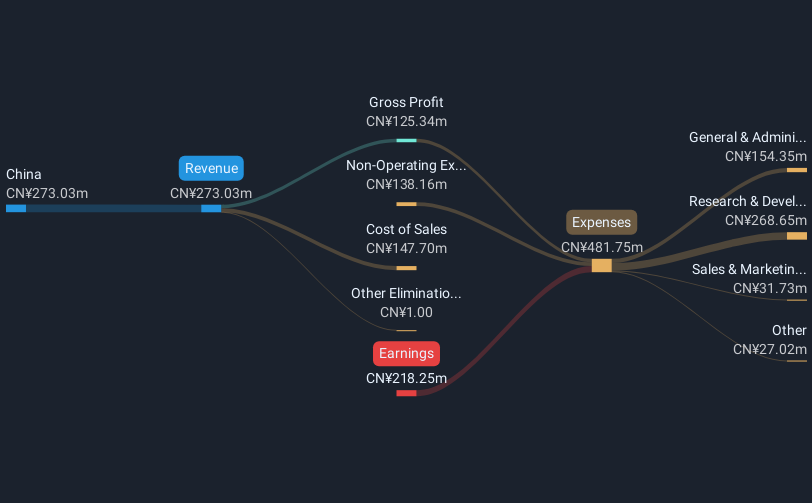

Jushri Technologies stands out in the tech landscape with a projected annual revenue growth of 61.9%, significantly surpassing the broader market's expectation of 13.3%. This impressive expansion is complemented by an anticipated earnings surge of 102.6% annually, positioning the company well for future profitability despite current unprofitability challenges. An extraordinary shareholders meeting scheduled for December 26, 2024, will further discuss strategic decisions including auditor reappointments, indicating active governance aimed at sustaining this growth trajectory. Notably, Jushri's commitment to innovation is underscored by substantial investments in R&D, essential for maintaining competitive advantage and driving long-term value creation in a rapidly evolving industry sector.

Seize The Opportunity

- Reveal the 798 hidden gems among our Global High Growth Tech and AI Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiecang Linear Motion TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603583

Zhejiang Jiecang Linear Motion TechnologyLtd

Zhejiang Jiecang Linear Motion Technology Co.,Ltd.

Excellent balance sheet with reasonable growth potential.