- China

- /

- Electrical

- /

- SZSE:300438

January 2025's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares amid sector-specific fluctuations. In this environment of cautious optimism, growth companies with high insider ownership stand out as potentially resilient investments, as insider confidence often signals strong alignment with shareholder interests and long-term company prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Let's dive into some prime choices out of the screener.

Shenzhen United Winners Laser (SHSE:688518)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen United Winners Laser Co., Ltd. manufactures and sells laser welding equipment both in China and internationally, with a market cap of CN¥5.41 billion.

Operations: The company's revenue is derived from the manufacturing and sales of laser welding equipment in domestic and international markets.

Insider Ownership: 14.3%

Earnings Growth Forecast: 48.8% p.a.

Shenzhen United Winners Laser's revenue is expected to grow at 16.3% annually, outpacing the broader Chinese market but below the 20% mark often associated with high-growth companies. Earnings are projected to rise significantly at 48.78%, indicating robust growth potential despite recent declines in profit margins and net income from CNY 252.4 million to CNY 94.75 million year-over-year. The company has a volatile share price and lacks recent insider trading activity, which may concern some investors seeking stability or insider confidence signals.

- Unlock comprehensive insights into our analysis of Shenzhen United Winners Laser stock in this growth report.

- Our valuation report here indicates Shenzhen United Winners Laser may be overvalued.

Guangzhou Great Power Energy and Technology (SZSE:300438)

Simply Wall St Growth Rating: ★★★★☆☆

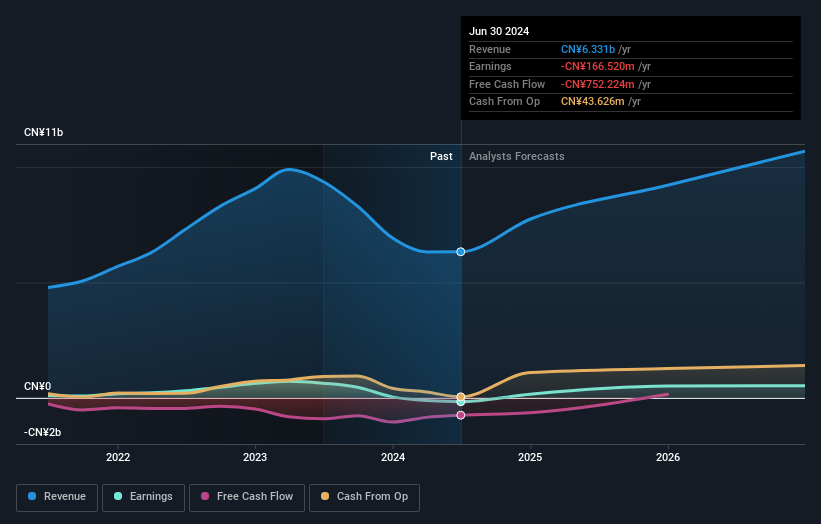

Overview: Guangzhou Great Power Energy and Technology Co., Ltd engages in the research, development, production, and sale of various batteries in China, with a market cap of CN¥13.64 billion.

Operations: The company's revenue is primarily derived from its Batteries / Battery Systems segment, totaling CN¥6.84 billion.

Insider Ownership: 34.5%

Earnings Growth Forecast: 81.3% p.a.

Guangzhou Great Power Energy and Technology is experiencing slower revenue growth at 18% annually, slightly above the Chinese market average but below high-growth thresholds. Despite a significant drop in net income from CNY 274.66 million to CNY 60.5 million year-over-year, earnings are forecasted to grow substantially by over 80% annually, indicating potential recovery. The company lacks recent insider trading activity, which may impact investor confidence regarding insider commitment or insights into future performance.

- Navigate through the intricacies of Guangzhou Great Power Energy and Technology with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Guangzhou Great Power Energy and Technology's share price might be on the expensive side.

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★☆☆

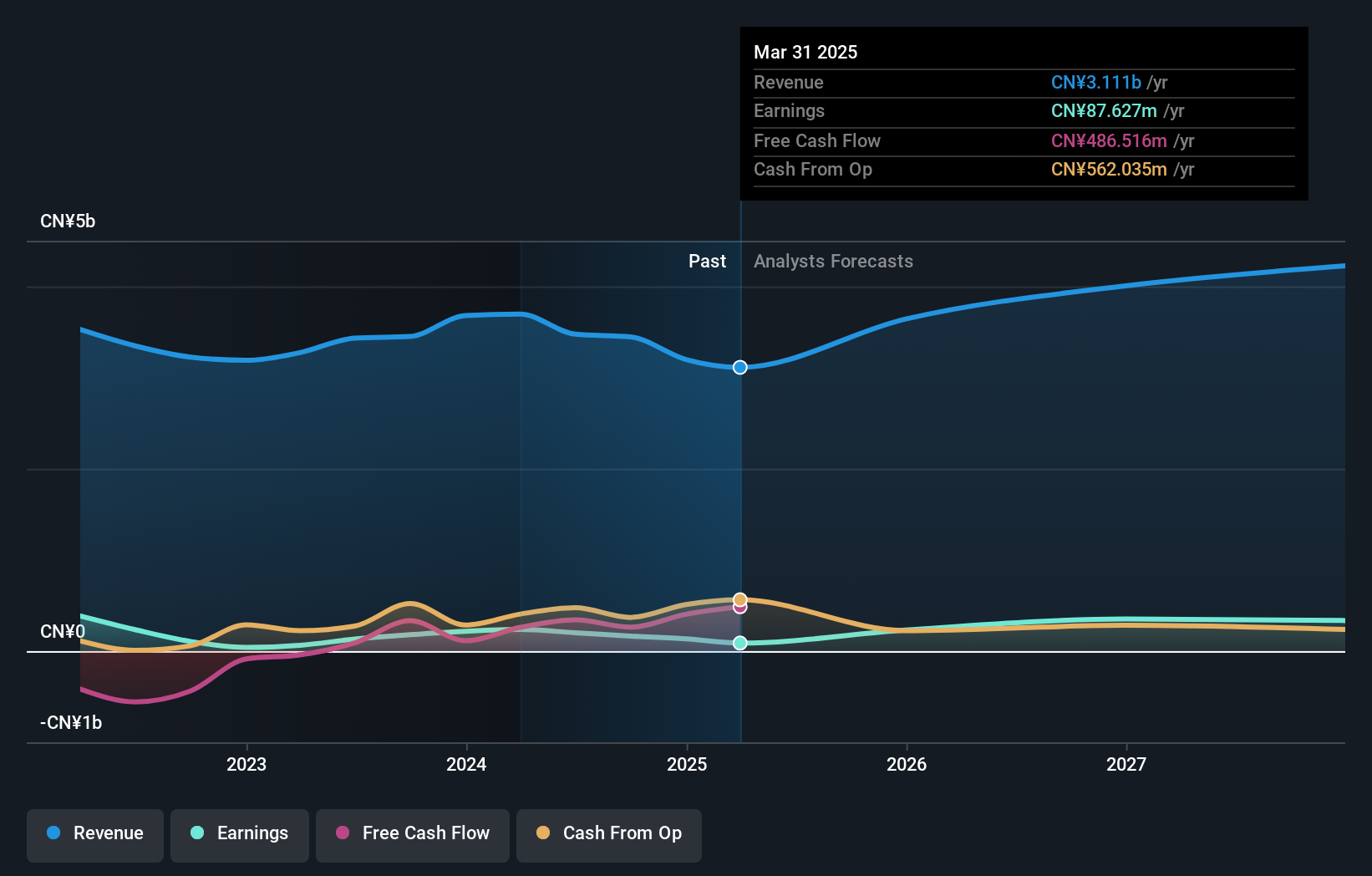

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. operates in the fiber laser industry and has a market cap of CN¥10.48 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 16.1%

Earnings Growth Forecast: 50% p.a.

Wuhan Raycus Fiber Laser Technologies is expected to see substantial earnings growth of 50% annually, outpacing the Chinese market. However, its forecasted revenue growth at 19.5% per year falls slightly below high-growth benchmarks. Recent financials show a decline in sales and net income for the first nine months of 2024, with earnings per share dropping from CNY 0.3067 to CNY 0.2137 year-over-year. The company has an unstable dividend track record and significant one-off items affecting results.

- Dive into the specifics of Wuhan Raycus Fiber Laser TechnologiesLtd here with our thorough growth forecast report.

- Our expertly prepared valuation report Wuhan Raycus Fiber Laser TechnologiesLtd implies its share price may be too high.

Make It Happen

- Explore the 1477 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300438

Guangzhou Great Power Energy and Technology

Researches, develops, produces, and sells various batteries in China.

Reasonable growth potential with mediocre balance sheet.