- China

- /

- Healthcare Services

- /

- SHSE:600211

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, investors are increasingly optimistic about the potential for future rate cuts. Amid this backdrop of rising stock indices and improved economic indicators, dividend stocks continue to be an attractive option for those seeking steady income streams in their portfolios. A good dividend stock often combines a reliable payout history with solid fundamentals, making it a compelling choice in today's market environment where stability is valued alongside growth potential.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.53% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

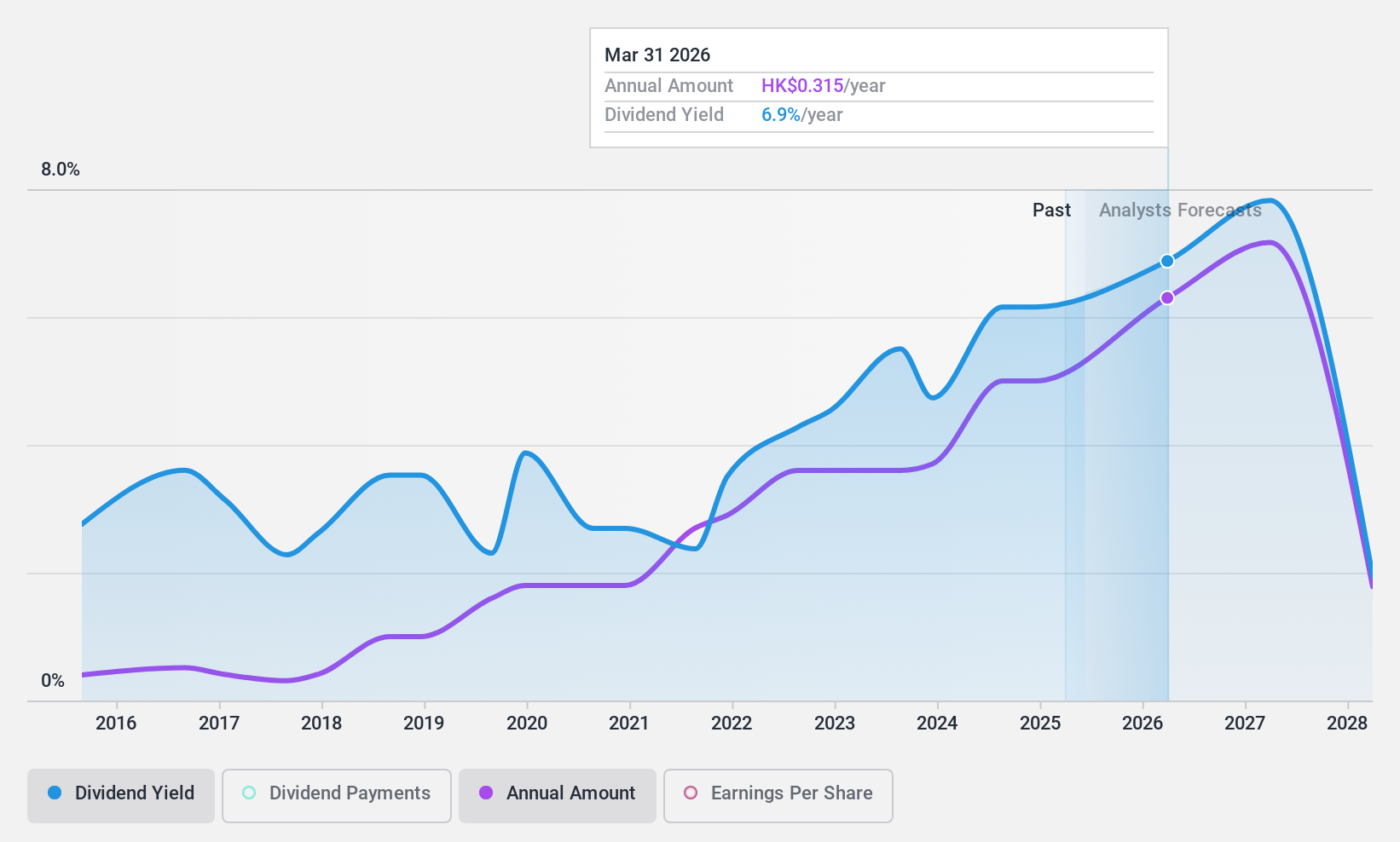

Bosideng International Holdings (SEHK:3998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People's Republic of China, with a market capitalization of approximately HK$42.36 billion.

Operations: Bosideng International Holdings Limited's revenue segments include Down Apparels at CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion.

Dividend Yield: 6.5%

Bosideng International Holdings has recently announced an interim dividend of HK$0.06 per share, with a payout ratio of 78.3%, indicating dividends are covered by earnings and cash flows. However, the dividend yield is lower than top-tier Hong Kong payers and historically volatile, suggesting some risk to reliability. The company commenced a significant share buyback program to enhance net asset value and earnings per share, potentially supporting future dividend sustainability despite past inconsistencies in growth stability.

- Dive into the specifics of Bosideng International Holdings here with our thorough dividend report.

- The analysis detailed in our Bosideng International Holdings valuation report hints at an deflated share price compared to its estimated value.

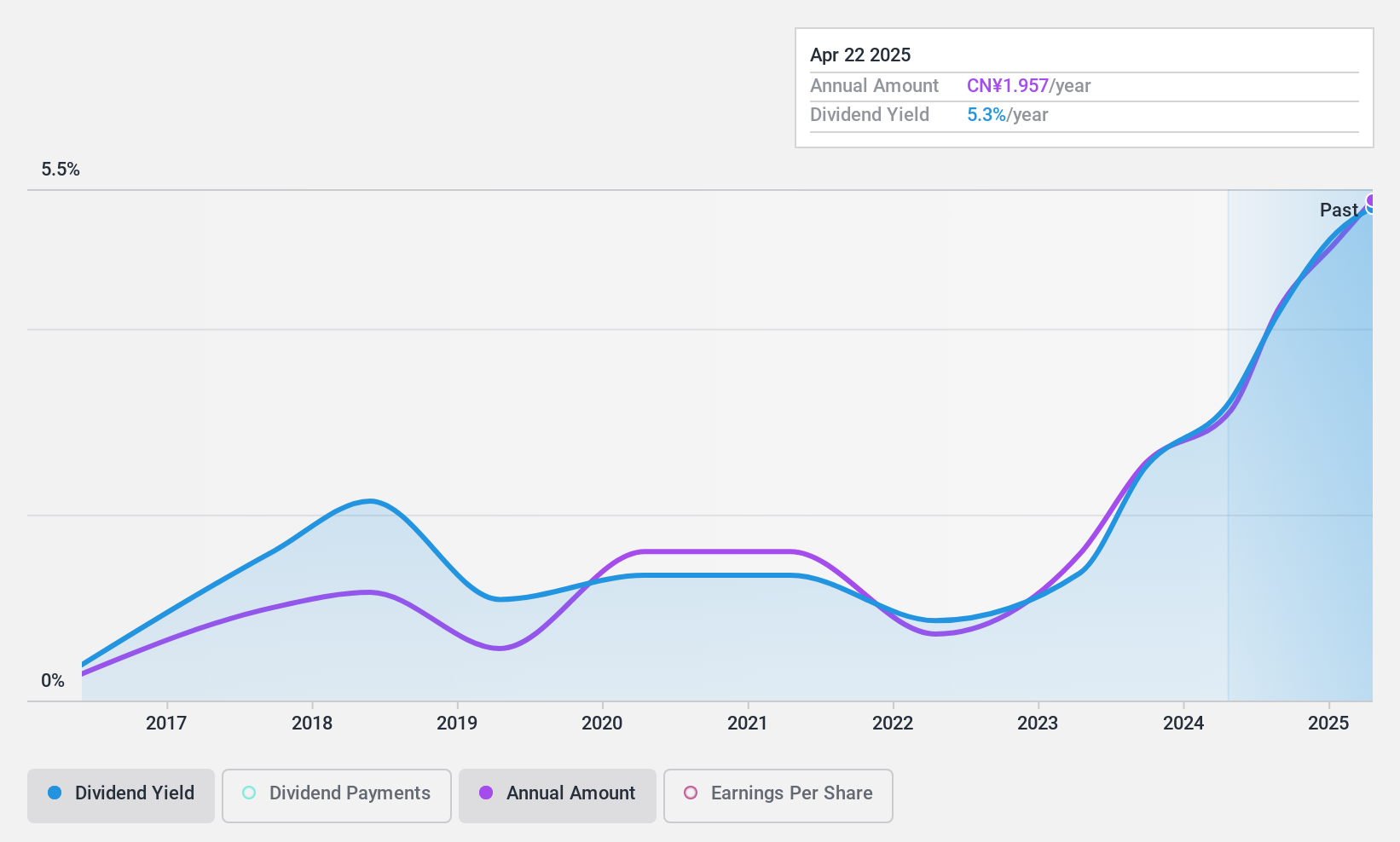

Tibet Rhodiola Pharmaceutical Holding (SHSE:600211)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tibet Rhodiola Pharmaceutical Holding Co. operates in the pharmaceutical industry with a focus on traditional Tibetan medicine and has a market cap of CN¥11.62 billion.

Operations: Tibet Rhodiola Pharmaceutical Holding Co. generates its revenue primarily from the pharmaceutical industry with a specialization in traditional Tibetan medicine.

Dividend Yield: 4.3%

Tibet Rhodiola Pharmaceutical Holding's dividend yield of 4.26% ranks in the top 25% of Chinese payers, supported by a sustainable payout ratio of 66.9%. The cash payout ratio is also low at 48.9%, indicating strong coverage by cash flows. Despite these positives, dividends have been historically volatile and unreliable over the past decade, with recent earnings showing a decline to CNY 791.87 million from CNY 855.34 million year-on-year.

- Take a closer look at Tibet Rhodiola Pharmaceutical Holding's potential here in our dividend report.

- Our valuation report here indicates Tibet Rhodiola Pharmaceutical Holding may be undervalued.

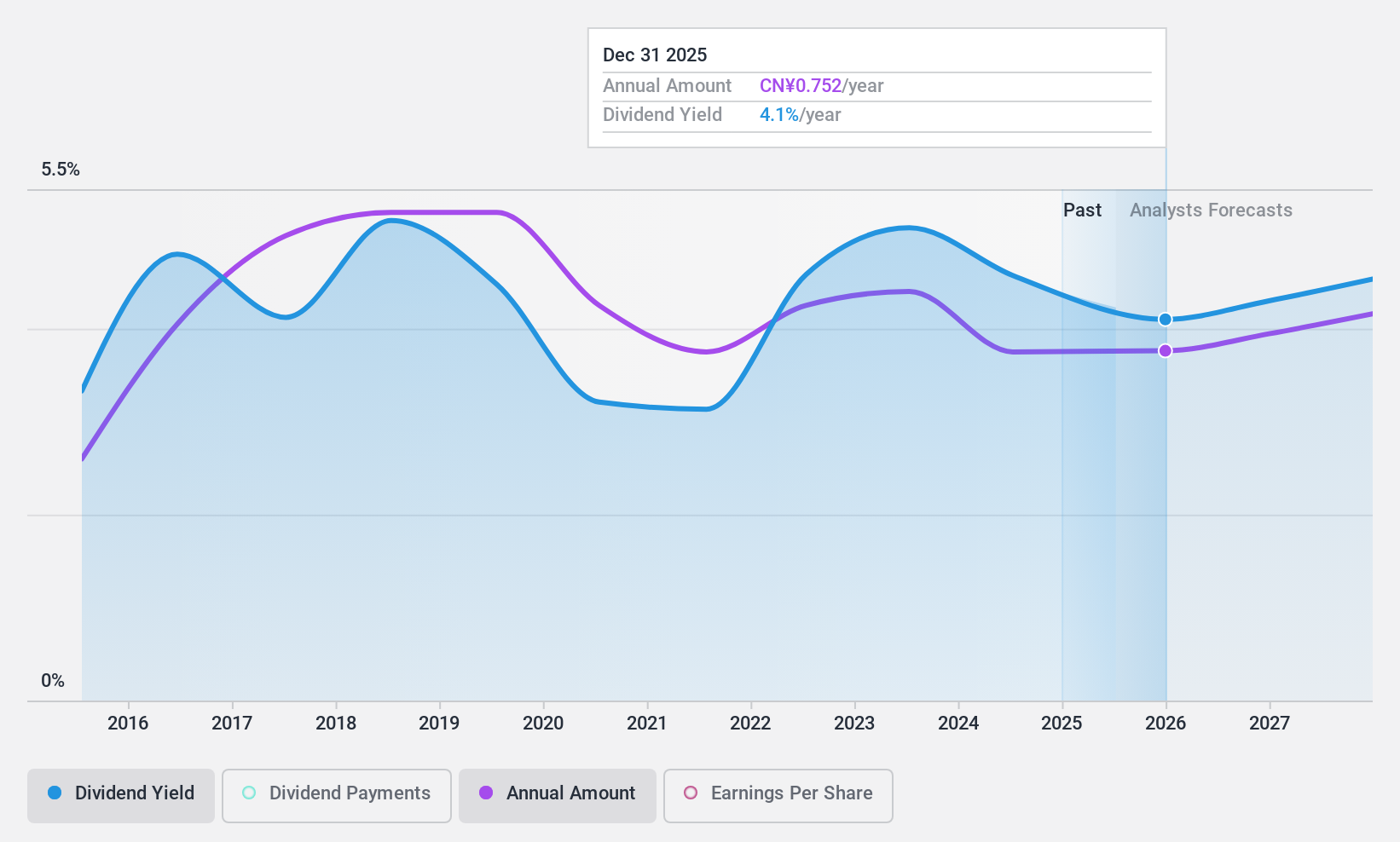

HUAYU Automotive Systems (SHSE:600741)

Simply Wall St Dividend Rating: ★★★★★★

Overview: HUAYU Automotive Systems Company Limited engages in the research, development, manufacturing, and sale of automotive parts globally with a market cap of CN¥52.37 billion.

Operations: HUAYU Automotive Systems Company Limited generates revenue through its research, development, manufacturing, and sale of automotive parts worldwide.

Dividend Yield: 4.5%

HUAYU Automotive Systems offers a robust dividend yield of 4.52%, placing it among the top 25% of Chinese dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 34% and 44.1%, respectively, indicating sustainability. Over the past decade, dividends have shown stability and growth with minimal volatility. However, recent results indicate a slight decline in revenue to CNY 119.49 billion and net income to CNY 4.47 billion year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of HUAYU Automotive Systems.

- The valuation report we've compiled suggests that HUAYU Automotive Systems' current price could be quite moderate.

Taking Advantage

- Discover the full array of 1997 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Rhodiola Pharmaceutical Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600211

Tibet Rhodiola Pharmaceutical Holding

Tibet Rhodiola Pharmaceutical Holding Co.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives