- China

- /

- Communications

- /

- SZSE:000561

High Growth Tech Stocks to Watch This October 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced more pressure than their large-cap counterparts, with the S&P 500 Index experiencing a dip after weeks of gains. In this environment, tech stocks continue to capture attention due to their resilience and growth potential; identifying those with strong fundamentals and innovative capabilities can be key in navigating these dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Shaanxi Fenghuo Electronics (SZSE:000561)

Simply Wall St Growth Rating: ★★★★★☆

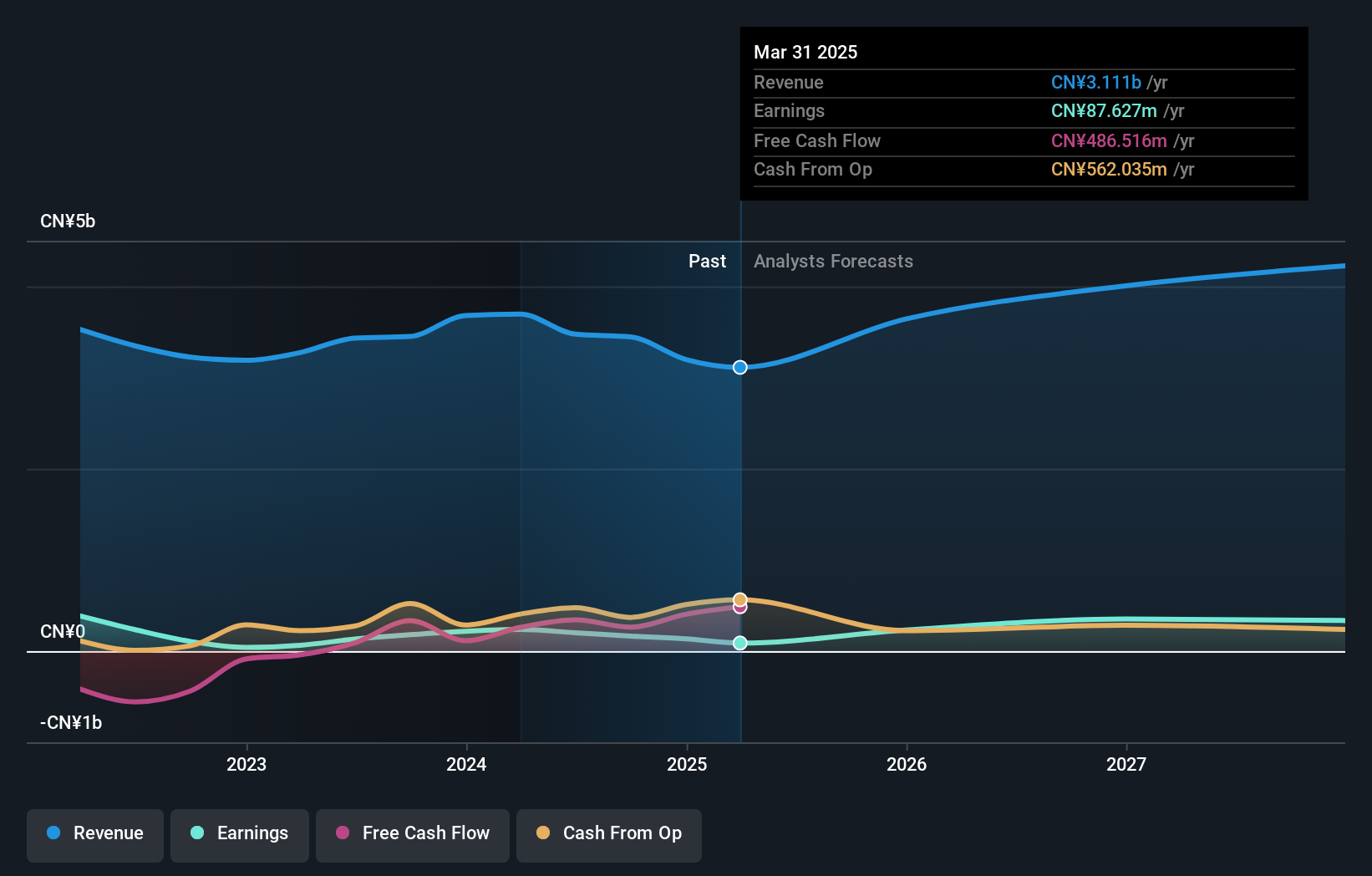

Overview: Shaanxi Fenghuo Electronics Co., Ltd. focuses on the development and production of military communications equipment and electroacoustic products in China, with a market cap of CN¥5.92 billion.

Operations: The company generates revenue primarily from military communications equipment and electroacoustic products. Its market cap is CN¥5.92 billion, reflecting its significant presence in these sectors within China.

Shaanxi Fenghuo Electronics, amidst a challenging financial landscape marked by a net loss of CNY 49.6 million for the first half of 2024, contrasts starkly with its ambitious revenue growth projections. Despite recent setbacks, the company's revenue is expected to surge at an impressive rate of 22.7% annually, outpacing the broader Chinese market's growth rate of 13.7%. This optimism is further bolstered by forecasts predicting earnings growth to rocket by 54.5% per year. In addition to financial maneuvers like recent share repurchases totaling CNY 3.84 million and consistent dividend payments, these figures highlight a strategic push towards profitability and market expansion over the next three years, underscoring its potential resilience and adaptability in the high-tech sector.

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. is a company that focuses on the development and manufacturing of fiber laser technologies, with a market cap of CN¥11.75 billion.

Operations: Raycus Fiber Laser specializes in fiber laser technologies, generating revenue primarily through the sale of laser products. The company focuses on innovation and development within the fiber laser industry to support its business operations.

Wuhan Raycus Fiber Laser Technologies has demonstrated resilience with a 21.2% annual revenue growth forecast, outpacing the broader Chinese market's average of 13.7%. Despite recent earnings challenges, with a net income drop to CNY 120.01 million from CNY 172.25 million year-over-year, the company is poised for significant recovery, projecting an earnings increase of 48.1% per annum. This growth trajectory is underpinned by substantial R&D investments that align with industry demands for advanced laser technologies, ensuring Wuhan Raycus remains at the forefront of innovation in its sector.

- Click to explore a detailed breakdown of our findings in Wuhan Raycus Fiber Laser TechnologiesLtd's health report.

Understand Wuhan Raycus Fiber Laser TechnologiesLtd's track record by examining our Past report.

Imeik Technology DevelopmentLtd (SZSE:300896)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Imeik Technology Development Co., Ltd. focuses on the research and development, production, and transformation of biomedical soft tissue repair materials in China, with a market cap of CN¥65.38 billion.

Operations: Imeik Technology Development Co., Ltd. generates revenue primarily from its Surgical & Medical Equipment segment, which recorded CN¥3.07 billion. The company is engaged in the development and production of biomedical soft tissue repair materials in China.

Imeik Technology Development Co., Ltd. has showcased robust performance with a significant increase in both revenue and net income, reporting CNY 2.38 billion and CNY 1.59 billion respectively for the nine months ending September 2024, up from the previous year's figures. This growth is underpinned by a strategic emphasis on R&D, which is evident from their consistent investment in innovation; this aligns with broader industry trends where tech companies are increasingly focusing on deep-tech advancements to stay competitive. With earnings per share also rising from CNY 4.69 to CNY 5.26, Imeik is not just growing but also enhancing its profitability, positioning itself well amidst market dynamics that favor technologically agile companies.

- Get an in-depth perspective on Imeik Technology DevelopmentLtd's performance by reading our health report here.

Learn about Imeik Technology DevelopmentLtd's historical performance.

Seize The Opportunity

- Investigate our full lineup of 1280 High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000561

Shaanxi Fenghuo Electronics

Engages in the development and production of military communications equipment and electroacoustic products in China.

High growth potential with adequate balance sheet.