- Japan

- /

- Professional Services

- /

- TSE:4194

Growth Companies With Insider Confidence In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising Treasury yields and shifting economic conditions, investors are increasingly focused on growth stocks that exhibit resilience and potential for long-term success. In this context, companies with high insider ownership often signal strong internal confidence in their future prospects, making them compelling considerations for those looking to align with informed stakeholders amidst current market challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

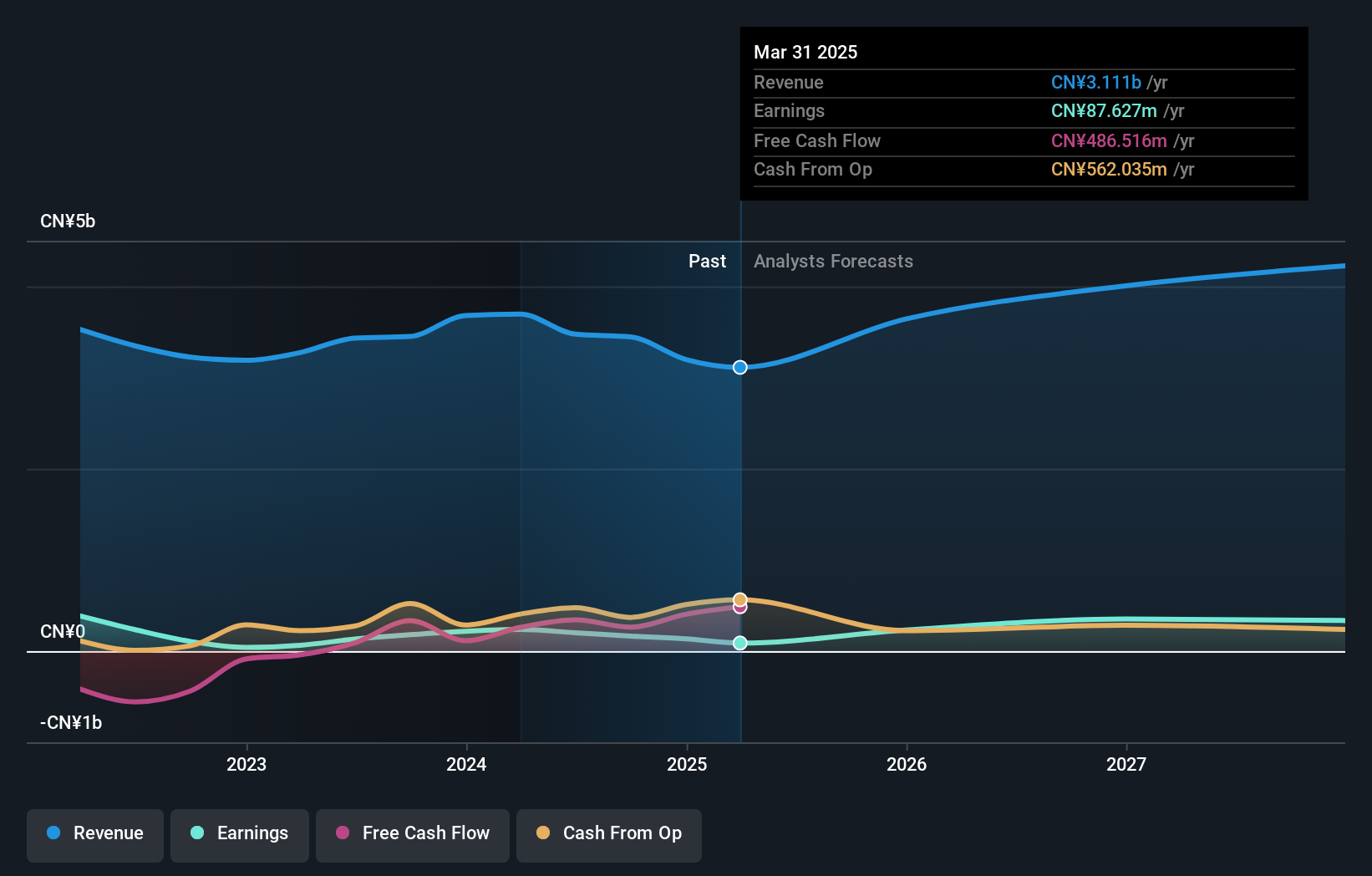

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. operates in the fiber laser industry and has a market cap of CN¥12.23 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific revenue segment details for Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Insider Ownership: 16.1%

Earnings Growth Forecast: 48.1% p.a.

Wuhan Raycus Fiber Laser Technologies shows strong growth potential with earnings forecasted to grow significantly at 48.1% annually, outpacing the Chinese market average. However, recent financial results indicate a decline in both sales and net income for the nine months ending September 2024, with revenue at CNY 2.35 billion compared to CNY 2.58 billion last year. Despite this, expected revenue growth remains robust at over 21% per year, suggesting resilience amid current challenges.

- Click here to discover the nuances of Wuhan Raycus Fiber Laser TechnologiesLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Wuhan Raycus Fiber Laser TechnologiesLtd's current price could be inflated.

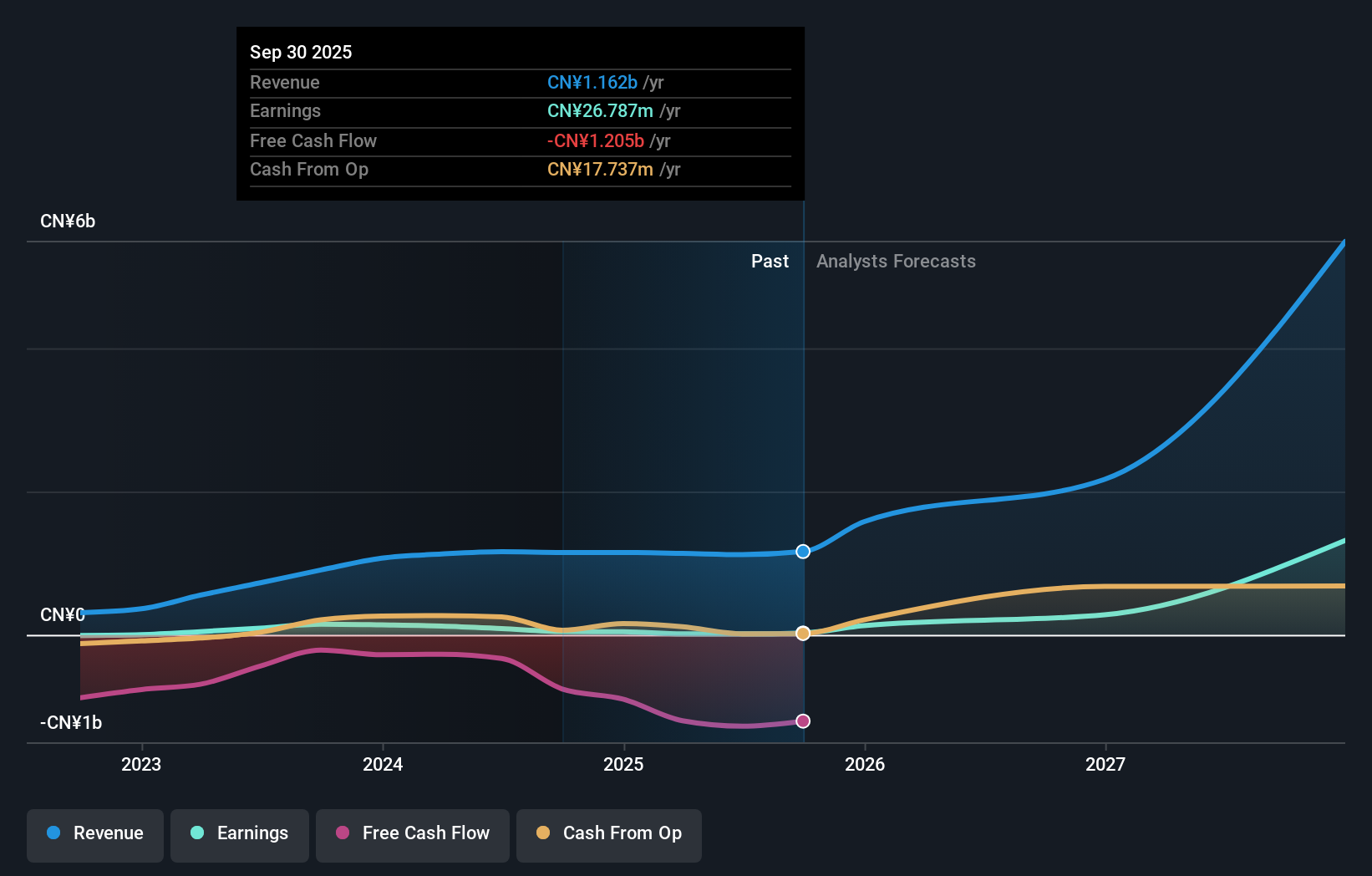

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★★

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) operates in the environmental technology sector and has a market cap of approximately CN¥16.84 billion.

Operations: Unfortunately, I don't have the specific revenue segment details for Qingdao Huicheng Environmental Technology Group Co., Ltd. to summarize. If you provide the necessary financial data, I'd be happy to help with that summary.

Insider Ownership: 32%

Earnings Growth Forecast: 71.2% p.a.

Qingdao Huicheng Environmental Technology Group is poised for significant growth, with earnings forecasted to rise by 71.2% annually, surpassing the Chinese market average. Despite a recent decline in net income to CNY 43.44 million for the nine months ending September 2024, revenue increased to CNY 862.19 million from the previous year. The company's high insider ownership was recently highlighted by Zhang Min's acquisition of a 5% stake for CNY 300 million.

- Navigate through the intricacies of Qingdao Huicheng Environmental Technology Group with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Qingdao Huicheng Environmental Technology Group's share price might be on the expensive side.

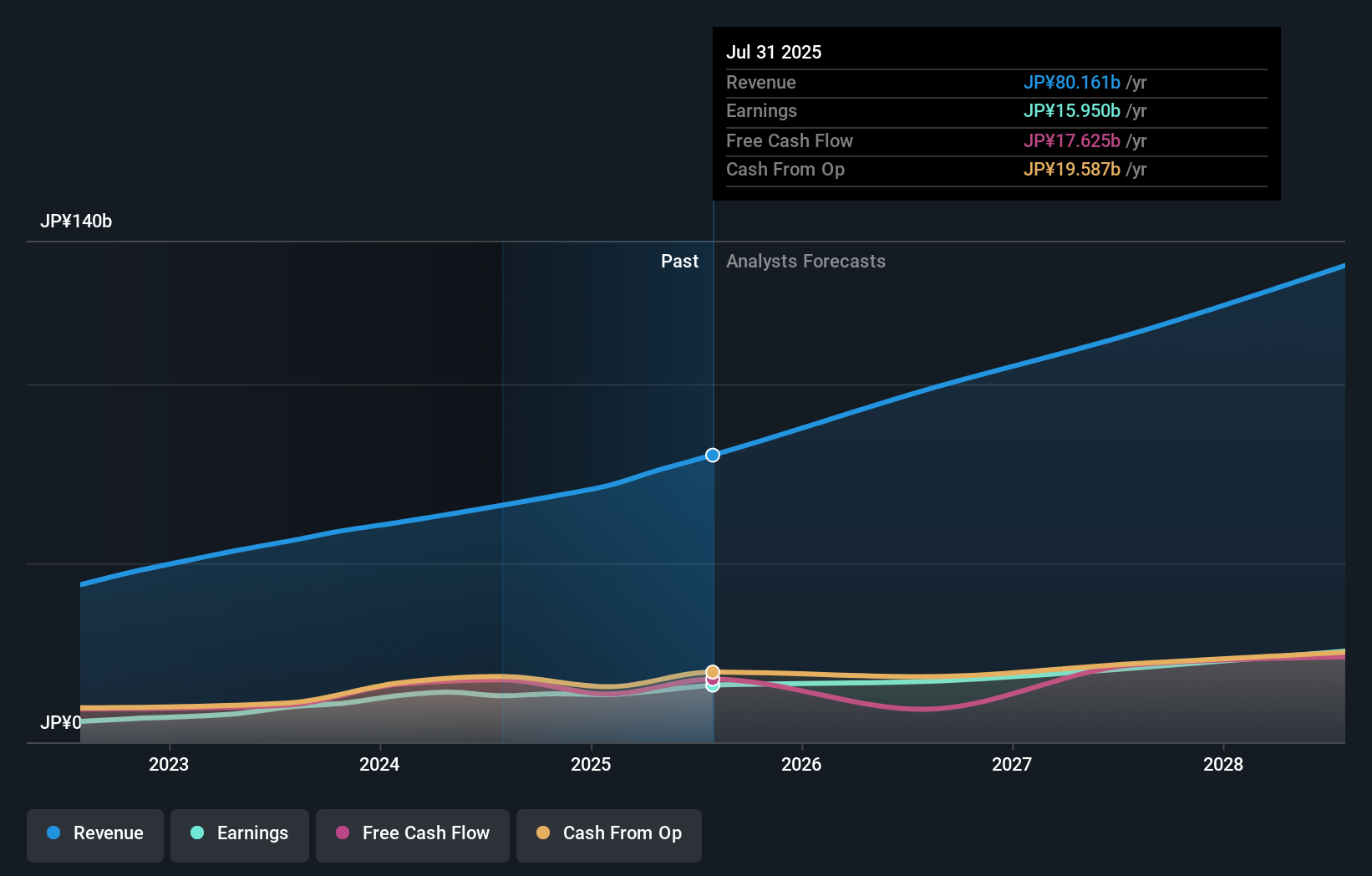

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market capitalization of approximately ¥323.77 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which generated ¥63.84 billion, and its Incubation segment, contributing ¥2.26 billion.

Insider Ownership: 39.4%

Earnings Growth Forecast: 12.4% p.a.

Visional is set to experience revenue growth at 10.8% annually, outpacing the Japanese market average of 4.2%. Earnings grew by 30.8% last year and are expected to continue growing at 12.4% per year, exceeding the market's forecast of 8.8%. The company trades significantly below its estimated fair value and anticipates net sales of ¥76.4 billion for fiscal year ending July 2025, with operating profit projected at ¥19.15 billion.

- Take a closer look at Visional's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Visional shares in the market.

Key Takeaways

- Delve into our full catalog of 1530 Fast Growing Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4194

Solid track record with reasonable growth potential.

Market Insights

Community Narratives