- Taiwan

- /

- Tech Hardware

- /

- TWSE:2059

Asian Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

Amidst the backdrop of rekindled U.S.-China trade tensions and fluctuating global markets, Asia remains a focal point for investors seeking growth opportunities. In such uncertain times, stocks with high insider ownership can offer a sense of stability and confidence, as they often indicate that those closest to the company believe in its long-term potential.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.5% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 26.3% | 99.1% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's uncover some gems from our specialized screener.

Xiamen Wanli Stone StockLtd (SZSE:002785)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Wanli Stone Stock Co., Ltd specializes in the development, processing, and installation of stone products and related items across several countries including China, Japan, South Korea, and the United States, with a market cap of CN¥8.48 billion.

Operations: The company's revenue is primarily derived from the Stone Processing and Manufacturing Industry, which accounts for CN¥1.07 billion, along with CN¥157.03 million from the Wholesale of Other Products segment.

Insider Ownership: 19%

Xiamen Wanli Stone Stock Ltd. demonstrates significant growth potential with its forecasted revenue to increase by 27.2% annually, outpacing the Chinese market's average. Despite recent volatility in share price and a decline in half-year sales to CNY 599.32 million, earnings per share improved slightly, reflecting resilience and potential profitability within three years. The lack of substantial insider trading activity over the past three months suggests stability in insider sentiment towards future growth prospects.

- Click here to discover the nuances of Xiamen Wanli Stone StockLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Xiamen Wanli Stone StockLtd's current price could be inflated.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system products globally and has a market cap of approximately CN¥24.66 billion.

Operations: Electric Connector Technology Co., Ltd. generates revenue from the production and sale of micro electronic connectors and interconnection system related products across China, North America, Europe, Japan, Asia Pacific, and other international markets.

Insider Ownership: 38.9%

Electric Connector Technology's insider ownership aligns with its growth trajectory, as revenue is expected to grow at 22.8% annually, surpassing the market average. Despite a recent dip in net income to CNY 242.66 million for the half-year ending June 2025, earnings are forecasted to rise significantly at 30.4% per year. Recent changes in company bylaws suggest strategic adjustments for future expansion, while the lack of substantial insider trading indicates confidence in its growth outlook.

- Click to explore a detailed breakdown of our findings in Electric Connector Technology's earnings growth report.

- Our expertly prepared valuation report Electric Connector Technology implies its share price may be lower than expected.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★★★

Overview: King Slide Works Co., Ltd. designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds across Taiwan, the United States, China, and internationally with a market cap of NT$356.89 billion.

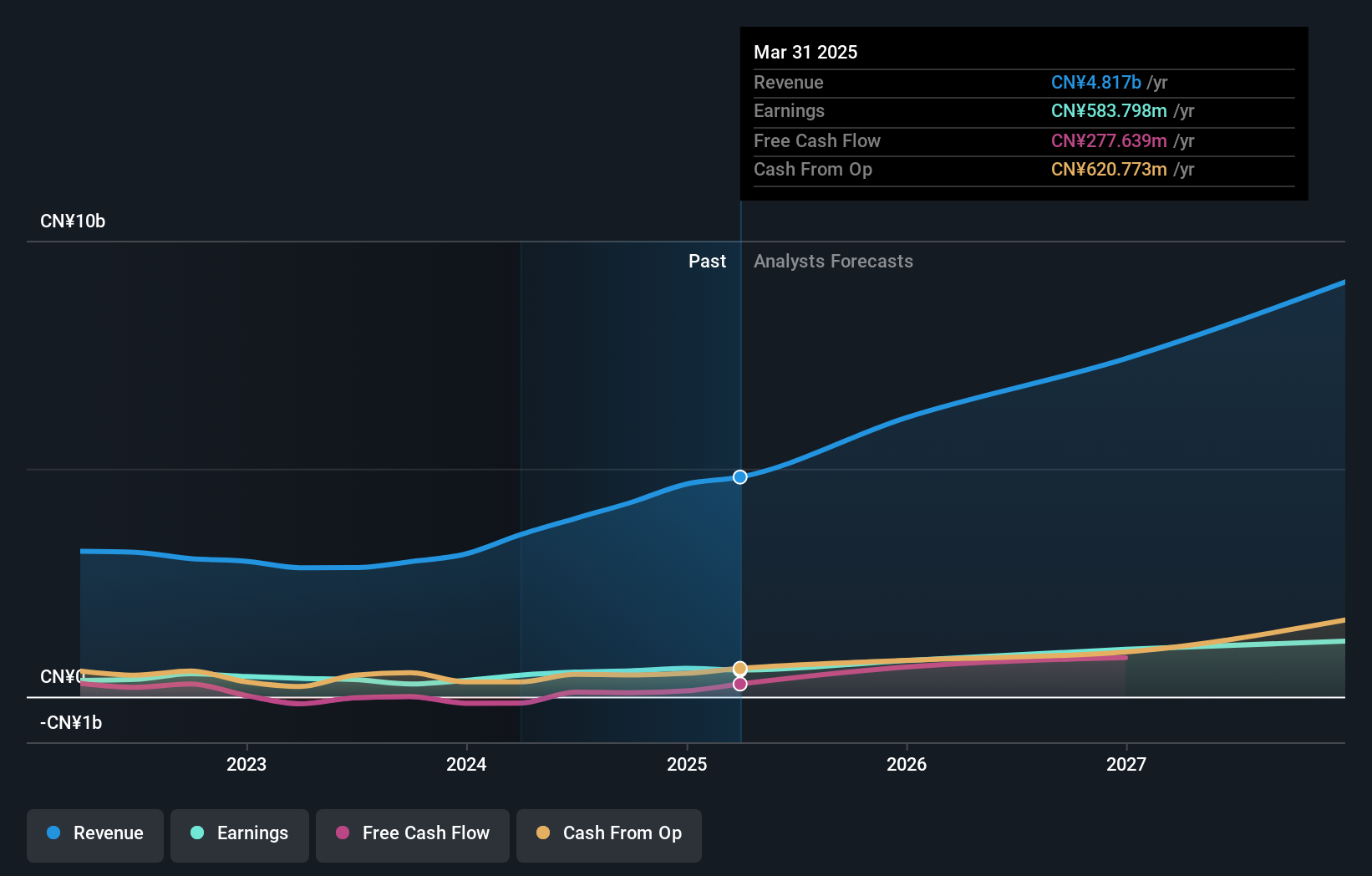

Operations: The company's revenue segments include NT$2.09 billion from King Slide Works Co., Ltd. and NT$12.22 billion from King Slide Technology Co., Ltd.

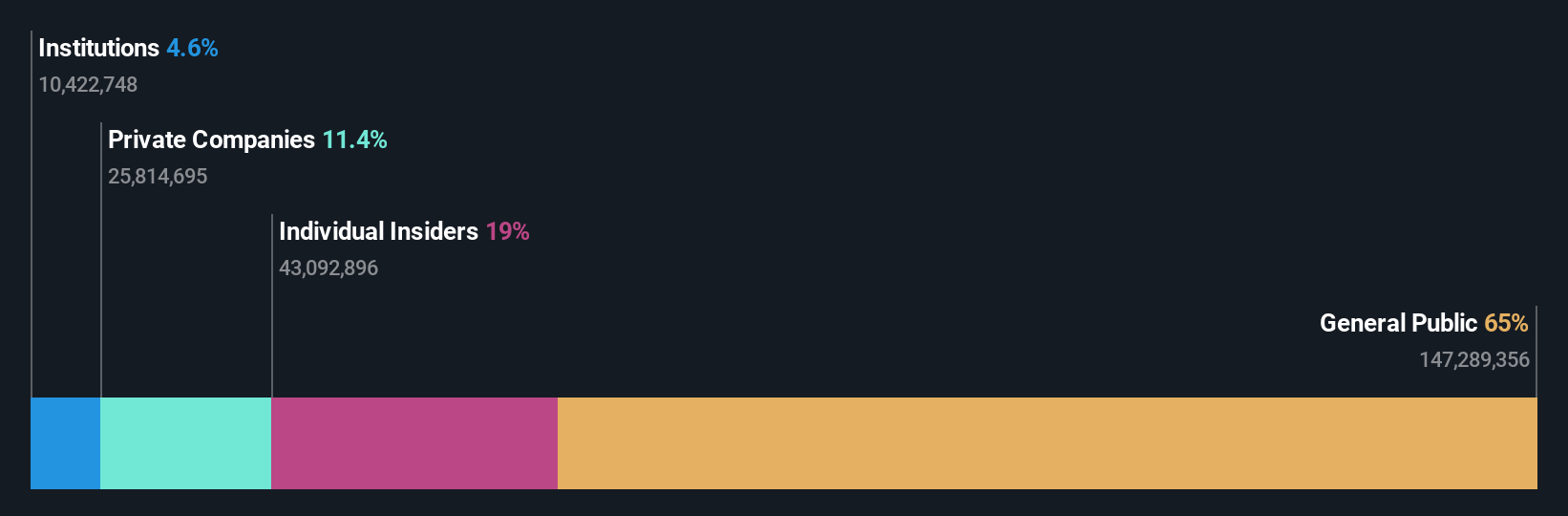

Insider Ownership: 14.3%

King Slide Works demonstrates strong growth potential with insider ownership aligning well with its forecasted earnings increase of 33.4% annually, outpacing the TW market average. Despite a recent decline in quarterly net income to TWD 614.1 million, six-month figures show improvement, indicating resilience. Revenue is projected to rise by 22.9% per year, exceeding the market's growth rate, while a high return on equity of 37.1% is anticipated within three years, underscoring robust financial health and strategic positioning for future expansion.

- Get an in-depth perspective on King Slide Works' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that King Slide Works is priced higher than what may be justified by its financials.

Key Takeaways

- Click here to access our complete index of 620 Fast Growing Asian Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if King Slide Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2059

King Slide Works

Designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds in Taiwan, the United States, China, and internationally.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives