- China

- /

- Electronic Equipment and Components

- /

- SZSE:300667

Market Participants Recognise Beijing Beetech Inc.'s (SZSE:300667) Revenues Pushing Shares 35% Higher

Those holding Beijing Beetech Inc. (SZSE:300667) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

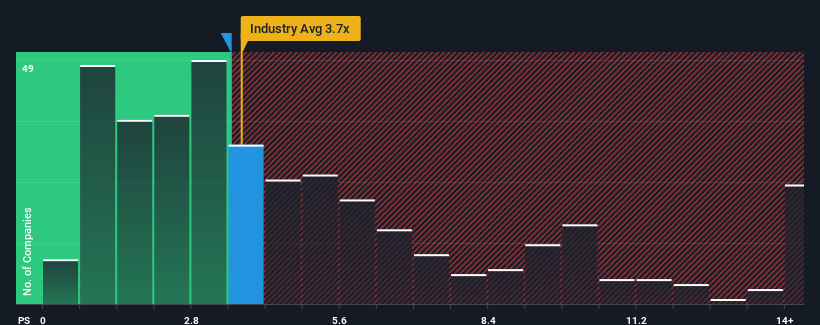

Although its price has surged higher, it's still not a stretch to say that Beijing Beetech's price-to-sales (or "P/S") ratio of 3.5x right now seems quite "middle-of-the-road" compared to the Electronic industry in China, where the median P/S ratio is around 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Beijing Beetech

What Does Beijing Beetech's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Beijing Beetech's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Beetech will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Beijing Beetech's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.8% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 27% over the next year. That's shaping up to be similar to the 25% growth forecast for the broader industry.

In light of this, it's understandable that Beijing Beetech's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Beijing Beetech's P/S Mean For Investors?

Beijing Beetech's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Beijing Beetech maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 1 warning sign for Beijing Beetech that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beetech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300667

Beijing Beetech

Produces and sells smart sensors and optoelectronic instrument products.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives