- China

- /

- Electronic Equipment and Components

- /

- SZSE:300667

After Leaping 25% Beijing Beetech Inc. (SZSE:300667) Shares Are Not Flying Under The Radar

Beijing Beetech Inc. (SZSE:300667) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

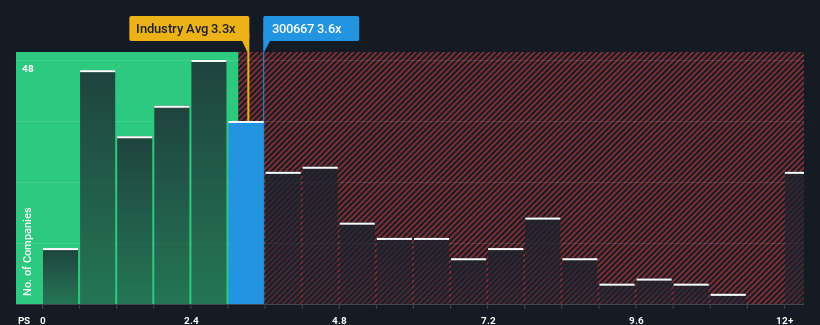

In spite of the firm bounce in price, there still wouldn't be many who think Beijing Beetech's price-to-sales (or "P/S") ratio of 3.6x is worth a mention when the median P/S in China's Electronic industry is similar at about 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Beijing Beetech

What Does Beijing Beetech's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Beijing Beetech has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Beetech will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Beijing Beetech would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 9.8% gain to the company's revenues. The latest three year period has also seen a 7.8% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 25% over the next year. With the industry predicted to deliver 25% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Beijing Beetech's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Beijing Beetech's P/S Mean For Investors?

Beijing Beetech appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Beijing Beetech's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you take the next step, you should know about the 2 warning signs for Beijing Beetech (1 is a bit concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beetech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300667

Beijing Beetech

Produces and sells smart sensors and optoelectronic instrument products.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives