- China

- /

- Electronic Equipment and Components

- /

- SZSE:300615

XDC Industries (Shenzhen) (SZSE:300615) Is Posting Promising Earnings But The Good News Doesn’t Stop There

XDC Industries (Shenzhen) Limited's (SZSE:300615) solid earnings announcement recently didn't do much to the stock price. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

Check out our latest analysis for XDC Industries (Shenzhen)

A Closer Look At XDC Industries (Shenzhen)'s Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

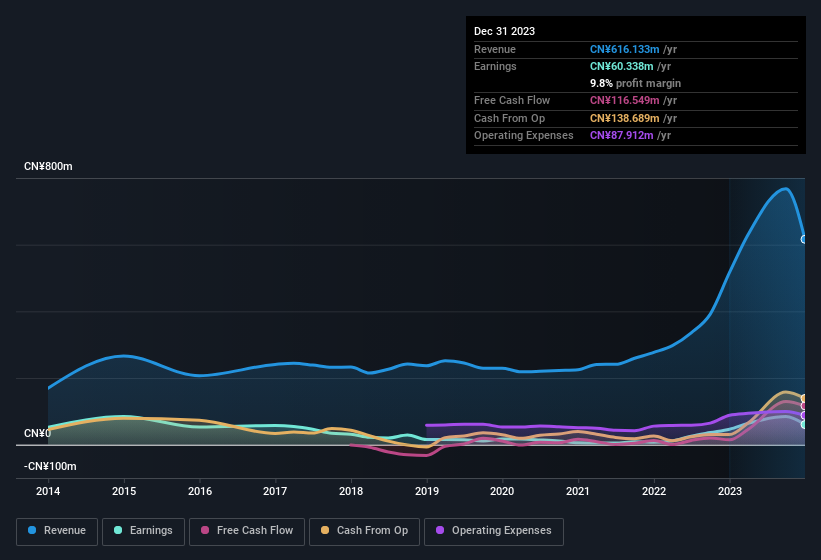

For the year to December 2023, XDC Industries (Shenzhen) had an accrual ratio of -0.18. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of CN¥117m, well over the CN¥60.3m it reported in profit. XDC Industries (Shenzhen)'s free cash flow improved over the last year, which is generally good to see. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of XDC Industries (Shenzhen).

How Do Unusual Items Influence Profit?

While the accrual ratio might bode well, we also note that XDC Industries (Shenzhen)'s profit was boosted by unusual items worth CN¥6.0m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On XDC Industries (Shenzhen)'s Profit Performance

XDC Industries (Shenzhen)'s profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Based on these factors, we think that XDC Industries (Shenzhen)'s profits are a reasonably conservative guide to its underlying profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 2 warning signs with XDC Industries (Shenzhen), and understanding these should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300615

XDC Industries (Shenzhen)

Engages in the research and development, production, and sale of RF devices in the mobile communications industry in China and internationally.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.