- China

- /

- Communications

- /

- SZSE:300570

High Growth Tech Giants in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and policy shifts, the technology sector in Asia continues to capture attention with its dynamic growth potential. In this environment, identifying promising tech stocks involves looking for companies that not only innovate but also adapt effectively to changing market conditions and economic challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.78% | 30.84% | ★★★★★★ |

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Foxconn Industrial Internet (SHSE:601138)

Simply Wall St Growth Rating: ★★★★★★

Overview: Foxconn Industrial Internet Co., Ltd. specializes in designing and manufacturing communication network and cloud service equipment, precision tools, and industrial solutions, with a market cap of CN¥1.36 trillion.

Operations: Foxconn Industrial Internet focuses on producing communication network and cloud service equipment, precision tools, and industrial solutions. With a market cap of CN¥1.36 trillion, the company leverages its expertise in these areas to drive its business operations.

Foxconn Industrial Internet's recent executive appointment and robust financial results underscore its strategic positioning in Asia's tech sector. With a significant year-over-year revenue jump from CNY 265.68 billion to CNY 360.76 billion and net income rising from CNY 8.74 billion to CNY 12.11 billion, the company demonstrates strong operational execution. The hiring of SHEN, TAO-PANG as CFO, with his extensive experience at Micron and HTC, aligns with Foxconn’s focus on enhancing financial strategies amid rapid growth—evidenced by a forecasted annual revenue increase of 28.2% and earnings growth of 27.7%. This performance is further bolstered by a resilient R&D commitment, positioning Foxconn Industrial Internet well for sustained innovation in high-tech manufacturing.

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongguan Aohai Technology Co., Ltd. engages in the research, development, production, and sale of consumer electronics products both in China and internationally, with a market cap of CN¥12.73 billion.

Operations: Aohai Technology focuses on the production and sale of consumer electronics, primarily within the Computer, Communications, and Other Electronic Equipment Manufacturing segment, generating CN¥6.65 billion in revenue. The company's operations extend both domestically and internationally.

Dongguan Aohai Technology has demonstrated a robust performance in the first half of 2025, with revenues climbing to CNY 3.19 billion, up from CNY 2.96 billion in the previous year, indicating a solid growth trajectory. Despite facing challenges like slower earnings growth compared to the broader tech industry—1.9% versus 18.4%—the company has maintained stability in its earnings per share and actively engaged in shareholder returns through a recent buyback of over one million shares for CNY 44.99 million. This strategic financial maneuvering showcases Aohai's commitment to enhancing shareholder value while navigating through competitive market dynamics and maintaining a steady pace in innovation and market expansion.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

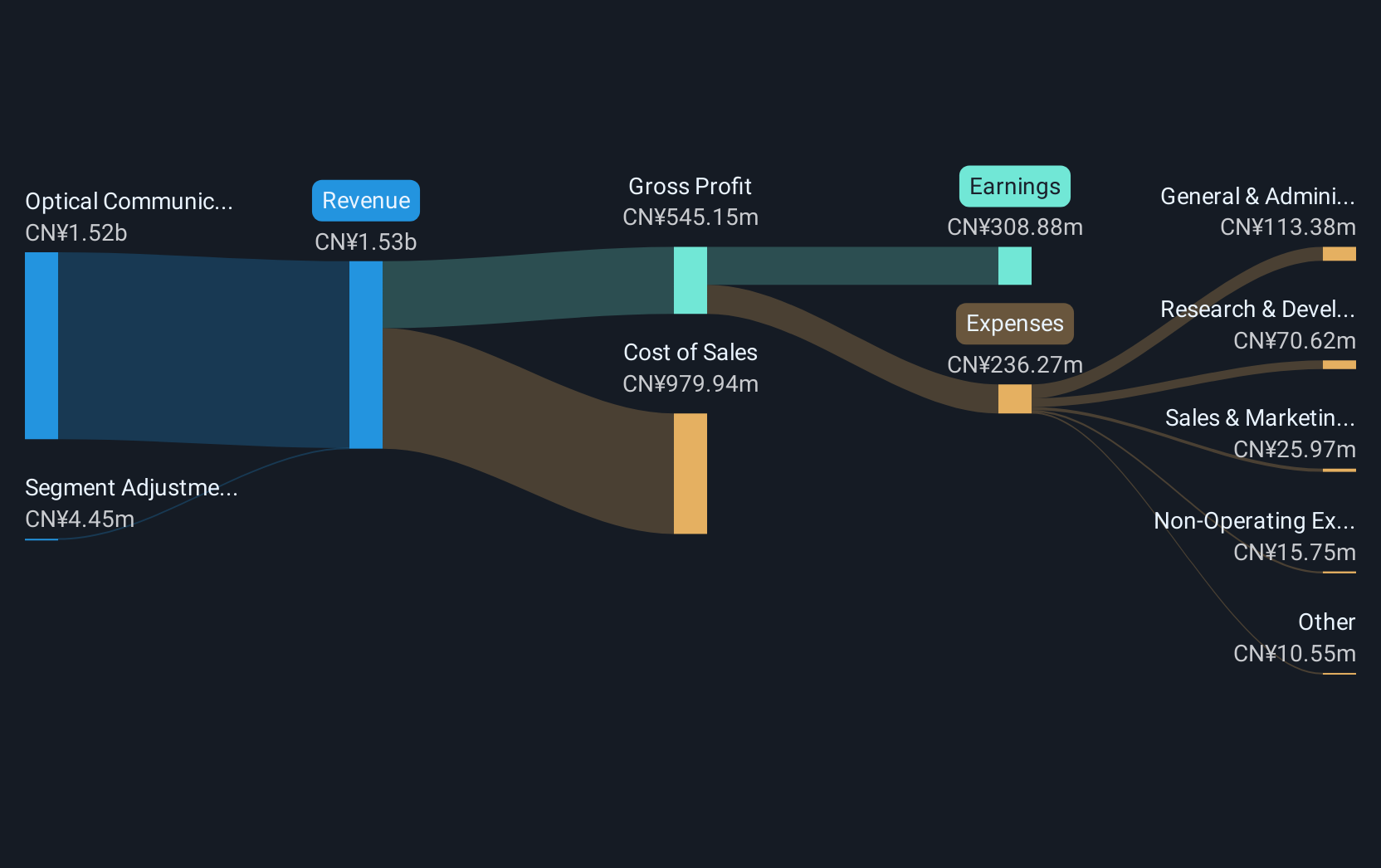

Overview: T&S Communications Co., Ltd. is engaged in the development, manufacturing, and sale of fiber optics communication products in China with a market capitalization of CN¥24.06 billion.

Operations: T&S Communications generates revenue primarily through its Optical Communication Components segment, which accounts for CN¥1.69 billion.

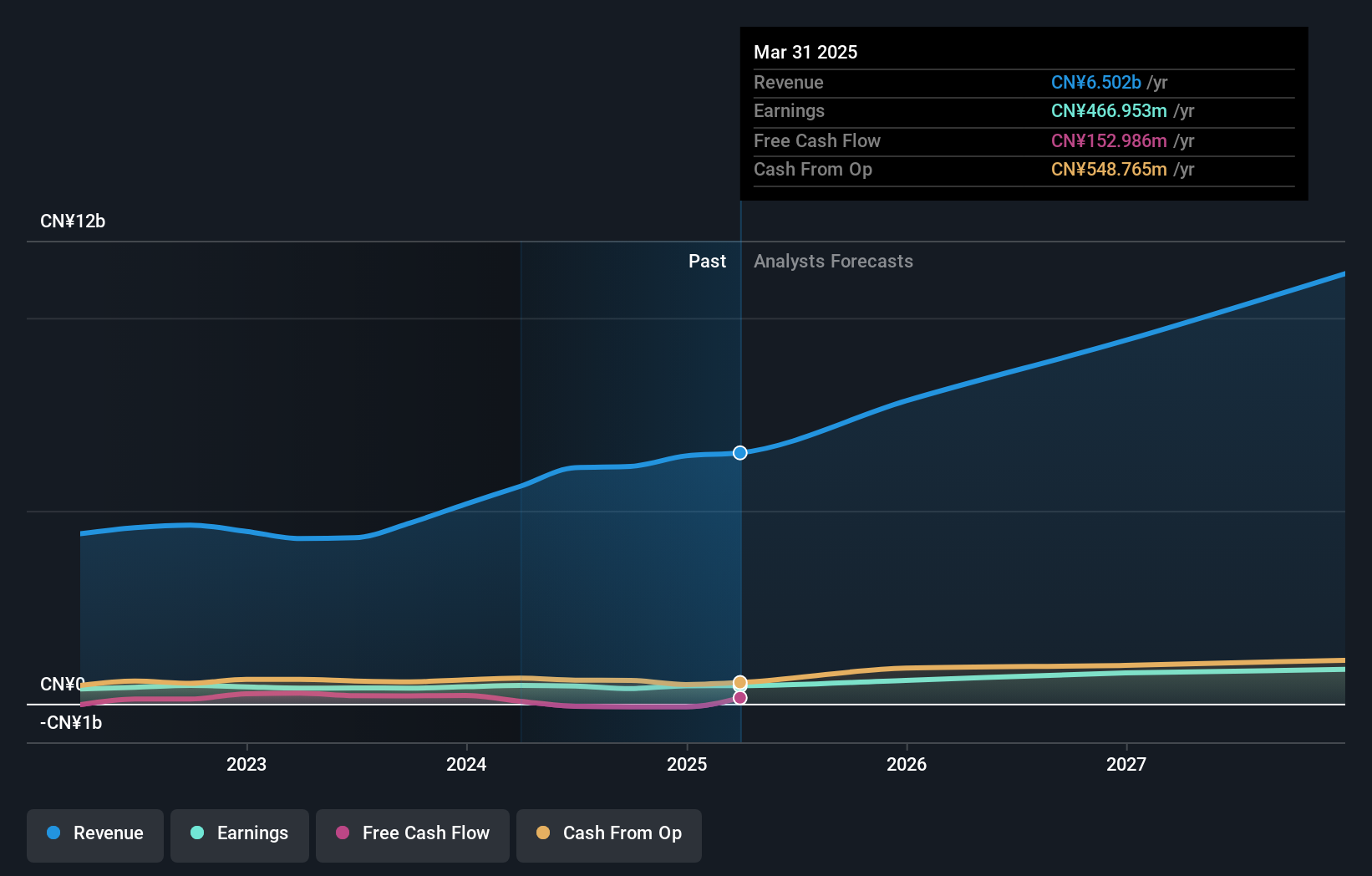

T&S CommunicationsLtd. has shown remarkable growth with a 117.9% increase in earnings over the past year, outpacing the communications industry's 8.2% average, reflecting its robust competitive edge in high-growth tech sectors in Asia. The company's revenue surged by an impressive 40.2% annually, significantly above the Chinese market average of 14.1%. This financial year, they reported first-half revenues of CNY 828.48 million, nearly doubling from CNY 509.85 million in the previous period, underlining their aggressive expansion and market capture strategies. With a forecasted annual earnings growth of 45%, T&S is not just keeping pace but setting benchmarks within its sector, bolstered by strategic R&D investments that promise to propel future innovations and maintain their technological lead.

Summing It All Up

- Access the full spectrum of 185 Asian High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T&S CommunicationsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300570

T&S CommunicationsLtd

Develops, manufactures, and sells fiber optics communication products in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026