- China

- /

- Communications

- /

- SZSE:300570

Asian Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets navigate a complex economic landscape, Asian equities have shown resilience amid varying regional developments. In this environment, companies with high insider ownership often capture investor interest due to the potential alignment of interests between shareholders and management, making them noteworthy candidates for growth-focused portfolios.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Techwing (KOSDAQ:A089030) | 19.1% | 64.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 84.7% |

| Sineng ElectricLtd (SZSE:300827) | 36.2% | 27.6% |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD specializes in the R&D, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥44.49 billion.

Operations: Shenzhen Megmeet Electrical Co., LTD generates revenue from various segments including Smart Home Appliances Electronic Control Products (CN¥3.88 billion), Industrial Power Products (CN¥2.41 billion), Industrial Automation (CN¥711.82 million), New Energy and Rail Transit (CN¥854.36 million), Smart Equipment (CN¥507.67 million), and Precision Connection (CN¥404.19 million).

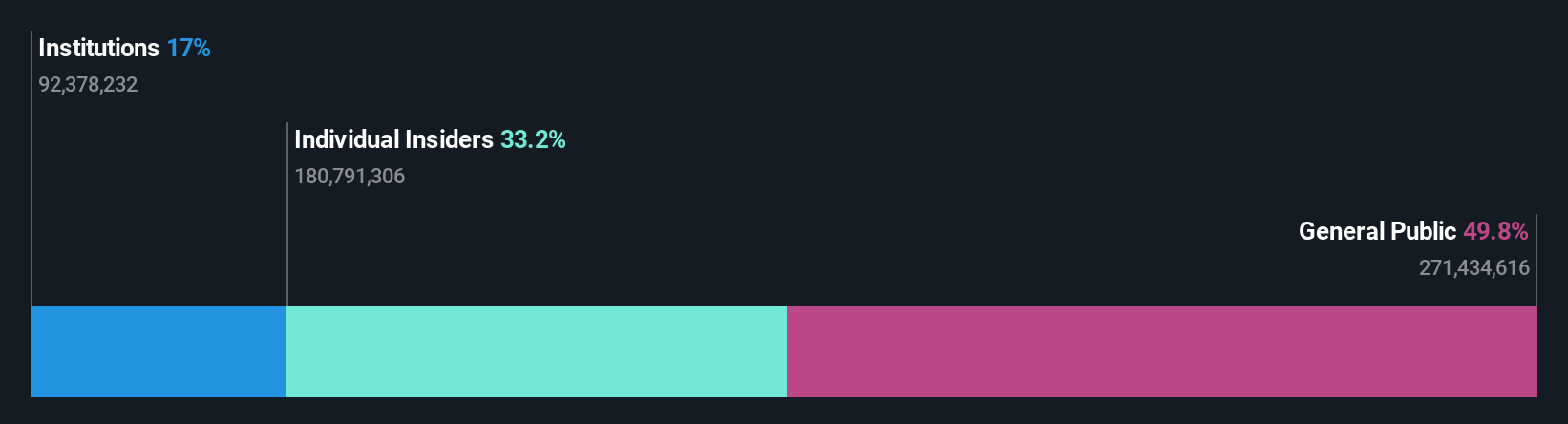

Insider Ownership: 33.2%

Shenzhen Megmeet Electrical shows robust revenue growth, with a recent increase to CNY 4.67 billion, although net income declined to CNY 173.59 million. Despite high volatility in share price and lower profit margins compared to last year, the company is expected to achieve significant earnings growth of 46.23% annually over the next three years, outpacing the Chinese market average. Revenue is also projected to grow at a strong pace of 23.6% per year.

- Unlock comprehensive insights into our analysis of Shenzhen Megmeet Electrical stock in this growth report.

- Our valuation report here indicates Shenzhen Megmeet Electrical may be overvalued.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. operates in the machinery and electronics sector, with a market cap of CN¥31.32 billion.

Operations: The company's revenue is derived from three main segments: Precision Parts (CN¥500.95 million), Micro Transmission System (CN¥1.05 billion), and Precision Molds and Other Products (CN¥114.69 million).

Insider Ownership: 18.2%

Shenzhen Zhaowei Machinery & Electronics demonstrates solid growth potential, with recent revenue rising to CNY 786.57 million and net income reaching CNY 113.27 million for the half year ended June 2025. The company is poised for annual revenue growth of 25.1%, surpassing the Chinese market average, though its forecasted earnings growth of 22.9% lags behind market expectations. Despite no recent insider trading data, high-quality earnings remain a key strength for this firm in Asia's competitive landscape.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Zhaowei Machinery & Electronics.

- Our comprehensive valuation report raises the possibility that Shenzhen Zhaowei Machinery & Electronics is priced higher than what may be justified by its financials.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in China, with a market cap of CN¥27.22 billion.

Operations: The company generates revenue primarily from Optical Communication Components, totaling CN¥1.69 billion.

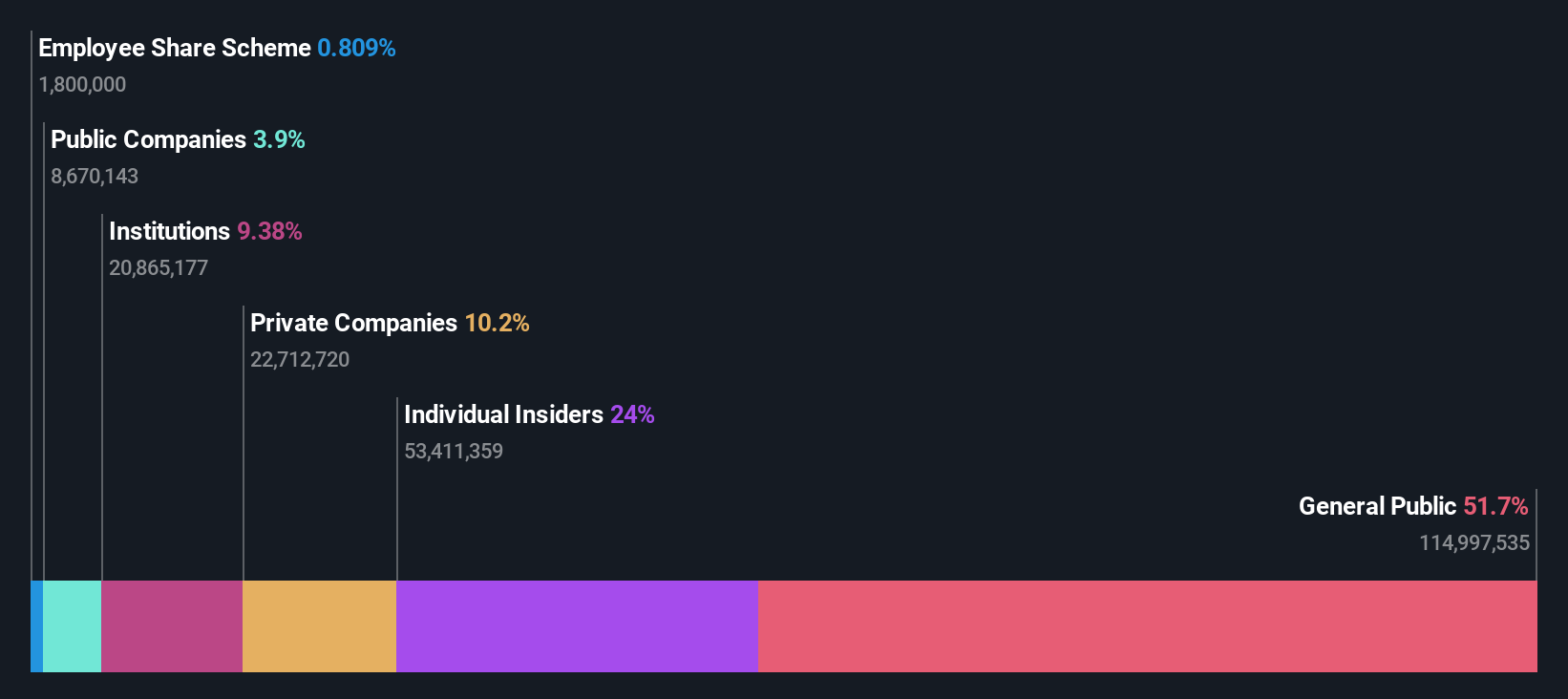

Insider Ownership: 23.5%

T&S Communications Ltd. showcases strong growth potential, with recent half-year revenue climbing to CNY 828.48 million and net income reaching CNY 173.36 million, reflecting robust earnings growth of 117.9% over the past year. Forecasts indicate annual profit growth of 45%, outpacing the Chinese market average, while its price-to-earnings ratio remains competitive within the industry. Despite a volatile share price and an unstable dividend track record, insider ownership aligns interests with shareholders' long-term goals.

- Navigate through the intricacies of T&S CommunicationsLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of T&S CommunicationsLtd shares in the market.

Seize The Opportunity

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 623 companies by clicking here.

- Curious About Other Options? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if T&S CommunicationsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300570

T&S CommunicationsLtd

Develops, manufactures, and sells fiber optics communication products in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives