- Sweden

- /

- Healthtech

- /

- OM:SECT B

3 Growth Companies That Insiders Are Betting On

Reviewed by Simply Wall St

In a week marked by record highs across major U.S. indices and geopolitical developments influencing market sentiment, investors are keenly observing the movements of growth companies with significant insider ownership. As markets continue to navigate through domestic policy shifts and global economic uncertainties, stocks with high insider stakes can offer insights into potential confidence in long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 43.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 116.0% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Here we highlight a subset of our preferred stocks from the screener.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

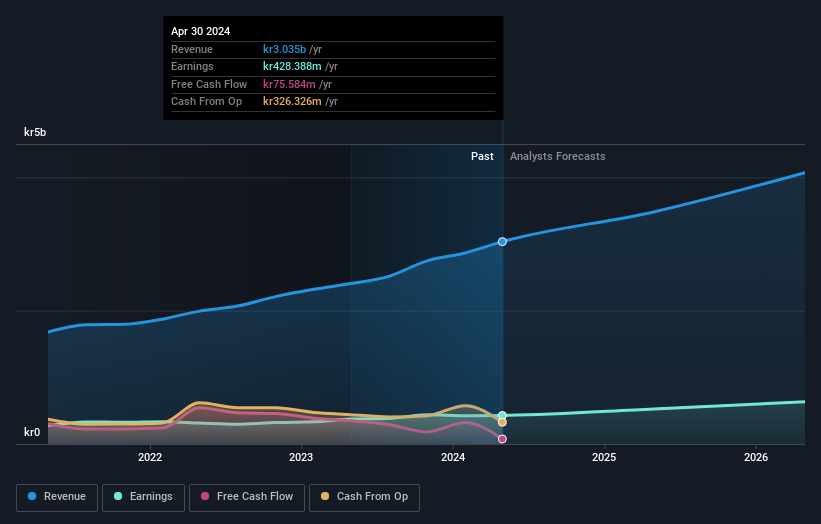

Overview: Sectra AB (publ) offers solutions in medical IT and cybersecurity across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK54.85 billion.

Operations: The company's revenue is primarily derived from Imaging IT Solutions, which accounts for SEK2.67 billion, followed by Secure Communications at SEK388.55 million and Business Innovation at SEK90.77 million.

Insider Ownership: 30.3%

Sectra's earnings grew by 17% last year, with future revenue growth forecast at 14.7% annually, outpacing the Swedish market. Although insider buying hasn't been substantial recently, Sectra's strategic contracts with healthcare providers like AZ Sint-Lucas Gent and UZ Leuven highlight its robust enterprise imaging solutions. These agreements enhance diagnostic efficiency and patient care while supporting Sectra's scalable business model. Recent financials show increased sales of SEK 736.75 million for Q1 2024, reflecting strong operational performance.

- Dive into the specifics of Sectra here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Sectra's current price could be inflated.

Kingdee International Software Group (SEHK:268)

Simply Wall St Growth Rating: ★★★★☆☆

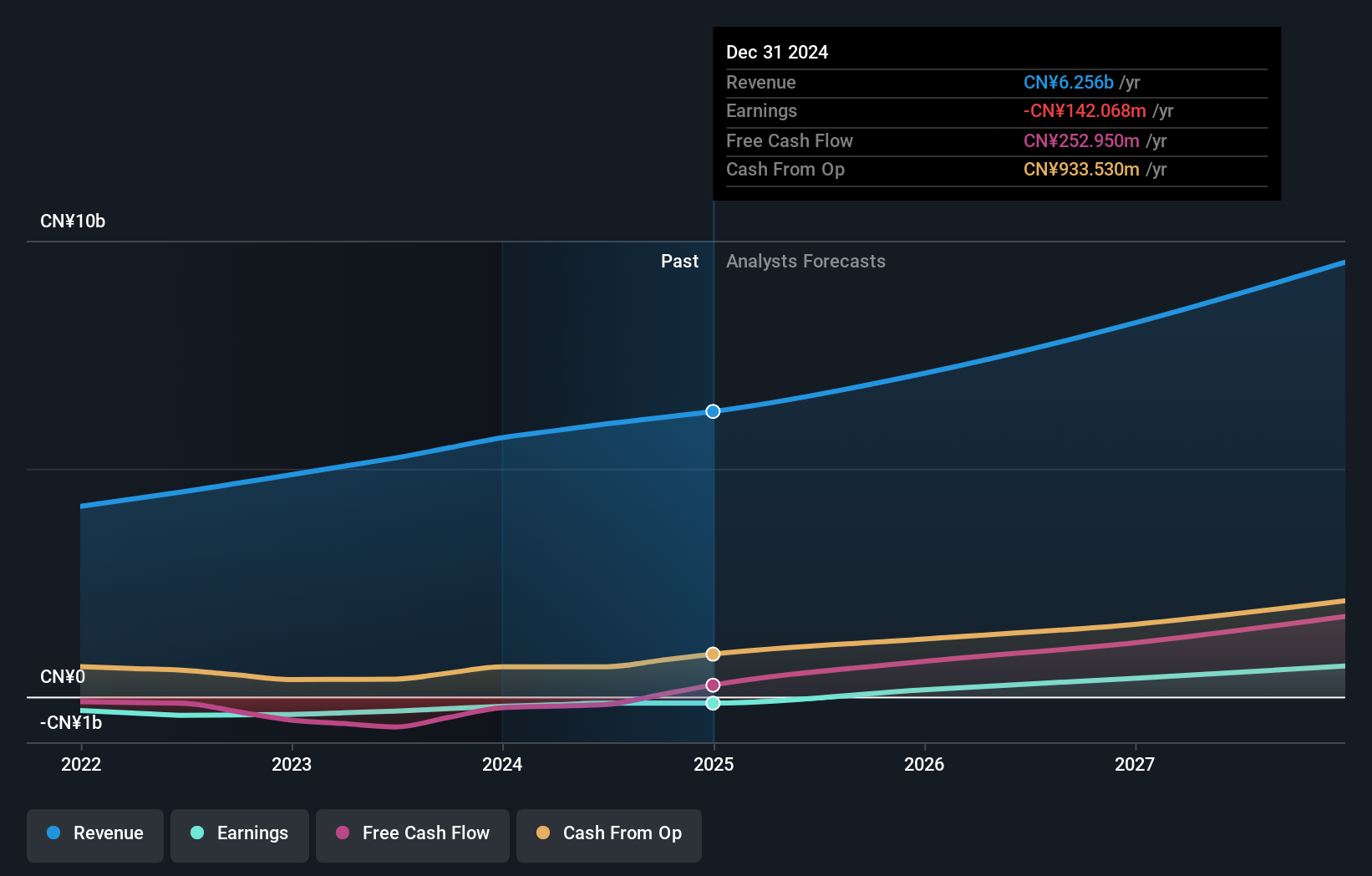

Overview: Kingdee International Software Group Company Limited is an investment holding company involved in the enterprise resource planning business, with a market cap of HK$31.11 billion.

Operations: The company generates revenue from its Cloud Service Business, which contributes CN¥4.86 billion, and its ERP Business and Others segment, which brings in CN¥1.13 billion.

Insider Ownership: 19.9%

Kingdee International Software Group is expected to achieve profitability within three years, with revenue projected to grow at 14.1% annually, outpacing the Hong Kong market. Despite recent shareholder dilution and low forecasted return on equity of 3.8%, the stock trades significantly below its estimated fair value, suggesting potential upside for investors focused on growth companies with substantial insider ownership.

- Take a closer look at Kingdee International Software Group's potential here in our earnings growth report.

- Our expertly prepared valuation report Kingdee International Software Group implies its share price may be lower than expected.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

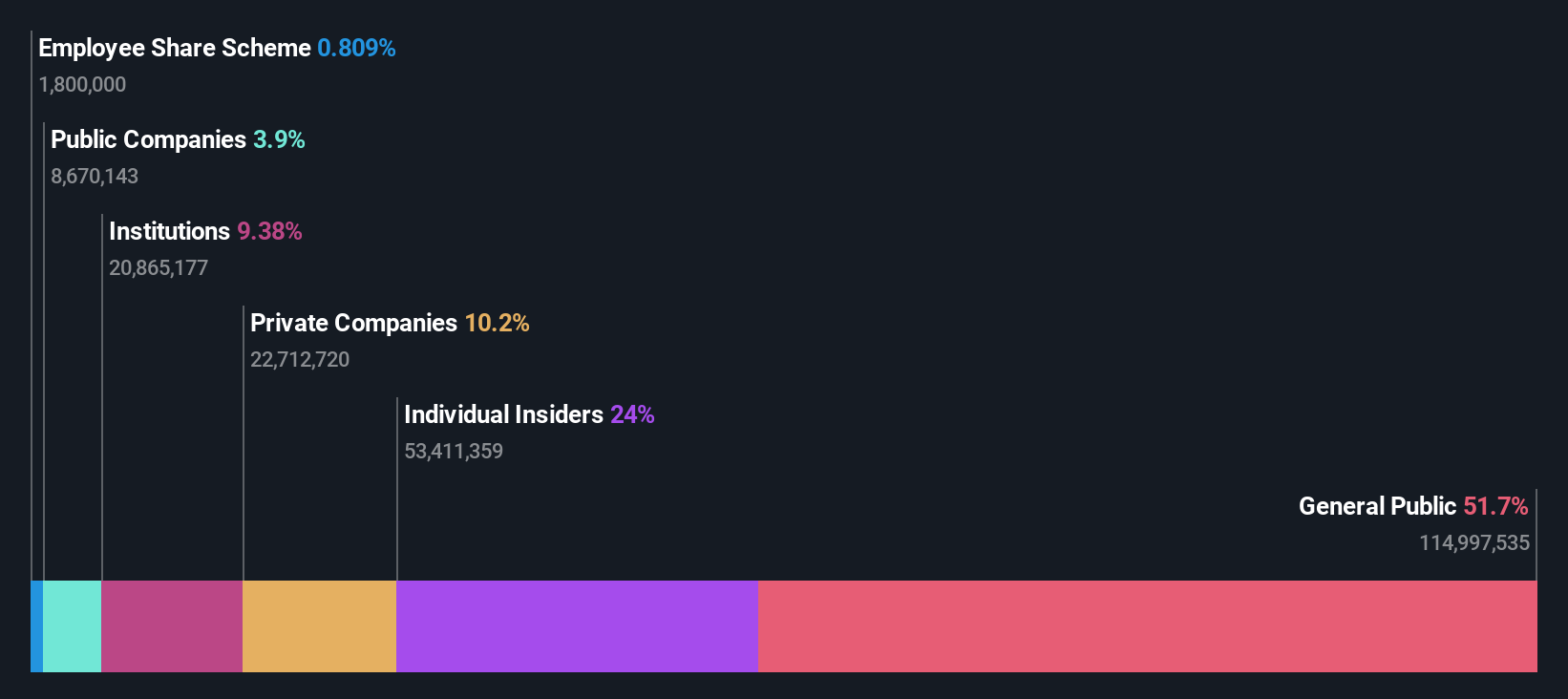

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in the People's Republic of China, with a market cap of CN¥15.49 billion.

Operations: The company's revenue primarily comes from Optical Communication Components, amounting to CN¥1.17 billion.

Insider Ownership: 24.9%

T&S Communications Ltd. demonstrates strong growth potential, with earnings projected to increase by 44.7% annually, surpassing the CN market's growth rate. Revenue is also expected to grow significantly at 38.3% per year. Recent earnings reports show a substantial rise in sales and net income for the first nine months of 2024, indicating robust performance despite a volatile share price and an unsustainable dividend yield of 0.72%.

- Click to explore a detailed breakdown of our findings in T&S CommunicationsLtd's earnings growth report.

- According our valuation report, there's an indication that T&S CommunicationsLtd's share price might be on the expensive side.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1516 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Sectra, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives