- China

- /

- Electronic Equipment and Components

- /

- SZSE:300546

We're Not Worried About Shenzhen Emperor Technology's (SZSE:300546) Cash Burn

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Shenzhen Emperor Technology (SZSE:300546) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

When Might Shenzhen Emperor Technology Run Out Of Money?

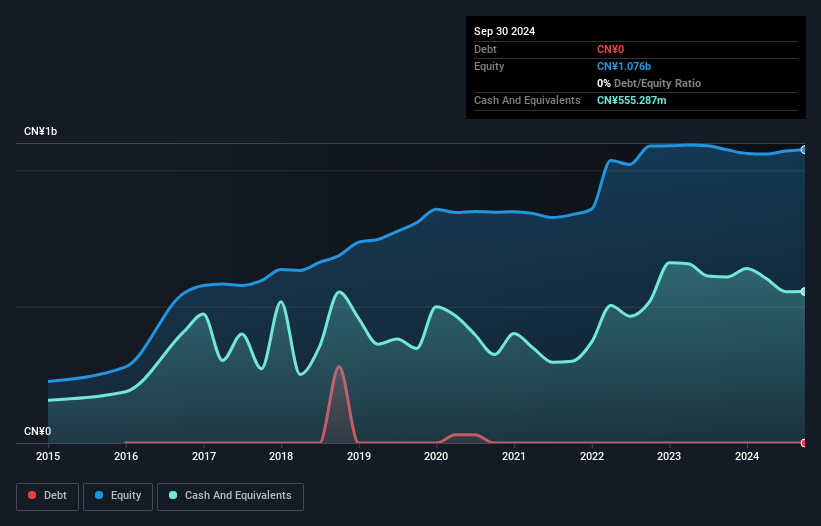

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Shenzhen Emperor Technology last reported its September 2024 balance sheet in October 2024, it had zero debt and cash worth CN¥555m. Importantly, its cash burn was CN¥32m over the trailing twelve months. So it had a very long cash runway of many years from September 2024. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

See our latest analysis for Shenzhen Emperor Technology

Is Shenzhen Emperor Technology's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Shenzhen Emperor Technology actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 11%. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Shenzhen Emperor Technology has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Shenzhen Emperor Technology To Raise More Cash For Growth?

Since its revenue growth is moving in the wrong direction, Shenzhen Emperor Technology shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CN¥3.4b, Shenzhen Emperor Technology's CN¥32m in cash burn equates to about 0.9% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Shenzhen Emperor Technology's Cash Burn?

As you can probably tell by now, we're not too worried about Shenzhen Emperor Technology's cash burn. For example, we think its cash runway suggests that the company is on a good path. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Shenzhen Emperor Technology has 2 warning signs (and 1 which is significant) we think you should know about.

Of course Shenzhen Emperor Technology may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300546

Shenzhen Emperor Technology

Operates as an identity products and solutions provider in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.