- China

- /

- Electronic Equipment and Components

- /

- SZSE:300515

There May Be Reason For Hope In Hunan Sundy Science and Technology's (SZSE:300515) Disappointing Earnings

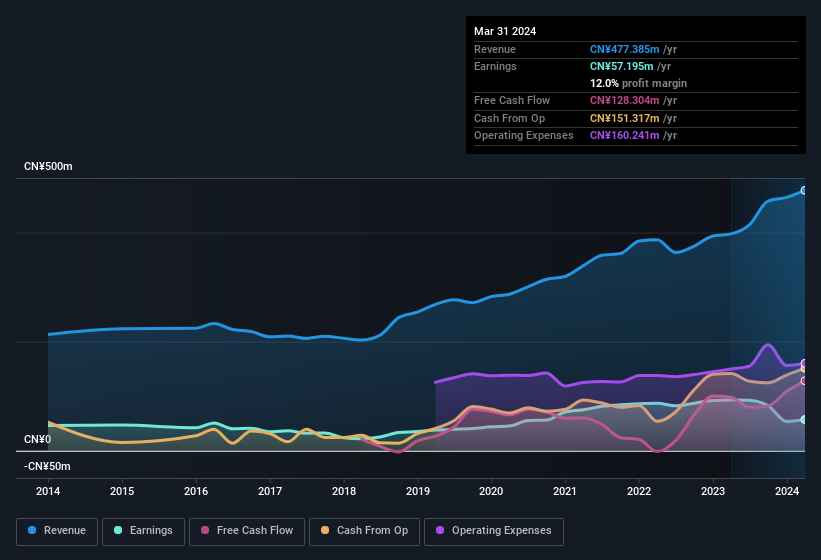

The market was pleased with the recent earnings report from Hunan Sundy Science and Technology Co., Ltd. (SZSE:300515), despite the profit numbers being soft. We think that investors might be looking at some positive factors beyond the earnings numbers.

Check out our latest analysis for Hunan Sundy Science and Technology

A Closer Look At Hunan Sundy Science and Technology's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Hunan Sundy Science and Technology has an accrual ratio of -0.18 for the year to March 2024. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of CN¥128m, well over the CN¥57.2m it reported in profit. Hunan Sundy Science and Technology's free cash flow improved over the last year, which is generally good to see.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hunan Sundy Science and Technology.

Our Take On Hunan Sundy Science and Technology's Profit Performance

Happily for shareholders, Hunan Sundy Science and Technology produced plenty of free cash flow to back up its statutory profit numbers. Based on this observation, we consider it possible that Hunan Sundy Science and Technology's statutory profit actually understates its earnings potential! On the other hand, its EPS actually shrunk in the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that Hunan Sundy Science and Technology has 3 warning signs and it would be unwise to ignore these.

Today we've zoomed in on a single data point to better understand the nature of Hunan Sundy Science and Technology's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Sundy Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300515

Hunan Sundy Science and Technology

Supplies coal analysis solutions in the People’s Republic of China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026