- India

- /

- Hospitality

- /

- NSEI:CHALET

Spotlighting Chalet Hotels And 2 Other Leading Growth Companies With Insider Ownership

Reviewed by Simply Wall St

In a week marked by a busy earnings season and mixed economic signals, global markets saw major indexes finish mostly lower, with growth stocks lagging behind value shares. Despite these challenges, insider ownership in growth companies can often signal confidence from those closest to the business, making them an intriguing focus for investors in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Chalet Hotels (NSEI:CHALET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chalet Hotels Limited owns, develops, manages, and operates hotels and resorts in India with a market cap of ₹188.05 billion.

Operations: The company's revenue segments include hotels and resorts operations in India.

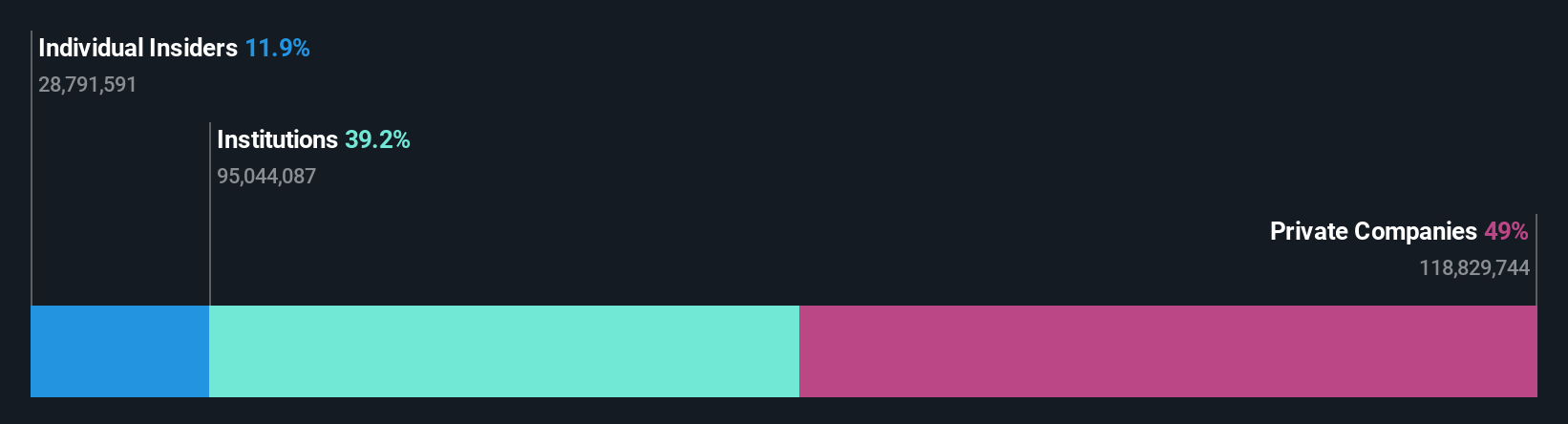

Insider Ownership: 11.8%

Revenue Growth Forecast: 18.4% p.a.

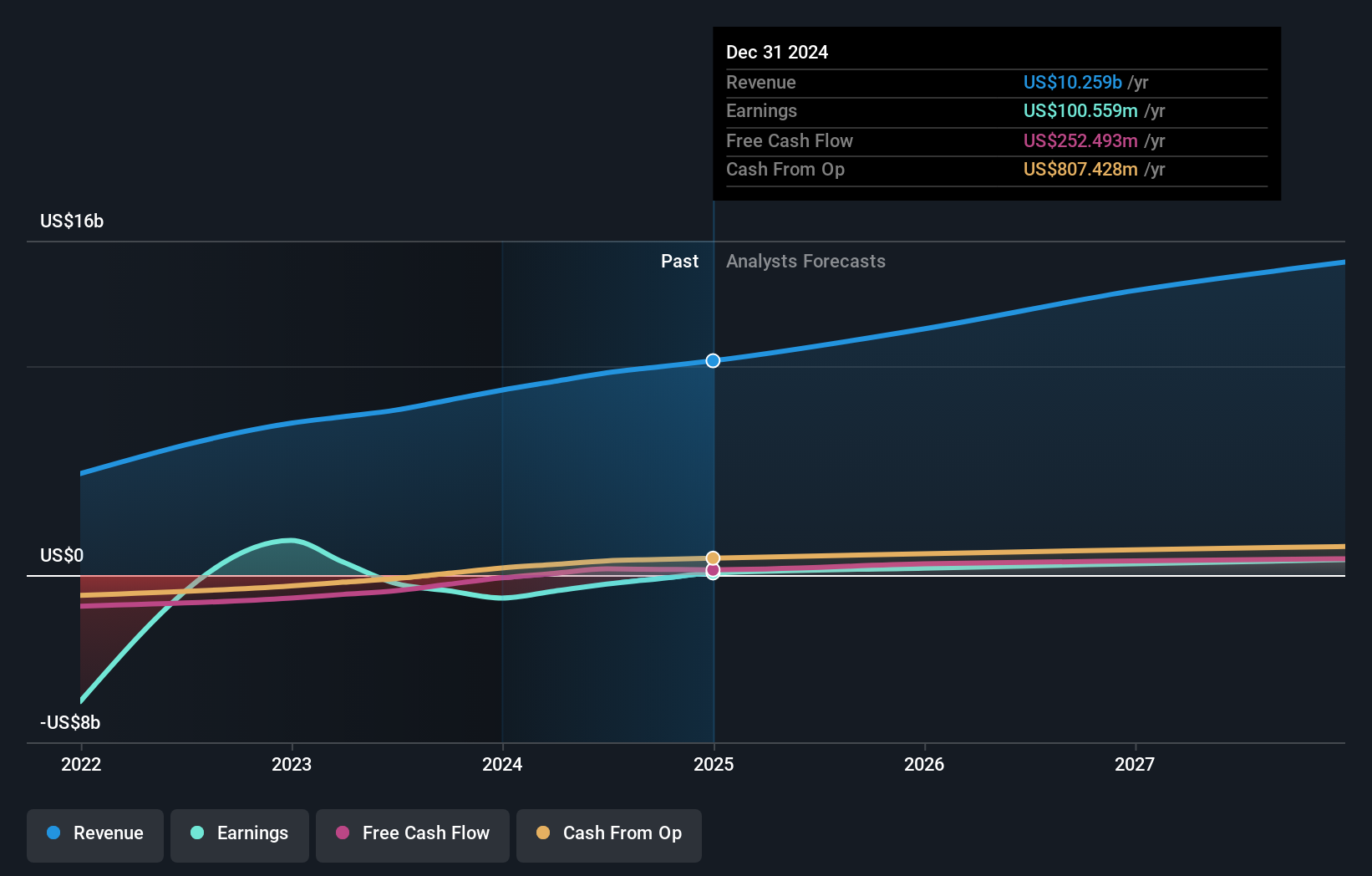

Chalet Hotels faces challenges with significant insider selling and declining profit margins, dropping from 20.6% to 4.9% over the past year. Despite high debt levels and recent financial losses, its earnings are forecast to grow substantially at 59.47% annually, outpacing the Indian market's growth rate of 17.9%. Recent amendments in company bylaws reflect adjustments for regulatory compliance, while ongoing GST disputes remain contestable without impacting operations significantly.

- Click here and access our complete growth analysis report to understand the dynamics of Chalet Hotels.

- The analysis detailed in our Chalet Hotels valuation report hints at an inflated share price compared to its estimated value.

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, an investment holding company with a market cap of HK$55.35 billion, provides express delivery services.

Operations: The company's revenue is primarily derived from its Transportation - Air Freight segment, which generated $9.68 billion.

Insider Ownership: 18.9%

Revenue Growth Forecast: 10.3% p.a.

J&T Global Express is positioned for substantial growth, with earnings projected to increase by 58.12% annually over the next three years. The company's revenue growth is expected to surpass the Hong Kong market average, and it plans to become profitable within this period. Recent share repurchase announcements aim to enhance shareholder value, while its addition to the Hang Seng China Enterprises Index underscores its market presence. However, its return on equity forecast remains relatively low at 15.3%.

- Get an in-depth perspective on J&T Global Express' performance by reading our analyst estimates report here.

- Our valuation report here indicates J&T Global Express may be undervalued.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market cap of CN¥94.60 billion.

Operations: The company's revenue segment primarily consists of Optical Communication Equipment, generating CN¥6.14 billion.

Insider Ownership: 24.9%

Revenue Growth Forecast: 41.4% p.a.

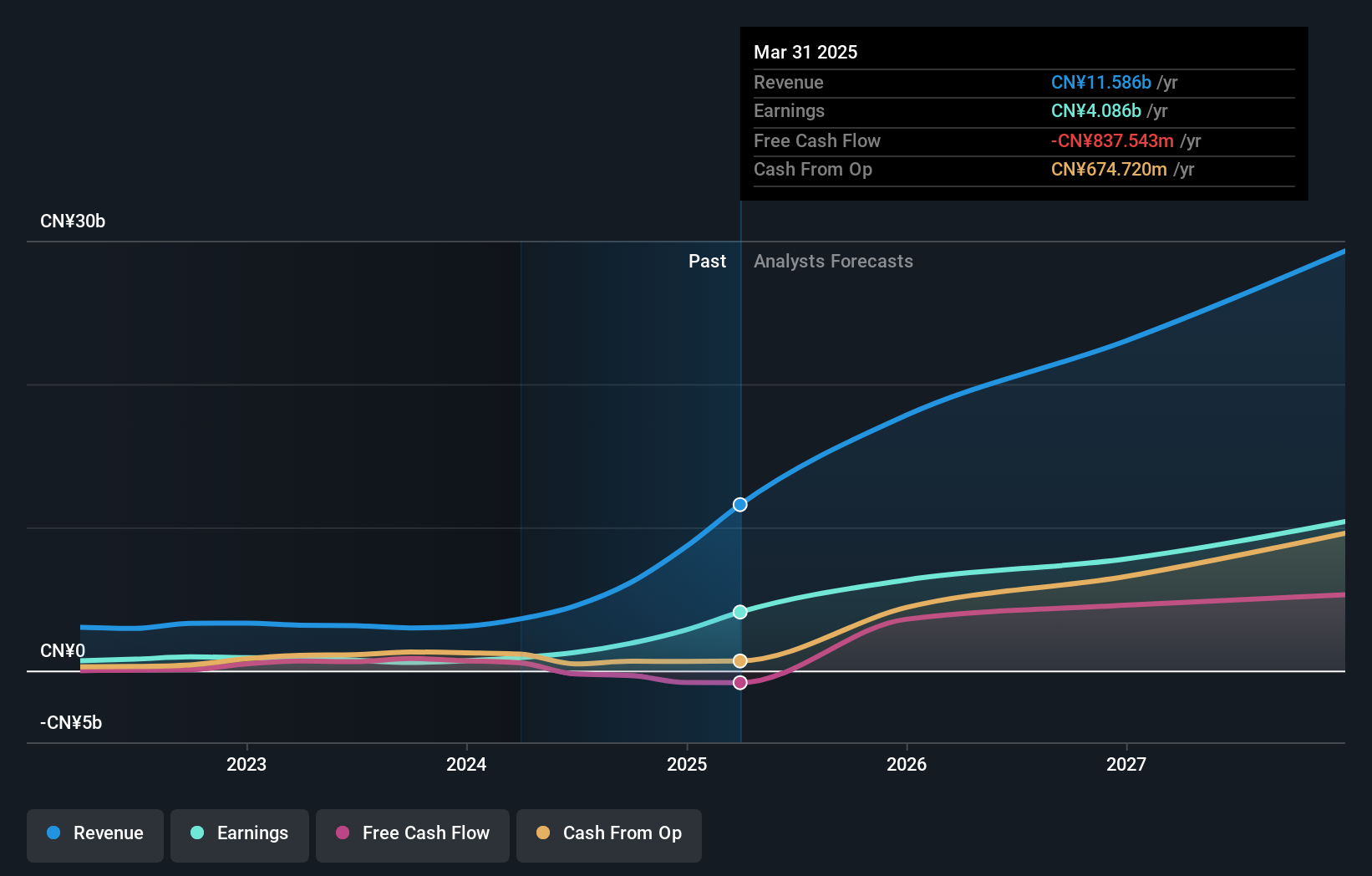

Eoptolink Technology demonstrates strong growth potential, with earnings forecasted to grow by 36.5% annually over the next three years, outpacing the Chinese market average. Revenue is expected to rise significantly at 41.4% per year. Recent financial results for the nine months ended September 2024 show sales of CNY 5.13 billion and net income of CNY 1.65 billion, reflecting substantial year-over-year increases despite a highly volatile share price recently.

- Delve into the full analysis future growth report here for a deeper understanding of Eoptolink Technology.

- Our valuation report unveils the possibility Eoptolink Technology's shares may be trading at a premium.

Taking Advantage

- Click this link to deep-dive into the 1528 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CHALET

Chalet Hotels

Owns, develops, manages, and operates hotels and resorts in India.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion