As global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, small-cap stocks have been underperforming their larger counterparts, with the Russell 2000 Index dipping into correction territory. In such volatile conditions, identifying high-growth tech stocks requires a focus on companies with strong fundamentals and innovative potential that can withstand economic pressures and leverage technological advancements for future growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★☆ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★☆☆

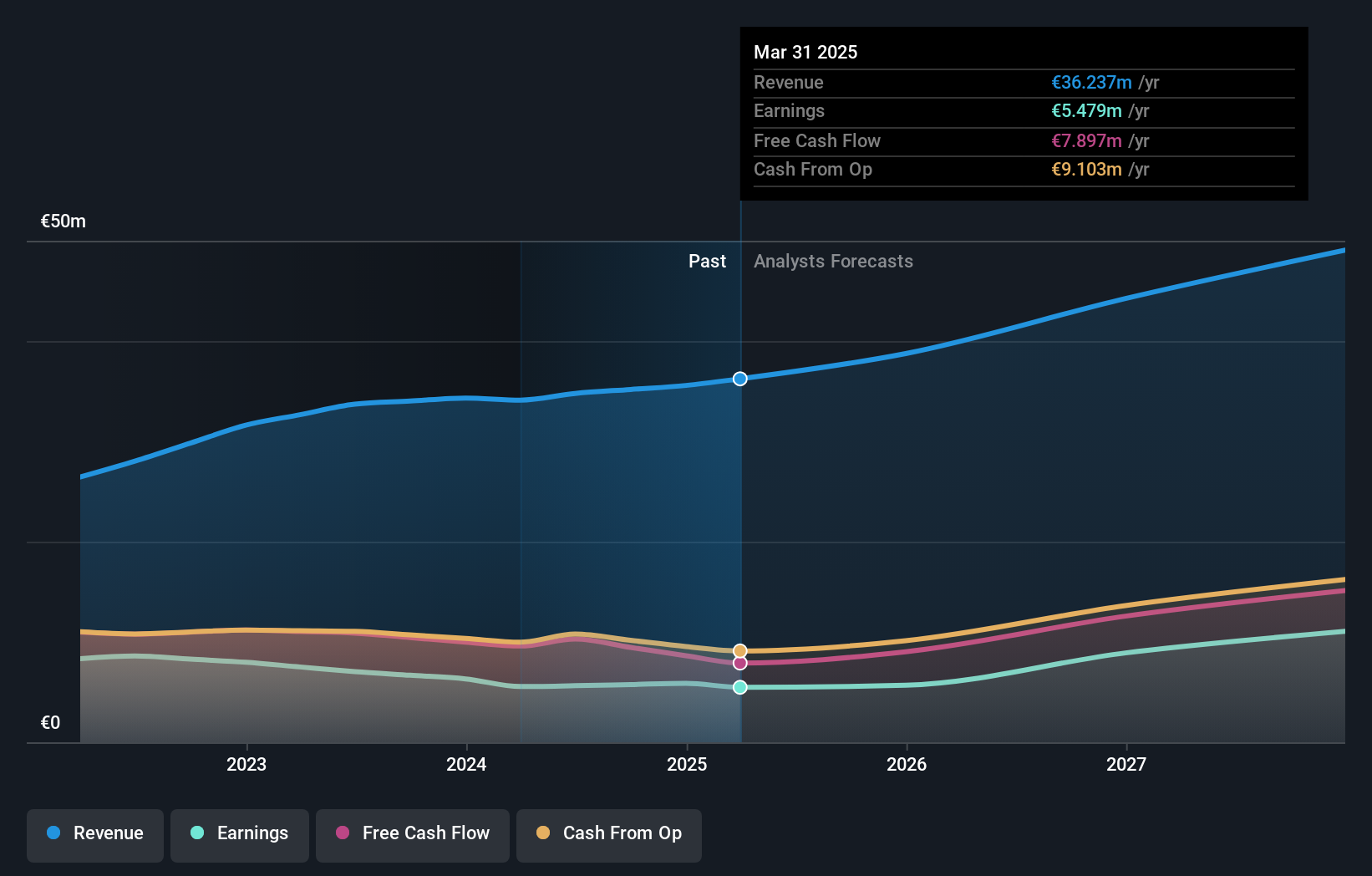

Overview: Admicom Oyj provides ERP cloud-based solutions in Finland and has a market capitalization of €243.84 million.

Operations: Admicom Oyj generates revenue primarily from its Software & Programming segment, which accounts for €34.78 million. The company focuses on delivering ERP cloud-based solutions within Finland.

Admicom Oyj, despite a challenging year with a 20% drop in earnings, is set to rebound with projected annual earnings growth of 19.2%. This figure notably surpasses the Finnish market's average of 14.3%. The company also stands out in revenue growth, expected at 9.5% annually, outpacing the local market's 2.9%. Recent strategic moves include an M&A call with Bauhub OÜ, signaling potential expansion and synergy benefits. With a robust forecast Return on Equity of 27% within three years and positive free cash flow, Admicom is navigating past its one-off losses totaling €3.8M last year towards promising fiscal health and industry competitiveness.

- Delve into the full analysis health report here for a deeper understanding of Admicom Oyj.

Understand Admicom Oyj's track record by examining our Past report.

Suzhou TFC Optical Communication (SZSE:300394)

Simply Wall St Growth Rating: ★★★★★★

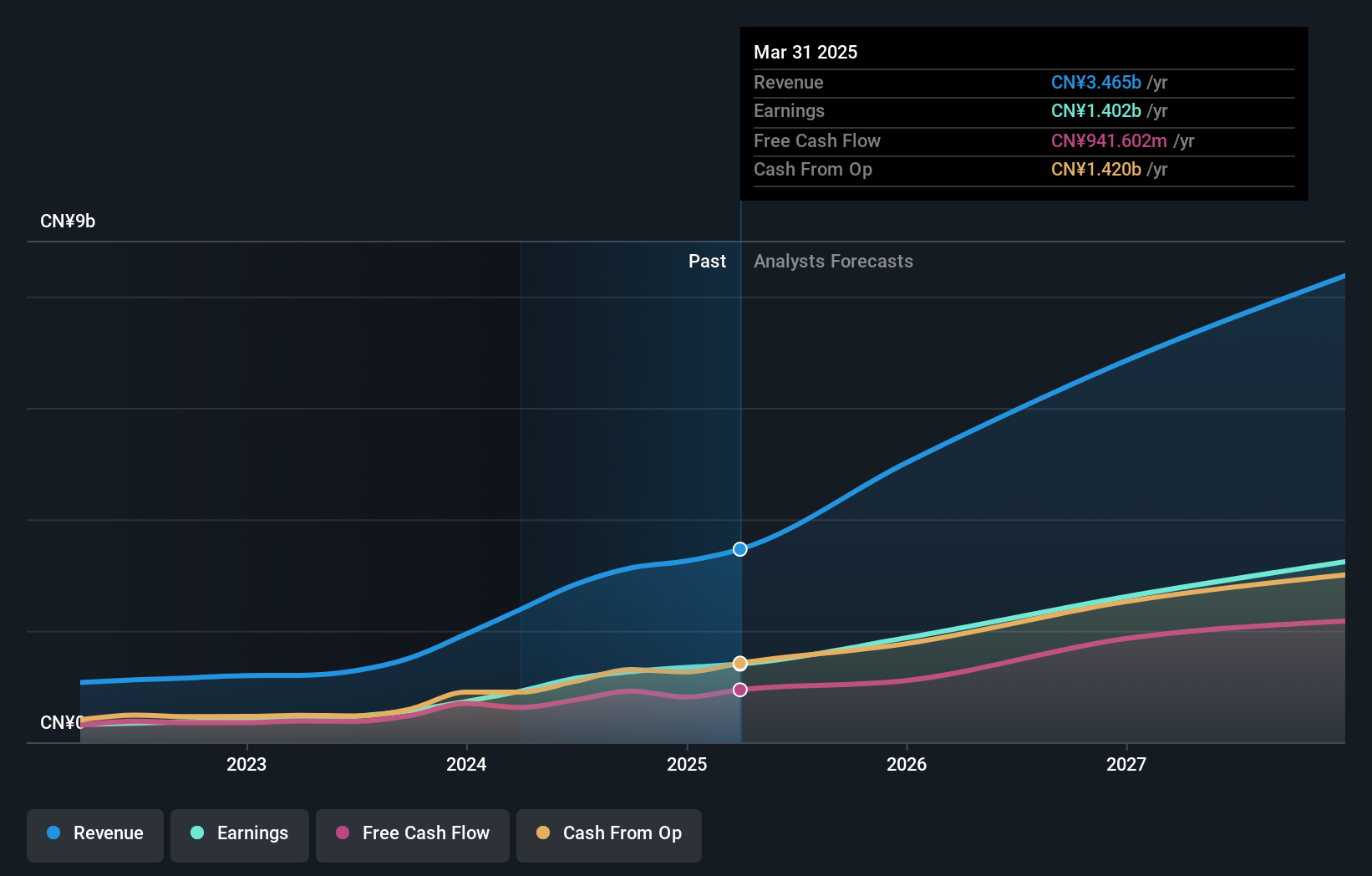

Overview: Suzhou TFC Optical Communication Co., Ltd. is a company focused on the development and production of optical communication devices, with a market capitalization of CN¥47.65 billion.

Operations: TFC Optical Communication generates revenue primarily from its optical communication device segment, which accounts for CN¥3.12 billion. The company focuses on the development and production of these devices, contributing significantly to its financial performance.

Suzhou TFC Optical Communication is navigating an impressive growth trajectory, with a notable 35% annual revenue increase and earnings surging by 33.8% each year, outpacing the Chinese market's growth rates of 13.9% and 25.3%, respectively. This performance is underpinned by significant investment in R&D, which not only fuels innovation but also positions the company well ahead of industry norms where recent developments include a strategic meeting to enhance cash management practices. Despite a highly volatile share price recently, Suzhou TFC’s aggressive focus on expanding its technological capabilities suggests robust future prospects in the competitive communications sector.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

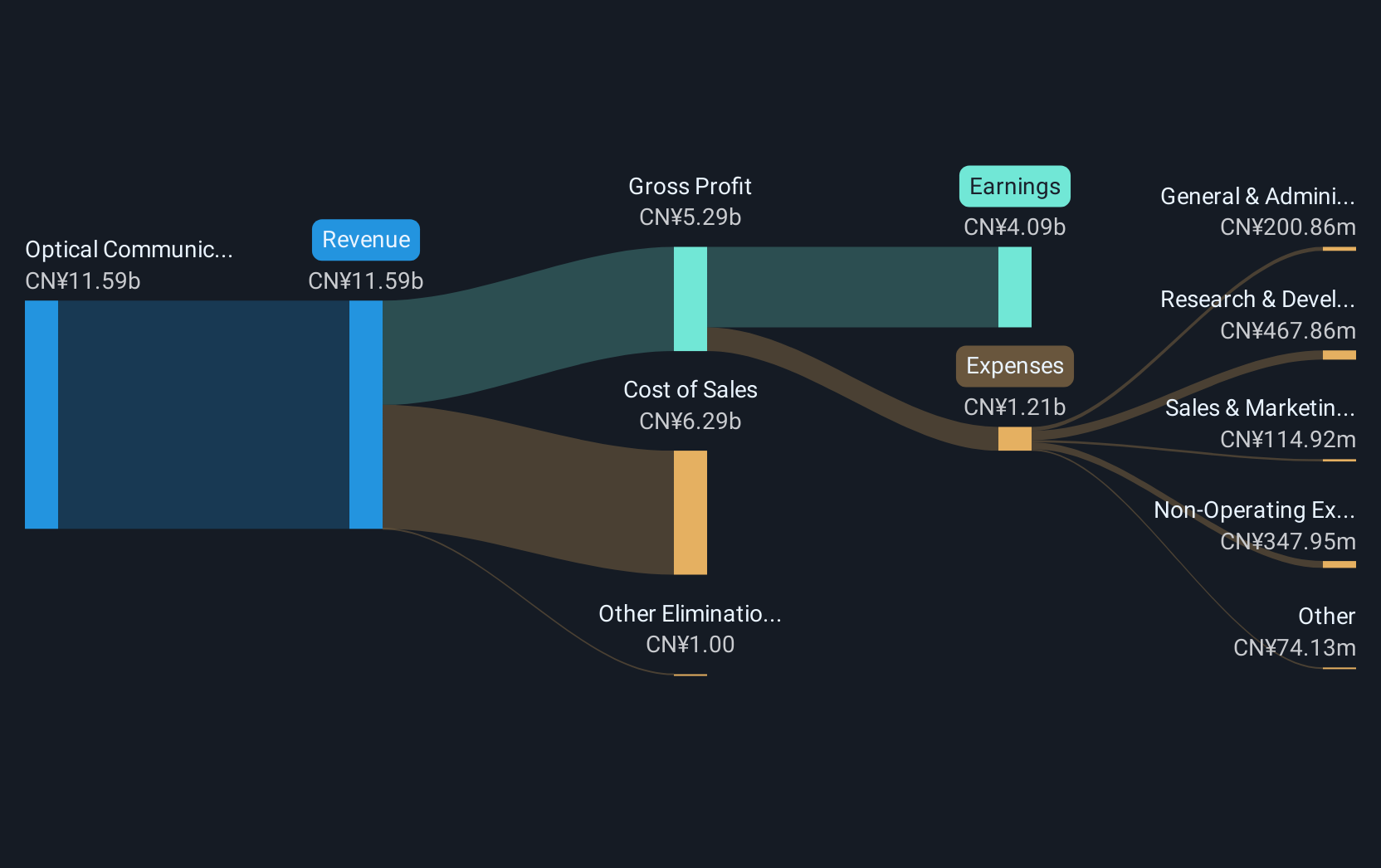

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market capitalization of CN¥79.17 billion.

Operations: Eoptolink Technology generates revenue primarily from its optical communication equipment segment, amounting to CN¥6.14 billion.

Eoptolink Technology has demonstrated a robust performance with revenue soaring to CNY 5.13 billion, marking an impressive increase from the previous year's CNY 2.09 billion. This surge is reflected in its net income, which escalated to CNY 1.65 billion, up from CNY 430 million, showcasing a substantial growth in profitability. The company's commitment to innovation is evident from its R&D investments, crucial for maintaining its competitive edge in the rapidly evolving tech landscape. With earnings projected to grow by 36.7% annually and revenue expected to rise by 41.7% per year, Eoptolink is poised for continued expansion in the high-stakes domain of technology and AI, further underscored by its recent strategic decisions during shareholder meetings aimed at refining operational efficiencies.

- Get an in-depth perspective on Eoptolink Technology's performance by reading our health report here.

Next Steps

- Explore the 1234 names from our High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ADMCM

Admicom Oyj

Engages in the cloud-based software and business process automation solutions in Finland.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)