- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets grapple with the uncertainty of new tariffs and mixed economic indicators, including a cooling U.S. labor market and fluctuating manufacturing activity, investors are closely monitoring how these factors impact high-growth tech stocks. In such a dynamic environment, identifying companies with robust earnings growth and resilience to geopolitical tensions can be crucial for those looking to navigate the evolving landscape of technology investments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market capitalization of HK$1.05 trillion.

Operations: Xiaomi Corporation generates revenue primarily through its smartphone segment, which contributes CN¥184.68 billion, and its IoT and lifestyle products, adding CN¥93.58 billion. The company also benefits from its Internet services segment, which brings in CN¥32.66 billion.

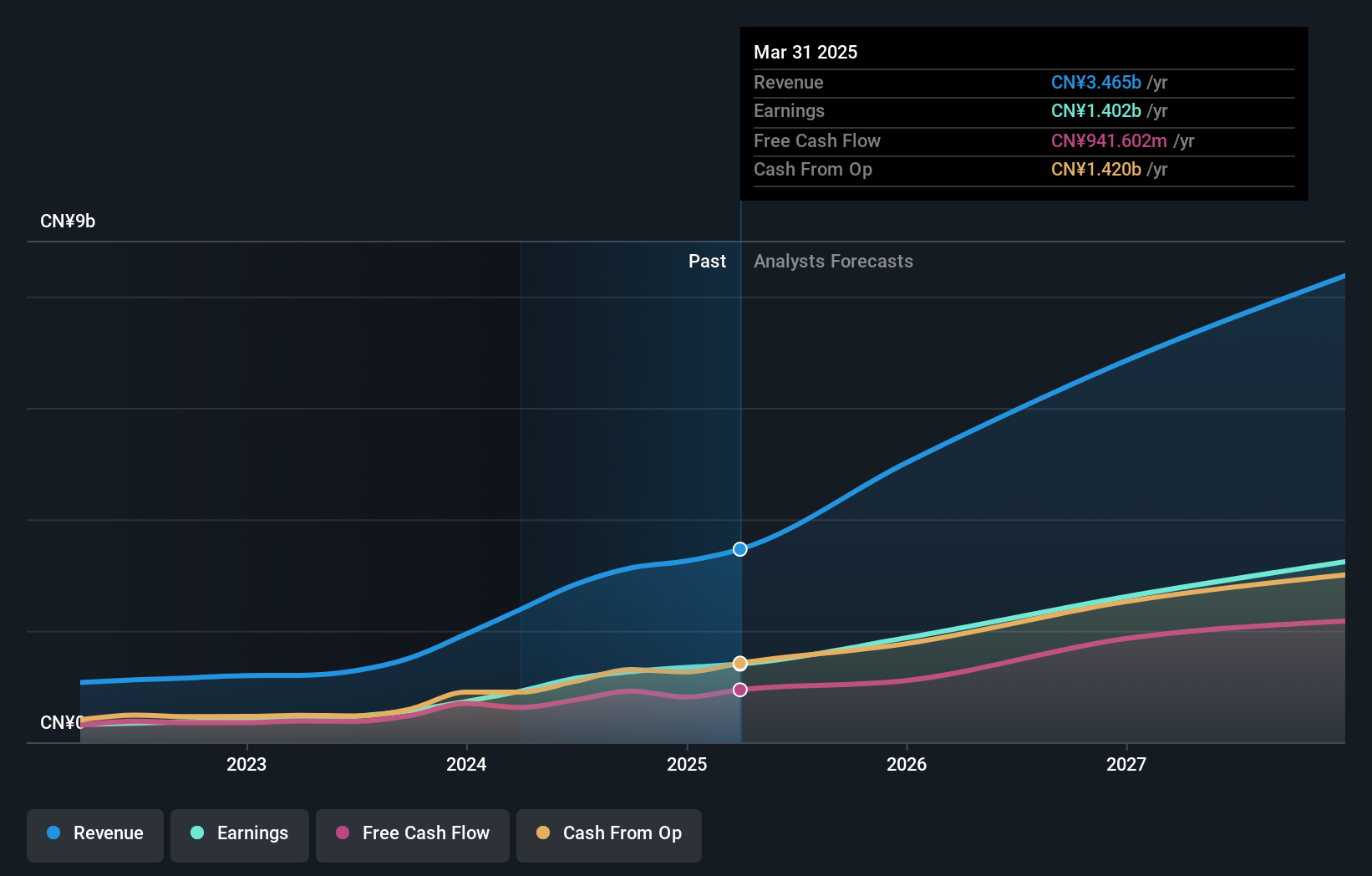

Xiaomi's recent financial performance underscores its robust position in the tech sector, with a notable 21.8% increase in earnings over the past year, outpacing the industry average of 21.5%. This growth is supported by a strong revenue surge of 14.6% annually, significantly above Hong Kong's market average of 7.8%. The company has also demonstrated its commitment to shareholder value through an aggressive share repurchase program, buying back shares worth HKD 1.35 billion since June last year. These strategic moves not only reflect Xiaomi’s solid market stance but also hint at its potential for sustained growth and innovation in high-demand tech segments.

Suzhou TFC Optical Communication (SZSE:300394)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou TFC Optical Communication Co., Ltd. is engaged in the production and sale of optical communication devices, with a market capitalization of CN¥50.32 billion.

Operations: TFC Optical Communication generates revenue primarily from the sale of optical communication devices, amounting to approximately CN¥3.12 billion. The company operates within the optical communication sector, focusing on device production and sales.

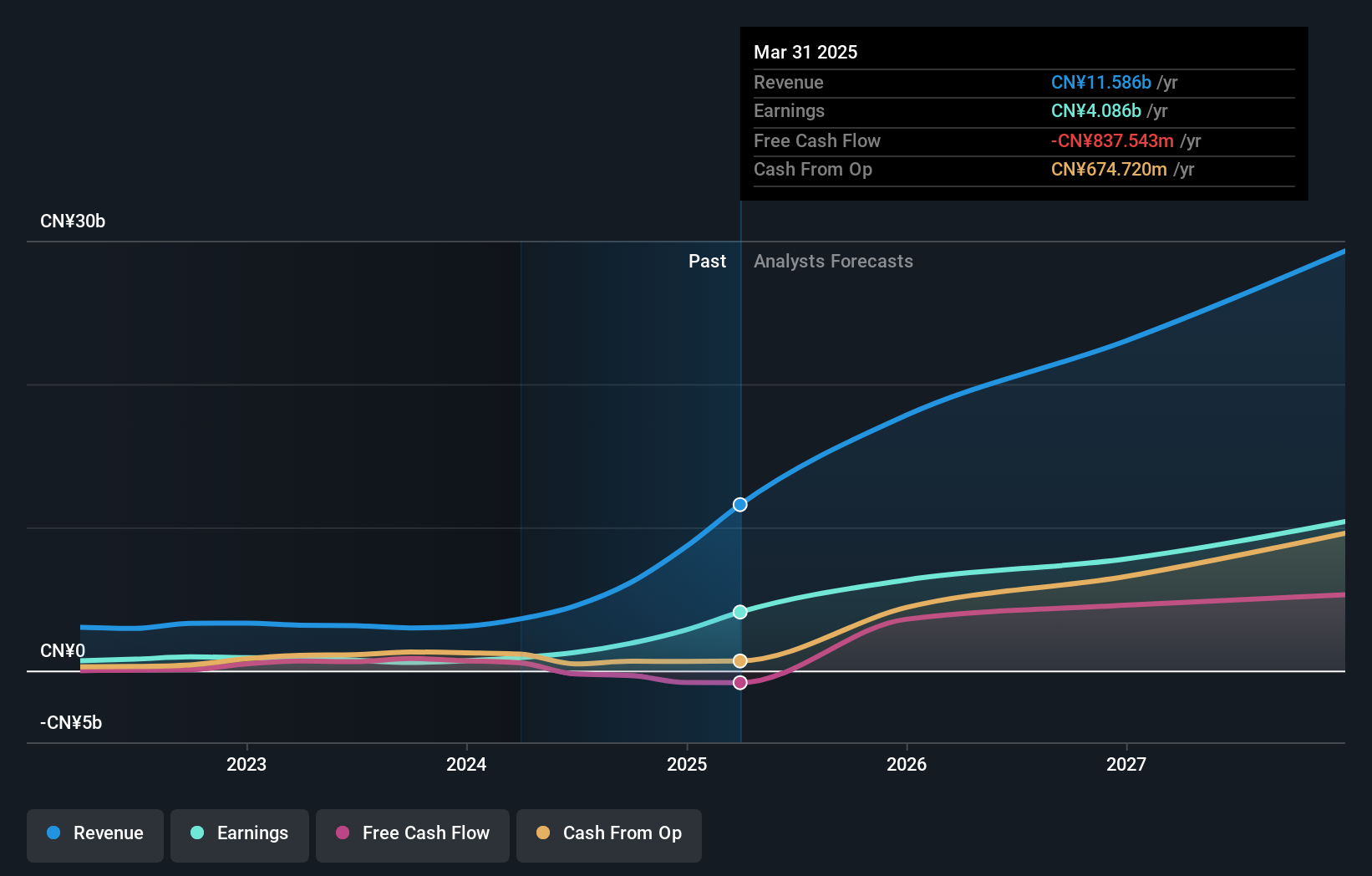

Suzhou TFC Optical Communication is making substantial strides in the tech sector, evidenced by a remarkable annual revenue growth of 35.1% and earnings expansion at 34%. This performance is bolstered by significant R&D investment, aligning with industry trends towards enhanced optical communication solutions. With earnings having surged by 124.3% over the past year, TFC's aggressive growth strategy outpaces both its industry and broader market expectations. These financial indicators, combined with a robust forecast that anticipates continued revenue acceleration above the market average of 13.5%, position Suzhou TFC as a dynamic entity within high-growth tech sectors, potentially shaping future innovations in optical communications.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market cap of CN¥78.33 billion.

Operations: Eoptolink focuses on optical communication equipment, generating revenue of CN¥6.14 billion from this segment. The company's operations span both domestic and international markets, emphasizing research and development in optical transceivers.

Eoptolink Technology is distinguishing itself in the tech landscape with an impressive annual revenue growth rate of 41.6% and earnings growth of 36.6%, both outpacing the broader Chinese market averages significantly. The company's commitment to innovation is evident from its substantial R&D spending, which has been pivotal in maintaining its competitive edge in a rapidly evolving industry. Despite challenges like a highly volatile share price over the past three months, Eoptolink’s strategic focus on advanced tech solutions continues to drive its financial performance forward, with expectations set for continued above-market growth rates and a promising return on equity forecast at 31.3% in three years' time.

Taking Advantage

- Investigate our full lineup of 1207 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives