- Hong Kong

- /

- Real Estate

- /

- SEHK:1209

3 Stocks That Might Be Undervalued In September 2024

Reviewed by Simply Wall St

As global markets rally to new highs following the Federal Reserve's first rate cut in over four years, investors are keenly observing opportunities that may arise from these shifting economic conditions. In this environment, identifying undervalued stocks can be particularly rewarding, as these equities often offer significant growth potential when market sentiment turns positive.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kotobuki Spirits (TSE:2222) | ¥1719.00 | ¥3434.73 | 50% |

| APR (KOSE:A278470) | ₩261000.00 | ₩521735.28 | 50% |

| Stella Chemifa (TSE:4109) | ¥4045.00 | ¥8083.91 | 50% |

| T'Way Air (KOSE:A091810) | ₩2850.00 | ₩5682.47 | 49.8% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$20.84 | MX$41.52 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$57.15 | US$114.15 | 49.9% |

| Enfusion (NYSE:ENFN) | US$9.58 | US$19.13 | 49.9% |

| Banca Sistema (BIT:BST) | €1.44 | €2.87 | 49.9% |

| Suzhou Oriental Semiconductor (SHSE:688261) | CN¥30.52 | CN¥60.78 | 49.8% |

| Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥8.43 | CN¥16.79 | 49.8% |

Let's explore several standout options from the results in the screener.

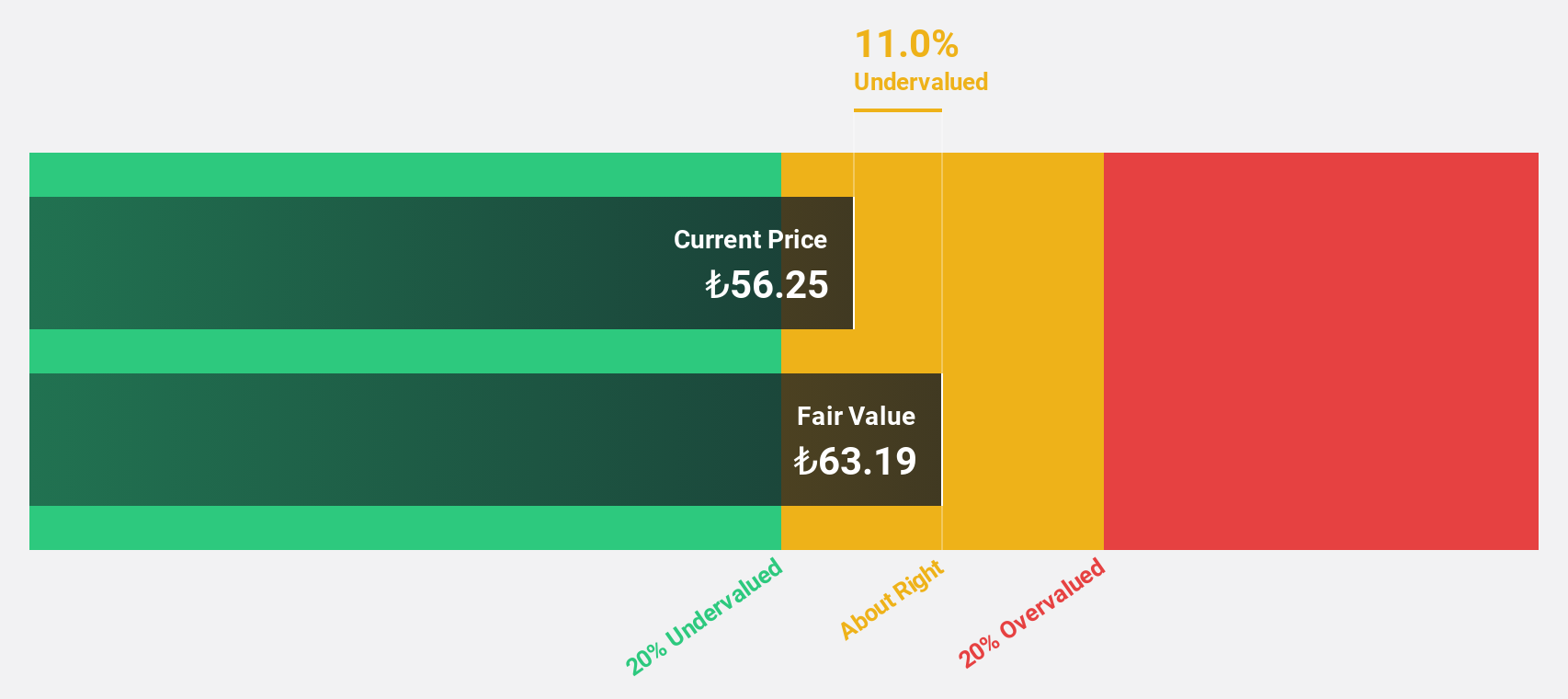

Akbank T.A.S (IBSE:AKBNK)

Overview: Akbank T.A.S., with a market cap of TRY332.02 billion, operates in Turkey and internationally, offering a range of banking products and services through its subsidiaries.

Operations: Akbank T.A.S. generates revenue primarily from Consumer Banking and Private Banking (TRY77.29 billion) and Commercial Banking, Corporate Banking, and SME Banking (TRY88.67 billion).

Estimated Discount To Fair Value: 14.2%

Akbank T.A.S. reported a decline in net income for Q2 and the first half of 2024, yet it remains undervalued based on cash flows. Trading at TRY63.85, below the estimated fair value of TRY74.42, analysts forecast earnings to grow significantly at 36.16% annually over the next three years, outpacing market growth expectations. Despite high non-performing loans (2.1%), Akbank's revenue is also expected to grow faster than the Turkish market at 34.5% per year.

- According our earnings growth report, there's an indication that Akbank T.A.S might be ready to expand.

- Click here to discover the nuances of Akbank T.A.S with our detailed financial health report.

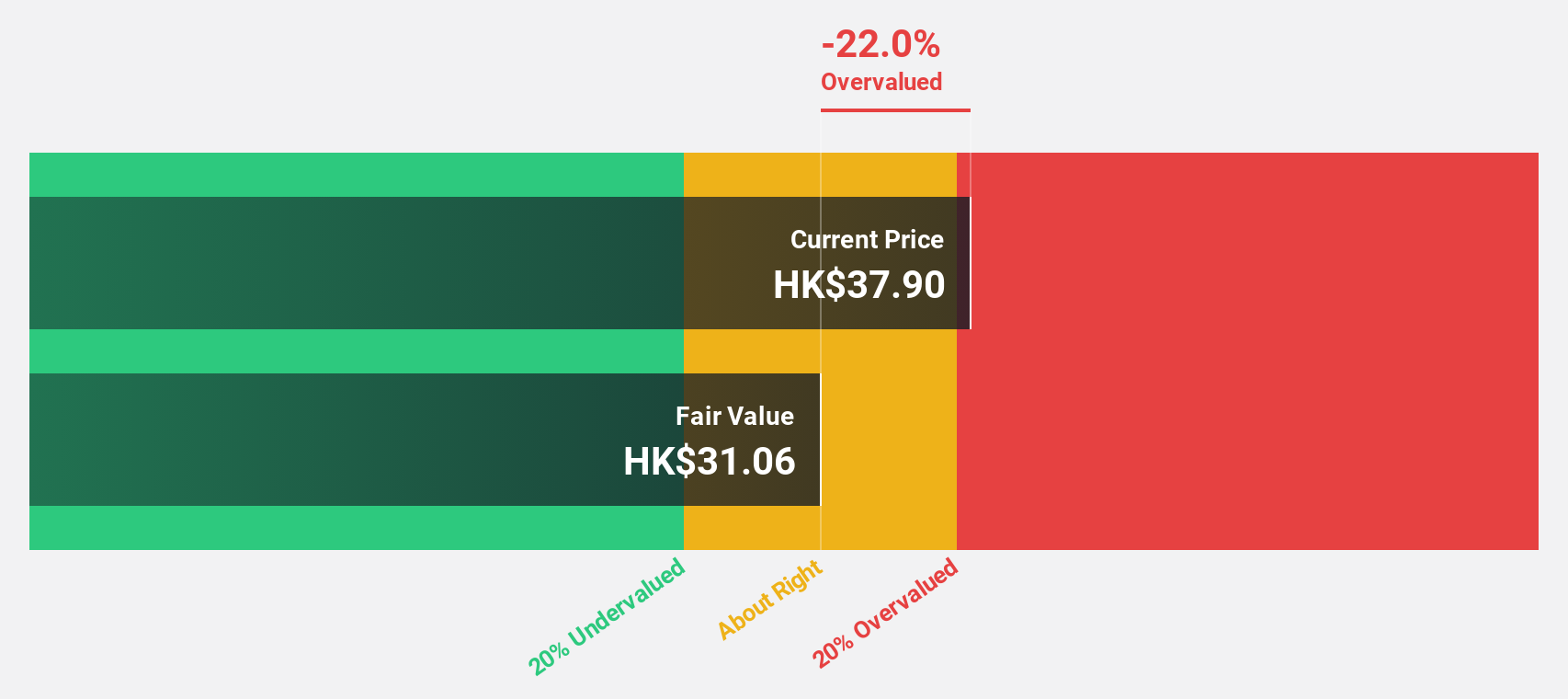

China Resources Mixc Lifestyle Services (SEHK:1209)

Overview: China Resources Mixc Lifestyle Services Limited (SEHK:1209) is an investment holding company that offers property management and commercial operational services in the People’s Republic of China, with a market cap of HK$61.74 billion.

Operations: The company's revenue segments are comprised of CN¥10.22 billion from the property management business and CN¥5.71 billion from the commercial management business.

Estimated Discount To Fair Value: 49.7%

China Resources Mixc Lifestyle Services is trading at HK$27.25, significantly below its estimated fair value of HK$54.19, suggesting it is undervalued based on cash flows. Recent earnings for the first half of 2024 showed a net income increase to CNY1.91 billion from CNY1.40 billion a year ago, with revenue rising to CNY7.96 billion from CNY6.79 billion. Analysts forecast earnings growth at 14.6% annually, outpacing the Hong Kong market's 11.6%.

- The growth report we've compiled suggests that China Resources Mixc Lifestyle Services' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of China Resources Mixc Lifestyle Services.

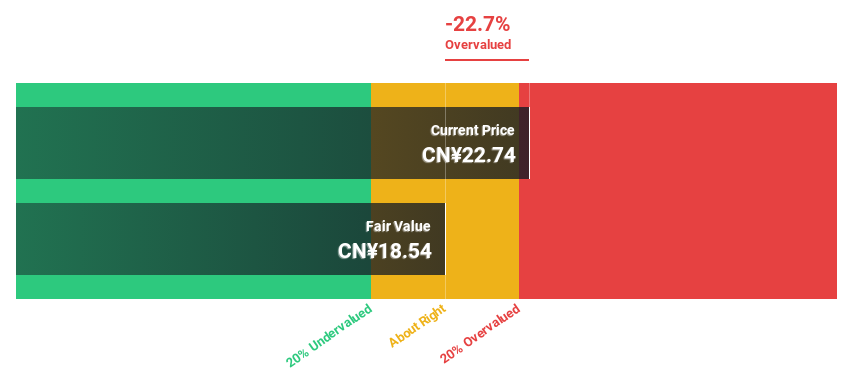

Lens Technology (SZSE:300433)

Overview: Lens Technology Co., Ltd. (SZSE:300433) engages in the production and sale of electronic components in China, with a market cap of CN¥79.35 billion.

Operations: Revenue from the production and sale of electronic components amounts to CN¥63.18 billion.

Estimated Discount To Fair Value: 11.9%

Lens Technology is trading at CN¥16.22, below its estimated fair value of CN¥18.41, indicating it is undervalued based on cash flows. Recent earnings for the half year ended June 30, 2024, showed revenue increased to CN¥28.87 billion from CN¥20.18 billion a year ago, with net income rising to CN¥861.26 million from CN¥554.29 million. Earnings are forecast to grow significantly at 23% annually over the next three years, outpacing the market's growth rate of 22%.

- Upon reviewing our latest growth report, Lens Technology's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Lens Technology.

Summing It All Up

- Click through to start exploring the rest of the 937 Undervalued Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1209

China Resources Mixc Lifestyle Services

An investment holding company, provides property management and commercial operational services in the People’s Republic of China.

Flawless balance sheet with solid track record.