CARsgen Therapeutics Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and a tepid economic growth outlook, investors are increasingly seeking opportunities in less conventional areas. Penny stocks, often overlooked due to their smaller size or newer status, can offer unique growth potential when supported by robust financials. In this context, we explore several promising penny stocks that combine solid fundamentals with the potential for significant upside in today's evolving market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.575 | MYR2.86B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.72 | MYR124.72M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.50 | £173.92M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.39 | CN¥2.15B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £459.28M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.28 | £323.7M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.36 | THB1.91B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.235 | £409.76M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CARsgen Therapeutics Holdings (SEHK:2171)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CARsgen Therapeutics Holdings Limited is an investment holding company focused on discovering, developing, and commercializing CAR-T cell therapies for treating hematological malignancies and solid tumors in China and the United States, with a market cap of HK$2.46 billion.

Operations: No revenue segments have been reported for the company.

Market Cap: HK$2.46B

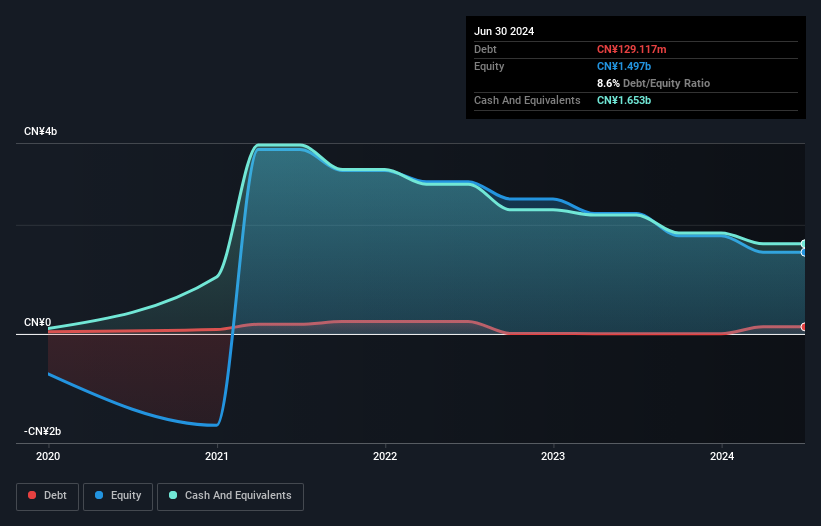

CARsgen Therapeutics Holdings, with a market cap of HK$2.46 billion, is pre-revenue, reporting sales of just CN¥6 million for the first half of 2024. Despite its unprofitability and negative return on equity (-46.41%), the company has reduced losses over the past five years by 28.9% annually. Its cash runway extends beyond two years, supported by short-term assets exceeding both short- and long-term liabilities significantly. Recent positive FDA inspection outcomes and ongoing clinical trials in CAR-T therapies highlight potential growth avenues, though high share price volatility remains a concern for investors considering penny stocks like CARsgen.

- Jump into the full analysis health report here for a deeper understanding of CARsgen Therapeutics Holdings.

- Examine CARsgen Therapeutics Holdings' earnings growth report to understand how analysts expect it to perform.

Carry Wealth Holdings (SEHK:643)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Carry Wealth Holdings Limited is an investment holding company that manufactures, trades, and markets garment products for various brands globally, with a market capitalization of HK$391.43 million.

Operations: The company's revenue is derived from its Garment Manufacturing and Trading segment, which generated HK$546.68 million.

Market Cap: HK$391.43M

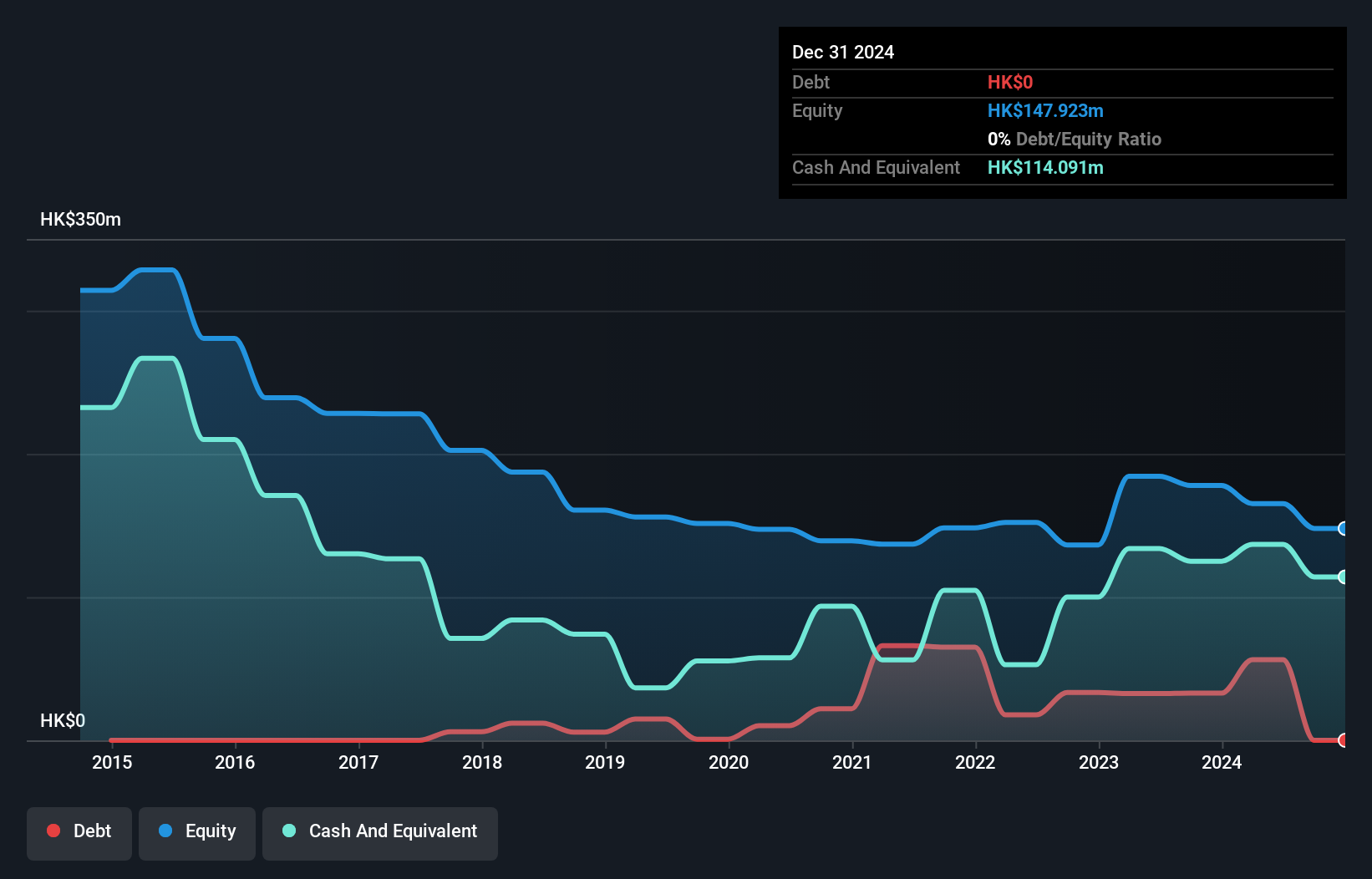

Carry Wealth Holdings, with a market cap of HK$391.43 million, reported HK$280.84 million in sales for the first half of 2024 but remains unprofitable with a net loss of HK$12.17 million, influenced by rising interest expenses and reduced gross profit margins due to operational challenges at its Heshan factory. Despite increased revenue from the previous year, volatility persists as short-term assets cover liabilities well and cash reserves exceed debt levels. The company has not diluted shareholders recently and maintains a cash runway exceeding three years, though management's inexperience may pose strategic risks for investors considering such stocks.

- Unlock comprehensive insights into our analysis of Carry Wealth Holdings stock in this financial health report.

- Gain insights into Carry Wealth Holdings' past trends and performance with our report on the company's historical track record.

Sichuan Etrol Technologies (SZSE:300370)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Etrol Technologies Co., Ltd. manufactures and sells smart industry, automation, and oil and gas products and solutions in China, with a market cap of CN¥4.74 billion.

Operations: The company generates revenue from its operations in China, amounting to CN¥466.33 million.

Market Cap: CN¥4.74B

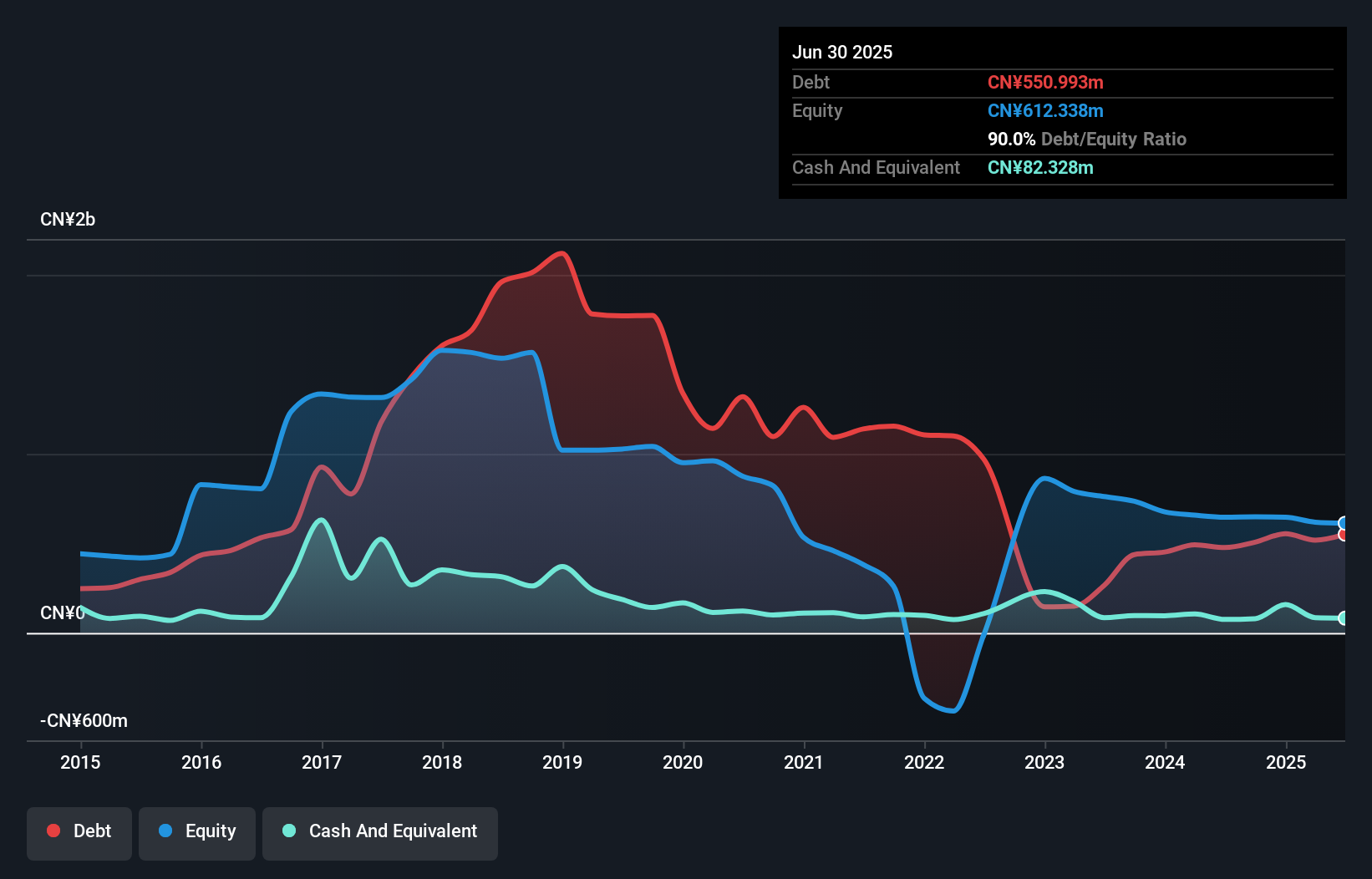

Sichuan Etrol Technologies, with a market cap of CN¥4.74 billion, reported a net loss reduction from CN¥119.91 million to CN¥34.57 million over the past nine months, indicating progress despite remaining unprofitable. The company's revenue for this period was CN¥234.52 million, slightly down from the previous year, reflecting challenges in maintaining growth momentum in its core markets. Short-term assets of CN¥501.1 million comfortably cover both short and long-term liabilities; however, high net debt to equity at 65.9% remains a concern alongside the company's limited cash runway if free cash flow continues declining at historical rates.

- Dive into the specifics of Sichuan Etrol Technologies here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Sichuan Etrol Technologies' track record.

Where To Now?

- Take a closer look at our Penny Stocks list of 5,815 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2171

CARsgen Therapeutics Holdings

An investment holding company, engages in discovering, developing, and commercializing chimeric antigen receptor T (CAR-T) cell therapies for the treatment of hematological malignancies and solid tumors in China and the United States.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives