As the year draws to a close, global markets have experienced a mix of gains and setbacks, with U.S. stocks showing moderate increases despite declining consumer confidence and mixed economic indicators. In this context, finding value in smaller or newer companies can be appealing to investors seeking opportunities beyond large-cap stocks. Penny stocks—though an older term—remain relevant as they often represent companies with potential for growth when backed by solid financials. This article highlights three penny stocks that demonstrate financial strength and may offer long-term potential for those interested in exploring smaller-cap investments.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.65M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.39M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,827 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Shengjing Bank (SEHK:2066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shengjing Bank Co., Ltd., along with its subsidiaries, provides banking products and related financial services in Mainland China, with a market capitalization of approximately HK$10.56 billion.

Operations: Shengjing Bank generates its revenue primarily from three segments: Corporate Banking (CN¥4.24 billion), Retail Banking (CN¥1.55 billion), and Treasury Business (CN¥1.01 billion).

Market Cap: HK$10.56B

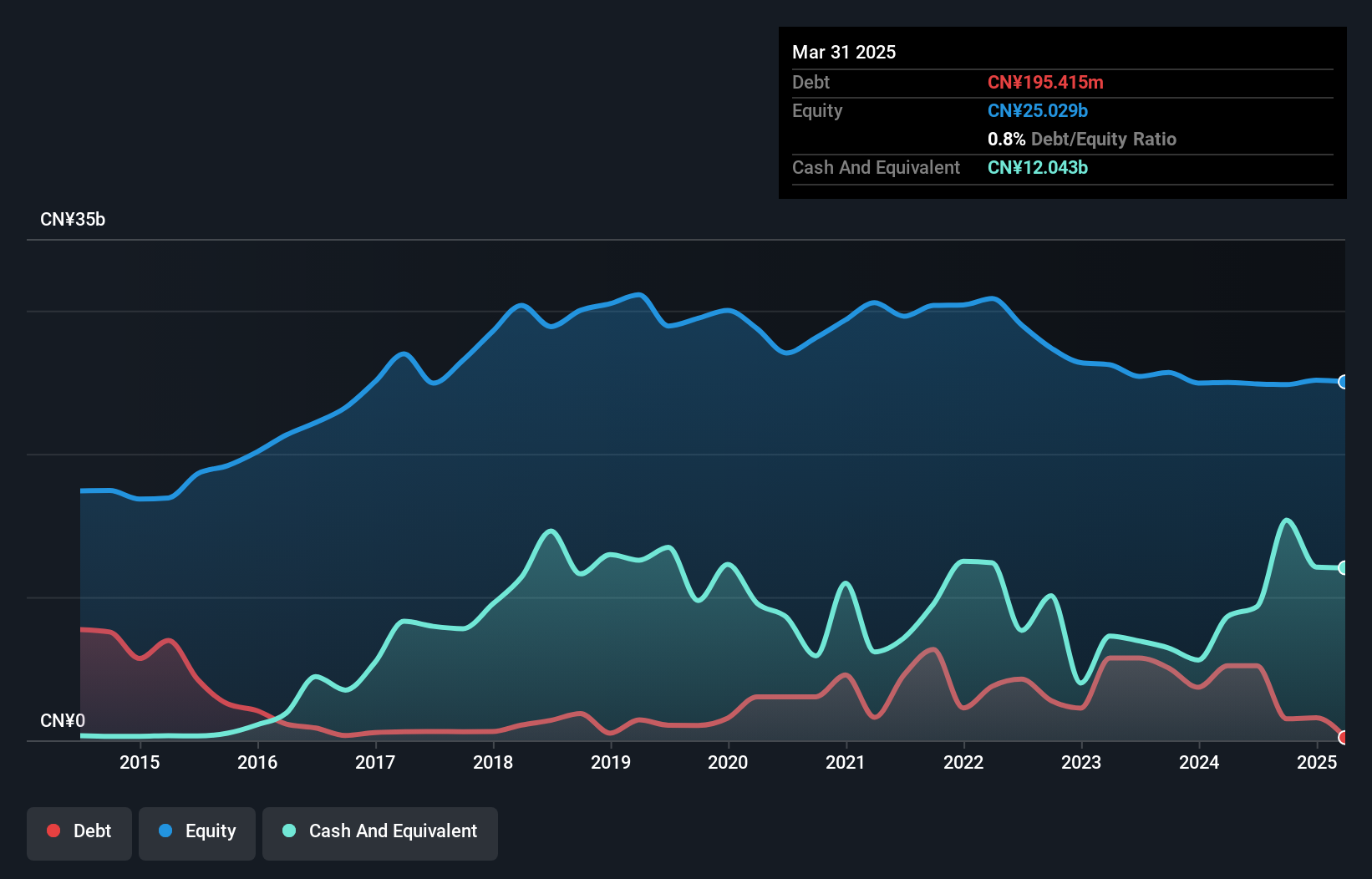

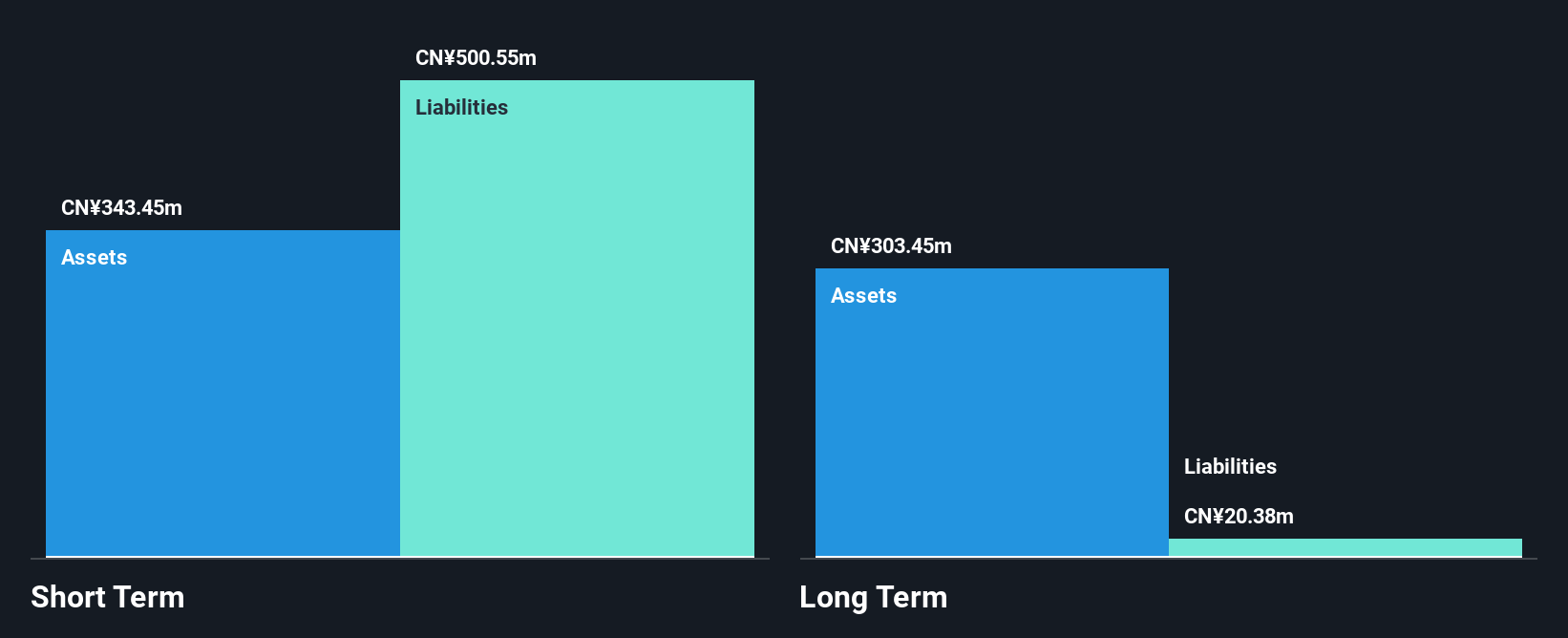

Shengjing Bank, with a market capitalization of HK$10.56 billion, primarily generates revenue from Corporate Banking (CN¥4.24 billion), Retail Banking (CN¥1.55 billion), and Treasury Business (CN¥1.01 billion). Despite its experienced management team, the bank faces challenges such as high bad loan levels (2.7%) and declining earnings over the past five years (-54.7% annually). The Return on Equity is low at 0.7%, and recent earnings growth has been negative (-26.2%). However, it maintains an appropriate Loans to Deposits ratio of 55% and sufficient allowance for bad loans at 158%.

- Navigate through the intricacies of Shengjing Bank with our comprehensive balance sheet health report here.

- Evaluate Shengjing Bank's historical performance by accessing our past performance report.

Sinopec Shanghai Petrochemical (SEHK:338)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinopec Shanghai Petrochemical Company Limited, along with its subsidiaries, engages in the manufacturing and sale of petroleum and chemical products in China, with a market cap of HK$27.91 billion.

Operations: Sinopec Shanghai Petrochemical Company Limited has not reported any specific revenue segments.

Market Cap: HK$27.91B

Sinopec Shanghai Petrochemical Company Limited, with a market cap of HK$27.91 billion, recently announced an Entrustment Contract valued at RMB 84.80 million for personnel secondment services with Baling New Materials. The company has reported significant production and sales figures across various petroleum and chemical products, although it remains unprofitable with a negative Return on Equity of -2.63%. Despite this, Sinopec's debt is well covered by operating cash flow (804.9%), and its short-term assets exceed both short-term and long-term liabilities, indicating strong liquidity management amidst its financial challenges.

- Take a closer look at Sinopec Shanghai Petrochemical's potential here in our financial health report.

- Assess Sinopec Shanghai Petrochemical's future earnings estimates with our detailed growth reports.

Hebei Huijin Group (SZSE:300368)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hebei Huijin Group Co., Ltd. operates in manufacturing, information system integration, information data centers, and supply chain business both in China and internationally, with a market cap of CN¥2.37 billion.

Operations: Hebei Huijin Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.37B

Hebei Huijin Group Co., Ltd. faces challenges with declining earnings, reporting a net loss of CN¥29.11 million for the first nine months of 2024, despite reducing losses from the previous year. Its short-term assets (CN¥567.2 million) do not cover its short-term liabilities (CN¥593 million), but they exceed long-term liabilities, indicating some financial resilience. The company has a satisfactory net debt to equity ratio of 27.9%, and its cash runway is sufficient for over a year based on current free cash flow trends. Recent board changes reflect ongoing corporate adjustments amidst these operational hurdles.

- Click here to discover the nuances of Hebei Huijin Group with our detailed analytical financial health report.

- Learn about Hebei Huijin Group's historical performance here.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 5,824 Penny Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2066

Shengjing Bank

Offers banking products and related financial services in Mainland China.

Excellent balance sheet very low.