As global markets navigate a mix of rising stock indices and declining consumer confidence, investors are closely monitoring economic signals that could impact their portfolios. With major U.S. indexes experiencing moderate gains despite fluctuating consumer sentiment, dividend stocks present an appealing option for those seeking stability and income in uncertain times. A good dividend stock often combines consistent payouts with solid financial health, offering potential resilience amid varying market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.08% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

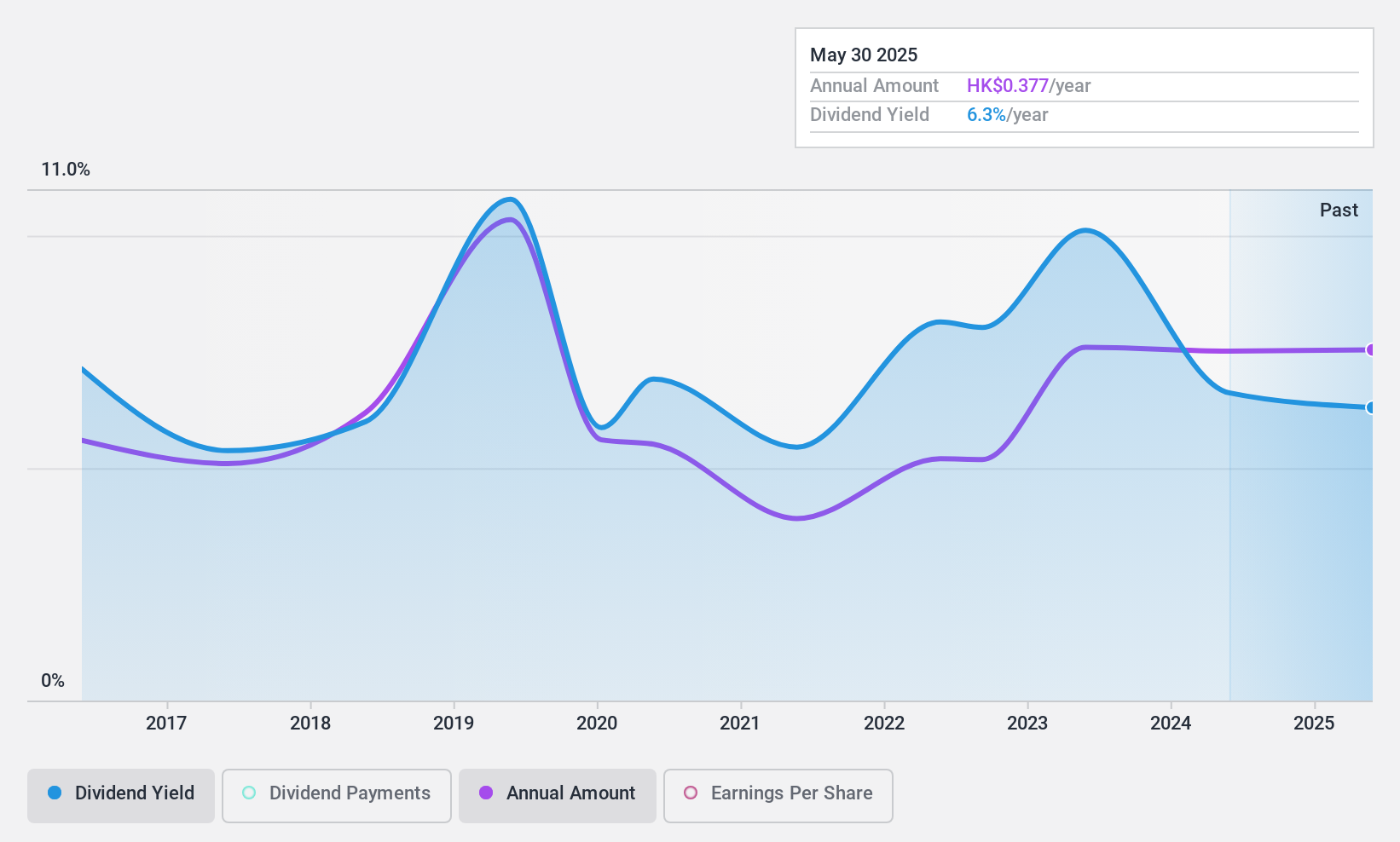

Carpenter Tan Holdings (SEHK:837)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carpenter Tan Holdings Limited is an investment holding company that designs, manufactures, and distributes wooden handicrafts and accessories under the Carpenter Tan brand, with a market cap of HK$1.46 billion.

Operations: The company's revenue segment includes the manufacture and sales of wooden handicrafts and accessories, totaling CN¥506 million.

Dividend Yield: 6.3%

Carpenter Tan Holdings offers a mixed dividend profile. Its Price-To-Earnings ratio of 7.8x suggests it may be undervalued compared to the Hong Kong market average of 10x. Despite a robust earnings growth of 20.6% over the past year and dividends being covered by earnings (49.4% payout ratio), its dividend yield at 6.34% is below top-tier payers in Hong Kong, and historical payments have been volatile, though covered by cash flows (89.5%).

- Get an in-depth perspective on Carpenter Tan Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report Carpenter Tan Holdings implies its share price may be too high.

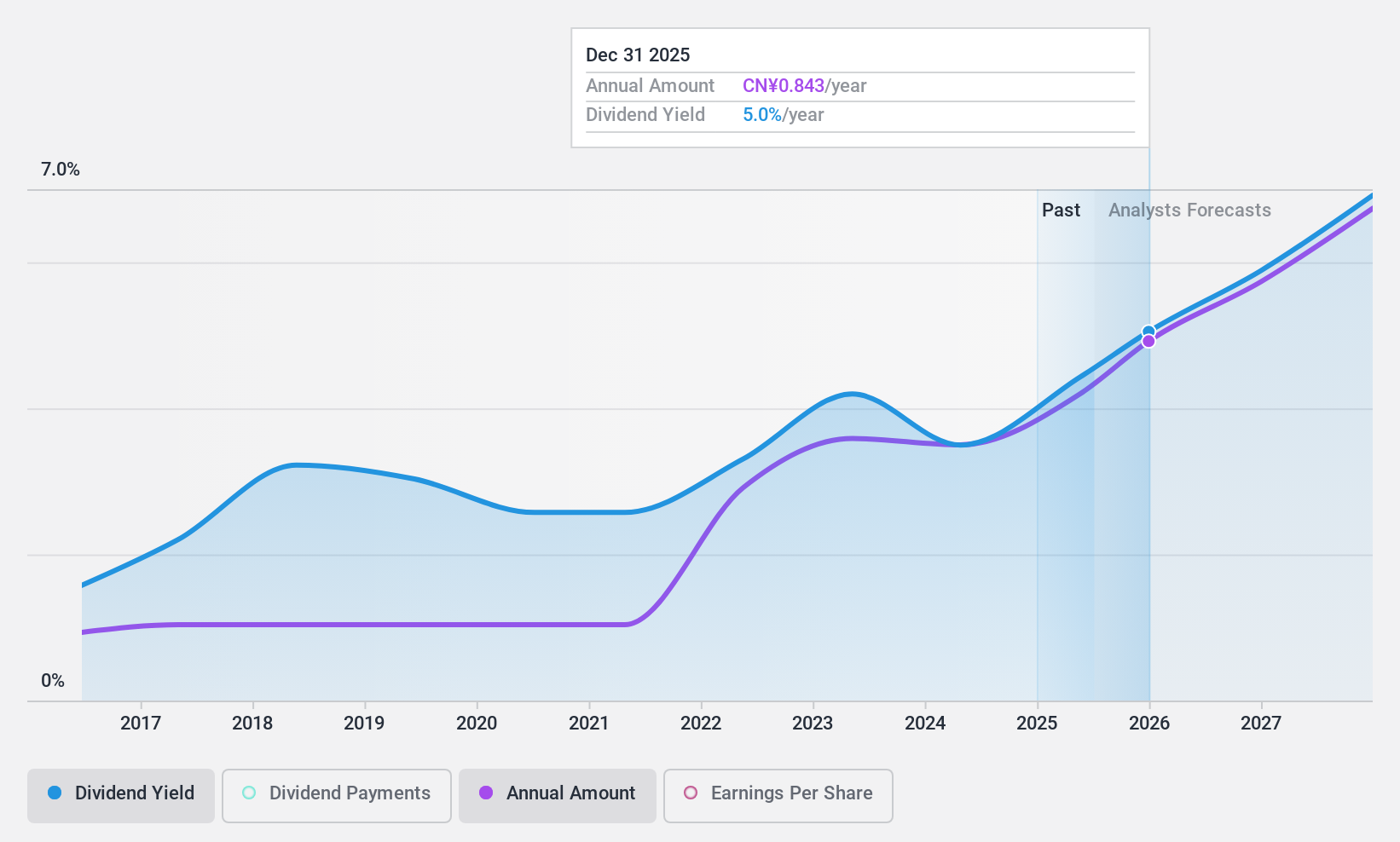

Beijing Sifang AutomationLtd (SHSE:601126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sifang Automation Co., Ltd provides power transmission, transformation protection, automation systems, and related services both in China and internationally, with a market cap of CN¥14.22 billion.

Operations: Beijing Sifang Automation Co., Ltd generates revenue through its offerings in power transmission, transformation protection, automation systems, power generation, enterprise power solutions, and power distribution and consumption systems across domestic and international markets.

Dividend Yield: 3.5%

Beijing Sifang Automation shows a solid dividend profile with a 70% payout ratio, indicating dividends are covered by earnings. Its cash payout ratio of 39.6% further supports sustainability. The dividend yield of 3.52% is competitive in the Chinese market, yet historical payments have been volatile over the past decade despite growth in earnings and dividends. Recent financials reveal increased sales and net income, suggesting potential for continued dividend support amidst analyst optimism on stock value growth.

- Click to explore a detailed breakdown of our findings in Beijing Sifang AutomationLtd's dividend report.

- In light of our recent valuation report, it seems possible that Beijing Sifang AutomationLtd is trading behind its estimated value.

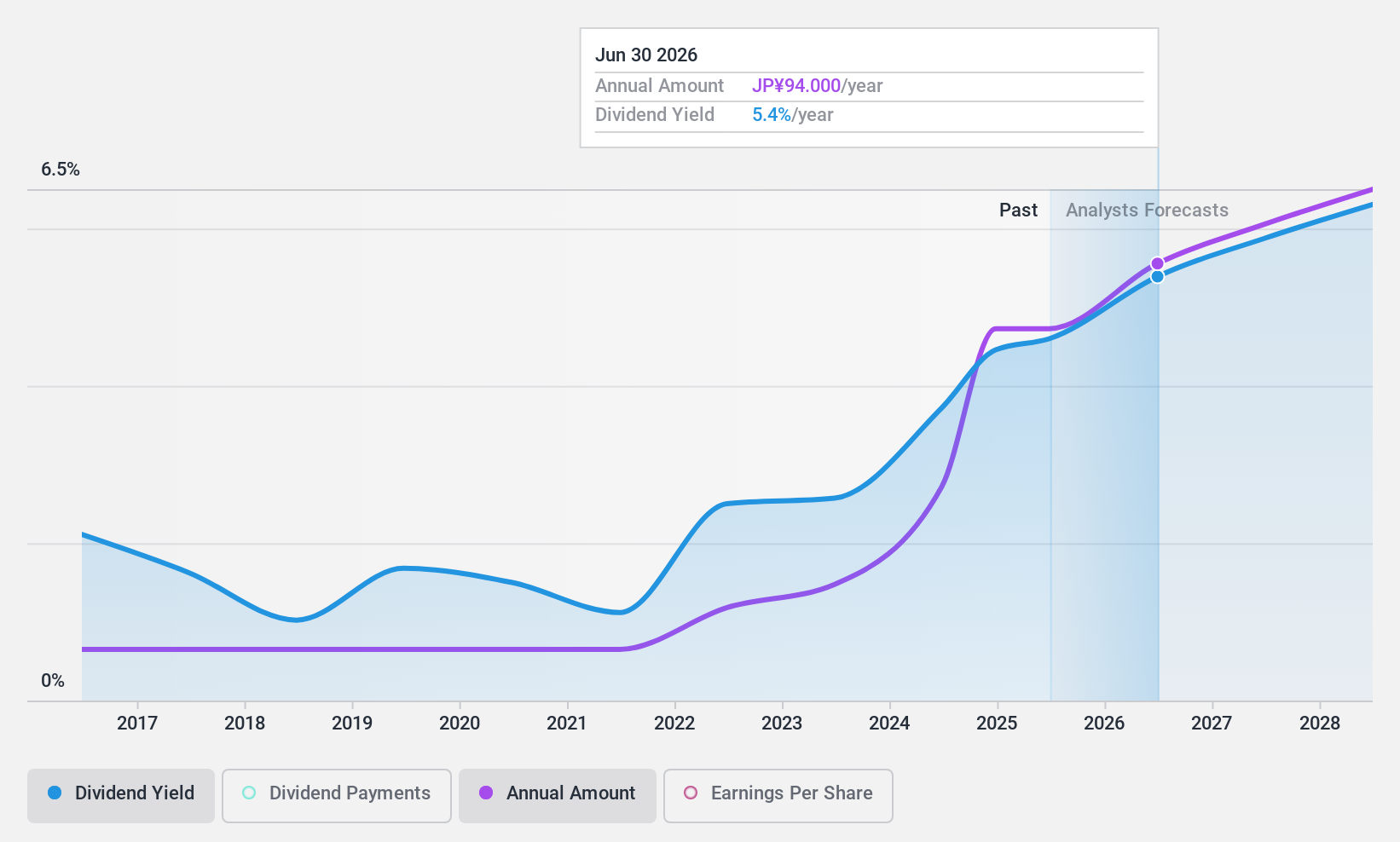

SuzukiLtd (TSE:6785)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Suzuki Co., Ltd. manufactures and sells connectors for car electronics parts in Japan, with a market cap of ¥26.01 billion.

Operations: Suzuki Co., Ltd. generates revenue from several segments, including Parts at ¥20.67 billion, Mechanical Equipment at ¥6.39 billion, Mold at ¥2.72 billion, and Rent at ¥352.09 million.

Dividend Yield: 4.4%

Suzuki Ltd. offers a compelling dividend profile with a low payout ratio of 26.4%, ensuring dividends are well-covered by earnings and cash flows, supported by a cash payout ratio of 40.2%. The company pays a high dividend yield of 4.41%, ranking in the top quartile in Japan, and has consistently increased dividends over the past decade without volatility. Recent ex-dividend date news confirms ongoing commitment to shareholder returns with a ¥40 payment scheduled for December 2024.

- Click here to discover the nuances of SuzukiLtd with our detailed analytical dividend report.

- The analysis detailed in our SuzukiLtd valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 1940 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:837

Carpenter Tan Holdings

An investment holding company, designs, manufactures, and distributes wooden handicrafts and accessories under the Carpenter Tan brand.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives