As global markets face headwinds from falling consumer confidence and regulatory uncertainties, particularly affecting tech stocks, investors are closely monitoring the performance of high-growth sectors. In this environment, a good stock to watch is one that demonstrates resilience through innovative offerings and strategic positioning within its industry, especially as concerns over inflation and trade policies continue to shape market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Jade Bird Fire (SZSE:002960)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jade Bird Fire Co., Ltd. specializes in the development, manufacturing, and sale of professional fire safety electronic products and systems both in China and internationally, with a market cap of CN¥8.77 billion.

Operations: The company focuses on creating and distributing fire safety electronic products and systems across domestic and international markets. They operate with a market cap of CN¥8.77 billion, emphasizing the development of innovative safety solutions.

Jade Bird Fire's strategic maneuvers, including the recent decision to repurchase and cancel restricted stocks, underscore its commitment to enhancing shareholder value. With an annual revenue growth rate of 15.4%, slightly above the Chinese market average of 13.2%, and a robust earnings growth forecast at 27.1% per year—surpassing the broader market's 25.4%—the company demonstrates solid financial health and potential for sustained growth. Despite challenges like a previous year’s earnings contraction by 25.8%, its positive free cash flow and high-quality past earnings indicate resilience and operational efficiency in a competitive electronic industry landscape.

- Click here to discover the nuances of Jade Bird Fire with our detailed analytical health report.

Gain insights into Jade Bird Fire's historical performance by reviewing our past performance report.

Kyland Technology (SZSE:300353)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kyland Technology Co., Ltd. specializes in industrial Ethernet technology both in China and globally, with a market capitalization of CN¥7.87 billion.

Operations: Kyland Technology Co., Ltd. focuses on industrial Ethernet solutions, serving both domestic and international markets.

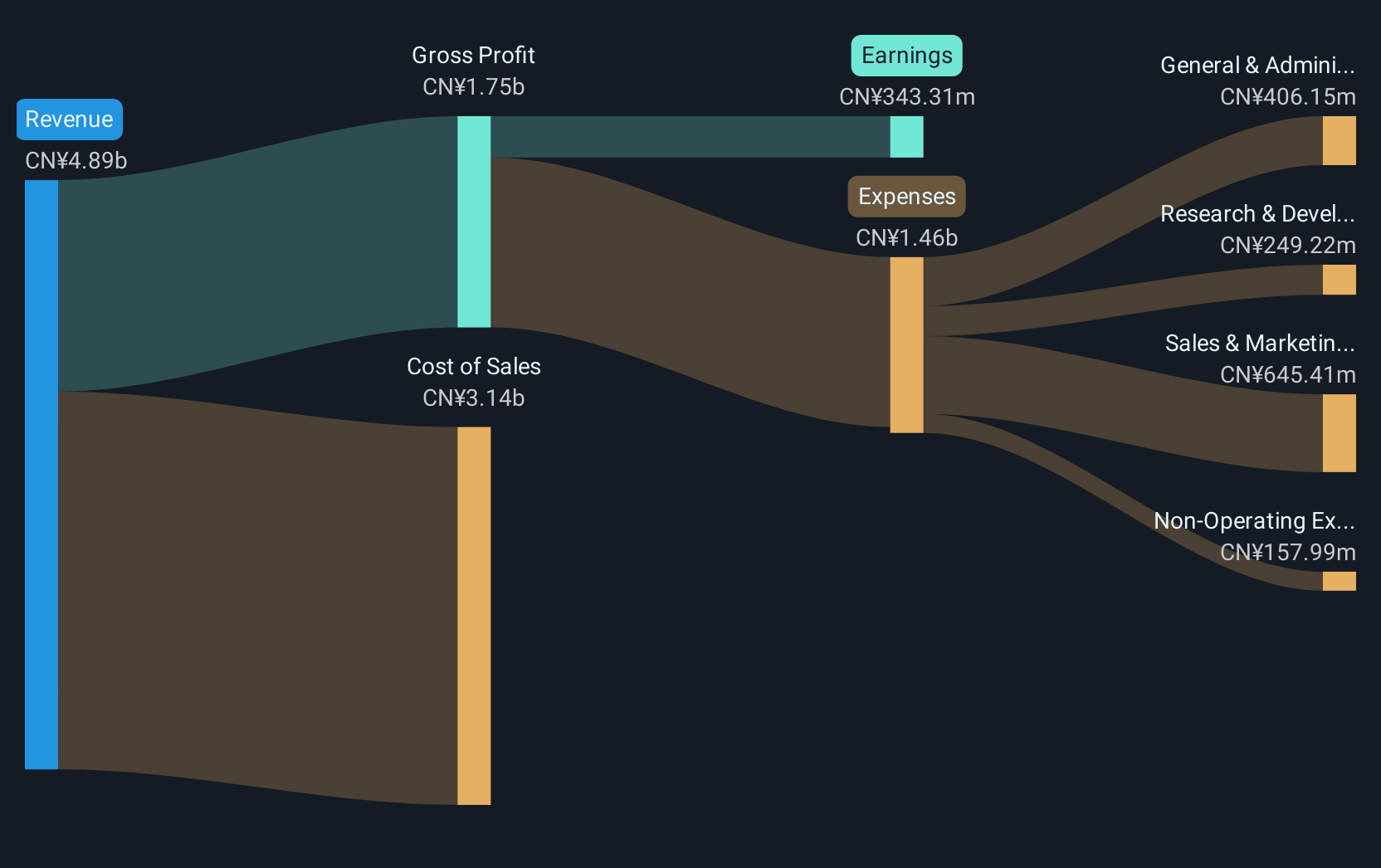

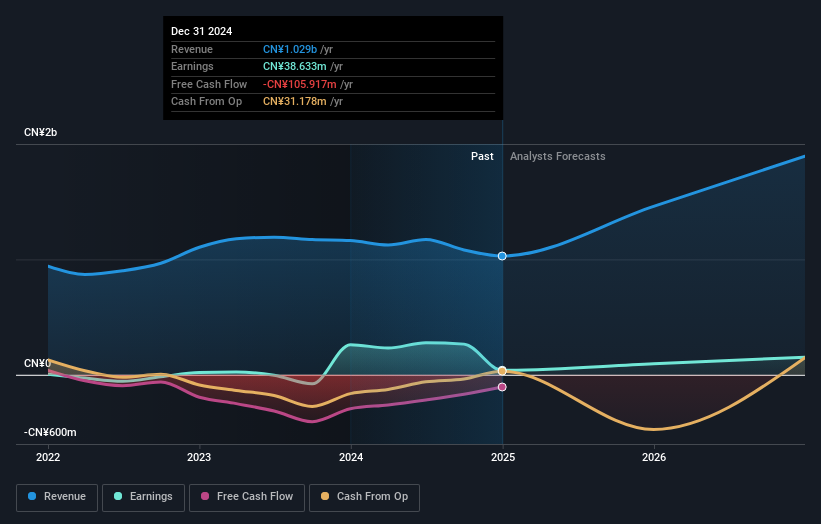

Kyland Technology, despite a challenging year with net income dropping to CNY 38.63 million from CNY 260.28 million, still projects robust future growth with expected annual revenue and earnings increases of 29.6% and 59.5%, respectively—figures that outpace both the industry and broader Chinese market averages. This anticipation is underpinned by significant R&D investments, totaling CNY {rd_expense_string}, which not only highlight the company's commitment to innovation but also position it well for capturing emerging tech trends. The recent board reshuffles, including new director appointments, could further steer the company towards these high-growth trajectories by infusing fresh perspectives into its strategic planning processes.

- Take a closer look at Kyland Technology's potential here in our health report.

Assess Kyland Technology's past performance with our detailed historical performance reports.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥13.64 billion.

Operations: The company generates revenue primarily through its Software Services segment, with reported earnings of CN¥2.28 billion. The business focuses on providing solutions in industrial Internet and intelligent manufacturing within China.

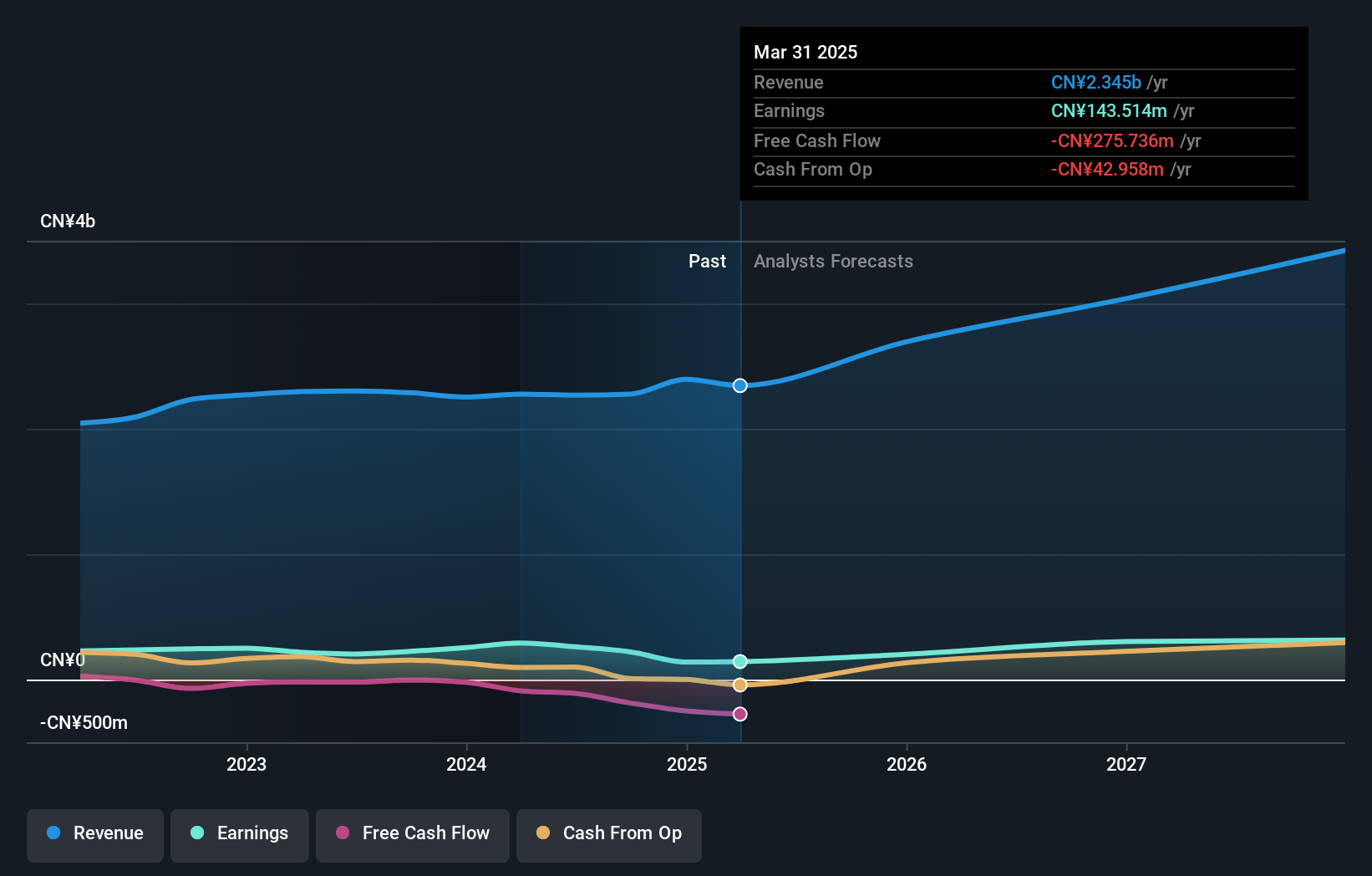

Guangzhou Sie Consulting, with a notable 13.9% annual revenue growth, outpaces the broader Chinese market's 13.2% increase, showcasing its robust position in the tech sector. Despite a slight earnings contraction of 2.1% last year, future projections are optimistic with an expected earnings surge of 27.5% annually. This growth trajectory is supported by substantial R&D investments which totaled CN¥70.3 million last year, emphasizing their commitment to innovation amid evolving industry dynamics. Additionally, recent strategic share repurchases totaling CN¥39.97 million for 2,550,450 shares reflect confidence in the company’s value and future prospects.

Taking Advantage

- Navigate through the entire inventory of 802 Global High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300687

Guangzhou Sie Consulting

Operates as solution provider in the fields of industrial Internet and intelligent manufacturing, core ERP, and business operation center in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives