- China

- /

- Electronic Equipment and Components

- /

- SZSE:300319

The Market Lifts Shenzhen Microgate Technology Co., Ltd. (SZSE:300319) Shares 26% But It Can Do More

Those holding Shenzhen Microgate Technology Co., Ltd. (SZSE:300319) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

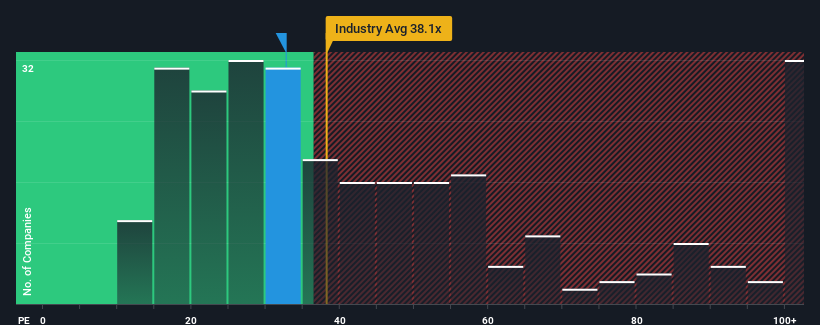

Even after such a large jump in price, there still wouldn't be many who think Shenzhen Microgate Technology's price-to-earnings (or "P/E") ratio of 32.7x is worth a mention when the median P/E in China is similar at about 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Shenzhen Microgate Technology has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Shenzhen Microgate Technology

How Is Shenzhen Microgate Technology's Growth Trending?

Shenzhen Microgate Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 8.5% decrease to the company's bottom line. Even so, admirably EPS has lifted 327% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 76% during the coming year according to the dual analysts following the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Shenzhen Microgate Technology is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Shenzhen Microgate Technology appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Microgate Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Shenzhen Microgate Technology has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300319

Shenzhen Microgate Technology

Engages in the research, development, production, and sale of passive electronic components and modules in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026