Amidst a backdrop of global economic uncertainties and fluctuating market sentiments, Asian tech markets have been capturing attention with their resilience and potential for growth. As investors navigate these dynamic conditions, identifying high-growth stocks in the tech sector requires a focus on companies that demonstrate strong fundamentals, innovative capabilities, and adaptability to changing economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 31.42% | 36.98% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Dmall (SEHK:2586)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dmall Inc. is an investment holding company that offers retail digitalization solutions across several countries, including China and Southeast Asia, with a market capitalization of approximately HK$10.62 billion.

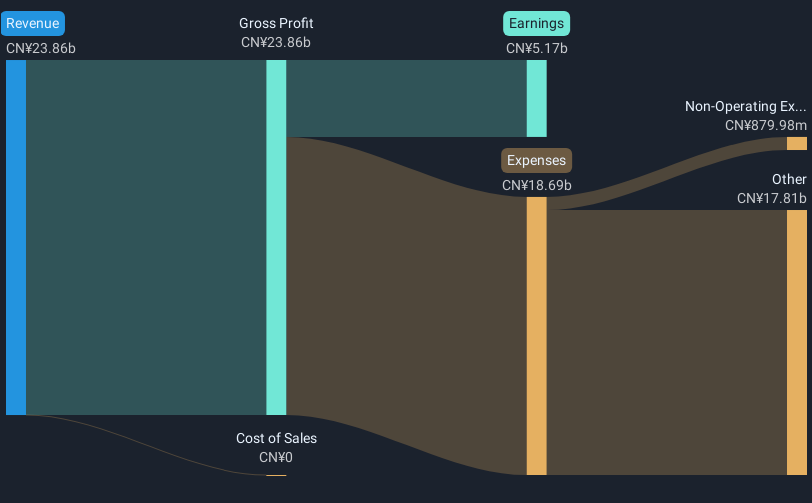

Operations: Dmall Inc. focuses on providing retail digitalization solutions, with its primary revenue streams coming from the Retail Core Service Cloud (CN¥1.63 billion) and E-Commerce Service Cloud (CN¥143.82 million). The company operates in multiple regions, including China and Southeast Asia, contributing to its market presence and financial performance.

Dmall, navigating the competitive tech landscape in Asia, shows promising growth metrics with an annual revenue increase of 29.5% and projected earnings growth of 88.4%. Despite current unprofitability and a volatile share price, the company is expected to break into profitability within three years—a notable turnaround given its recent R&D investments which are strategically aligned with emerging market demands. The firm's focus on innovation could potentially reshape its sector, supported by substantial financial commitments to research and development that underscore a forward-looking approach in a rapidly evolving industry environment.

- Unlock comprehensive insights into our analysis of Dmall stock in this health report.

Gain insights into Dmall's past trends and performance with our Past report.

Zhongji Innolight (SZSE:300308)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhongji Innolight Co., Ltd. is engaged in the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market cap of CN¥115.18 billion.

Operations: Zhongji Innolight focuses on the optical communication sector, specifically in the development and sale of transceiver modules and optical devices. The company operates within China, leveraging its expertise in research and production to support its product offerings.

Zhongji Innolight has demonstrated robust financial performance, with its recent earnings report showing a more than doubling of sales to CNY 23.86 billion and net income soaring to CNY 5.17 billion in 2024, up from CNY 2.17 billion the previous year. This growth trajectory is supported by an aggressive R&D strategy that aligns with industry demands, evidenced by a forecasted annual earnings increase of 28.8%. The company's strategic focus on innovation is further underscored during its recent shareholders meeting, where discussions included the reallocation of repurchased shares for cancellation and governance enhancements through independent director elections—moves that could strengthen corporate oversight and future growth prospects in the competitive tech sector in Asia.

- Take a closer look at Zhongji Innolight's potential here in our health report.

Explore historical data to track Zhongji Innolight's performance over time in our Past section.

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital Garage, Inc. is a context company operating in Japan and internationally with a market cap of ¥221.55 billion.

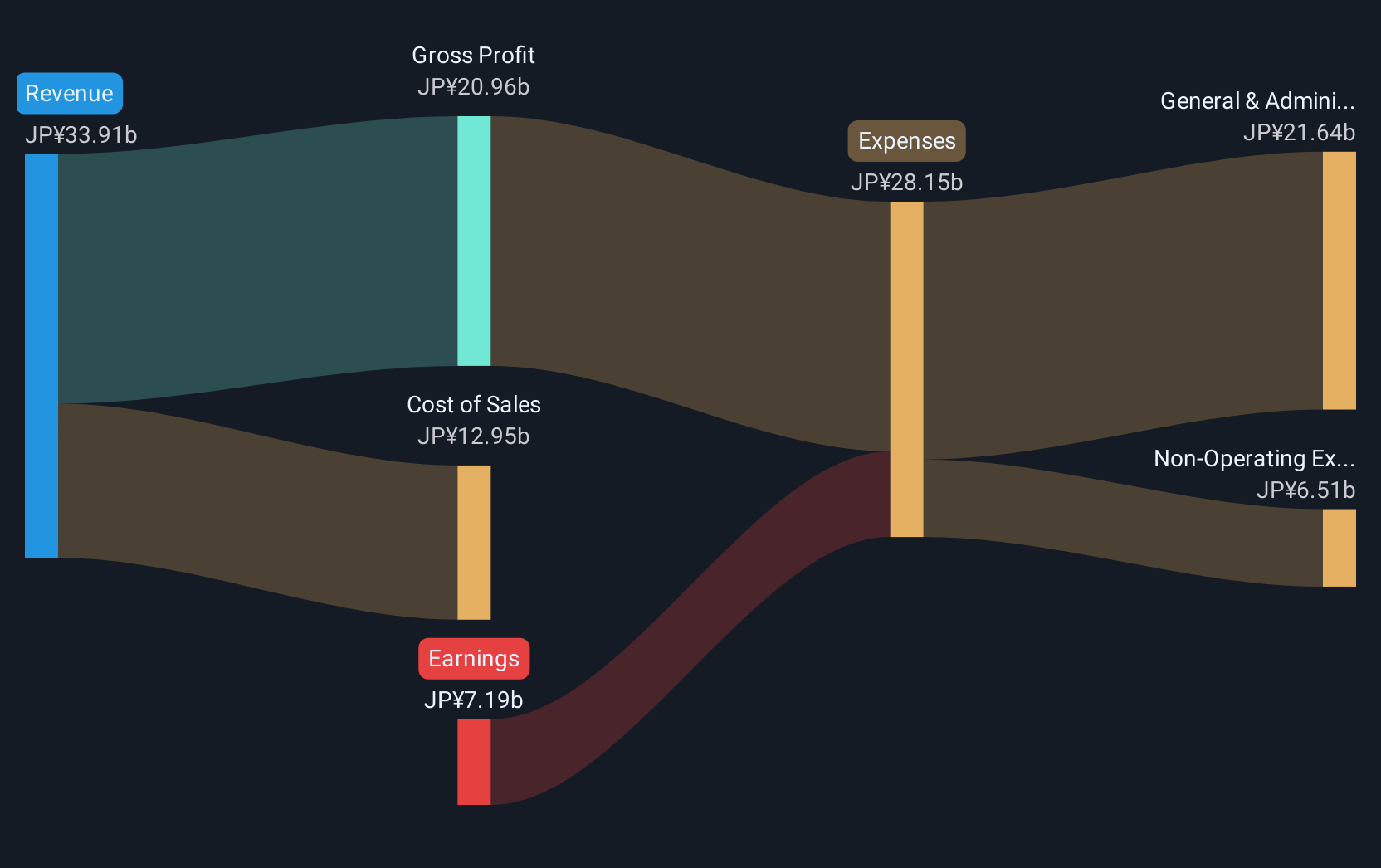

Operations: Digital Garage focuses on providing digital marketing, payment solutions, and venture incubation services across Japan and international markets. The company generates revenue from its diverse portfolio of digital marketing initiatives and financial technology services. It also invests in startups through its venture incubation segment, contributing to its growth strategy.

Digital Garage is shaping up as a compelling narrative in Asia's tech landscape, with a notable uptick in its financial and strategic initiatives. Recently, the company not only increased its year-end dividend to JPY 43 from JPY 40 but also announced a special dividend of JPY 10 per share, signaling strong cash flow and shareholder confidence. These moves coincide with robust revenue growth forecasts pegged at 15.1% annually, outpacing the Japanese market average of 4.3%. Furthermore, earnings are expected to surge by an impressive 106.87% per year over the next three years, reflecting Digital Garage's effective alignment with high-demand tech sectors and its potential for sustained profitability amidst competitive pressures.

- Get an in-depth perspective on Digital Garage's performance by reading our health report here.

Evaluate Digital Garage's historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 518 Asian High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2586

Dmall

An investment holding company, provides retail digitalization solutions to retailers in China, Hong Kong, Cambodia, Singapore, Malaysia, Poland, Macau, Indonesia, the Philippines, and Brunei.

Exceptional growth potential with imperfect balance sheet.