- China

- /

- Electronic Equipment and Components

- /

- SZSE:300227

Some Confidence Is Lacking In Shenzhen Sunshine Laser & Electronics Technology Co., Ltd. (SZSE:300227) As Shares Slide 28%

The Shenzhen Sunshine Laser & Electronics Technology Co., Ltd. (SZSE:300227) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Indeed, the recent drop has reduced its annual gain to a relatively sedate 4.1% over the last twelve months.

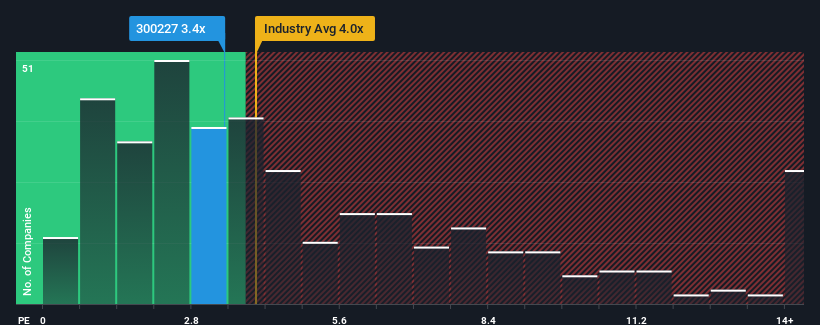

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Shenzhen Sunshine Laser & Electronics Technology's P/S ratio of 3.4x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in China is also close to 4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Shenzhen Sunshine Laser & Electronics Technology

How Shenzhen Sunshine Laser & Electronics Technology Has Been Performing

Revenue has risen at a steady rate over the last year for Shenzhen Sunshine Laser & Electronics Technology, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. Those who are bullish on Shenzhen Sunshine Laser & Electronics Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen Sunshine Laser & Electronics Technology will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Shenzhen Sunshine Laser & Electronics Technology?

The only time you'd be comfortable seeing a P/S like Shenzhen Sunshine Laser & Electronics Technology's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 5.4%. The solid recent performance means it was also able to grow revenue by 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Shenzhen Sunshine Laser & Electronics Technology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Following Shenzhen Sunshine Laser & Electronics Technology's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenzhen Sunshine Laser & Electronics Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Shenzhen Sunshine Laser & Electronics Technology (1 can't be ignored) you should be aware of.

If you're unsure about the strength of Shenzhen Sunshine Laser & Electronics Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300227

Shenzhen Sunshine Laser & Electronics Technology

Shenzhen Sunshine Laser & Electronics Technology Co., Ltd.

Second-rate dividend payer with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)