- China

- /

- Electronic Equipment and Components

- /

- SZSE:300344

Spotlighting National Bank of Umm Al-Qaiwain (PSC) Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, recent shifts have highlighted the resilience of smaller-cap indices like the Russell 2000 and S&P MidCap 400, which have outperformed their larger counterparts. Investing in penny stocks—an area once synonymous with speculative ventures but still holding potential for growth—can offer unique opportunities when these companies exhibit strong financial health. In this article, we explore three penny stocks that stand out for their robust balance sheets and potential for future growth, providing investors with a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.07B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

Click here to see the full list of 5,784 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates with a market cap of AED4.50 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: AED4.5B

National Bank of Umm Al-Qaiwain (PSC) presents a mixed profile for investors interested in smaller-cap stocks. Despite its relatively low Return on Equity at 8.9% and high bad loans ratio of 4.4%, the bank maintains a stable net profit margin, albeit slightly reduced from last year. The Price-to-Earnings ratio is favorable compared to the market, suggesting potential undervaluation. Recent earnings reports indicate steady income growth over nine months, though quarterly figures show a decline compared to the previous year. The bank's funding is primarily low-risk customer deposits, which may appeal to risk-averse investors seeking stability amidst volatility concerns.

- Take a closer look at National Bank of Umm Al-Qaiwain (PSC)'s potential here in our financial health report.

- Evaluate National Bank of Umm Al-Qaiwain (PSC)'s historical performance by accessing our past performance report.

Beijing Century Real TechnologyLtd (SZSE:300150)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Century Real Technology Co., Ltd specializes in the manufacturing and sale of railway traffic safety monitoring systems, as well as urban rail transit passenger information and broadcast systems, with a market cap of CN¥2.56 billion.

Operations: No specific revenue segments have been reported for Beijing Century Real Technology Co., Ltd.

Market Cap: CN¥2.56B

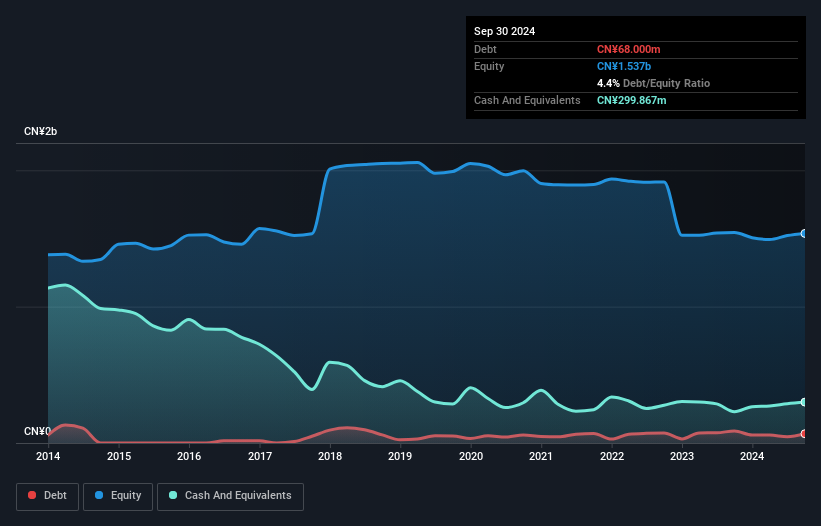

Beijing Century Real Technology Ltd demonstrates a mixed outlook for those exploring smaller-cap investments. Despite reporting revenue of CN¥323.34 million for the first half of 2024, the company remains unprofitable with declining earnings over five years at a rate of 44.9% annually. While its debt is well-covered by operating cash flow and it holds more cash than total debt, volatility remains high compared to most Chinese stocks, and its share price has been unstable recently. The management team is seasoned with an average tenure of 7.1 years, adding some stability to its operational framework amidst financial challenges.

- Dive into the specifics of Beijing Century Real TechnologyLtd here with our thorough balance sheet health report.

- Assess Beijing Century Real TechnologyLtd's previous results with our detailed historical performance reports.

Cubic Digital TechnologyLtd (SZSE:300344)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cubic Digital Technology Co., Ltd. manufactures and sells steel frame foamed cement composite boards in China, with a market cap of CN¥2.98 billion.

Operations: Cubic Digital Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.98B

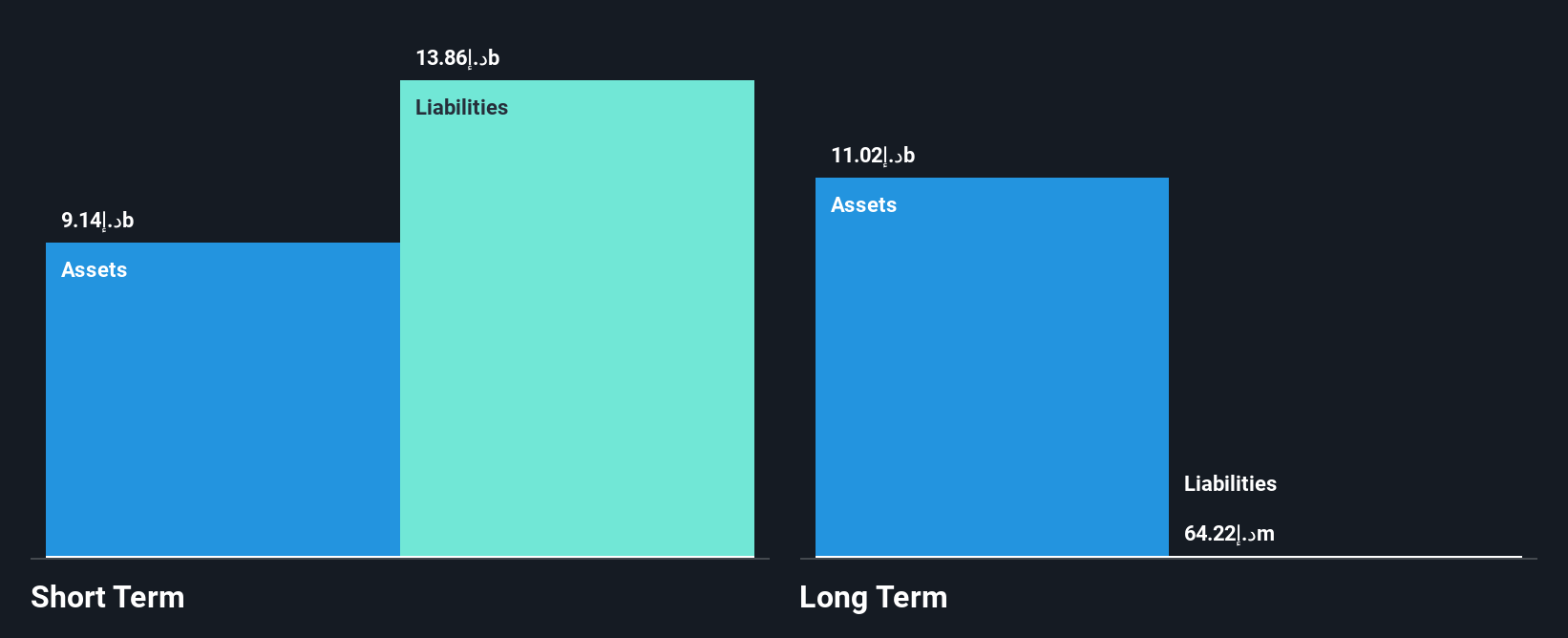

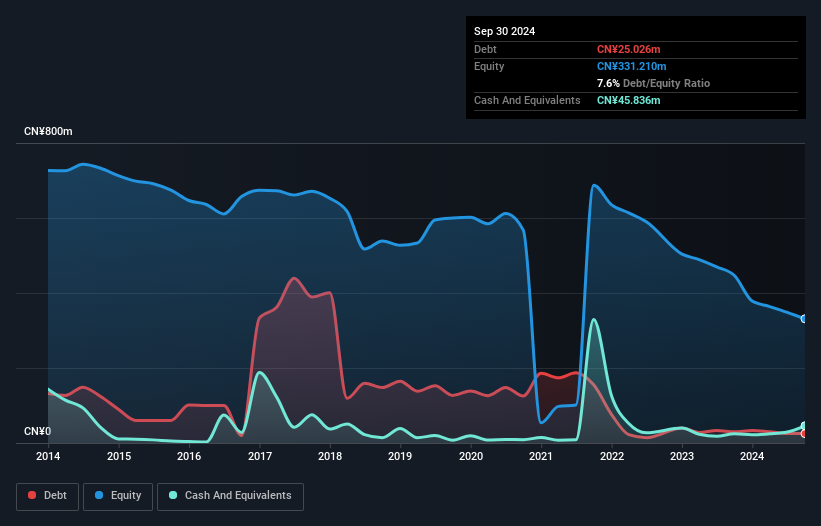

Cubic Digital Technology Co., Ltd. presents a complex picture for investors interested in smaller-cap stocks. The company reported revenue of CN¥149 million for the first half of 2024, showing growth from the previous year, but remains unprofitable with a net loss of CN¥33.92 million. Despite its financial challenges, Cubic Digital maintains more cash than debt and has reduced its debt-to-equity ratio significantly over five years to 7.2%. Additionally, it boasts sufficient cash runway for over three years if current free cash flow trends continue, although share price volatility remains high compared to most Chinese stocks.

- Navigate through the intricacies of Cubic Digital TechnologyLtd with our comprehensive balance sheet health report here.

- Learn about Cubic Digital TechnologyLtd's historical performance here.

Make It Happen

- Dive into all 5,784 of the Penny Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300344

Cubic Digital TechnologyLtd

Manufactures and sells steel frame foamed cement composite boards in China.

Flawless balance sheet and slightly overvalued.