- China

- /

- Electronic Equipment and Components

- /

- SHSE:603516

Three Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In recent weeks, global markets have experienced varied movements with the S&P 500 advancing and small-cap indices like the Russell 2000 outperforming, while European markets reacted to interest rate cuts by the ECB. Amid these shifts, investors often look for growth companies where significant insider ownership can signal confidence from those closest to the business. Identifying such stocks requires careful consideration of both market conditions and company fundamentals, as strong insider ownership may indicate potential alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Growth Rating: ★★★★★☆

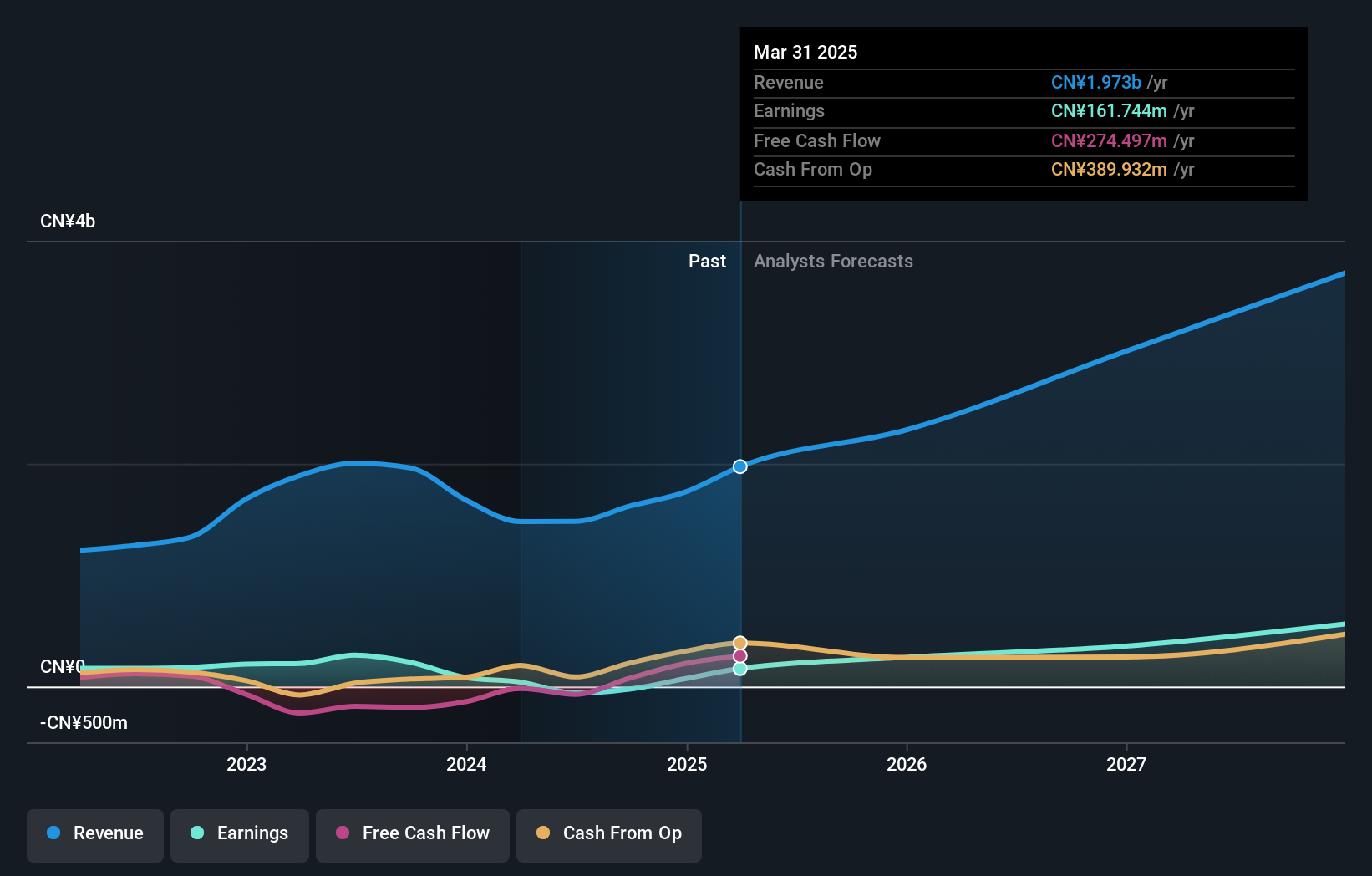

Overview: Beijing Tricolor Technology Co., Ltd manufactures and sells professional audio and video products worldwide, with a market cap of CN¥6.69 billion.

Operations: The company's revenue primarily comes from the Display Control Industry, contributing CN¥511.31 million.

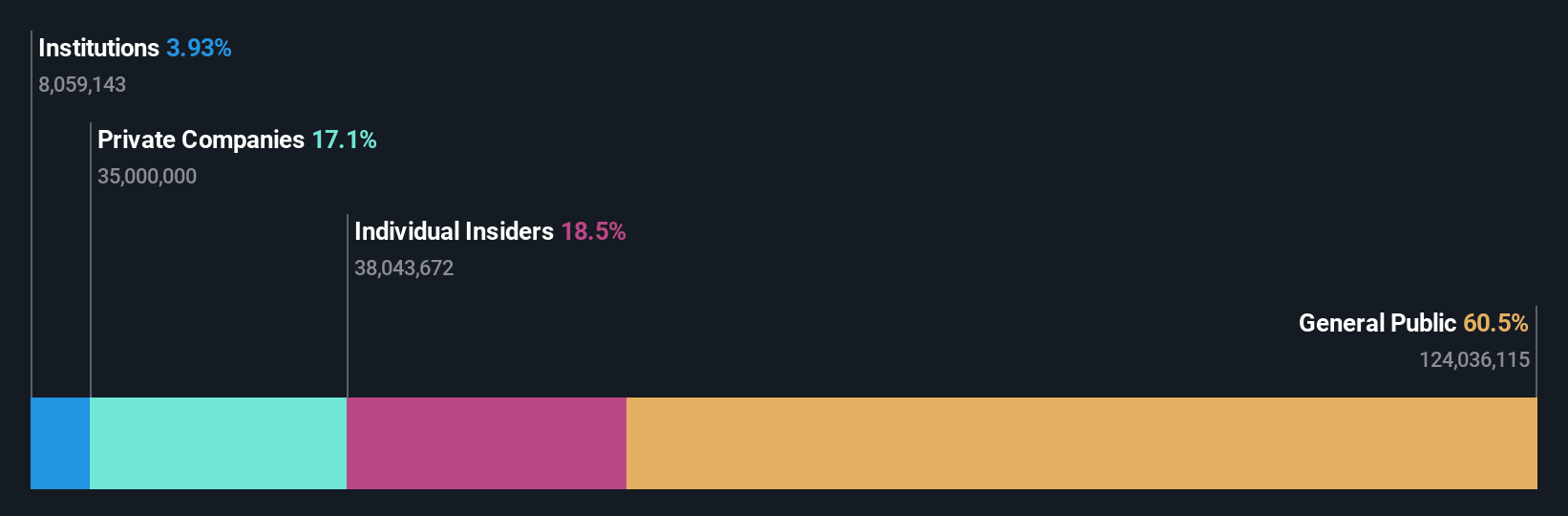

Insider Ownership: 38%

Revenue Growth Forecast: 29.9% p.a.

Beijing Tricolor Technology has demonstrated significant earnings growth, with net income rising to CNY 39.24 million for the first half of 2024 from CNY 6.61 million a year earlier. Despite recent share price volatility, its revenue is forecasted to grow at a robust pace of nearly 30% annually, outpacing the broader Chinese market. However, shareholders have experienced dilution over the past year and no substantial insider trading activity was reported recently.

- Navigate through the intricacies of Beijing Tricolor Technology with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Beijing Tricolor Technology's current price could be inflated.

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. is engaged in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of approximately CN¥6.93 billion.

Operations: Broadex Technologies generates its revenue primarily from the development, production, and sale of integrated optoelectronic devices within the optical communications sector.

Insider Ownership: 11.6%

Revenue Growth Forecast: 25.2% p.a.

Broadex Technologies is poised for substantial growth, with revenue forecasted to increase by 25.2% annually, surpassing the broader Chinese market's growth rate of 13.5%. Despite recent earnings declines and share price volatility, the company is expected to become profitable within three years. A recent transaction saw Ningbo Ningju Asset Management acquiring a 5.04% stake for CNY 246.21 million, indicating confidence in future prospects despite low return on equity forecasts and no significant insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of Broadex Technologies.

- According our valuation report, there's an indication that Broadex Technologies' share price might be on the expensive side.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chenming Electronic Tech. Corp., with a market cap of NT$32.06 billion, is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally.

Operations: The company's revenue segment includes the production and sales of computer and mobile device components, amounting to NT$7.64 billion.

Insider Ownership: 19.2%

Revenue Growth Forecast: 54.8% p.a.

Chenming Electronic Tech. is experiencing robust growth, with earnings and revenue forecasted to rise significantly at 96.68% and 54.8% annually, respectively, outpacing the Taiwanese market averages. Recent financials show a strong performance with Q2 sales reaching TWD 2.60 billion and net income of TWD 193.17 million, reflecting substantial year-over-year increases. Despite share price volatility and no recent insider trading activity, the company trades at a notable discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in Chenming Electronic Tech's earnings growth report.

- Our expertly prepared valuation report Chenming Electronic Tech implies its share price may be lower than expected.

Summing It All Up

- Navigate through the entire inventory of 1483 Fast Growing Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tricolor Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603516

Beijing Tricolor Technology

Manufactures and sells professional audio and video products worldwide.

Flawless balance sheet slight.

Market Insights

Community Narratives