- China

- /

- Tech Hardware

- /

- SHSE:600130

3 Promising Penny Stocks With Market Caps Under US$500M

Reviewed by Simply Wall St

Global markets have experienced a turbulent start to the year, with U.S. equities facing declines amid inflation concerns and political uncertainties, while European indices have shown resilience. In such a fluctuating market landscape, investors often seek opportunities in smaller or newer companies that might offer unique growth potential. Penny stocks, though an older term, continue to intrigue investors due to their affordability and potential for significant returns when backed by strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.60 | £412.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.89 | £712.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Starflex (SET:SFLEX) | THB2.60 | THB2.02B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,727 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ningbo BirdLtd (SHSE:600130)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ningbo Bird Co., Ltd. engages in the research, development, production, and sale of mobile phones and motherboards in China, with a market cap of CN¥3.28 billion.

Operations: No revenue segments have been reported for the company.

Market Cap: CN¥3.28B

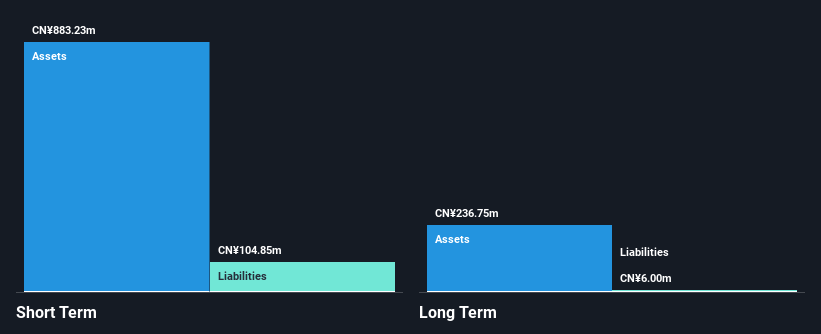

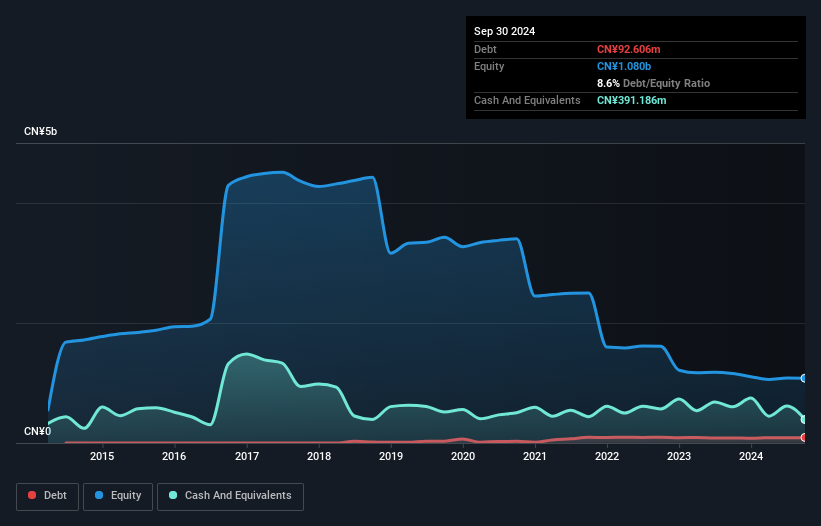

Ningbo Bird Co., Ltd. has faced challenges with declining earnings, reporting a net income of CN¥4.11 million for the nine months ending September 2024, down from CN¥14.61 million the previous year. Despite this, the company remains debt-free and its short-term assets significantly exceed both short and long-term liabilities, providing some financial stability amidst volatility in share price and earnings performance. However, profitability has been impacted by large one-off gains and lower profit margins compared to last year. The company's Return on Equity is low at 0.6%, indicating limited efficiency in generating returns from shareholders' equity.

- Jump into the full analysis health report here for a deeper understanding of Ningbo BirdLtd.

- Understand Ningbo BirdLtd's track record by examining our performance history report.

Tangel Culture (SZSE:300148)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tangel Culture Co., Ltd. operates in China, focusing on the research and development, distribution, agency, and operation of mobile games, book publishing and distribution, as well as educational businesses with a market cap of CN¥2.80 billion.

Operations: Tangel Culture Co., Ltd. does not have any specific revenue segments reported.

Market Cap: CN¥2.8B

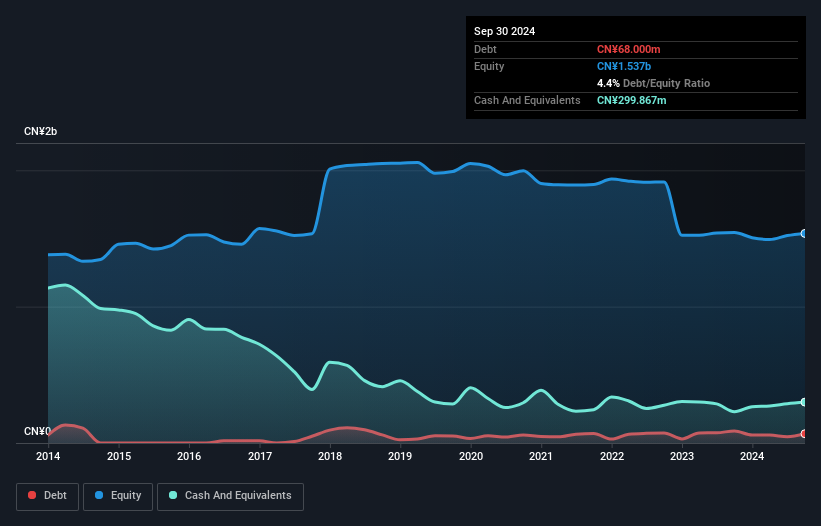

Tangel Culture Co., Ltd. has demonstrated financial resilience with a net income of CN¥20.96 million for the nine months ending September 2024, reversing a net loss from the previous year. Despite being unprofitable historically, it has reduced losses at an annual rate of 18.2% over five years and maintains more cash than debt, ensuring financial stability with short-term assets covering both short and long-term liabilities. However, its share price remains highly volatile compared to most Chinese stocks, and its board lacks experience with an average tenure of just 2.3 years, which may impact strategic direction moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Tangel Culture.

- Examine Tangel Culture's past performance report to understand how it has performed in prior years.

Beijing Century Real TechnologyLtd (SZSE:300150)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Century Real Technology Co., Ltd specializes in manufacturing and selling railway traffic safety monitoring systems as well as urban rail transit passenger information and broadcast systems, with a market cap of CN¥2.35 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥2.35B

Beijing Century Real Technology Co., Ltd. has shown positive momentum with a net income of CN¥32.73 million for the nine months ending September 2024, up from CN¥21.45 million the previous year. Despite being unprofitable historically, it benefits from strong financial positioning as short-term assets significantly exceed liabilities and cash surpasses total debt, ensuring liquidity and stability. The management team is seasoned with an average tenure of 7.7 years, providing experienced leadership, though its return on equity remains negative due to ongoing losses. Trading below estimated fair value offers potential investment appeal amid stable weekly volatility over the past year.

- Unlock comprehensive insights into our analysis of Beijing Century Real TechnologyLtd stock in this financial health report.

- Evaluate Beijing Century Real TechnologyLtd's historical performance by accessing our past performance report.

Make It Happen

- Click this link to deep-dive into the 5,727 companies within our Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo BirdLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600130

Ningbo BirdLtd

Researches, develops, produces, and sells mobile phones and motherboards in China.

Flawless balance sheet slight.