- China

- /

- Medical Equipment

- /

- SHSE:688576

Undiscovered Gems With Potential To Explore This January 2025

Reviewed by Simply Wall St

As the global markets navigate a complex landscape of inflation concerns and political uncertainty, small-cap stocks have notably underperformed, with the Russell 2000 Index slipping into correction territory. Amidst this backdrop of choppy market conditions and resilient labor data, investors may find opportunities in lesser-known companies that exhibit strong fundamentals and adaptability to changing economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 10.58% | 0.55% | 4.78% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| TOMONY Holdings | 68.34% | 6.88% | 13.82% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Techno Ryowa | 0.19% | 3.96% | 11.17% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Korea Electric Terminal (KOSE:A025540)

Simply Wall St Value Rating: ★★★★★☆

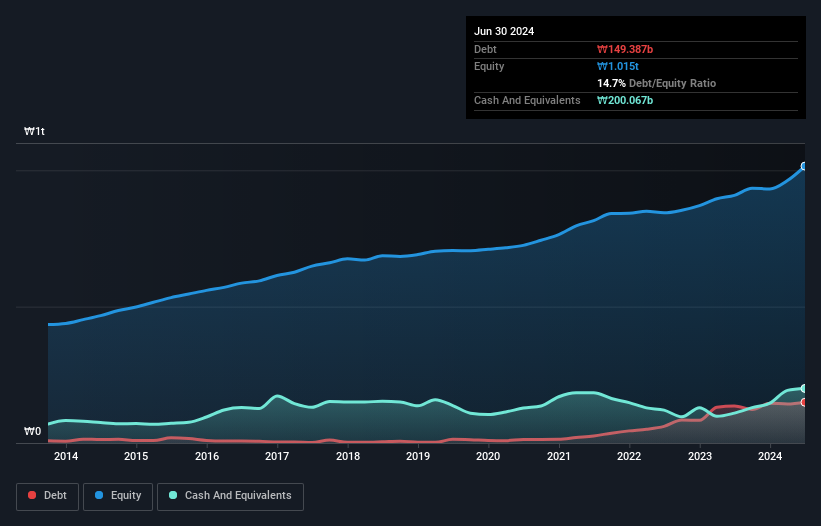

Overview: Korea Electric Terminal Co., Ltd. manufactures and sells parts for automotive and electronics in South Korea and internationally, with a market cap of ₩704.51 billion.

Operations: The company's revenue is primarily derived from the automotive and electronics sector, totaling ₩1.45 trillion.

Korea Electric Terminal, a small player in the electrical sector, is trading at a notable 92.3% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 94.7%, outpacing the industry's 14% growth rate and indicating robust performance. The company's debt to equity ratio has risen from 1.7 to 12.3 over five years, yet its interest payments are well covered with EBIT covering them 522 times over. Despite this leverage increase, it remains free cash flow positive and profitable with no cash runway concerns—an attractive mix for investors eyeing growth prospects in this space.

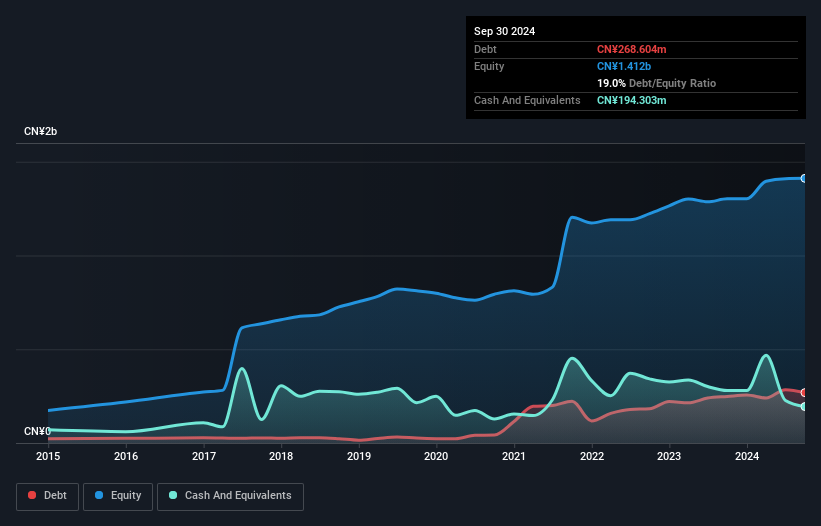

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥7.27 billion.

Operations: The primary revenue stream for EmbedWay Technologies comes from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, generating CN¥1.15 billion.

EmbedWay Technologies, a small player in the tech space, has shown impressive growth with earnings soaring 96.7% last year, outpacing the industry average of -0.3%. Their net income for the first nine months of 2024 was CNY 78.28 million, a significant increase from CNY 31.84 million in the previous year. The company's debt to equity ratio rose from 3.2% to 19% over five years but remains satisfactory at just 5.3%, indicating prudent financial management. With earnings forecasted to grow by nearly 34% annually and strong EBIT coverage of interest payments at 41.8 times, EmbedWay seems well-positioned for continued success in its sector.

- Take a closer look at EmbedWay Technologies (Shanghai)'s potential here in our health report.

Understand EmbedWay Technologies (Shanghai)'s track record by examining our Past report.

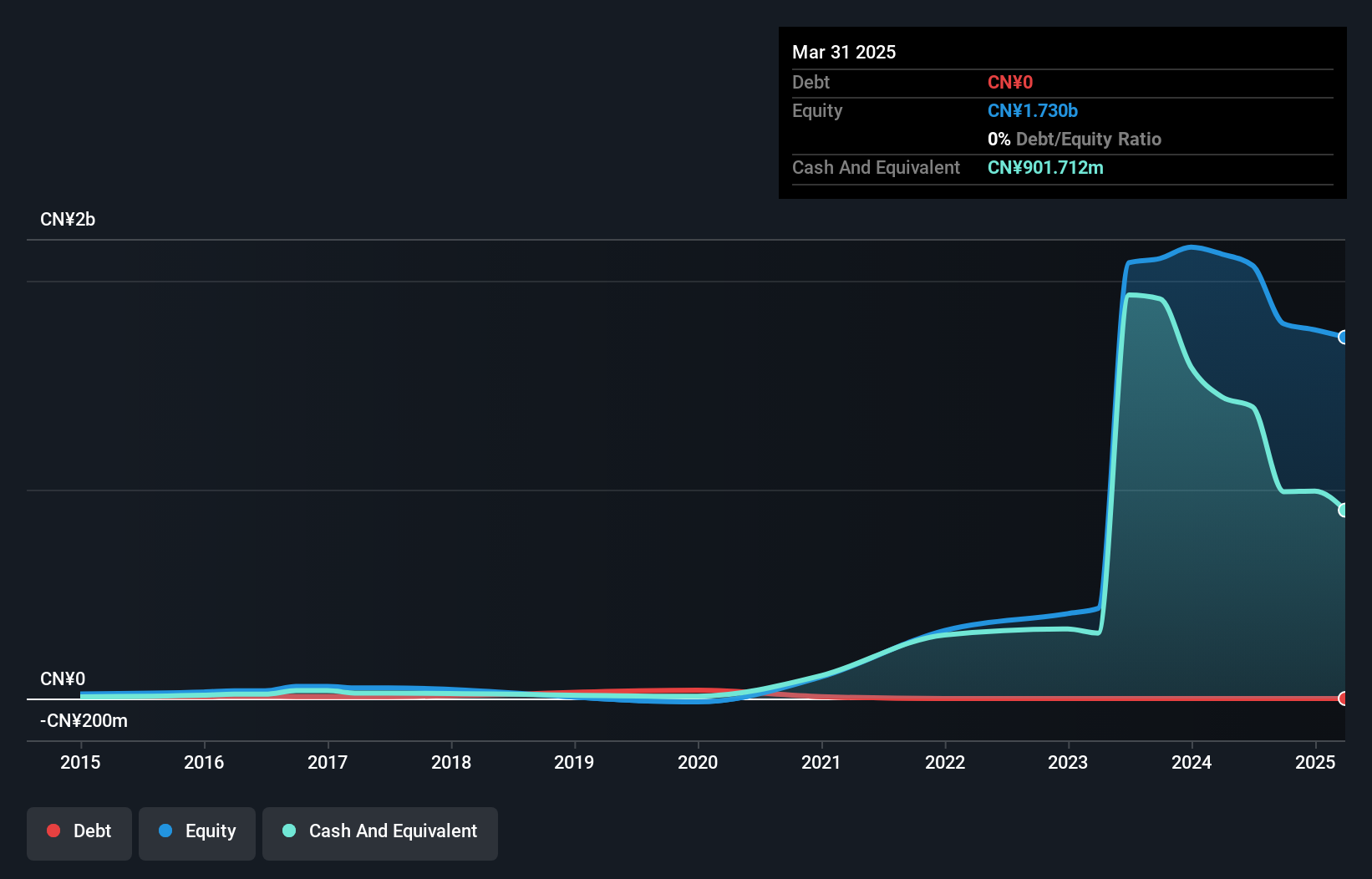

Chongqing Xishan Science & Technology (SHSE:688576)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Xishan Science & Technology Co., Ltd. is a company with a market cap of CN¥2.68 billion, engaged in various technological and scientific operations.

Operations: Chongqing Xishan Science & Technology generates revenue primarily from its technological and scientific operations. The company's financial structure is characterized by its market capitalization of CN¥2.68 billion, indicating a significant presence in its sector.

Chongqing Xishan Science & Technology, a nimble player in the market, showcases a promising profile with earnings growth of 22.4% over the past year, outpacing its industry peers who saw an -8.9% change. The company is trading at a price-to-earnings ratio of 22.6x, which is favorable compared to the broader Chinese market's 31.8x benchmark. Despite not being free cash flow positive recently, it remains debt-free and has executed share buybacks totaling CNY 150 million for approximately 4.73% of its shares since September last year, indicating confidence in its valuation and future prospects.

Seize The Opportunity

- Embark on your investment journey to our 4512 Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688576

Chongqing Xishan Science & Technology

Chongqing Xishan Science & Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives