In a week marked by mixed performances across major stock indices, growth stocks outpaced value shares significantly, with the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 Index saw a decline. As investors navigate these dynamic market conditions, identifying high-growth tech stocks with promising potential involves assessing factors such as innovation, scalability, and adaptability to evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Gosuncn Technology Group (SZSE:300098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gosuncn Technology Group Co., Ltd. offers IoT products and services in China with a market capitalization of CN¥12.80 billion.

Operations: The company specializes in IoT products and services within China. It generates revenue primarily through its technology solutions, focusing on innovative applications for connected devices.

Gosuncn Technology Group, amidst a challenging market, projects an annual revenue growth of 13.9%, slightly outpacing the Chinese market's average of 13.8%. This is coupled with an expected profit surge by an impressive 92.2% annually over the next three years, signaling a potential turnaround from its current unprofitable status. Despite a volatile share price and recent earnings showing a reduced net loss from CNY 66.84 million to CNY 45.99 million year-over-year, the company has actively engaged in strategic decisions like amending its articles of association and reappointing audit firms to bolster governance and financial health. These moves reflect Gosuncn's proactive stance in navigating through fiscal recovery while investing in future growth through R&D expenditures that are vital for maintaining competitive edge in high-tech sectors. In terms of capital management, Gosuncn completed a share repurchase program buying back shares worth CNY 15.4 million which might indicate confidence by management in the company’s future prospects despite current financial uncertainties. The firm’s focus on enhancing operational efficiencies and governance structures could be pivotal as it aims to leverage emerging tech trends and meet escalating demands within the tech industry effectively.

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rakus Co., Ltd. and its subsidiaries offer cloud services in Japan, with a market capitalization of ¥357.64 billion.

Operations: Rakus Co., Ltd. focuses on providing cloud-based solutions in Japan, generating revenue primarily through its subscription services. The company leverages its technological expertise to cater to a wide range of business needs, aiming for efficient and scalable service delivery.

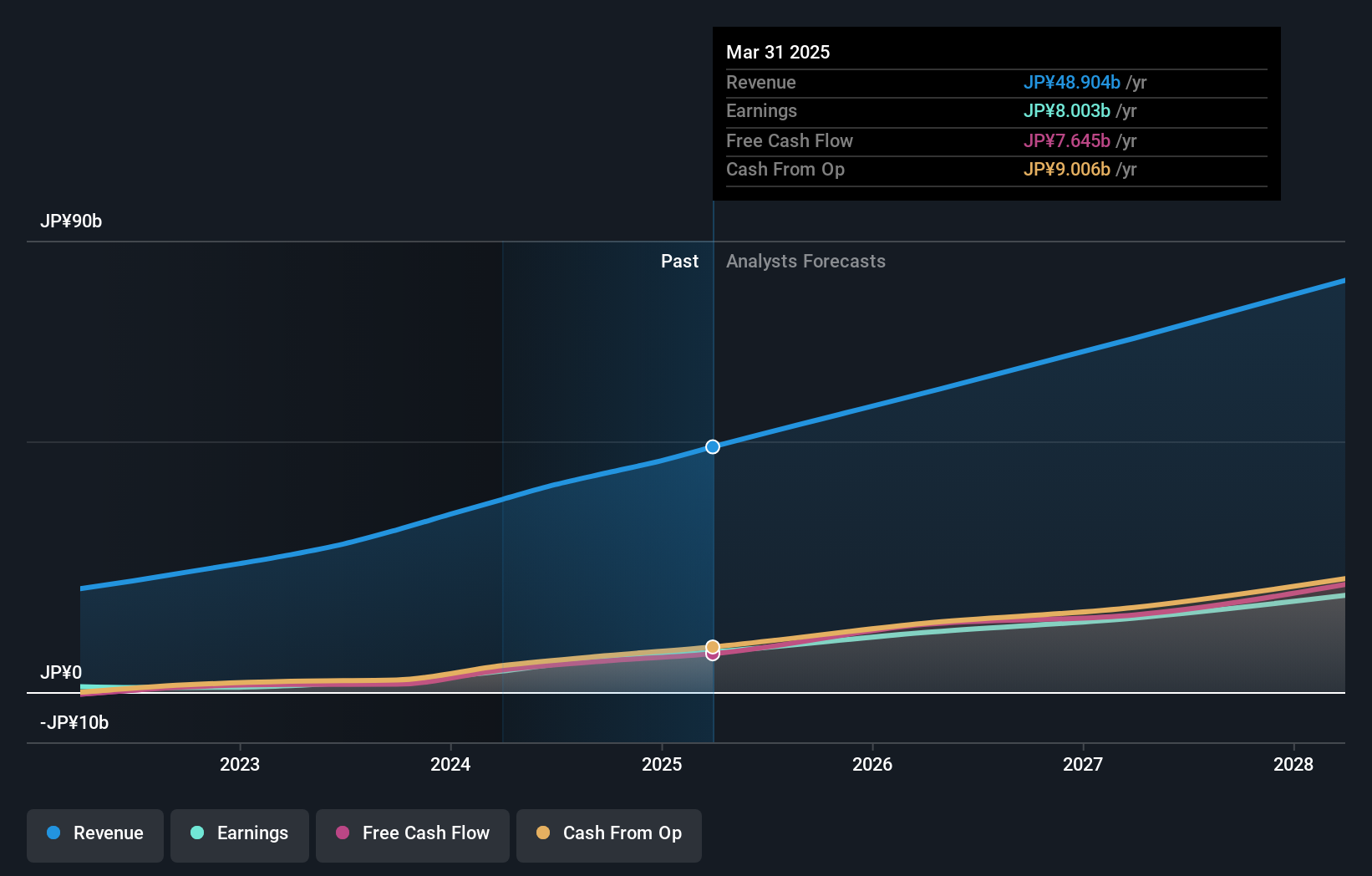

Rakus Co., Ltd. is demonstrating robust growth with its recent upward revision in earnings guidance, projecting a significant increase in net sales to JPY 48.5 billion and operating profit to JPY 9.4 billion for the fiscal year ending March 2025. This adjustment reflects a promising trajectory, underscored by a notable rise in October sales to JPY 4.165 billion, aligning with strategic enhancements across its operations. The firm's commitment to innovation is evident from its R&D investments, which have been pivotal in maintaining competitive advantage within the tech sector, fostering both revenue growth at an annual rate of 16.7% and earnings expansion by approximately 25.8%. These figures not only surpass general market trends but also highlight Rakus’s potential as a dynamic player in high-growth tech environments, suggesting optimistic future prospects if current strategies persist.

- Dive into the specifics of Rakus here with our thorough health report.

Review our historical performance report to gain insights into Rakus''s past performance.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally, with a market capitalization of approximately €612.40 million.

Operations: The company generates revenue primarily from IT-Services (€1.44 billion) and IT-Solutions (€132.20 million). These segments reflect its focus on providing comprehensive technology solutions across various regions.

Adesso SE is capitalizing on robust growth trends, as evidenced by its impressive earnings surge of 42.3% per year, outpacing the broader German market's growth rate of 20.7%. This performance is anchored in strategic R&D investments that have not only enhanced product offerings but also significantly boosted revenue to €965.2 million from €836.75 million year-over-year. Moreover, the company's proactive approach in shareholder value enhancement through a share repurchase program underlines its financial agility and commitment to growth, with plans to buy back up to 200,000 shares for €10 million. This strategy reflects a strong alignment with market opportunities and investor confidence amidst volatile conditions.

- Navigate through the intricacies of adesso with our comprehensive health report here.

Assess adesso's past performance with our detailed historical performance reports.

Key Takeaways

- Take a closer look at our High Growth Tech and AI Stocks list of 1289 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADN1

adesso

Provides IT services in Germany, Austria, Switzerland, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives