As October 2024 unfolds, global markets are experiencing a mixed landscape, with rising U.S. Treasury yields exerting pressure on stocks and the S&P 500 Index finishing lower after several weeks of gains. Amidst this backdrop, growth stocks have shown resilience, particularly in the tech sector where innovation and adaptability can be key indicators of potential success in navigating economic fluctuations and market sentiment shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

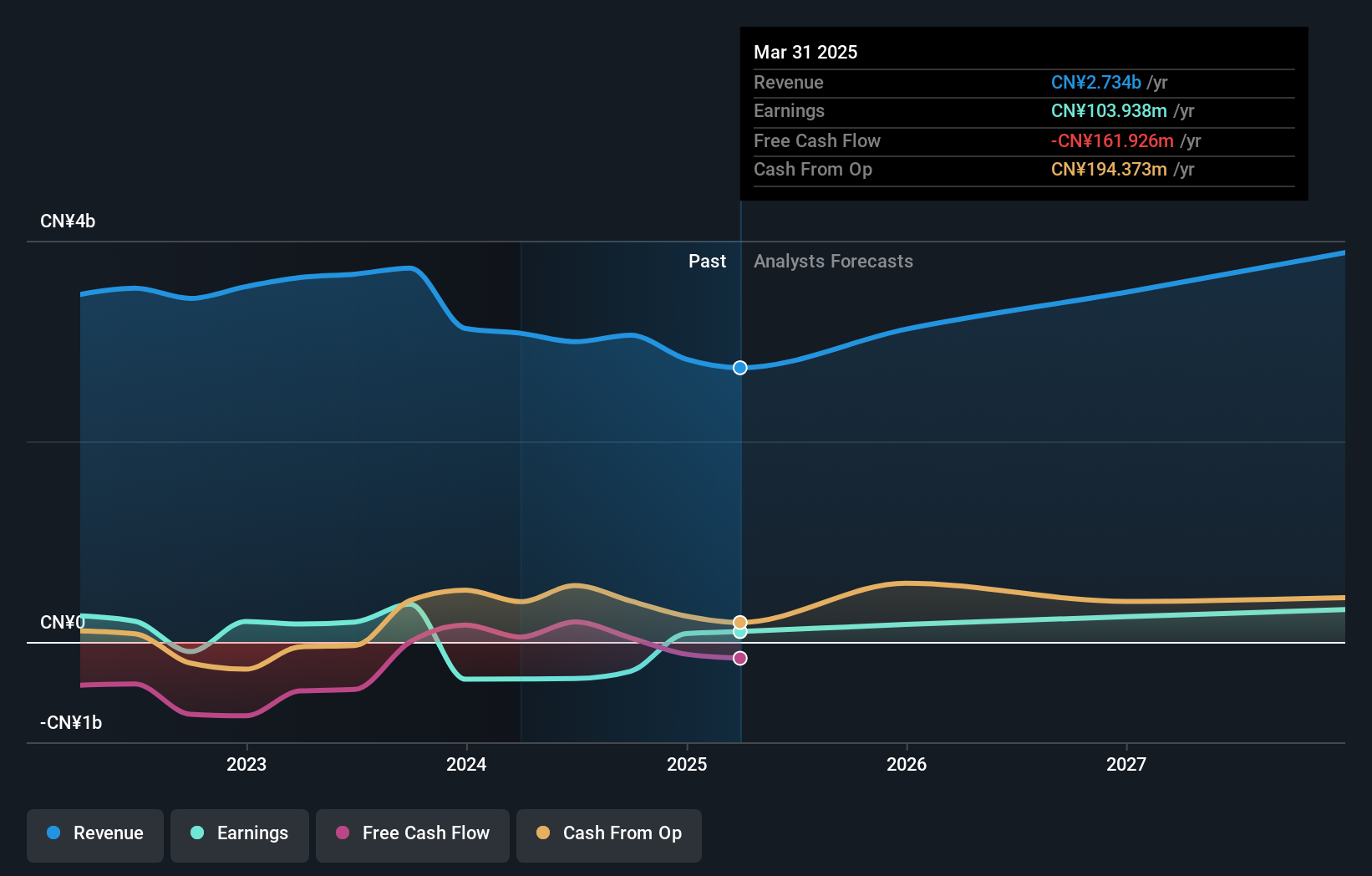

Overview: Topsec Technologies Group Inc. operates in China, offering cybersecurity, big data, and cloud services with a market cap of CN¥7.93 billion.

Operations: The company's primary revenue stream is its cybersecurity segment, generating CN¥3.06 billion.

Topsec Technologies Group has demonstrated resilience with a notable reduction in net loss to CNY 169.28 million from CNY 248.31 million year-over-year, alongside a commitment to shareholder returns through consistent dividend payments, recently affirming a CNY 0.18 per 10 shares distribution. Despite facing sales declines, the company's strategic focus on R&D is evident with an investment aimed at fostering innovation and capturing market trends in tech development. This approach is underscored by expectations of revenue growth at an annual rate of 15.4%, outpacing the CN market's average of 13.7%. Moreover, the company has actively repurchased shares worth CNY 60 million this year, reinforcing its confidence in long-term value creation amidst ongoing efforts to pivot towards profitability within three years, supported by projected earnings growth of approximately 72.9% annually.

- Click here and access our complete health analysis report to understand the dynamics of Topsec Technologies Group.

Learn about Topsec Technologies Group's historical performance.

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. offers intelligent management and security protection solutions for communication and information networks, with a market cap of CN¥4.63 billion.

Operations: Sinovatio Technology focuses on delivering intelligent management and security solutions tailored for communication and information networks. The company's revenue is primarily derived from these specialized solutions, reflecting its strategic emphasis in the tech sector.

Shenzhen Sinovatio Technology has faced challenges with a significant revenue drop to CNY 362.34 million from CNY 460.06 million year-over-year and a shift from net income to a loss of CNY 46.96 million. Despite these setbacks, the company's commitment to innovation is reflected in its R&D investments, crucial for staying competitive in the tech sector where rapid evolution is common. With an expected revenue growth rate of 32% annually, outpacing the Chinese market average of 13.7%, and projected earnings growth at an impressive rate of approximately 117% per year, Sinovatio aims to leverage its development efforts into substantial profitability over the next three years, signaling potential recovery and robust future prospects.

Wuhu Token Sciences (SZSE:300088)

Simply Wall St Growth Rating: ★★★★★☆

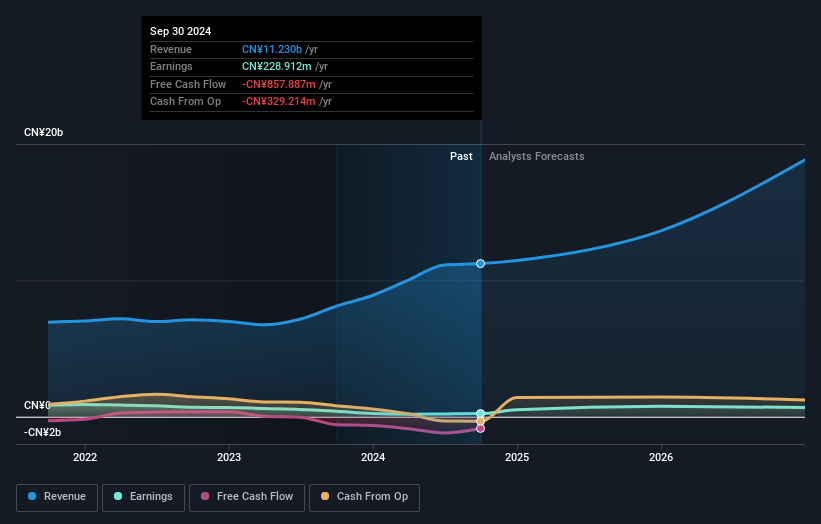

Overview: Wuhu Token Sciences Co., Ltd. focuses on the research, development, manufacturing, and sale of key touch display device materials in China with a market cap of approximately CN¥17.06 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, contributing CN¥11.23 billion. It engages in the processing and sale of materials essential for touch display devices.

Wuhu Token Sciences has demonstrated a robust performance with a 37.2% surge in year-to-date revenue, reaching CNY 8.64 billion. This growth is complemented by an aggressive share buyback strategy, repurchasing 0.85% of its shares for CNY 150.18 million, underscoring confidence in its financial health and commitment to shareholder value. Despite a slight dip in net income to CNY 292.95 million, the firm's future looks promising with projected annual earnings growth of 43.6%, significantly outpacing the broader Chinese market forecast of 24.6%. This financial trajectory is bolstered by substantial R&D investments, positioning Wuhu Token Sciences at the forefront of innovation within the tech sector.

- Navigate through the intricacies of Wuhu Token Sciences with our comprehensive health report here.

Assess Wuhu Token Sciences' past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 1280 High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topsec Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002212

Topsec Technologies Group

Provides cyber security, big data, and cloud services in China.

Flawless balance sheet with reasonable growth potential.