As global markets navigate a week of broad-based gains, with U.S. indexes approaching record highs and smaller-cap stocks outperforming, investors are increasingly looking for opportunities that balance affordability with potential growth. Penny stocks, often associated with smaller or newer companies, offer a unique investment avenue despite their somewhat outdated label. By focusing on those with solid financial health and clear growth potential, these stocks can present intriguing opportunities for investors seeking to capitalize on emerging market trends.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.205 | £402.8M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.59 | £67.89M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.44 | SGD310.8M | ★★★★★☆ |

Click here to see the full list of 5,778 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and supplies material handling equipment for the non-ferrous metallurgy and port terminals industries both in China and internationally, with a market cap of CN¥4.16 billion.

Operations: No specific revenue segments are reported for Zhuzhou Tianqiao Crane Co., Ltd.

Market Cap: CN¥4.16B

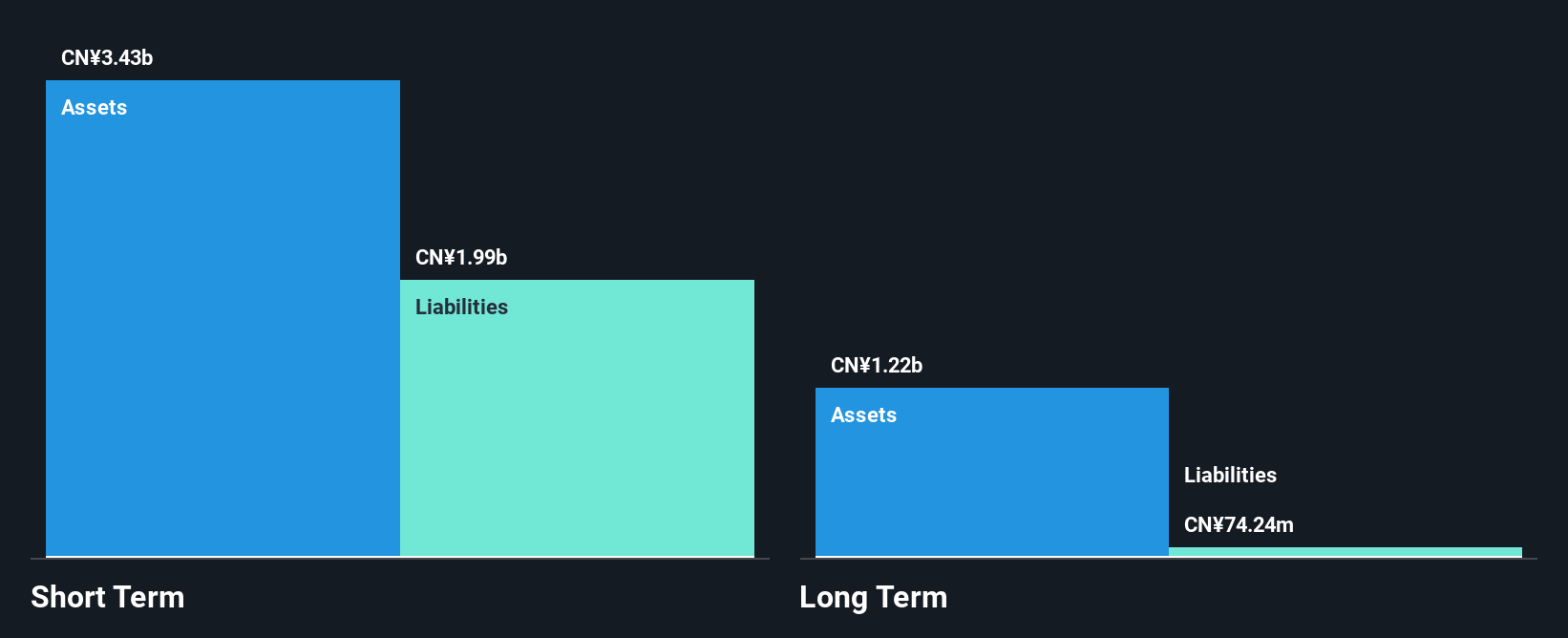

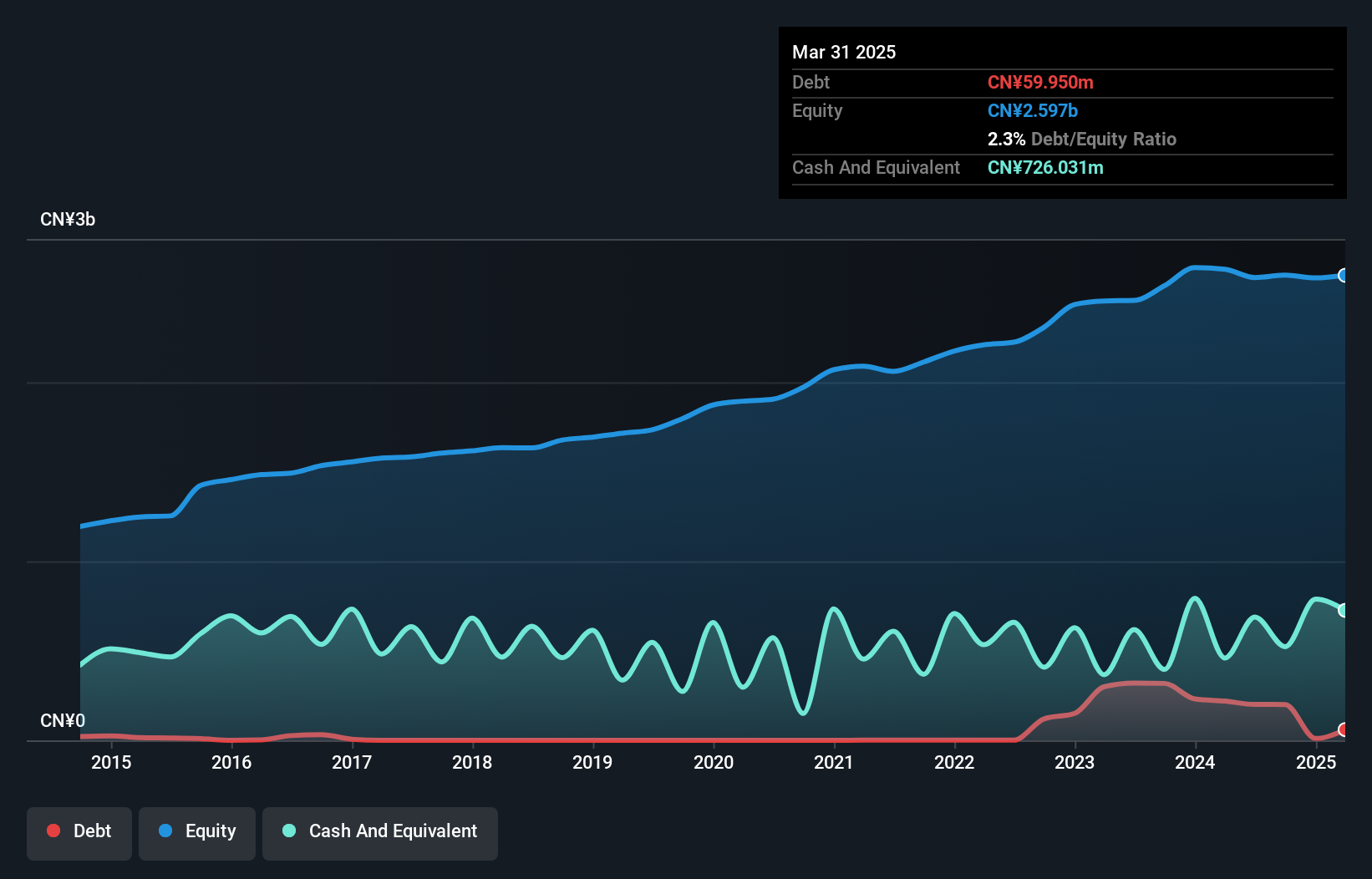

Zhuzhou Tianqiao Crane Co., Ltd. has demonstrated significant earnings growth over the past year, with a very large increase of 6332.4%, surpassing the Machinery industry's average performance. The company's revenue for the nine months ending September 2024 was CN¥1.07 billion, up from CN¥948.99 million a year ago, and it achieved a net income of CN¥17.62 million compared to a prior loss. Its debt is well covered by operating cash flow and short-term assets exceed both short- and long-term liabilities, indicating strong financial health despite having an inexperienced board with an average tenure of 1.5 years.

- Click here to discover the nuances of Zhuzhou Tianqiao Crane with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Zhuzhou Tianqiao Crane's track record.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand, with a market cap of CN¥4.64 billion.

Operations: No revenue segments have been reported for the company.

Market Cap: CN¥4.64B

Sanchuan Wisdom Technology has faced challenges with declining earnings, reporting a net income of CN¥71.5 million for the nine months ending September 2024, down from CN¥162.36 million the previous year. Despite this, its financial position remains solid with short-term assets of CN¥1.9 billion exceeding both short- and long-term liabilities significantly. The company's debt is well covered by operating cash flow, and it holds more cash than total debt, suggesting prudent financial management. However, profit margins have decreased from 12% to 7.9%, and return on equity at 5.6% is considered low compared to industry standards.

- Click here and access our complete financial health analysis report to understand the dynamics of Sanchuan Wisdom Technology.

- Gain insights into Sanchuan Wisdom Technology's historical outcomes by reviewing our past performance report.

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanfang Zhongjin Environment Co., Ltd. operates in the general equipment manufacturing sector through its subsidiaries and has a market capitalization of CN¥6.42 billion.

Operations: Nanfang Zhongjin Environment Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥6.42B

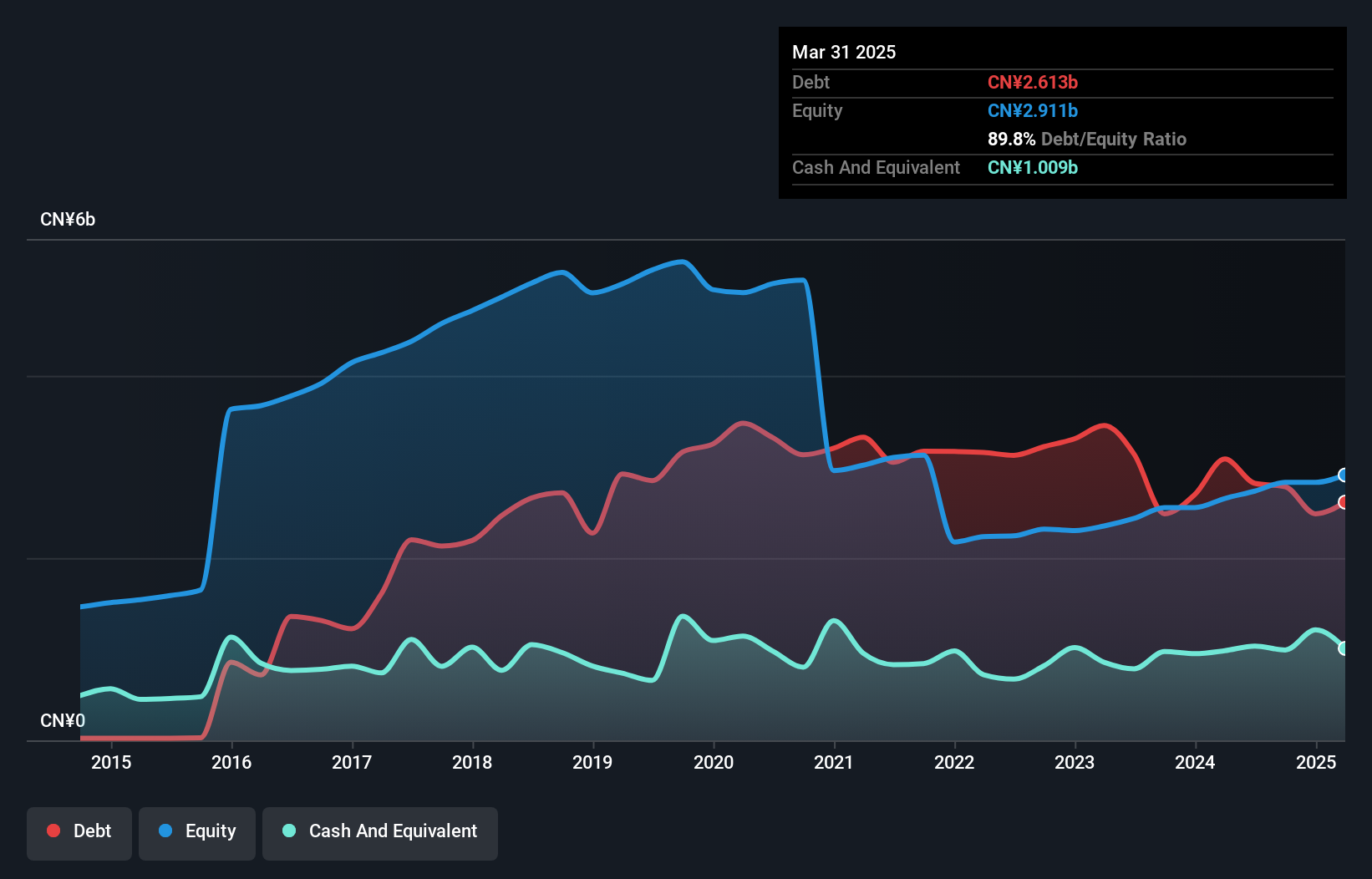

Nanfang Zhongjin Environment Co., Ltd. has demonstrated stable financial performance, reporting a net income of CN¥251.88 million for the nine months ending September 2024, up from CN¥215.97 million the previous year, with improved profit margins at 4.5%. Despite high debt levels and a net debt to equity ratio of 63.3%, short-term assets of CN¥5.4 billion cover both short- and long-term liabilities adequately. The company benefits from experienced management and board teams, although its return on equity remains low at 9.2%. Earnings growth is forecasted to continue, supported by strong interest coverage and operational cash flow efficiency.

- Dive into the specifics of Nanfang Zhongjin Environment here with our thorough balance sheet health report.

- Gain insights into Nanfang Zhongjin Environment's future direction by reviewing our growth report.

Turning Ideas Into Actions

- Click here to access our complete index of 5,778 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanfang Pump Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300145

Nanfang Pump Industry

Through its subsidiaries, engages in the general equipment manufacturing business.

Adequate balance sheet and fair value.

Market Insights

Community Narratives