- China

- /

- Electronic Equipment and Components

- /

- SZSE:003015

Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd's (SZSE:003015) 25% Share Price Surge Not Quite Adding Up

Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd (SZSE:003015) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

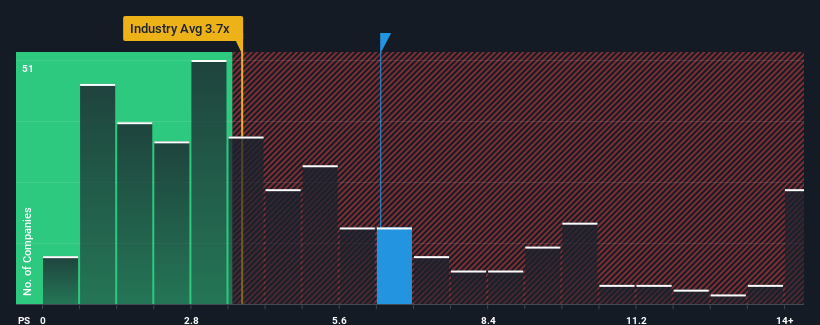

Since its price has surged higher, given around half the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider Jiangsu Rijiu Optoelectronics as a stock to avoid entirely with its 6.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Jiangsu Rijiu Optoelectronics

What Does Jiangsu Rijiu Optoelectronics' Recent Performance Look Like?

For instance, Jiangsu Rijiu Optoelectronics' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Rijiu Optoelectronics' earnings, revenue and cash flow.How Is Jiangsu Rijiu Optoelectronics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Jiangsu Rijiu Optoelectronics' is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. The last three years don't look nice either as the company has shrunk revenue by 16% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Jiangsu Rijiu Optoelectronics' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to Jiangsu Rijiu Optoelectronics' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Jiangsu Rijiu Optoelectronics revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 5 warning signs for Jiangsu Rijiu Optoelectronics (3 can't be ignored!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003015

Jiangsu Rijiu Optoelectronics

Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026