- China

- /

- Electronic Equipment and Components

- /

- SZSE:002990

High Growth Tech Stocks in Asia for May 2025

Reviewed by Simply Wall St

The Asian markets have been buoyed by a positive shift in global trade dynamics, particularly following the U.S.-China agreement to temporarily reduce tariffs, which has improved investor sentiment across the region. In this environment of easing trade tensions and moderated inflationary pressures, high-growth tech stocks in Asia are drawing attention for their potential to capitalize on technological advancements and increased demand for innovative solutions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.64% | 30.42% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.42% | ★★★★★★ |

| Cowell e Holdings | 20.16% | 24.57% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.10% | ★★★★★★ |

| PharmaResearch | 25.85% | 28.36% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

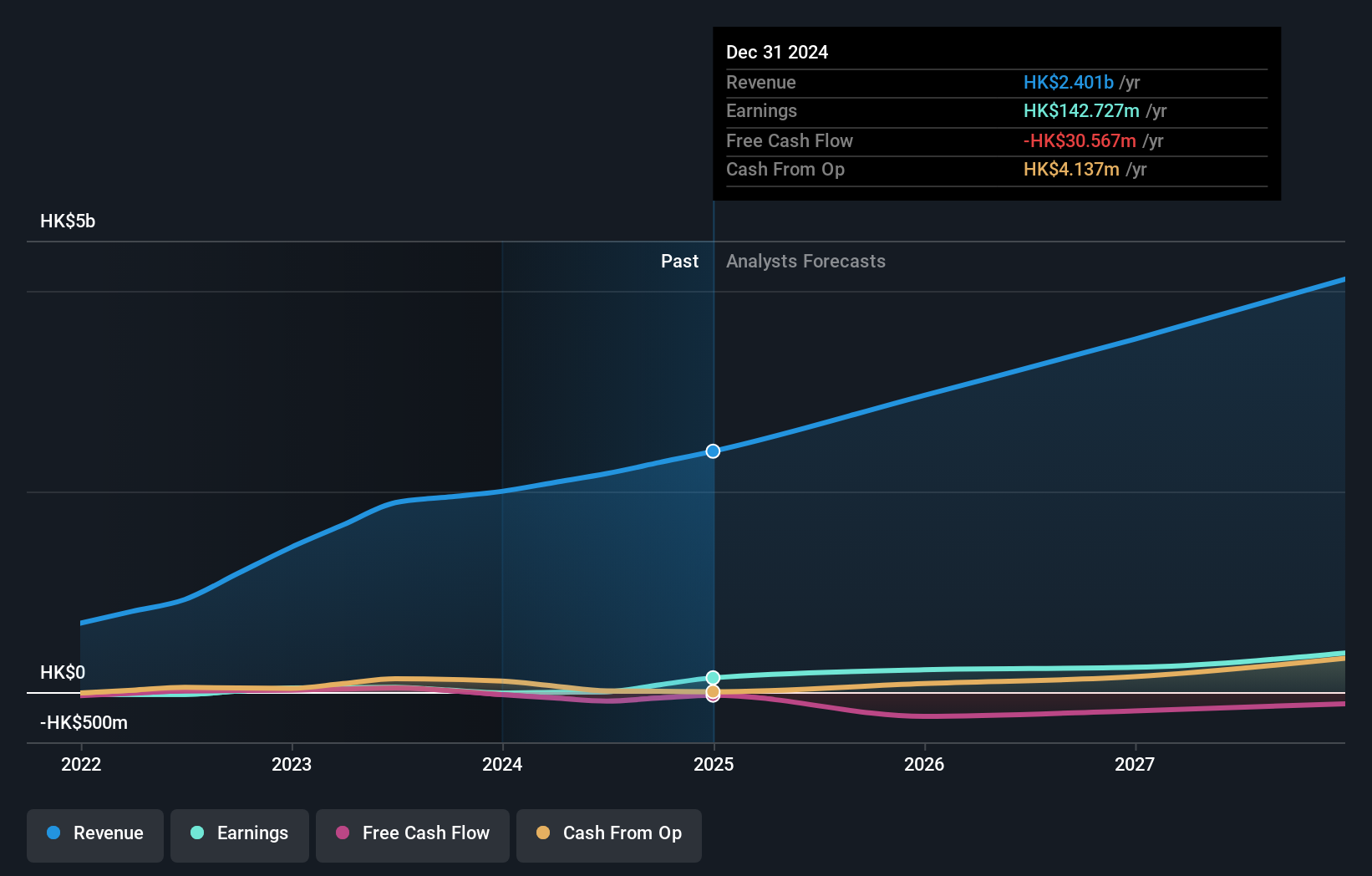

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and other international markets, with a market cap of HK$8.80 billion.

Operations: The company generates revenue primarily through its software as a service (SaaS) offerings, amounting to HK$2.40 billion. It operates in markets including the United States and Mainland China, focusing on digital content asset protection and transactions.

Vobile Group, a player in the tech sector, has shown notable financial and strategic developments. In 2024, the company transitioned from a net loss to reporting substantial profits with net income reaching HKD 142.73 million, up from a previous year's loss of HKD 7.82 million, reflecting an impressive turnaround in its operational efficiency. This resurgence is partly due to its innovative DreamMaker platform which integrates AI-driven video production with copyright protection capabilities, tapping into new revenue streams by empowering independent creators. Additionally, Vobile recently raised HKD 152 million through zero-coupon convertible bonds at a premium rate over its share price on May 2nd, indicating strong investor confidence and providing capital for further expansion and technological advancements. These moves underscore Vobile's robust growth trajectory in the competitive tech landscape of Asia while enhancing its offerings in copyright management and content monetization.

- Click here to discover the nuances of Vobile Group with our detailed analytical health report.

Gain insights into Vobile Group's historical performance by reviewing our past performance report.

Maxvision Technology (SZSE:002990)

Simply Wall St Growth Rating: ★★★★☆☆

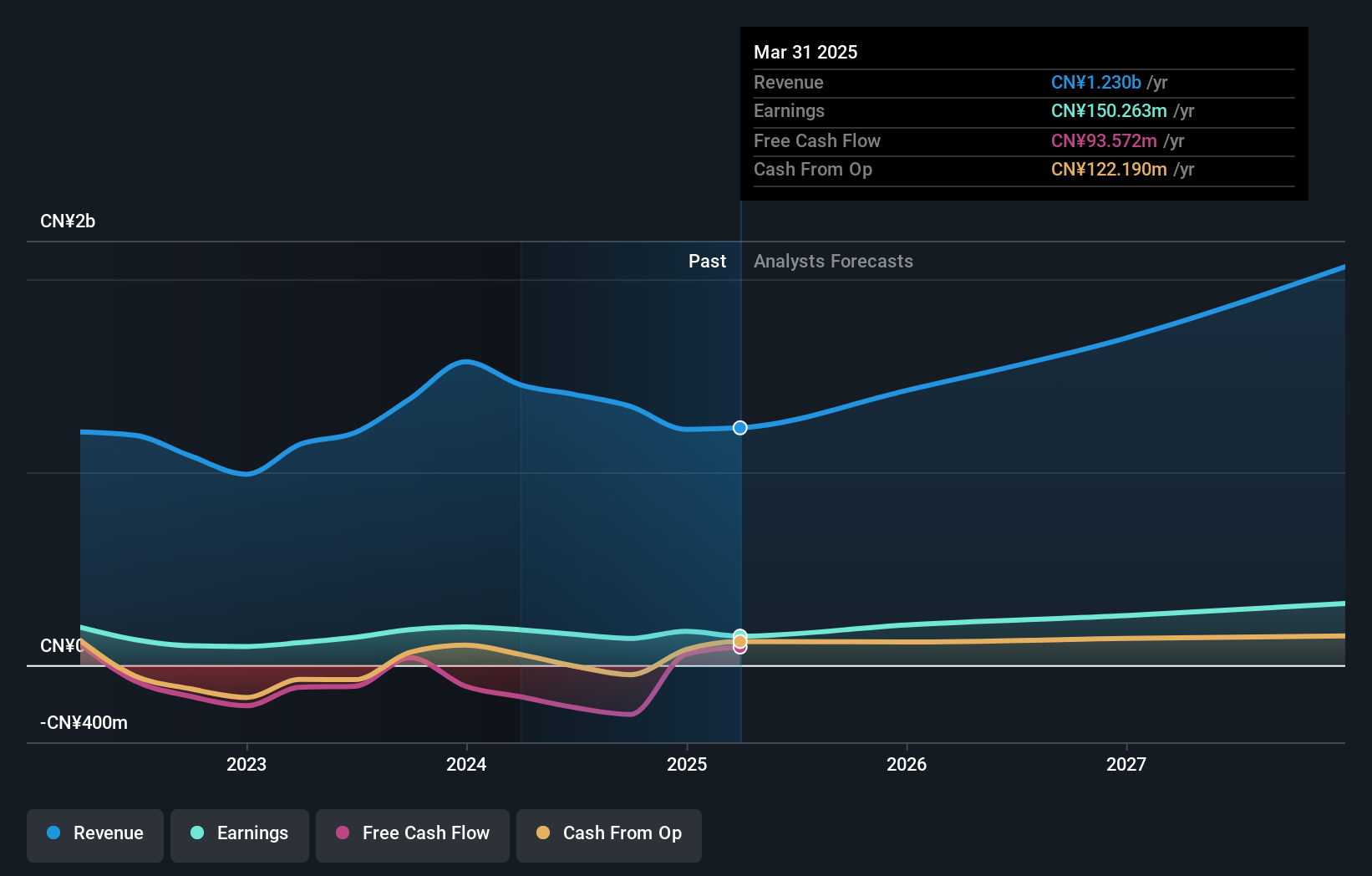

Overview: Maxvision Technology Corp. focuses on developing artificial intelligence, big data, and Internet of Things solutions, with a market cap of CN¥7.63 billion.

Operations: Maxvision Technology Corp. generates revenue through its research and development activities in artificial intelligence, big data, and Internet of Things solutions. The company's business operations are centered on leveraging advanced information technology to deliver innovative solutions across these sectors.

Maxvision Technology, navigating a challenging landscape, reported a dip in annual revenue from CNY 1.57 billion to CNY 1.22 billion and a decrease in net income from CNY 198.23 million to CNY 174.9 million year-over-year. Despite these setbacks, the company's strategic focus on R&D remains robust, evidenced by its commitment to innovation and development within the tech sector. This dedication is crucial as it seeks to rebound and capitalize on growing sectors such as AI and software development in Asia. The firm's recent adjustments to its dividend policy reflect a strategic reallocation of resources towards these pivotal growth areas, aiming for enhanced market agility and shareholder value over time.

- Click to explore a detailed breakdown of our findings in Maxvision Technology's health report.

Assess Maxvision Technology's past performance with our detailed historical performance reports.

Wistron (TWSE:3231)

Simply Wall St Growth Rating: ★★★★☆☆

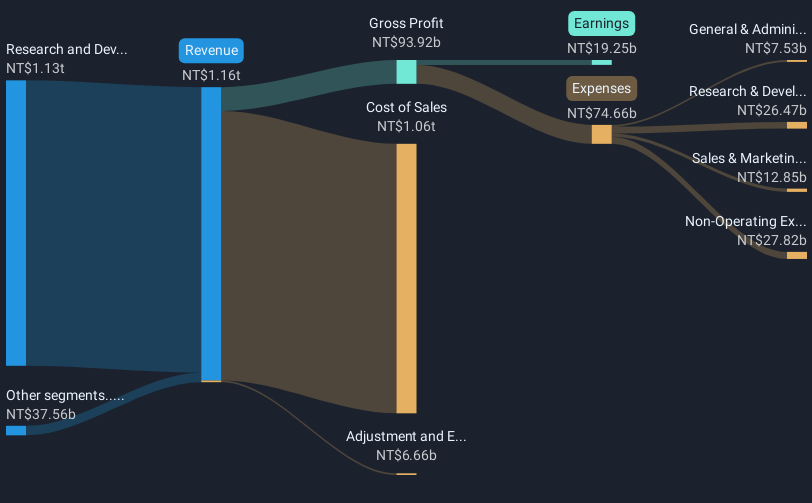

Overview: Wistron Corporation, along with its subsidiaries, focuses on designing, manufacturing, and selling information technology products across the United States, Europe, China, and other international markets with a market cap of NT$316.92 billion.

Operations: The company generates revenue primarily through its Research and Development and Manufacturing Services Operations, amounting to NT$1.13 trillion. This segment is a significant contributor to its overall business model, highlighting its focus on providing comprehensive IT solutions globally.

Wistron's recent strategic maneuvers, including a significant TWD 1.88 billion investment in AI plant improvements and the establishment of Wistron InfoComm (USA) Corporation with a USD 48.85 million contract, underscore its aggressive expansion into high-tech sectors. These moves coincide with robust financial performance, evidenced by a first-quarter sales surge to TWD 346.49 billion from TWD 239.33 billion year-over-year and an increase in net income to TWD 5.33 billion from TWD 3.52 billion, reflecting annualized earnings growth of over 20%. This trajectory is supported by Wistron's commitment to R&D, crucial for sustaining innovation and competitive edge in the rapidly evolving tech landscape of Asia.

- Dive into the specifics of Wistron here with our thorough health report.

Review our historical performance report to gain insights into Wistron's's past performance.

Where To Now?

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 491 more companies for you to explore.Click here to unveil our expertly curated list of 494 Asian High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Maxvision Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002990

Maxvision Technology

Engages in the research of artificial intelligence, big data, Internet of Things, and other information technology solutions.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives