- Japan

- /

- Interactive Media and Services

- /

- TSE:4449

Growth Companies With Strong Insider Ownership In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the evolving economic landscape, U.S. stocks have been buoyed by optimism surrounding potential trade deals and a surge in artificial intelligence-related investments. With major indices reaching new highs, growth stocks have notably outperformed their value counterparts, highlighting the market's current favor for companies with robust potential for expansion. In this environment, one key factor that can enhance a growth company's appeal is strong insider ownership, which often signals confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hitevision (SZSE:002955)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hitevision Co., Ltd. specializes in the research, design, development, production, and sale of interactive display products in China with a market cap of CN¥5.53 billion.

Operations: Hitevision Co., Ltd. generates revenue primarily through its interactive display products in China.

Insider Ownership: 37.5%

Hitevision demonstrates potential as a growth company with high insider ownership, despite recent earnings and revenue declines. The company's earnings are projected to grow significantly at 25.1% annually over the next three years, surpassing the Chinese market average. While revenue growth is forecasted at 15.8% annually, it's still above the market average of 13.3%. Trading at a favorable price-to-earnings ratio of 20.7x compared to the market's 34.7x enhances its appeal among peers and industry players.

- Delve into the full analysis future growth report here for a deeper understanding of Hitevision.

- According our valuation report, there's an indication that Hitevision's share price might be on the cheaper side.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Co., Ltd. offers marketing solutions and has a market cap of ¥75.76 billion.

Operations: The company generates revenue through its HR Solutions segment, which accounts for ¥10.13 billion, and its Marketing Solutions segment, contributing ¥3.78 billion.

Insider Ownership: 39.8%

Plus Alpha Consulting Ltd. exhibits growth potential with earnings forecasted to increase by 17.42% annually, outpacing the Japanese market average of 8.2%. Despite high share price volatility, it trades significantly below its estimated fair value. The company's recent buyback program, involving ¥755.06 million for 0.97% of shares, aims to enhance capital efficiency and shareholder returns. Revenue is expected to grow at 13.9% annually, exceeding the market's average growth rate of 4.3%.

- Navigate through the intricacies of Plus Alpha ConsultingLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Plus Alpha ConsultingLtd may be undervalued.

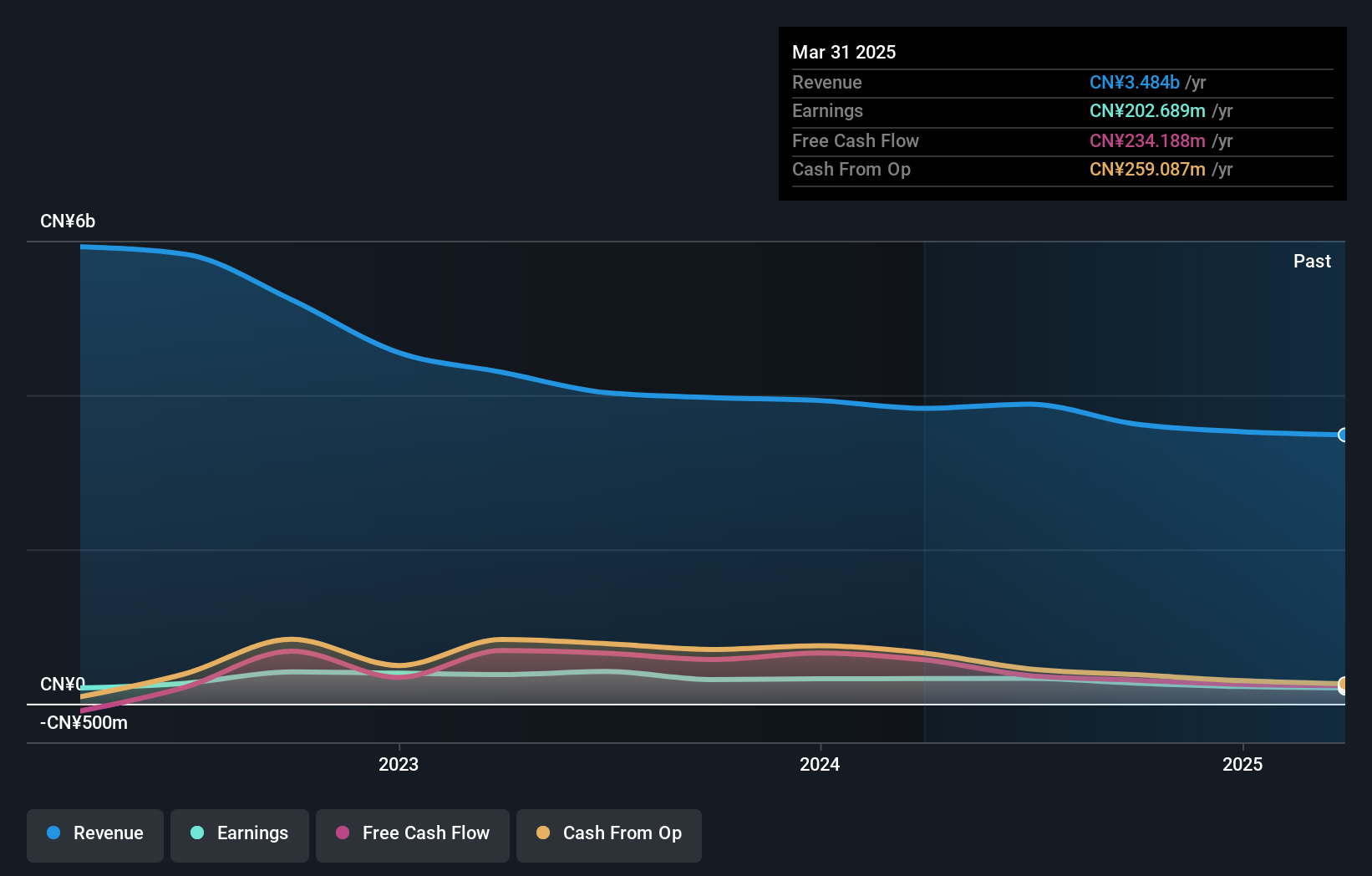

giftee (TSE:4449)

Simply Wall St Growth Rating: ★★★★★☆

Overview: giftee Inc. operates in the Internet service sector in Japan with a market cap of ¥41.43 billion.

Operations: The company generates revenue from its E-Gift Platform Business, amounting to ¥8.78 billion.

Insider Ownership: 34.3%

giftee Inc. shows substantial growth potential, with earnings expected to increase by 58.6% annually, surpassing the Japanese market average of 8.2%. Revenue is forecasted to grow at 23.6% per year, well above the market's 4.3%. Despite recent delisting due to inactivity and a volatile share price, analysts agree on a potential stock price rise of nearly 60%. The company anticipates JPY 9.11 billion in net sales and an operating profit of JPY 1.70 billion for FY2024.

- Click to explore a detailed breakdown of our findings in giftee's earnings growth report.

- Our expertly prepared valuation report giftee implies its share price may be too high.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1470 more companies for you to explore.Click here to unveil our expertly curated list of 1473 Fast Growing Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4449

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives